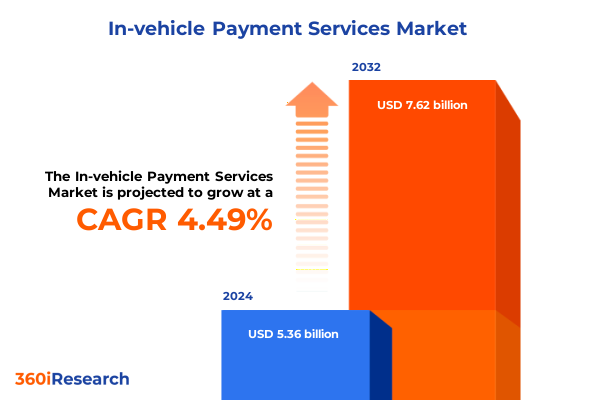

The In-vehicle Payment Services Market size was estimated at USD 5.58 billion in 2025 and expected to reach USD 5.81 billion in 2026, at a CAGR of 4.55% to reach USD 7.62 billion by 2032.

Unlocking the Road Ahead: How In-Vehicle Payments Are Redefining Mobility and Customer Experiences in Automotive Innovation

The in-vehicle payment market has emerged at the nexus of automotive connectivity and digital commerce, driven by consumer expectations for seamless, on-the-move transactions. Drivers increasingly demand integrated solutions that eliminate friction when paying for tolls, parking, fuel, and drive-through services. Automakers and technology providers have responded by embedding secure payment modules directly into infotainment systems and head units, transforming vehicles into mobile commerce platforms.

Underpinning this transformation are advanced connectivity and security frameworks. Internet of Things sensors, 5G networks, and artificial intelligence engines enable real-time communication between vehicles and payment gateways, while blockchain protocols ensure immutable transaction records. These technologies facilitate instantaneous authorization, dynamic fraud detection, and personalized offers based on driver location and preferences, elevating both convenience and trust in the payment experience.

Strategic collaborations illustrate this convergence. CarIQ Technologies’ Vehicle Wallet, launched in partnership with Visa, integrates vehicle identity verification with payment orchestration, while Hyundai Motor America’s alliance with Parkopedia brings OEM-branded parking and mobility payments to factory-installed systems. As electric and autonomous vehicles proliferate, these in-vehicle payment ecosystems will evolve to handle charging sessions, subscription services, and over-the-air feature upgrades without compromising security or usability.

Navigating the Inflection Point: Unprecedented Technological and Consumer Paradigm Shifts Propelling In-Vehicle Payments into the Mainstream

The in-vehicle payment sector is experiencing transformative shifts fueled by consumer preferences and technological breakthroughs. Contactless transactions, once novel, have become expected, driving near-field communication and mobile wallet integrations into vehicle cockpits. Embedded payment modules now routinely employ biometric authentication and tokenization to accelerate point-of-sale experiences without sacrificing security.

Electric and autonomous vehicles have further redefined payment use cases. EV owners seek unified platforms that manage AC charging and DC fast-charging payments, while autonomous mobility services require fully automated billing workflows for ride-hail, tolling, and parking. These demand profiles are steering payment providers toward cloud-native, microservices architectures that can scale dynamically and integrate new transaction types.

Blockchain has emerged as a critical enabler, embedding decentralized validation to reinforce data integrity and cross-border interoperability. When combined with AI-driven analytics for context-aware offers and proactive fraud prevention, distributed ledger and machine learning technologies enhance user engagement and lower operational risk.

The accelerating rollout of 5G connectivity promises ultra-low latency and massive device concurrency, enabling real-time edge computing and richer personalization. As network availability expands, innovative payment scenarios-dynamic toll pricing, micro-transactions for infotainment services, and remote pre-authorization-will become mainstream, embedding commerce firmly within the digital mobility fabric.

