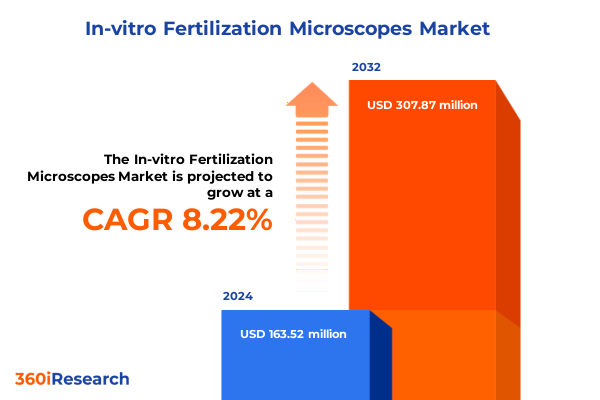

The In-vitro Fertilization Microscopes Market size was estimated at USD 176.13 million in 2025 and expected to reach USD 190.01 million in 2026, at a CAGR of 8.30% to reach USD 307.87 million by 2032.

Transforming Fertility Care Through Next-Generation Microscopy Innovations That Elevate Precision and Success Rates in In-Vitro Fertilization Treatments

In recent years, the landscape of fertility treatment has witnessed unparalleled transformation driven by rapid technological advances. As patient demand for more personalized, precise, and efficient in-vitro fertilization (IVF) procedures continues to grow, microscopes have emerged as a critical fulcrum in the clinical workflow. These sophisticated optical instruments are not merely passive observation tools; they function as active enablers of embryologists’ decision-making, improving embryo selection protocols through enhanced imaging clarity and real-time monitoring capabilities.

Against a backdrop of rising global infertility rates and increasingly stringent regulatory requirements, IVF clinics are seeking microscopy solutions that integrate seamlessly with time-lapse imaging systems, AI-powered analytics, and closed-system incubators. This convergence of imaging and data science is redefining conventional embryology practices, enabling the identification of subtle morphological markers of embryo viability with greater confidence. Consequently, modern IVF microscopes are being designed not only for optical excellence but also for connectivity, ergonomics, and workflow automation.

This executive summary explores the current state of the IVF microscope market, delving into pivotal technological shifts, tariff implications, segmentation dynamics, and regional variations. It also highlights strategies deployed by leading manufacturers and actionable recommendations for stakeholders. By framing these insights within a robust research framework, this report offers decision-makers a clear, concise overview of the forces shaping the future of fertility care delivery.

Disruptive Technological Breakthroughs and Emerging Trends That Are Redefining In-Vitro Fertilization Microscopy to Optimize Embryo Visualization, Analysis, and Clinical Workflows

The in-vitro fertilization microscopy market is undergoing a wave of innovation that is fundamentally reshaping clinical workflows and patient outcomes. Breakthroughs in super-resolution imaging, digital holography, and multispectral fluorescence have expanded the boundaries of embryo assessment, allowing for subcellular visualization without compromising cell integrity. Innovations such as label-free imaging techniques reduce handling risks, while AI-driven pattern recognition algorithms offer automated grading of embryo morphology, minimizing subjective variability among embryologists.

Simultaneously, manufacturers are accelerating the integration of microscopes into closed-system incubators, ensuring that embryos remain in stable, controlled environments throughout observation. This convergence of incubation and imaging not only reduces thermal and mechanical stress on embryos but also streamlines laboratory footprints, enabling high-volume IVF centers to optimize space utilization and throughput. Portable microscopy units are also gaining traction, facilitating point-of-care fertilization monitoring in smaller clinics and academic research facilities.

Furthermore, the rise of tele-embryology is unlocking remote expert consultations, as high-definition live feeds and cloud-based image repositories become commonplace. This digital collaboration model is proving invaluable in regions with limited specialized expertise, democratizing access to advanced embryo selection methodologies. Collectively, these technological and operational shifts are redesigning how IVF services are delivered and paving the way for higher implantation success rates.

Assessing the Cumulative Impact of 2025 United States Tariff Policies on In-Vitro Fertilization Microscopy Supply Chains, Costs, and Industry Dynamics

In January 2025, the United States Trade Representative concluded its four-year review under Section 301, implementing a significant uptick in tariff rates on a broad array of Chinese-origin medical and optical equipment. Optical microscopes, classified under HTS 9011.80, experienced a 25 percent tariff increase, markedly elevating import costs for key components and finished units originating from China. This adjustment compounded on the existing baseline duties for medical instruments, translating into an additional cost burden for IVF clinics reliant on imported analysis stations (Section 301 tariffs, HTSUS 9011.80.0000).

