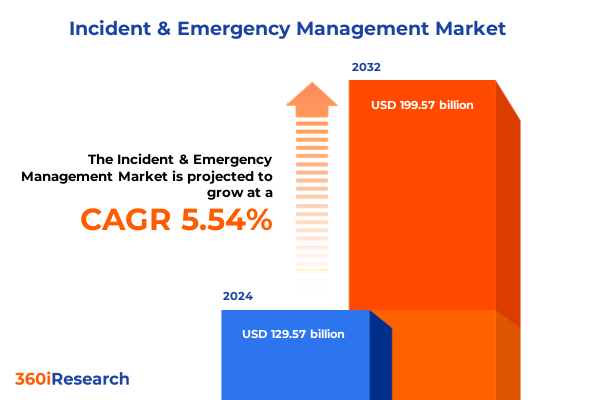

The Incident & Emergency Management Market size was estimated at USD 136.20 billion in 2025 and expected to reach USD 143.18 billion in 2026, at a CAGR of 5.60% to reach USD 199.57 billion by 2032.

Setting the Stage for Resilient Incident and Emergency Management Strategies in a Rapidly Evolving Global Risk Environment

Every major incident underscores the critical importance of robust emergency management practices that can adapt rapidly to evolving threats. Whether confronting natural disasters, technological failures, or security breaches, organizations across industries must build resilient frameworks that protect lives, assets, and reputations. The complexity of today’s risk environment demands not only advanced systems and technologies but also seamless coordination among government agencies, private entities, first responders, and community stakeholders.

This executive summary synthesizes the most pressing trends, challenges, and opportunities shaping the incident and emergency management market. Drawing on extensive primary interviews, in-depth case studies, and rigorous secondary research, the analysis reveals how integration of digital platforms, regulatory shifts, and global trade dynamics are driving transformation. As leaders seek to enhance situational awareness, accelerate response times, and optimize resource deployments, this overview will crystallize the strategic imperatives that will define success over the coming years.

Uncovering the Transformative Technological Accelerations Operational Overhauls and Regulatory Evolutions Redefining Modern Emergency Response Frameworks

Innovation in emergency management has accelerated at an unprecedented pace, fueled by breakthroughs in data analytics, artificial intelligence, and the Internet of Things. Command centers now leverage predictive modeling and real-time sensor feeds to anticipate hazards before they escalate, while unmanned aerial systems deliver crucial visibility in complex environments. These technological advances are reshaping operational paradigms, enabling decision-makers to allocate resources with pinpoint accuracy and to maintain continuity amid disruption.

Parallel to technological leaps, regulatory frameworks are evolving to mandate higher levels of preparedness and interoperability. Governments are introducing stringent performance standards for mass notification and geospatial systems, compelling organizations to upgrade legacy infrastructure and adopt unified communication protocols. Moreover, public-private partnerships are emerging as foundational pillars, ensuring that expertise and assets are shared seamlessly across responder networks. As these dynamics converge, stakeholders must recalibrate their strategies to harness transformational change and to sustain excellence in incident mitigation and recovery.

Assessing the Cumulative Economic Operational and Strategic Impacts of Recent United States Tariff Measures on Emergency Management Supply Chains in 2025

The ripple effects of United States tariff policies in 2025 have reverberated through the incident and emergency management supply chain, driving cost pressures and procurement delays. Broad-based levies on imported steel and aluminum have inflated the expenses associated with critical infrastructure components, from perimeter intrusion detection hardware to surveillance towers. As businesses grapple with increased input costs, capital expenditures for disaster recovery systems have been postponed or scaled back, challenging vendors to optimize production and to offer more cost-efficient deployment models.

In parallel, defense and aerospace contractors central to emergency communication and mass notification systems have reported margin compressions attributable to elevated tariff burdens. One leading conglomerate revised its 2025 profit outlook downward after absorbing a substantial $125 million hit tied to steel and aluminum duties, even as demand for its Patriot air defense and secure communication platforms surged. These financial headwinds underscore the need for organizations to evaluate alternative sourcing strategies, to negotiate long-term supplier agreements, and to accelerate digital tool adoption that can mitigate supply chain volatility.