Assessing the Cumulative Impact of 2025 United States Tariffs on In-Vehicle Payment Ecosystems and Automotive Supply Chains

The United States’ tariff regime in 2025 has introduced complex headwinds for in-vehicle payment services, inflating input costs across hardware and software components. Early in the year, emergency economic authority was used to raise steel and aluminum duties above 50 percent, while imposing 25 percent tariffs on imported passenger vehicles and auto parts. This disrupted global supply chains and raised the price of embedded payment modules and NFC chips, prompting some providers to reassess sourcing strategies.

In April 2025, a universal 10 percent tariff on imports from outside North America took effect, exempting Canada and Mexico under USMCA. Manufacturers sourcing semiconductors and specialized telematics units from Europe and Asia encountered new duty burdens, intensifying margin pressures and driving moves toward localized production or renegotiated vendor agreements to contain costs.

China-specific tariffs on EVs and automotive electronics remained punitive, exacerbating cost volatility for connected-car payment platforms. To mitigate these impacts, service providers are adopting modular, software-defined payment architectures that reduce reliance on specialized hardware. Over-the-air software updates and containerized transaction modules allow rapid adaptation to shifting trade policies while maintaining feature velocity.

The cumulative effect underscores the need for diversified supply bases, agile procurement frameworks, and multi-tiered inventory strategies. Onshoring and nearshoring initiatives, longer contract tenures, and proactive duty planning are essential for stabilizing cost structures and ensuring consistent deployment of secure in-vehicle payment solutions.

Unearthing Strategic Segmentation Insights for In-Vehicle Payments Across Payment Methods, Applications, Vehicle Types, Connectivity, and Transaction Types

In-vehicle payment services encompass a multidimensional segmentation framework aligned with diverse consumer behaviors and technological contexts. Methods include credit and debit cards-tokenized for secure, card-on-file convenience-in addition to in-car digital tokens, mobile wallets, NFC interfaces, and prepaid account solutions. These payment modes enable drivers to select the transaction experience that best matches their security, speed, and integration preferences.

Applications cover a breadth of use cases: drive-through orders processed through integrated POS terminals; fuel payments for both diesel and petrol dispensers; EV charging sessions divided into AC and DC fast-charging categories; as well as parking and toll payments managed via in-cabin software interfaces. Each scenario demands tailored authentication protocols and transaction flows to ensure reliability and compliance with regional regulations.

Vehicle types further segment the market, with heavy-duty and light-duty commercial fleets leveraging telematics-integrated payment platforms for streamlined expense tracking, and passenger vehicles-hatchbacks, sedans, and SUVs-prioritizing consumer-centric experiences. Connectivity options include embedded systems spanning 3G, 4G LTE, and emerging 5G networks, integrated solutions that merge infotainment systems with external devices, and tethered setups reliant on paired smartphones.

Transaction types are categorized as point-of-sale events executed in real time at service locations, recurring billing mechanisms for subscriptions and permits, and remote transactions that handle preauthorization and booking outside the vehicle. This granular segmentation empowers OEMs and service providers to tailor roadmaps and user experiences to evolving market demands and technological advancements.

This comprehensive research report categorizes the In-vehicle Payment Services market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Payment Method

- Connectivity

- Transaction Type

- Application

- Vehicle Type

Mapping Regional Dynamics Impacting In-Vehicle Payment Adoption Across the Americas, Europe Middle East Africa, and Asia-Pacific Markets

The Americas region leads in-vehicle payment adoption, driven by a mature ecosystem of connected vehicles, advanced telematics infrastructure, and consumer preference for cashless mobility. In the United States and Canada, electric vehicle networks and smart city programs have enabled over seventy percent of charging stations and toll collection points to support direct, in-cabin transactions. Collaborative initiatives between transportation authorities, highway operators, and automotive OEMs further standardize payment interfaces across jurisdictions, simplifying adoption for fleet managers and individual drivers alike.

Within Europe, Middle East, and Africa, regulatory harmonization and public-private partnerships are catalyzing the integration of in-vehicle wallets into urban infrastructure. The European Union’s drive for interoperable tolling and parking systems has accelerated deployment of embedded terminals and roadside NFC devices in key markets such as Germany and France. In the Gulf region, smart mobility investments are complemented by digital identity frameworks, enabling secure contactless transactions in premium vehicle models and commercial fleets.