Concurrently, the U.S. administration suspended the de minimis exemption on low-value imports, subjecting packages valued at $800 or less to either a 54 percent ad valorem duty or a $100 flat fee, a policy particularly impactful on smaller portable microscopes and replacement parts often shipped in low-value consignments (de minimis changes, May 2025). In April 2025, a global reciprocal tariff of 10 percent on all imports, layered atop existing duties, further compounded importer liability, effectively increasing landed costs by up to 60 percent for certain Chinese-manufactured optics (global reciprocal tariff, April 2025).

These cumulative tariff measures have disrupted procurement strategies, inducing longer lead times as suppliers re-evaluate their sourcing footprints. Many suppliers have responded by shifting manufacturing to tariff-exempt jurisdictions such as Taiwan and South Korea, or by accelerating domestic production initiatives. While these adaptations mitigate immediate cost escalations, they also introduce new complexities in quality control, regulatory compliance, and supply-chain transparency. The net effect of these tariffs has been a reconfiguration of the global microscopy supply network, incentivizing on-shore and near-shore manufacturing to alleviate geopolitical risk.

Deep Dive into Market Segmentation Insights for In-Vitro Fertilization Microscopes Across Type, Form Factor, Application, End User, and Distribution Channel Dimensions

The IVF microscope market can be analyzed through multiple dimensions that reveal nuanced customer preferences and technology adoption patterns. Across product configurations, laboratory-grade inverted and upright microscopes dominate high-throughput fertility centers where ergonomic design and digital integration are paramount for extended use. Conversely, stereo microscopes and embryo microscopes find favor in specialized clinics focusing on manual oocyte manipulation and micromanipulation procedures, where depth perception and manipulation space are critical.

Form factor distinctions further highlight market segmentation. Benchtop microscopes remain the workhorses of central embryology laboratories, valued for stability, advanced optics, and modular upgrade options. In contrast, the emergence of portable microscopes addresses the needs of small clinics and academic research environments, offering flexibility and cost-efficiency for decentralized fertilization monitoring or teaching applications.

Functional demands delineate application-based preferences. Egg retrieval and identification leverage stereo imaging to isolate oocytes with minimal handling stress, while embryo development monitoring increasingly relies on time-lapse systems integrated into inverted microscopes. Fertilization process monitoring has grown more sophisticated with polarization optics that visualize spindle alignment, and genetic screening workflows are often paired with fluorescence microscopy platforms. Sperm analysis benefits from dark-field and phase-contrast capabilities to assess motility and morphology with precision.

End-user diversity spans academic institutions employing research-grade systems for developmental biology studies, fertility clinics requiring turnkey microscopy-incubator hybrids, and hospitals integrating IVF labs into broader assisted-reproductive service lines. Distribution channels are equally bifurcated: offline sales through established laboratory equipment distributors offer hands-on demonstrations and service contracts, while online portals provide rapid configuration tools, competitive pricing, and direct relationships with manufacturers, appealing to cost-conscious buyers seeking minimal procurement friction.

This comprehensive research report categorizes the In-vitro Fertilization Microscopes market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Form Factor

- Application

- End User

- Distribution Channel

Analyzing Regional Dynamics and Growth Drivers for In-Vitro Fertilization Microscopes Across the Americas Europe Middle East Africa and Asia-Pacific Markets

Regional dynamics in the IVF microscopy market are shaped by varying healthcare infrastructures, reimbursement frameworks, and per capita fertility treatment demand. In the Americas, advanced fertility centers in North America are driving demand for high-end microscopy solutions that incorporate AI analytics and closed-environment imaging. Latin American markets, while still developing, show heightened interest in cost-effective portable systems, as expanding insurance coverage and growing urban middle classes fuel clinic expansion.

Within Europe, Middle East, & Africa (EMEA), regulatory harmonization efforts such as the EU’s In-Vitro Diagnostic Regulation are compelling manufacturers to align their products with stringent quality and safety requirements. This has elevated uptake of certified microscope-incubator hybrids in Western Europe, while markets in the Middle East are investing heavily in state-of-the-art IVF suites, often bundling advanced imaging systems with comprehensive lab automation. In sub-Saharan Africa, demand is nascent but growing, with clinics prioritizing durable and low-maintenance benchtop units due to infrastructure constraints.