Illuminating Critical Market Segmentation Insights Across Solution Service Communication Deployment Industry and End User Dimensions Driving Emergency Management Adoption

A thorough examination of market segmentation uncovers distinct patterns across solution type, service type, communication type, deployment mode, industry vertical, and end user profiles. Disaster recovery, emergency mass notification, geospatial intelligence, inventory and resource coordination, perimeter intrusion detection, surveillance, and traffic management offerings each demand tailored integration strategies to align with organizational risk profiles. Consulting, emergency operations coordination, public information dissemination, and training and simulation services play an integral role in ensuring that these systems deliver optimal performance when it matters most.

Furthermore, first responder communication tools such as radios and wearables, alongside satellite phones and vehicle-integrated systems, have become indispensable. Cloud-based, on-premise, and hybrid deployment models offer varying trade-offs between scalability and control, while vertical-specific requirements in sectors like banking, education, energy, government and defense, healthcare, telecommunications, retail, and logistics shape solution roadmaps. Finally, the distinct needs of disaster recovery agencies, enterprise operations teams, first responders on the front lines, homeland security units, and humanitarian organizations underscore the importance of flexible platforms that can adapt to diverse operational environments and mission imperatives.

This comprehensive research report categorizes the Incident & Emergency Management market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Solution Type

- Services Type

- Communication Type

- Deployment Mode

- Industry Vertical

Examining Distinct Regional Dynamics and Strategic Opportunities in Emergency Management Across the Americas Europe Middle East Africa and Asia Pacific

Geographical dynamics exert a profound influence on emergency management priorities, with distinct drivers emerging across the Americas, Europe Middle East and Africa, and Asia Pacific. In North and South America, increasing urbanization and climate-related extreme weather events have accelerated investment in mass notification systems, geospatial analytics platforms, and interoperable communication networks. Public safety agencies and critical infrastructure operators alike are prioritizing unified command solutions that can coordinate responses seamlessly across vast metropolitan regions.

Across Europe Middle East and Africa, regulatory bodies are mandating comprehensive incident reporting, cross-border coordination frameworks, and stringent cybersecurity standards for emergency management systems. Government and defense entities are collaborating with technology providers to fortify border security, to manage refugee influx scenarios, and to enhance civil protection capabilities. In Asia Pacific, rapid digital transformation initiatives are fueling adoption of AI-driven resource management, drone-enabled surveillance, and resilient cloud architectures, particularly in economies facing both seismic and maritime risks. Regional nuances in regulation, threat profiles, and technological maturity continue to shape differentiated market trajectories.

This comprehensive research report examines key regions that drive the evolution of the Incident & Emergency Management market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Strategic Partnerships Driving Excellence and Competitive Differentiation in the Incident and Emergency Management Landscape

Leading technology providers and service integrators are redefining the competitive landscape through strategic acquisitions, partnerships, and product innovations. Pioneers in critical communications have expanded portfolios to integrate IoT devices and AI-powered analytics into legacy radio networks, while specialized software firms are embedding advanced mapping and resource allocation modules into emergency operation centers. Simultaneously, system integrators are forging alliances with cloud infrastructure leaders to deliver hybrid deployment models that balance data sovereignty requirements with scalable performance.

On the services front, consultancies with deep domain expertise in disaster planning and public information campaigns are leveraging predictive modeling tools to refine scenario-based training programs. First responder equipment manufacturers are collaborating with telecommunication operators to introduce vehicle-integrated and satellite-enabled solutions that ensure continuous connectivity in austere environments. These strategic moves underscore the imperative for vendors to cultivate end-to-end capabilities, to anticipate evolving threat vectors, and to deliver turnkey solutions that address the full spectrum of incident management needs.

This comprehensive research report delivers an in-depth overview of the principal market players in the Incident & Emergency Management market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ARCOS LLC

- BlackBerry Limited

- Broadcom Inc. by Avago Technologies

- Cydarm Technologies Pty Ltd.

- DEKRA SE

- Eaton Corporation PLC

- Emergency Management Services International, Inc.

- Environmental Systems Research Institute, Inc.

- Everbridge, Inc.

- Furuno Electric Co., Ltd.

- Fusion Risk Management, Inc.

- Garmin Ltd.

- Hexagon AB

- Honeywell International, Inc.

- International Business Machines Corporation

- Intrepid Networks LLC

- Johnson Controls International PLC

- Lockheed Martin Corporation

- LTIMindtree Limited by Larsen & Toubro Ltd.

- Motorola Solutions Inc.