Asia-Pacific exhibits rapid uptake of in-vehicle payment services, supported by dense urban corridors and government initiatives promoting digital commerce. In China, Japan, and South Korea, a majority of CBD residents use connected car payments for tolls, parking, and drive-through purchases. Collaborations between leading OEMs, smartphone manufacturers, and financial institutions are pioneering advanced authentication methods and ecosystem-wide solutions tailored to high-frequency transit environments.

Each regional bloc presents distinct market drivers: the Americas excels in scale and readiness; EMEA benefits from standardized regulations and cross-border interoperability; and Asia-Pacific leads in digital wallet ubiquity and urban mobility integration. These insights inform targeted go-to-market approaches and localized solution designs.

This comprehensive research report examines key regions that drive the evolution of the In-vehicle Payment Services market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Key Industry Players Driving Innovation in In-Vehicle Payment Services Through Partnerships, Technology Leadership, and Ecosystem Collaborations

Established payment networks and technology firms are pivotal in defining the in-vehicle payment ecosystem. Visa, MasterCard, and American Express have extended tokenization and digital wallet platforms into automotive environments, leveraging robust merchant networks and fraud analytics to underpin secure, real-time transactions within vehicle dashboards.

Collaborative innovations underscore the sector’s momentum: CarIQ Technologies’ Vehicle Wallet, co-developed with Visa, integrates vehicle identity verification and seamless payment orchestration, while Hyundai Motor America’s partnership with Parkopedia brings OEM-branded parking and mobility transactions to factory-installed systems. These alliances demonstrate how OEMs and fintech providers coalesce to deliver frictionless in-cabin commerce and unlock new value streams.

On the hardware front, semiconductor leaders such as NXP Semiconductors and Infineon Technologies embed secure elements, cryptographic engines, and NFC transceivers into automotive control units, enabling contactless and cardless transaction flows. Concurrently, cloud service providers are offering edge computing frameworks that support over-the-air updates, data privacy compliance, and scalable transaction processing for global vehicle fleets.

Emerging fintech platforms contribute modular, software-defined payment infrastructures, blockchain-based settlement capabilities, and AI-driven personalization engines. By decoupling transaction logic from hardware dependencies, these solutions empower rapid feature rollouts and reduce integration complexity, shaping the next generation of in-vehicle payment offerings.

This comprehensive research report delivers an in-depth overview of the principal market players in the In-vehicle Payment Services market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- American Express Company

- Continental AG

- Fidelity National Information Services, Inc.

- Fiserv, Inc.

- Global Payments Inc.

- HARMAN International Industries, Incorporated

- Mastercard Incorporated

- Mercedes-Benz Mobility AG

- PayPal Holdings, Inc.

- Razorpay Inc.

- Robert Bosch GmbH

- Visa Inc.

Actionable Recommendations for Industry Leaders to Capitalize on In-Vehicle Payment Opportunities and Navigate Emerging Market Challenges

Industry leaders aiming to capitalize on in-vehicle payment trends should pursue strategic alliances that span automakers, financial institutions, and mobility service operators. Co-developing OEM-branded wallet solutions with established payment networks streamlines integration and leverages existing merchant acquirer relationships, reducing time to market and bolstering customer trust.

Securing robust hardware and software frameworks is essential. Automakers and tier-one suppliers should embed secure elements, adopt tokenization, and implement real-time fraud analytics. Collaborations with specialist semiconductor manufacturers and cybersecurity experts will ensure resilient architectures that comply with stringent automotive and data privacy regulations.

Tailoring offerings to regional dynamics enhances relevance and adoption. Configurable applications supporting multiple currencies, languages, and transaction modes-real-time point-of-sale, recurring subscriptions, and remote pre authorization-address specific market requirements. Onshore and nearshore sourcing of hardware can mitigate tariff impacts and strengthen supply chain agility.

