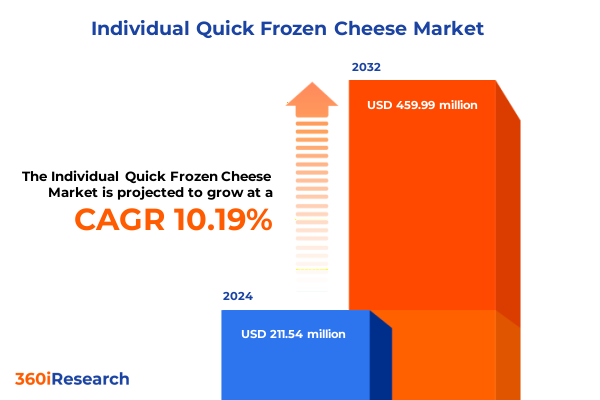

The Individual Quick Frozen Cheese Market size was estimated at USD 230.37 million in 2025 and expected to reach USD 253.52 million in 2026, at a CAGR of 10.38% to reach USD 459.98 million by 2032.

Unveiling the Individual Quick Frozen Cheese Sector’s Unprecedented Growth Drivers, Consumer Trends, and Strategic Imperatives for Industry Stakeholders

The individual quick frozen cheese segment represents a pivotal niche within the broader dairy industry, characterized by its focus on preserving cheese at the peak of freshness for versatile applications. This category encompasses an array of formats, from finely grated and pre-shredded shreds to block, cubed, and sliced varieties, all engineered to maintain flavor integrity and textural consistency under freezing conditions. As consumer lifestyles evolve toward convenience and efficiency, the demand for ready-to-use cheese ingredients has intensified across both foodservice and residential channels. Transitioning seamlessly from freezer to table, quick frozen cheese offers operational advantages for manufacturers, distributors, and end users alike, enabling reduced waste, streamlined production processes, and on-demand availability.

In an era defined by dynamic consumer preferences and shifting economic landscapes, the quick frozen cheese market has become a bellwether for innovation within the frozen food arena. Entrepreneurs and established dairy firms are investing in advanced freezing technologies, refined logistical networks, and sustainable packaging solutions to differentiate their offerings. From pizza chains and sandwich makers to institutional caterers and home cooks, stakeholders across the value chain are capitalizing on the consistency and extended shelf life that quick frozen cheese delivers. This introduction outlines the foundational elements driving growth and sets the stage for a deeper examination of the market’s transformative shifts, regulatory impacts, segmentation nuances, and strategic imperatives.

Navigating Transformative Consumer, Technological, and Regulatory Shifts Redefining the Quick Frozen Cheese Market Landscape in 2025

Over the past two years, the quick frozen cheese landscape has undergone profound transformation driven by technological, regulatory, and consumer behavior shifts. Consumers are increasingly seeking artisanal and specialty frozen cheese varieties that deliver an elevated taste experience and authentic craftsmanship in convenient formats, reflecting a broader trend toward premiumization within the frozen food category. Simultaneously, demand for health-focused cheese innovations-such as reduced-sodium, lower-fat, and fortified formulations-has surged, propelled by rising awareness of cardiovascular wellness and dietary balance. These developments have prompted major producers to diversify their portfolios and collaborate with research institutions to create novel cheese blends that address both indulgence and nutrition.

Technological advancements in individual quick freezing techniques have also reshaped supply chain efficiency. Enhanced IQF (Individual Quick Freeze) processes now enable cheese to be frozen within seconds of production, locking in moisture and flavor while preventing ice crystal formation. This innovation has resulted in consistent melting performance and superior product quality, critical for high-volume foodservice operators and private-label manufacturers. At the same time, regulatory agendas focused on import tariffs, food safety standards, and sustainability benchmarks have required companies to fortify their compliance frameworks. Navigating new tariff schedules and environmental certifications has become integral to strategic planning, underscoring the importance of agile operational models and diversified sourcing strategies.