- NEC Corporation

- Nippon Telegraph & Telephone Corporation

- Petrofac Limited

- Raytheon Technologies Corporation

- Safran Electronics & Defense

- SGS Société Générale de Surveillance SA

- Siemens AG

- Singlewire Software, LLC

- Sophos Ltd.

- The Response Group, LLC

- Trimble Inc.

- TÜV Rheinland AG

- Veoci Inc.

- Wolters Kluwer N.V.

Delivering Pragmatic Actionable Recommendations to Empower Industry Leaders to Enhance Resilience Agility and Collaboration in Emergency Management

Industry leaders must prioritize the integration of unified communication platforms and geospatial intelligence to achieve holistic situational awareness. By consolidating disparate data streams into a single pane of glass, response teams can make informed decisions faster and reduce the risk of information silos. Concurrently, organizations should invest in scalable cloud and hybrid solutions that permit rapid system expansion during large-scale incidents while maintaining stringent data security protocols.

Risk mitigation strategies should include diversified supplier networks and upstream inventory planning to insulate operations from geopolitical disruptions. Developing robust public-private collaboration frameworks and conducting regular multi-agency exercises will strengthen organizational agility. Finally, embedding advanced analytics into training and simulation services, combined with continuous skill development programs for first responders and command staff, will ensure that stakeholders remain prepared to confront both known and emerging threats with confidence.

Outlining the Rigorous Multimethod Research Approach Data Sources and Analytical Frameworks Employed to Deliver Actionable Emergency Management Insights

This research employed a multimethod approach encompassing extensive primary interviews with senior executives in public safety agencies, first responder organizations, and leading technology providers. These qualitative insights were complemented by a comprehensive review of regulatory documents, public filings, and industry publications to map the evolving policy environment. Secondary data sources included trade journals, government reports, and reputable news outlets to contextualize tariff dynamics and regional market nuances.

Analytical frameworks were applied to segment the market across six critical dimensions: solution type, service type, communication type, deployment mode, industry vertical, and end user. Data triangulation techniques validated findings through cross-referencing between stakeholder interviews and published statistics. Finally, iterative reviews with advisory board members and subject matter experts ensured methodological rigor and the delivery of insights that are both actionable and strategically relevant to senior decision-makers.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Incident & Emergency Management market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Incident & Emergency Management Market, by Solution Type

- Incident & Emergency Management Market, by Services Type

- Incident & Emergency Management Market, by Communication Type

- Incident & Emergency Management Market, by Deployment Mode

- Incident & Emergency Management Market, by Industry Vertical

- Incident & Emergency Management Market, by Region

- Incident & Emergency Management Market, by Group

- Incident & Emergency Management Market, by Country

- United States Incident & Emergency Management Market

- China Incident & Emergency Management Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1113 ]

Synthesizing Key Learnings and Strategic Imperatives to Propel Future Innovation Resilience and Collaboration in Incident and Emergency Management Practices

The converging forces of technological innovation, regulatory evolution, and global trade dynamics are reshaping the incident and emergency management landscape. As organizations confront increasingly sophisticated risks, the ability to integrate advanced communications, geospatial analytics, and resilient infrastructure will distinguish industry leaders from laggards. Tariff-related cost pressures underscore the importance of diversified sourcing strategies and agile procurement practices.

Moving forward, stakeholders must commit to holistic strategies that encompass both operational execution and strategic foresight. By harnessing unified platforms, fostering interagency collaboration, and embedding advanced analytics into every facet of emergency response, organizations can build the resilience necessary to navigate an unpredictable risk environment. This summary illuminates the strategic imperatives that will drive market success and offers a roadmap for informed decision-making in the years to come.

Empower Your Organization’s Emergency Management with Exclusive Strategic Insights and Expert Guidance by Securing the Comprehensive Market Research Report

If you are poised to elevate your organization’s incident and emergency management capabilities to new heights, securing the full market research report will equip you with the actionable strategies and data-driven insights essential for success. By partnering with Ketan Rohom (Associate Director, Sales & Marketing), you will gain personalized guidance tailored to your operational needs and strategic priorities. Reach out today to explore how this comprehensive analysis can inform your decision-making, optimize resource allocation, and reinforce resilience across your emergency management ecosystem.

- How big is the Incident & Emergency Management Market?

- What is the Incident & Emergency Management Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?