Finally, embracing an iterative, data-driven development cycle fueled by user feedback and machine learning insights will enable rapid feature optimization and personalized experiences. Analyzing anonymized transaction and behavioral data can inform location-based offers, dynamic pricing models, and loyalty integrations, unlocking new monetization avenues and reinforcing competitive differentiation.

Transparent Research Methodology Outlining Rigorous Data Collection, Primary and Secondary Research Approaches, and Analytical Frameworks

Our study integrates both primary and secondary research methodologies to deliver a comprehensive market perspective. Primary research included targeted interviews with senior executives, product managers, and technology architects from automotive OEMs, payment networks, and hardware suppliers, supplemented by surveys that captured real-world usage patterns, pain points, and emerging requirements across key markets.

Secondary research comprised an extensive review of corporate publications, industry white papers, patent filings, and regulatory documents. We analyzed trade data and tariff schedules to assess the impact of 2025 policy shifts on cost structures and supply chains. Quantitative data points were triangulated through vendor revenue reports, telematics deployment statistics, and automotive production volumes.

Analytical rigor was ensured through a multi-layered validation process. Qualitative insights were corroborated via expert panels and scenario planning workshops, while quantitative figures underwent cross-referencing with multiple data sources. We applied strategic frameworks-including SWOT analysis, Porter’s Five Forces, and value chain mapping-to distill actionable implications and guide forward-looking recommendations for industry stakeholders.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our In-vehicle Payment Services market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- In-vehicle Payment Services Market, by Payment Method

- In-vehicle Payment Services Market, by Connectivity

- In-vehicle Payment Services Market, by Transaction Type

- In-vehicle Payment Services Market, by Application

- In-vehicle Payment Services Market, by Vehicle Type

- In-vehicle Payment Services Market, by Region

- In-vehicle Payment Services Market, by Group

- In-vehicle Payment Services Market, by Country

- United States In-vehicle Payment Services Market

- China In-vehicle Payment Services Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1590 ]

Concluding Insights on the Evolutionary Trajectory and Strategic Imperatives Shaping the Future of In-Vehicle Payment Services

In-vehicle payment services are an indispensable component of the connected mobility era, enabling seamless commerce within the vehicle environment. This analysis has highlighted how advanced connectivity, digital wallets, and embedded secure hardware are converging to deliver intuitive user experiences. The evaluation of US tariff impacts revealed the critical need for supply chain resilience, while segmentation and regional insights offered strategic guidance for targeted market entry and solution design.

Key industry collaborations-spanning payment networks, OEMs, semiconductor vendors, and fintech startups-demonstrate the power of cross-sector partnerships to accelerate innovation. As the automotive landscape evolves with electrification and autonomy, integrated payment platforms will shift from convenience enhancers to core components of vehicle value propositions, encompassing charging reservations, loyalty programmability, and proactive security controls.

Organizations that proactively align technical excellence with strategic foresight will define the future of in-vehicle commerce. Anticipating regulatory changes, harmonizing multi-regional deployment, and leveraging AI-driven personalization will distinguish market leaders and unlock new revenue models. Ultimately, in-vehicle payments will underpin a new dimension of digital mobility experiences and redefine driver engagement in the years ahead.

Drive Growth and Gain Competitive Advantage by Contacting Ketan Rohom to Access the Comprehensive In-Vehicle Payment Services Market Research Report

To explore the full breadth of insights, methodologies, and strategic recommendations presented in this executive summary, industry decision-makers are invited to secure access to the comprehensive In-Vehicle Payment Services market research report. Ketan Rohom, Associate Director of Sales & Marketing, stands ready to guide organizations through the report’s in-depth analyses, bespoke regional breakdowns, and vendor benchmarking studies. Engage directly with Ketan Rohom to discuss tailored research packages, licensing options, and data extract services that can support your organization’s strategic planning and digital mobility initiatives. Our team looks forward to empowering your next-generation product and partnership decisions.

- How big is the In-vehicle Payment Services Market?

- What is the In-vehicle Payment Services Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?