Assessing the Comprehensive Repercussions of 2025 U.S. Tariff Measures on the Individual Quick Frozen Cheese Supply Chain and Pricing Dynamics

The imposition of sweeping U.S. tariffs in 2025 introduced significant complexity to the individual quick frozen cheese supply chain, reshaping cost structures and sourcing strategies. Effective April 5, a baseline 10 percent tariff was applied to all cheese imports under an IEEPA order, with elevated reciprocal duties ranging from 20 percent for the European Union to 34 percent on Chinese exports. These measures aimed to incentivize domestic production and address trade imbalances, yet they also raised landed costs for import-dependent manufacturers and private-label packagers. As a result, many firms initiated frontloading strategies ahead of tariff implementation and explored alternate supply routes through tariff-exempt free trade agreement partners.

Beyond direct pricing impacts, the new tariff regime prompted accelerated investment in U.S. cold-chain infrastructure. Domestic dairy processors expanded freezing capacity and refrigerated warehousing to accommodate a shift toward local sourcing. At the same time, strategic partnerships between U.S. companies and producers in Southeast Asia and Latin America gained traction, leveraging trade corridors with lower tariff burdens. For foodservice operators, the added cost pressure led to menu revisions and ingredient reformulations, while retail brands recalibrated pricing models to absorb part of the duty increase without alienating price-sensitive consumers. Although short-term disruptions emerged, the cumulative tariff effects have galvanized a more resilient and geographically diversified supply ecosystem in the quick frozen cheese segment.

Illuminating Critical Market Segmentation Dimensions to Reveal Nuanced Demand Patterns in the Quick Frozen Cheese Ecosystem

A nuanced understanding of individual quick frozen cheese demand emerges through examination of multiple segmentation dimensions. Product type analysis spans traditional Cheddar, Feta, Mozzarella, and various Processed cheese blends, each catering to distinct taste profiles and functional uses. Within frozen forms, flexibility extends from Block formats ideal for slicing and dicing to Cubed options suited for controlled portioning, while Shredded variants-available as Finely Grated or Pre Shredded-enable rapid integration into recipes. Complementing these, Sliced configurations, whether Thick Sliced or Thin Sliced, provide immediate utility for sandwich assemblers and culinary professionals.

Packaging innovations further refine market positioning, with stand-up Bag solutions-offered in both Resealable and Single-Serve formats-enhancing portion management and shelf visibility. Tray and Box formats address bulk usage scenarios, whereas Vacuum Packs extend shelf life and reinforce product integrity. Channels of distribution have also evolved; traditional Supermarket and Hypermarket outlets coexist alongside Convenience Stores and burgeoning Online retail avenues that encompass Direct-to-Consumer models and E-commerce platform partnerships. Finally, end user segmentation reveals divergent needs: Foodservice applications, ranging from Full-Service Restaurants and Institutional Caterers to Quick Service Restaurants, demand consistent performance and supply reliability, while Residential consumers prioritize convenience, cost efficiency, and multifunctional applications in home cooking.

This comprehensive research report categorizes the Individual Quick Frozen Cheese market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Form

- Packaging Type

- Distribution Channel

- End User

Decoding Regional Consumption Patterns and Growth Catalysts Across the Americas, EMEA, and Asia-Pacific Quick Frozen Cheese Markets

Regional dynamics in the quick frozen cheese sector underscore varied growth catalysts and consumption behaviors across key markets. In the Americas, the United States remains the primary consumption hub, driven by mature fast-food and foodservice industries that integrate frozen cheese into pizzas, sandwiches, and value-added products. Canada’s market is buoyed by strong dairy cooperatives and export-oriented processors, while Mexico leverages lower-cost production to supply both domestic and cross-border demand. The region’s established cold-chain networks and sustained consumer appetite for on-premise dining support a stable demand environment.

Europe, Middle East & Africa (EMEA) presents a tapestry of traditional cheese cultures and emerging convenience trends. Western European countries maintain robust artisanal and industrial cheese production, with frozen formats gaining traction among time-pressed urban consumers. In the Middle East, rapid urbanization and rising disposable incomes have spurred adoption of Western-style dishes, boosting demand for consistency and extended shelf life in frozen cheese applications. African markets, though still nascent, are witnessing early investments in cold-chain infrastructure, signaling potential for future growth as retail modernizes.

