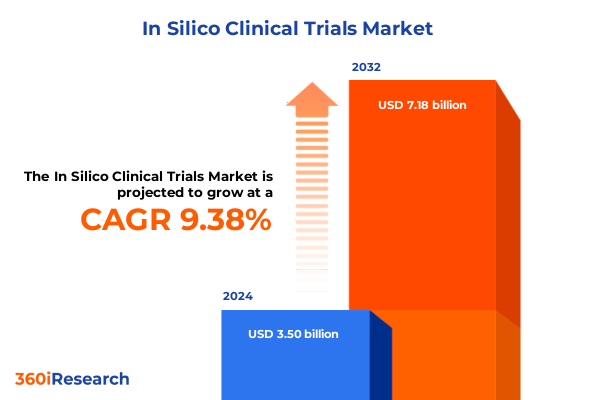

The In Silico Clinical Trials Market size was estimated at USD 3.81 billion in 2025 and expected to reach USD 4.16 billion in 2026, at a CAGR of 9.46% to reach USD 7.18 billion by 2032.

Unlocking the Future of Drug Development Through Virtual Patient Simulations Embracing In Silico Clinical Trials Innovation

In silico clinical trials represent a groundbreaking shift in biomedical research, leveraging advanced computer simulations to predict how medical treatments interact with human physiology. An in silico clinical trial, often referred to as a virtual clinical trial, employs individualized computational models to estimate the efficacy and safety of investigational products without exposing real patients to potential risks. As regulatory agencies and industry leaders increasingly recognize the limitations of conventional in vivo and in vitro studies, these simulations offer a complementary approach that can refine trial design, optimize dosing strategies, and identify safety concerns early in development. This transformative method integrates diverse data sources-ranging from physiological parameters to disease progression models-into cohesive frameworks that can be iteratively tested and validated.

Exploring the Revolutionary Advances Accelerating Clinical Research Through AI Simulation Digital Twins and Mechanistic Modeling Approaches

The landscape of clinical research is undergoing profound transformation driven by the convergence of artificial intelligence, cloud computing, and mechanistic modeling techniques. Artificial intelligence and machine learning algorithms are now being harnessed to generate virtual patient populations, enabling researchers to explore a vast array of treatment scenarios within a controlled digital environment. Meanwhile, cloud-based simulation platforms have eliminated many of the infrastructure constraints associated with on-premise hardware, allowing organizations to scale computational experiments rapidly and collaborate across geographies in real time. Additionally, digital twin constructs-computerized replicas of individual patients or entire cohorts-are providing unprecedented insights into variability in drug response, powering more precise and patient-specific trial designs.

Assessing How 2025 United States Trade Policies Are Reshaping Technology Access and Infrastructure for Virtual Clinical Trial Platforms

In 2025, the implementation of new United States trade policies introduced substantial tariffs on critical hardware components and laboratory equipment, reshaping the technology ecosystem underpinning in silico clinical trials. While digital services remain largely exempt, the added duties on imported data-center switches, storage arrays, and specialized computing servers have elevated costs for organizations operating on-premise computational clusters. As a result, many research institutions have deferred hardware refresh cycles and shifted workloads to cloud providers where tariffs do not apply. Consequently, this strategic pivot has amplified adoption of cloud-native simulation services, but it has also introduced greater complexity in data governance and compliance protocols as datasets traverse international boundaries.

Unveiling Critical Market Segmentation Dynamics That Drive Adoption of In Silico Clinical Trial Solutions Across Products Phases and Technologies

The in silico clinical trials sector can be viewed through multiple analytical lenses, each shedding light on distinct drivers of adoption and innovation. From a product perspective, service offerings encompass consulting and training, where specialized experts guide organizations through model-informed drug development workflows, as well as custom simulation engagements and robust model development and validation packages. Parallel to these, software solutions enable self-service simulation through dedicated platforms for trial design, virtual patient modeling, and comprehensive mechanistic simulations. Across the clinical continuum, model applications span from first-in-human dose predictions in Phase I to comparative effectiveness assessments in Phase IV studies. Technologically, the market spans emerging digital twins, AI-powered predictive algorithms, cloud-native simulation frameworks, and classical mechanistic modeling environments. Moreover, therapeutic applications extend from disease modeling networks that simulate oncology and rare conditions to virtual devices testing cardiovascular interventions. Lastly, the end-user community driving demand ranges from academic research centers to contract research organizations, medical device firms, pharmaceutical and biotech corporations, and even regulatory bodies seeking to augment safety evaluations with simulation data.

This comprehensive research report categorizes the In Silico Clinical Trials market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Phase

- Technology Platform

- Application

- Therapeutic Area

- End User

Mapping Regional Innovation Hotspots and Adoption Trends Across Americas Europe Middle East Africa and Asia Pacific for Virtual Trial Technologies

Across the Americas, strong public and private R&D investments coupled with proactive regulatory guidance have established North America as a leader in virtual trial methodologies. Innovative consortia and academic partnerships have accelerated the validation of simulation models for novel drug modalities. By contrast, the Europe, Middle East and Africa region benefits from harmonized regulatory frameworks across the European Medicines Agency and emerging digital health policies, enabling pan-regional adoption of computational tools in both drug and device development. Conversely, the Asia-Pacific landscape is marked by rapid expansion in computational infrastructure and a surge in domestic software vendors offering model-based solutions tailored to local clinical workflows. Governments in this region actively support digital health initiatives, creating fertile ground for next-generation in silico platforms.

