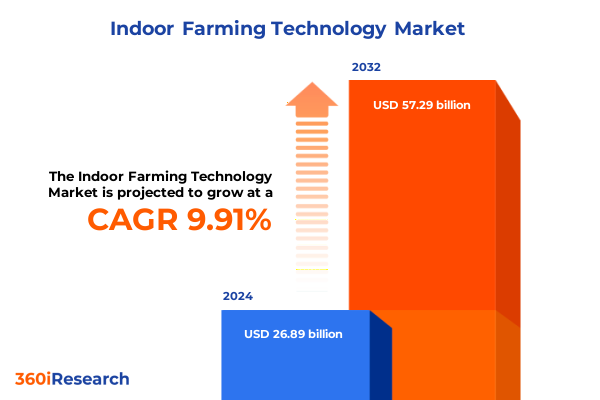

The Indoor Farming Technology Market size was estimated at USD 29.44 billion in 2025 and expected to reach USD 32.26 billion in 2026, at a CAGR of 9.97% to reach USD 57.29 billion by 2032.

Setting the Stage for an Executive Summary on How Cutting-Edge Indoor Farming Technologies Are Redefining Agriculture’s Future

The rapid convergence of technological innovation and growing demands for resilient food systems has thrust indoor farming technologies into the spotlight of modern agriculture. Stakeholders across supply chains-from seed suppliers to retailers-are looking to controlled environment agriculture as a means to mitigate climate risks, reduce resource consumption, and deliver consistent, year-round yields. In response, this executive summary distills the most salient developments in indoor farming into a strategic overview tailored for decision-makers.

Originally conceived to supplement traditional greenhouses, sophisticated indoor farms now harness cutting-edge LED lighting, advanced climate control, and automation to replicate and enhance natural growth conditions. These advances have shifted indoor farming from niche pilot projects into scalable operations capable of producing leafy greens, microgreens, herbs, and even certain berries at commercial volumes. Simultaneously, challenges such as high energy costs, complex supply chains for specialized components, and evolving trade policies have intensified the need for clear strategic insights.

This document presents a structured analysis of the transformative forces at play-from technological breakthroughs and tariff landscapes to segmentation dynamics, regional adoption patterns, and leadership profiles. By examining how each factor interconnects, this summary aims to equip agricultural leaders, technology providers, investors, and policymakers with the context and foresight necessary to navigate the rapidly evolving indoor farming ecosystem.

Mapping the Transformative Shifts in Indoor Farming Technology That Are Reshaping Production and Sustainability Across Global Agrifood Systems

Over the past year, the indoor farming landscape has undergone a series of transformative shifts driven by the maturation of key technologies and the integration of digital intelligence. Next-generation LED lighting systems now offer precision spectra tailored to every stage of plant development, cutting energy consumption by up to 40 percent while boosting yields by more than 25 percent-setting a new standard for energy efficiency in controlled environment agriculture. Alongside lighting advances, AI-driven nutrient delivery platforms in closed-loop hydroponic and aeroponic systems have demonstrated water savings of nearly 90 percent, while optimizing the concentration of essential minerals to maximize growth and crop quality.

Simultaneously, smart environmental monitoring networks composed of IoT sensors and machine learning algorithms are enabling real-time control over temperature, humidity, and CO₂ levels. These systems proactively detect plant stress signals, allowing operators to mitigate disease risks and reduce pesticide use by up to 90 percent. Modular vertical farming racks and containerized solutions have likewise evolved, delivering scalable infrastructures that can be deployed in urban centers or repurposed warehouse spaces within weeks. By unlocking land-use efficiencies up to 350 times greater than traditional fields, these modular designs are redefining how and where food can be produced.

Furthermore, the integration of renewable energy sources-from rooftop solar arrays to on-site battery storage-combined with AI-driven energy management platforms is fortifying the economic and environmental sustainability of indoor farms. Meanwhile, the adoption of blockchain for secure, immutable traceability is responding to consumer demands for transparency, ensuring that every leaf and stem can be traced from seed to shelf. Collectively, these shifts paint a picture of an industry in the midst of a profound technological renaissance.

Unpacking the Cumulative Impact of Recent United States Tariffs on Indoor Farming Equipment Inputs and Operational Costs in 2025

In 2025, a series of tariff measures enacted by the U.S. government have materially affected the cost structures and supply chains underpinning indoor farming operations. For equipment manufacturers, tariffs on imported steel and aluminum-set at 25 percent for Canada and Mexico and 10 percent for China-have driven up the prices of frames, racks, and greenhouse structures, prompting some operators to defer expansion plans amid uncertainty over further trade negotiations. At the same time, tariffs on core agricultural machinery and components have introduced supply disruptions: distributors report hesitancy among growers when pricing for specialized irrigation controllers, HVAC units, and lighting frames can swing dramatically in a matter of weeks.