Asia-Pacific stands out as the fastest-expanding region, propelled by increasing Western dietary influences, urban migration, and evolving retail landscapes that integrate e-commerce and modern trade. Major economies such as China, Japan, and India are experiencing accelerated integration of frozen cheese into fast-food outlets, bakery chains, and home meal solutions, supported by rising disposable incomes and shifting culinary preferences. The diverse regional tapestry reflects both established consumption patterns and high-growth potential in emerging markets.

This comprehensive research report examines key regions that drive the evolution of the Individual Quick Frozen Cheese market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Players and Their Strategic Maneuvers Shaping the Competitive Landscape of Quick Frozen Cheese

The competitive arena of individual quick frozen cheese features a blend of global dairy giants and specialized processors executing differentiated strategies. Leading multinational cooperatives and private enterprises such as Arla Foods amba, Fonterra Co-operative Group, Saputo Inc., and Lactalis leverage extensive R&D capabilities and scale to introduce advanced freezing methods and value-added cheese blends. These incumbents have invested heavily in cold-chain networks and global distribution platforms to optimize cost efficiency and market reach. Meanwhile, U.S.-based players like Schreiber Foods, The Kraft Heinz Company, and Leprino Foods maintain significant positions by aligning proprietary technologies-such as Quality-Locked Cheese freezing systems-with high-volume foodservice contracts and private-label partnerships.

Regional specialists and niche innovators have also secured footholds through targeted offerings. Companies such as Grande Cheese Company and Valley Milk emphasize localized production agility, tailoring form, packaging, and flavor profiles to adjacent markets. Meanwhile, specialty producers like Casa RADICCI and Granarolo integrate artisanal cheese traditions into frozen formats, appealing to premium segments. Strategic alliances and joint ventures between global majors and regional firms have further reshaped the landscape, enabling knowledge transfer in freeze technology and co-development of market-specific products. Across all tiers, sustainability and supply chain resilience initiatives are emerging as key differentiators in corporate strategies, reinforcing brand credibility and stakeholder engagement.

This comprehensive research report delivers an in-depth overview of the principal market players in the Individual Quick Frozen Cheese market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Agropur Dairy Cooperative

- Almarai Company

- Arla Foods amba

- Bel Brands USA, Inc.

- Bel Group S.A.

- Dairy Farmers of America, Inc.

- FrieslandCampina N.V.

- Glanbia plc

- Lactalis American Group, Inc.

- Meggle SE

- Meiji Holdings Co., Ltd.

- Murray Goulburn Co-operative Co. Limited

- Parmalat S.p.A.

- Royal FrieslandCampina N.V.

- Saputo Inc.

- Sargento Foods, Inc.

- Savencia Fromage & Dairy SAS

- Schreiber Foods, Inc.

- The Kraft Heinz Company

Guiding Industry Leaders with Targeted Strategic Recommendations to Capitalize on Emerging Opportunities in Quick Frozen Cheese

Industry leaders poised to capitalize on quick frozen cheese opportunities should adopt a multi-pronged strategic approach. First, optimizing supply chain flexibility through diversified sourcing and agile cold-chain partnerships will mitigate exposure to tariff volatility and regional disruptions. Embracing dual-sourcing arrangements that balance domestic production with low-tariff import corridors can sustain supply continuity while preserving cost competitiveness. Next, investing in advanced individual quick freeze technologies and cooperative R&D alliances will enhance product performance and enable faster time-to-market for novel cheese formulations.

Furthermore, tailoring product portfolios to emerging consumer preferences-whether through health-focused variants, artisanal specialty blends, or plant-based analogs-can drive brand differentiation and premiumization. Integrating sustainable packaging innovations, such as recyclable vacuum packs and biodegradable tray materials, will address environmental expectations and regulatory trends. In parallel, strengthening digital commerce capabilities, including direct-to-consumer platforms and e-tail partnerships, will unlock new distribution avenues and foster consumer engagement. Finally, establishing collaborative industry consortia for tariff advocacy and standardized food safety certifications can amplify collective influence and streamline compliance burdens, positioning companies for long-term growth and resilience in the dynamic quick frozen cheese sector.