Asia-Pacific remains a vibrant growth hub, driven by high demographic demand in China, India, and Southeast Asia. China’s increasing domestic manufacturing capabilities have introduced competitively priced microscopes with rapidly evolving feature sets, while Japan and South Korea continue to innovate in super-resolution and optical coherence tomography microscopy. The Asia-Pacific region also leads in tele-embryology initiatives, leveraging advanced telecommunications to provide remote diagnostic support to smaller centers.

These regional variances underscore the importance of tailored go-to-market strategies that account for local regulatory landscapes, pricing sensitivities, and technological readiness. Manufacturers that customize their product portfolios to address region-specific clinical workflows and service requirements are positioned to capture share across these diverse markets.

This comprehensive research report examines key regions that drive the evolution of the In-vitro Fertilization Microscopes market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Illuminating Leading Industry Players and Strategic Movements Shaping Competitive Dynamics in the In-Vitro Fertilization Microscopy Market

Competition in the IVF microscopy market is anchored by global optics powerhouses that have leveraged their heritage in life-science instrumentation to develop specialized IVF solutions. Olympus and Nikon continue to innovate in inverted microscope platforms, focusing on seamless integration with time-lapse imaging and AI-enabled embryo scoring. Their extensive service networks and training programs provide a formidable barrier to new entrants.

Leica Microsystems, with its strong emphasis on fluorescence and super-resolution imaging, has differentiated itself in the genetic diagnostics segment, collaborating with molecular assay providers to deliver turnkey solutions for preimplantation genetic testing. Thermo Fisher Scientific has also expanded its footprint through strategic acquisitions, bundling microscopy with consumables and digital analytics software.

Specialized companies like Hamilton Thorne have carved niches in sperm analysis and micromanipulation tools, offering purpose-built laser-based ablation systems that integrate with third-party microscopes. Tokai Hit’s strength lies in its incubator-microscope hybrids, which provide closed-system environments optimized for live-cell imaging and embryo culture, a critical value proposition for clinics focused on implantation success rates.

Smaller, regionally focused OEMs are making inroads by offering cost-competitive portable and benchtop models that meet basic embryology requirements at lower price points. These players often partner with local distributors to provide tiered service offerings, appealing to emerging markets seeking reliable performance with minimal upfront investment. The competitive landscape thus reflects a spectrum of strategic approaches, from high-end integrated platforms to value-oriented standalone units.

This comprehensive research report delivers an in-depth overview of the principal market players in the In-vitro Fertilization Microscopes market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ACCU-SCOPE Inc

- Carl Zeiss AG

- Eppendorf SE

- Esco Micro Pte. Ltd.

- Getner Instruments Pvt. Ltd.

- Hamilton Thorne, Inc.

- Labomed Europe B.V.

- Leica Microsystems GmbH

- Linkam Scientific Instruments Ltd.

- Luxo Corporation

- Meiji Techno Co., Ltd.

- Microscope World

- Narishige Co., Ltd.

- Nikon Corporation

- Olympus Corporation

Actionable Recommendations for Industry Leaders to Capitalize on Technological Advances, Regulatory Changes, and Market Demand in IVF Microscopy

To capitalize on the evolving IVF microscopy landscape, industry leaders should pursue a multipronged strategy that aligns product innovation with changing clinical demands. First, investing in modular, upgradeable platforms will enable customers to extend system lifecycles and adopt emerging imaging modalities without complete hardware replacements. Embedding AI-powered analytics into these architectures can further differentiate offerings by reducing manual grading workload and delivering predictive insights on embryo viability.

Second, diversifying manufacturing footprints across tariff-exempt regions will mitigate the financial impact of evolving trade policies. Establishing assembly or component fabrication sites in Taiwan, South Korea, or domestic U.S. facilities can help maintain competitive pricing while ensuring regulatory compliance. Concurrently, securing temporary tariff exclusions through proactive engagement with trade authorities can offer short-term relief for critical components.

Third, expanding service and support ecosystems is essential to cement customer loyalty. Offering tiered service contracts that encompass preventive maintenance, remote diagnostics, and operator training will enhance uptime and drive recurring revenue. Partnerships with laboratory information management system providers can create integrated workflows that streamline data management and improve traceability for regulatory inspections.