Beyond structural components, the imposition of a 25 percent duty on fertilizer imports-particularly potash and nitrogen products sourced from Canada-has elevated input costs at a time when efficient nutrient management is critical for hydroponic and nutrient film technique setups. Growers reliant on precise mineral formulas have experienced price increases exceeding $100 per ton on key nutrient blends, squeezing operational margins and accelerating the search for alternative domestic suppliers. Moreover, retaliatory tariffs imposed by major trading partners have constrained export opportunities for U.S.-grown leafy greens and herbs, further compressing revenue streams for high-tech crop producers.

Collectively, these policy shifts have underscored the fragility of global supply chains for indoor farming. While some larger operators with diversified sourcing networks have managed to absorb the increased costs, smaller and mid-sized farms face acute challenges in accessing affordable components and inputs. In response, many participants are pursuing local partnerships for manufacturing critical hardware, advocating for tariff exemptions on ag-tech essentials, and exploring lease-to-own models for equipment to mitigate upfront capital burdens. As the tariff landscape continues to evolve, industry stakeholders must balance short-term cost pressures with strategic investments in resilient domestic supply ecosystems.

Unearthing Key Segmentation Insights That Illuminate the Multifaceted Components, Offerings, Technologies, and Crop Types Driving Indoor Farming Innovation

A nuanced understanding of market segmentation reveals the multi-dimensional drivers of indoor farming innovation and adoption. From a component perspective, climate control systems-comprising cooling, heating, and integrated HVAC modules-are the backbone of nearly every controlled environment setup, ensuring precise management of temperature and humidity. Irrigation systems, spanning drip, flood-and-drain, mist, and nutrient film techniques, deliver tailored water and nutrient regimes that support both high-density leafy greens and specialty herbs. Lighting solutions have also diversified, with fluorescent, high-pressure sodium, and advanced LED grow lights each addressing crop-specific spectral requirements. Meanwhile, sensors and automation technologies-encompassing environmental sensors, control systems, monitoring software, and robotics-form the digital nervous system that collects data and executes real-time adjustments. Structural components such as growing tents, modular racks, and multi-tier shelving provide the flexible frameworks that align with space constraints, whether in repurposed warehouses or urban rooftop facilities.

On the offering side, the dichotomy between product and service has become more pronounced. Pure product providers focus on delivering turnkey hardware-racks, lighting arrays, and irrigation manifolds-while service-oriented firms offer consulting, installation, maintenance, and monitoring packages designed to optimize performance over the full equipment lifecycle. This hybrid business model enables growers to access best-in-class technologies without the need for extensive in-house expertise.

Technology type segmentation further clarifies operational approaches. Aeroponics, with its fine mist nutrient delivery, excels in ultra-water-efficient cultivation of microgreens and herbs, while aquaponics integrates fish production with plant growth to create closed-loop nutrient cycles. Hydroponics remains the most widely adopted soilless method for high-volume lettuce and leafy green production, and vertical farming configurations-stacked growing towers within controlled chambers-maximize output per square foot.

Finally, crop type segmentation highlights market focus areas. Flowers command niche markets for ornamental and medicinal applications, while fruits and berries target premium retail channels. Herbs serve both culinary and nutraceutical segments, and leafy greens form the core of most indoor farm portfolios due to their rapid growth cycles. Emerging interest in microgreens reflects a willingness to pay premium prices for nutrient-dense, gourmet produce. These segmentation insights provide a structured lens through which industry participants can align their technology investments, service offerings, and crop selections with evolving market demands.

This comprehensive research report categorizes the Indoor Farming Technology market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Offering

- Produce Type

- Farming Type

- Automation Level

- End User

Revealing Critical Regional Insights Into How the Americas, EMEA, and Asia-Pacific Regions Are Pioneering Indoor Farming Adoption and Growth

Regional dynamics are shaping the trajectory of indoor farming adoption and investment in distinctive ways. In the Americas, the United States and Canada have seen spirited growth driven by urban logistics considerations and consumer appetite for locally produced, pesticide-free greens. However, recent funding declines-venture investments in U.S. indoor farm startups fell from over $2.1 billion in 2021 to just $57 million in 2025-have prompted a recalibration toward partnerships with foodservice and retail giants that can underwrite operational scale. Mexico is beginning to explore hybrid greenhouse models that blend traditional field cultivation with controlled environment extensions, while Brazil’s agribusiness sector evaluates vertical farming as a hedge against seasonal variability and logistical bottlenecks.