This comprehensive research report examines key regions that drive the evolution of the In Silico Clinical Trials market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Leading Industry Players and Their Strategic Innovations Shaping the In Silico Clinical Trials Ecosystem and Competitive Landscape

Several industry leaders are driving the commercial evolution of virtual clinical trials through strategic platform enhancements, collaborative partnerships, and regulatory engagement. A standout example is Certara’s Simcyp Simulator, which has informed dosing decisions for over a hundred drugs by integrating mechanistic physiologically-based pharmacokinetic models annually, reinforcing its role as a de facto standard for PBPK simulations. Dassault Systèmes has also significantly advanced its BIOVIA suite, embedding AI modules to refine large-scale trial simulations and accelerating data-driven trial design processes. Complementing these established players, Schrödinger’s accurate molecular modeling algorithms and Insilico Medicine’s AI-driven discovery pipelines are each pushing the boundaries of virtual drug candidate optimization, while GNS Healthcare’s machine learning platform specializes in simulating disease progression within real-world patient cohorts.

This comprehensive research report delivers an in-depth overview of the principal market players in the In Silico Clinical Trials market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abzena Ltd.

- AiCure, LLC

- Aitia NV

- Certara, Inc.

- Coriolis Pharma Research GmbH

- Dassault Systèmes SE

- Evotec SE

- GNS Healthcare Inc.

- IBM Corporation

- ICON plc

- Insilico Medicine, Inc.

- InSilicoTrials Technologies SpA

- IQVIA Holdings Inc.

- Lunai Bioworks Inc

- Merck KGaA

- NOVA IN SILICO SAS

- Novadiscovery SA

- PAREXEL INTERNATIONAL, INC.

- PathAI, Inc.

- Recursion Pharmaceuticals, Inc.

- Saama Technologies, LLC

- Schrödinger, Inc.

- Simulations Plus, Inc.

- Tempus AI, Inc.

- The AnyLogic Company

- Unlearn.ai, Inc.

- Veritas In Silico Inc.

- Virtonomy GmbH

- WuXi AppTec Co., Ltd.

- ZMT Zurich MedTech AG

Strategic Imperatives for Industry Leaders to Harness Virtual Trial Technologies Optimize Collaboration and Drive Competitive Advantage in Drug Development

To fully leverage the potential of in silico clinical trials, industry leaders should prioritize investments in integrated data ecosystems that unify electronic health records, real-world evidence repositories, and historical trial datasets. Such unified architectures will enhance model fidelity and predictive accuracy from the earliest trial phases. Additionally, fostering collaborative alliances between software vendors, academic institutions, and regulatory agencies can accelerate the development of shared validation standards, reducing time-to-acceptance for novel simulation methodologies. Organizations should also establish internal centers of excellence staffed by computational scientists and regulatory liaisons to embed simulation workflows across all stages of drug and device development. Finally, decision-makers must anticipate evolving tariff landscapes by adopting cloud-native infrastructures that mitigate supply chain risks and ensure sustained access to cutting-edge computational resources.

Transparent Research Framework Integrating Primary Expert Interviews Secondary Data Analysis and Rigorous Validation for In Silico Clinical Trial Insights

This research synthesized insights from a multi-tiered methodology combining primary and secondary investigations. Initially, an extensive review of peer-reviewed literature and regulatory guidance documents laid the conceptual foundation. Subsequently, in-depth interviews with leading pharmacometricians, regulatory affairs specialists, and technology vendors provided qualitative perspectives on emerging best practices. To ensure data robustness, quantitative analyses of publicly disclosed clinical trial records and platform utilization metrics were performed. Finally, a rigorous validation process involved cross-referencing expert inputs against real-world case studies, including regulatory submissions leveraging simulation evidence, to confirm the applicability of our findings.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our In Silico Clinical Trials market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- In Silico Clinical Trials Market, by Product Type

- In Silico Clinical Trials Market, by Phase

- In Silico Clinical Trials Market, by Technology Platform

- In Silico Clinical Trials Market, by Application

- In Silico Clinical Trials Market, by Therapeutic Area

- In Silico Clinical Trials Market, by End User

- In Silico Clinical Trials Market, by Region

- In Silico Clinical Trials Market, by Group

- In Silico Clinical Trials Market, by Country

- United States In Silico Clinical Trials Market

- China In Silico Clinical Trials Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 3180 ]

Concluding Perspectives on the Evolution of Virtual Clinical Trials and the Path Forward for Transforming Drug Development Through Computational Innovation

As computational power continues to grow and algorithmic sophistication advances, in silico clinical trials are poised to become an indispensable complement to traditional research paradigms. The increasing regulatory acceptance of simulation evidence for dose selection and safety assessments underscores the technology’s maturation and legitimacy. By thoughtfully integrating virtual trials into the development pipeline, organizations can mitigate risks, streamline decision-making, and accelerate patient access to innovative therapies. In the years ahead, continued collaboration among stakeholders and ongoing methodological refinements will further solidify the role of simulation-driven research in delivering safer, more effective medical interventions.

Unlock Comprehensive Virtual Trial Market Insights by Connecting with Ketan Rohom to Secure Your Detailed In Silico Clinical Trials Report Today

Are you ready to capitalize on the unparalleled insights of the in silico clinical trials landscape? Connect directly with Associate Director of Sales & Marketing, Ketan Rohom, to secure your comprehensive market research report. Ketan stands ready to guide you through the report’s rich analysis and answer any questions you may have regarding its applications for your organization. Reach out today to unlock the full potential of virtual trial technologies and stay at the forefront of drug development innovation.

- How big is the In Silico Clinical Trials Market?

- What is the In Silico Clinical Trials Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?