Finally, forging strategic alliances with fertility clinics and academic centers for real-world validation studies will accelerate adoption of novel imaging technologies. Co-development programs and early-access pilot projects can generate compelling clinical evidence, fostering broader market acceptance and informing future product roadmaps.

Robust Research Methodology Integrating Primary Interviews, Secondary Data Analysis, and Rigorous Validation to Ensure Research Integrity

This research employs a rigorous mixed-methods approach to ensure robustness and credibility. Primary data collection involved in-depth interviews with key opinion leaders, including chief embryologists, IVF lab managers, and procurement directors, capturing real-world perspectives on equipment performance, workflow challenges, and purchase drivers. Quantitative surveys supplemented these insights, capturing feedback from over 150 clinical laboratories worldwide on feature preferences and investment priorities.

Secondary research entailed exhaustive analysis of technical publications, regulatory filings, patent landscapes, and white papers from leading optics and life-science instrumentation providers. Publicly available tariff orders and customs databases were reviewed to quantify the impact of U.S. trade policies on microscope imports. Company financial disclosures and press releases provided additional color on product launches, strategic partnerships, and market expansion initiatives.

These sources were triangulated through iterative validation workshops with in-house subject-matter experts specializing in optics, reproductive medicine, and international trade. Data integrity checks, thematic coding of qualitative inputs, and statistical cross-verification of survey responses underpin the methodological rigor. This holistic process ensures that the findings and recommendations presented in this report reflect the most current, accurate, and actionable insights available.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our In-vitro Fertilization Microscopes market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- In-vitro Fertilization Microscopes Market, by Type

- In-vitro Fertilization Microscopes Market, by Form Factor

- In-vitro Fertilization Microscopes Market, by Application

- In-vitro Fertilization Microscopes Market, by End User

- In-vitro Fertilization Microscopes Market, by Distribution Channel

- In-vitro Fertilization Microscopes Market, by Region

- In-vitro Fertilization Microscopes Market, by Group

- In-vitro Fertilization Microscopes Market, by Country

- United States In-vitro Fertilization Microscopes Market

- China In-vitro Fertilization Microscopes Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 954 ]

Synthesis of Key Findings Underpinning Strategic Decision-Making in the In-Vitro Fertilization Microscopy Sector to Drive Competitive Advantage

This executive summary has highlighted the pivotal role of microscopy innovations in elevating IVF outcomes and addressed the complex interplay of technological, regulatory, and competitive forces shaping the market. By unpacking transformative imaging modalities and quantifying the effects of recent U.S. tariffs, stakeholders can better anticipate cost pressures and supply-chain adaptations.

Moreover, detailed segmentation analysis clarifies how product type, form factor, application, end user, and distribution channel preferences vary across clinic sizes and geographies. Regional insights further underscore the importance of tailored strategies for the Americas, EMEA, and Asia-Pacific, where divergent regulatory environments and infrastructure readiness dictate distinct product value propositions.

Competitive profiling of established optics leaders and specialized OEMs illustrates a spectrum of strategic postures, from high-end integrated platforms to cost-competitive standalone units. The actionable recommendations provide a roadmap for manufacturers and distributors to optimize product architectures, diversify manufacturing footprints, enhance support services, and cultivate collaborative validation partnerships.

Together, these synthesized insights empower decision-makers to navigate industry headwinds, capitalize on emerging opportunities, and ultimately drive superior patient outcomes in assisted reproductive care.

Connect with Our In-Vitro Fertilization Microscopy Market Expert Ketan Rohom to Acquire Comprehensive Research Insights Tailored to Your Needs

Our dedicated market specialist Ketan Rohom, Associate Director of Sales & Marketing, stands ready to guide your organization through the complex dynamics of the in-vitro fertilization microscopy industry. Armed with deep domain knowledge and tailored analytical expertise, he can help you identify strategic growth opportunities, optimize procurement strategies, and unlock value at every stage of the microscope lifecycle. Engage with Ketan to discuss how this comprehensive research can inform your product development roadmaps, distribution plans, and partnership initiatives. Reach out now to secure the full report and elevate your competitive positioning with actionable data-backed insights.

- How big is the In-vitro Fertilization Microscopes Market?

- What is the In-vitro Fertilization Microscopes Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?