In Europe, the United Kingdom has witnessed both caution and ambition. The administration of Jones Food Company in April 2025-after accumulating £22 million in debt-underscores the financial risks associated with rapid scale-up in high-cost environments. Yet countries such as the Netherlands and Germany continue to pioneer research-driven vertical farms, leveraging established greenhouse industries to develop integrated systems and export expertise abroad. Emerging Middle Eastern hubs in the United Arab Emirates and Saudi Arabia are also allocating sovereign wealth and technology grants to indoor farms as part of broader food security initiatives.

Asia-Pacific presents perhaps the most dynamic growth profile. India’s success with hydroponic projects-exemplified by the Government Holkar Science College initiative in Indore, which has achieved significant yield improvements and received national research awards-demonstrates the appeal of low-cost, scalable systems in water-stressed regions. Similarly, Singapore’s push toward its 30 by 30 food security strategy, coupled with pilot programs integrating AI-driven sensor networks, positions the city-state as a global testbed for urban farming technologies. Japan and South Korea are rapidly adopting modular, containerized farms to serve dense metropolitan markets, underscoring the regional commitment to marrying technological sophistication with localized supply resilience.

This comprehensive research report examines key regions that drive the evolution of the Indoor Farming Technology market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Key Company Profiles That Define Leadership, Innovation, and Strategic Direction Within the Rapidly Evolving Indoor Farming Sector

The competitive landscape of indoor farming is defined by a diverse array of innovators, each carving distinct niches based on technology, scale, and market orientation. Bowery Farming, once the largest vertical farming operation in the U.S., leveraged its BoweryOS platform-combining automation, robotics, and real-time data analytics-to supply over 850 retail locations across the Northeast before ceasing operations in late 2024 amid yield variability and cost challenges. AeroFarms, renowned for patented aeroponic systems and sustainable practices, reemerged from Chapter 11 bankruptcy in 2023 with a lean focus on its Danville, Virginia facility, reinforcing its commitment to renewable energy and reduced land use while maintaining an SQF score of 100 percent in FDA audits.

Meanwhile, Gotham Greens has scaled a network of 13 hydroponic greenhouse facilities across the United States, supplying branded lettuces, herbs, and ready-to-eat salad kits through both retail and foodservice channels. The company’s emphasis on modular expansion and strategic partnerships underscores its hybrid model that blends proprietary greenhouse engineering with consumer branding. BrightFarms, a subsidiary of a major media conglomerate, focuses on siting hydroponic greenhouses near supermarket distribution centers to deliver non-GMO, pesticide-free greens with minimal cold-chain transit times, showcasing an asset-light approach that prioritizes logistical efficiency.

On the frontier of high-value produce, Oishii has carved a premium segment by cultivating specialty strawberries under vertical farm conditions, commanding retail prices upward of $50 per container and illustrating the potential for boutique crop strategies. Eden Green Technology, based in Texas, operates large-scale greenhouse-vertical hybrids, serving institutional and retail buyers while steadily expanding its R&D capabilities. Collectively, these leading companies exemplify the range of strategic approaches-from software-driven vertical farms to greenhouse-centric hydroponic networks-shaping the future of controlled environment agriculture.

This comprehensive research report delivers an in-depth overview of the principal market players in the Indoor Farming Technology market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Advanced Nutrients Ltd.

- AeroFarms, LLC

- Altius Farms, Inc.

- Bluelab Corporation Limited

- BrightFarms, Inc.

- CubicFarm Systems Corp.

- Emerald Harvest, Inc.

- Freight Farms, Inc.

- Gotham Greens LLC

- GP Solutions, Inc.

- Hydrofarm Holdings Group, Inc.

- HydroGarden Ltd.

- Intelligent Growth Solutions Limited

- Kalera GmbH

- Logiqs B.V.

- Metropolis Farms Canada Inc.

- Mirai Group Co., Ltd.

- Plenty Unlimited Inc.

- Richel Group Inc.

- Signify Holding B.V.

- Sky Greens Pte Ltd

- The Scotts Miracle-Gro Company

- TruLeaf Sustainable Agriculture, Inc.

- Urban Crop Solutions BV

- Voeks Inc.

Delivering Actionable Recommendations for Industry Leaders to Capitalize on Emerging Indoor Farming Opportunities and Navigate Complex Operational Challenges

To navigate the complexities of technology adoption, policy shifts, and competitive pressures, industry leaders should pursue a multi-pronged strategy. First, investing in next-generation LED and climate control systems can yield immediate reductions in operational costs and carbon footprints, positioning farms to leverage both consumer demand for sustainability and potential regulatory incentives. Second, establishing strategic partnerships with domestic manufacturers of critical components-such as racks, sensors, and nutrient delivery modules-can mitigate tariff vulnerabilities and enhance supply chain resilience.