Elucidating the Rigorous Research Methodology Underpinning Insights into the Individual Quick Frozen Cheese Market

This report synthesizes insights derived from a rigorous, multi-tiered research methodology designed to ensure data accuracy and relevance. The process commenced with exhaustive secondary research, encompassing academic journals, trade publications, regulatory filings, and reputable industry news outlets to map historical trends, technological milestones, and policy developments. Key data points and emerging themes were then validated through primary research, including structured interviews with senior executives from dairy processors, foodservice operators, and retail buyers across major geographies.

Quantitative data underwent triangulation via cross-validation with import-export statistics, tariff schedules, and proprietary supply-chain performance metrics. Segmentation frameworks were refined through iterative feedback from subject-matter experts, market participants, and academic scholars. The final insights were stress-tested against alternative scenarios-ranging from tariff escalations to supply chain disruptions-to identify potential inflection points. All research adhered to stringent ethical standards, ensuring respondent confidentiality and data integrity. Limitations are acknowledged concerning rapidly evolving tariff policies and proprietary sales figures, yet the robust methodology provides a high-confidence foundation for strategic decision-making in the individual quick frozen cheese domain.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Individual Quick Frozen Cheese market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Individual Quick Frozen Cheese Market, by Product Type

- Individual Quick Frozen Cheese Market, by Form

- Individual Quick Frozen Cheese Market, by Packaging Type

- Individual Quick Frozen Cheese Market, by Distribution Channel

- Individual Quick Frozen Cheese Market, by End User

- Individual Quick Frozen Cheese Market, by Region

- Individual Quick Frozen Cheese Market, by Group

- Individual Quick Frozen Cheese Market, by Country

- United States Individual Quick Frozen Cheese Market

- China Individual Quick Frozen Cheese Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1749 ]

Synthesis of Findings Highlighting Key Drivers, Challenges, and Strategic Opportunities in the Quick Frozen Cheese Sector

In summary, the individual quick frozen cheese segment has emerged as a critical frontier within the dairy sector, shaped by evolving consumer demands, technological advancements, and geopolitical factors. Artisanal premiumization, health-oriented innovations, and refined freezing technologies have collectively elevated product standards, while 2025 tariff measures have induced supply chain realignments and cost recalibrations. Market segmentation across product types, forms, packaging configurations, distribution channels, and end-user segments underscores the diverse applications and strategic levers available to stakeholders.

Regional analysis reveals stable demand in the Americas, diversified growth trajectories across EMEA, and rapid expansion in Asia-Pacific driven by shifting culinary preferences and modern trade channels. Competitive dynamics feature a mix of global dairy powerhouses and regional specialists, all vying through proprietary technologies, sustainability commitments, and collaborative ventures. To thrive amid complexity, industry participants must adopt supply chain agility, targeted product differentiation, and digital-first distribution strategies. This executive summary distills the core findings, equipping decision-makers with the context and foresight needed to navigate an increasingly competitive and dynamic quick frozen cheese landscape.

Seize Critical Market Insights Today by Connecting with Ketan Rohom to Secure Your Comprehensive Quick Frozen Cheese Market Analysis

For organizations seeking to navigate the evolving quick frozen cheese landscape with confidence, expert guidance and comprehensive intelligence are essential. Engaging with Ketan Rohom, Associate Director of Sales & Marketing, will provide direct access to in-depth market analysis tailored to strategic priorities. By reaching out, companies can secure a detailed exploration of consumer behaviors, supply chain dynamics, and competitive positioning that informs decision-making. Partnering with our specialist ensures timely delivery of actionable insights designed to drive growth, mitigate risks, and identify emerging opportunities in the quick frozen cheese sector. Act now to elevate your market strategy and gain a competitive advantage by consulting with Ketan Rohom to obtain the full market research report.

- How big is the Individual Quick Frozen Cheese Market?

- What is the Individual Quick Frozen Cheese Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?