Third, operators should explore service-based revenue models that bundle consulting, installation, and ongoing maintenance, thereby creating recurring income streams while reducing capital barriers for new adopters. Fourth, integrating blockchain-enabled traceability platforms can differentiate premium, organic, or nutraceutical crops in competitive retail environments. Fifth, forging alliances with academic and government research institutions will accelerate pilot programs in emerging technology areas-such as robotics for seeding and harvesting-while unlocking grant funding and public sector support.

By combining technology investments with adaptive business models and policy advocacy, indoor farm leaders can both manage near-term cost pressures and lay the groundwork for scalable, profitable growth. These recommendations serve as a roadmap for translating emerging trends into operational advantages.

Outlining the Rigorous Research Methodology Employed to Ensure Comprehensive, Balanced, and Data-Driven Analysis of Indoor Farming Technologies

This analysis draws on a comprehensive research methodology combining primary and secondary sources to ensure both breadth and depth of insight. Secondary research encompassed the review of industry publications, reputable news outlets, and technical white papers to identify current technology trends, tariff developments, and regional adoption patterns. Primary research included interviews with agritech executives, equipment suppliers, and policy experts to validate market dynamics and capture emerging forward-looking perspectives.

Data triangulation was employed to reconcile information from diverse sources, ensuring accuracy and minimizing bias. Key variables-such as energy consumption metrics, yield improvements, and cost drivers-were cross-checked against published case studies and pilot program reports. The segmentation framework was developed by synthesizing established component-, offering-, technology-, and crop-type taxonomies from industry consortia and academic journals.

Regional analyses were informed by market performance indicators, government initiatives, and documented case studies from leading indoor farming projects. Competitive profiling relied on publicly available corporate filings, press releases, and verified third-party reporting to outline the strategic positioning and innovation focus of major operators. This rigorous approach provides stakeholders with a robust foundation for informed decision-making and strategic planning.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Indoor Farming Technology market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Indoor Farming Technology Market, by Offering

- Indoor Farming Technology Market, by Produce Type

- Indoor Farming Technology Market, by Farming Type

- Indoor Farming Technology Market, by Automation Level

- Indoor Farming Technology Market, by End User

- Indoor Farming Technology Market, by Region

- Indoor Farming Technology Market, by Group

- Indoor Farming Technology Market, by Country

- United States Indoor Farming Technology Market

- China Indoor Farming Technology Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1113 ]

Drawing Conclusions on the Current State and Future Trajectory of Indoor Farming Technologies to Guide Strategic Decision-Making and Investment Priorities

Indoor farming technologies are at an inflection point, driven by innovations in lighting, automation, and digital intelligence, yet tempered by economic realities and policy headwinds. The sector’s ability to deliver consistent, resource-efficient yields aligns with broader imperatives around climate resilience and urban food security. However, the recent imposition of tariffs, alongside capital constraints and intense competition, underscores the need for adaptive strategies.

Key segmentation insights reveal that no single technology or crop category will dominate; instead, success will depend on aligning component systems, service offerings, and crop selections to specific market demands. Regional variations further highlight the importance of tailoring approaches-from the structured greenhouse networks of North America and Europe to the water-efficient hydroponic pilots in Asia Pacific. Leading companies exemplify diverse strategic models, ranging from software-driven automation platforms to asset-light greenhouse partnerships.

Looking ahead, indoor farming’s growth trajectory will hinge on continued technological refinement, the development of resilient domestic supply ecosystems, and the forging of novel business models that offset capital and operational challenges. By synthesizing the trends, tariff impacts, segmentation dynamics, and competitive landscapes detailed herein, stakeholders are equipped with the insights necessary to craft winning strategies in this rapidly evolving arena.

Take Informed Action Today by Connecting with Our Associate Director of Sales & Marketing to Secure Your Definitive Indoor Farming Technology Report

I invite you to take the next step toward equipping your organization with the insights needed to navigate the evolving indoor farming landscape. To secure a comprehensive market research report on indoor farming technology that delves into key trends, tariff impacts, segmentation analyses, regional dynamics, and competitive profiles, please reach out to Ketan Rohom, Associate Director, Sales & Marketing. Engaging with Ketan will ensure you receive tailored guidance on report options, pricing structures, and any custom data needs your team may have. Don’t miss the opportunity to leverage authoritative research and actionable intelligence that will inform your strategic planning and investment decisions.

- How big is the Indoor Farming Technology Market?

- What is the Indoor Farming Technology Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?