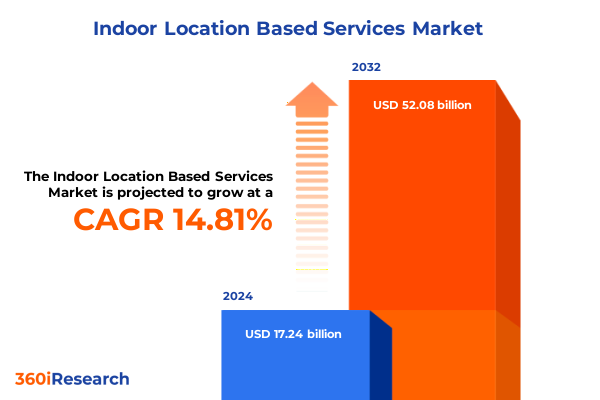

The Indoor Location Based Services Market size was estimated at USD 19.59 billion in 2025 and expected to reach USD 22.26 billion in 2026, at a CAGR of 14.99% to reach USD 52.08 billion by 2032.

Setting the Stage for Indoor Location Based Services as a Strategic Asset in Modern Enterprise and Consumer Environments

Indoor location based services have rapidly become a pivotal technology for organizations and consumers alike, offering unprecedented visibility into movement and behavior within enclosed environments. As modern enterprises and public venues seek to optimize experiences and operational workflows, these services provide critical data that drive decision-making, enhance safety, and unlock new revenue streams. The convergence of mobile connectivity, sensor fusion, and cloud analytics has laid a robust foundation for next-generation location intelligence that extends far beyond traditional GPS limitations.

The emergence of diverse positioning technologies-from Bluetooth Low Energy beacons paired with inertial sensors to Wi-Fi Round Trip Time protocols-has significantly elevated accuracy and scalability. In retail settings, the integration of micro-location platforms has enabled personalized interactions, real-time navigation, and targeted marketing campaigns, empowering brands to engage shoppers more effectively while gathering valuable behavioral insights. Similarly, healthcare facilities and logistics hubs are deploying indoor positioning systems to streamline patient flow and asset tracking, underscoring the versatility and critical importance of this technology across verticals.

Given ongoing advancements in sensor design, algorithmic precision, and interoperability standards, the stage is set for indoor location based services to become an indispensable component of smart building ecosystems. As enterprises prepare to implement or expand these capabilities, understanding the current landscape, technological enablers, and operational benefits is crucial for charting a successful path forward. This introduction outlines the strategic context and value drivers that make indoor location intelligence an essential asset in today’s competitive environment.

Identifying Transformative Technology Shifts That Are Redefining the Indoor Positioning Experience Across Multiple Sectors

The indoor positioning landscape is undergoing a series of transformative shifts fueled by technological breakthroughs and standardization efforts. Bluetooth 6.0’s channel sounding feature introduces enhanced range and sub-meter accuracy potential, while traditional BLE beacons continue to deliver reliable 2–3 meter precision when fused with smartphone inertial data. Meanwhile, Wi-Fi Round Trip Time, standardized in 802.11mc, has begun to unlock sub-meter positioning on compatible Android devices, driving interest despite its limited device support and infrastructure requirements.

Beyond radio frequency innovations, open standards are gaining traction to promote interoperability and faster integration. Apple’s Indoor Mapping Data Format, now an Open Geospatial Consortium community standard, exemplifies industry collaboration toward a unified mapping framework for indoor spaces. These standardization efforts are critical for enabling cross-platform deployment of location services, simplifying development workflows, and reducing fragmentation across hardware and software vendors.

Concurrently, the proliferation of IoT and smart building technologies is expanding the context in which indoor location services operate. From dynamic environmental monitoring and energy management to context-aware notifications triggered by a user’s proximity, the integration of location intelligence with broader IoT ecosystems is reshaping operational paradigms in commercial, public, and industrial environments. These converging trends underscore the imperative for stakeholders to embrace multi-technology strategies and open standards to future-proof their indoor positioning initiatives.

Unpacking the Cumulative Impact of 2025 U.S. Tariff Policies on Indoor Location Based Services and Global Supply Chains

In early 2025, the introduction of a universal baseline tariff of 10 percent on virtually all imports marked a turning point for the indoor location based services supply chain, layering on top of pre-existing duties and targeted Section 301 measures. These sweeping trade actions were compounded by an additional 10 percent levy on Chinese goods implemented in late 2024 and significant hikes on high-tech categories, including a doubling of semiconductor tariffs to 50 percent and a 100 percent tariff on electric vehicles.

The ripple effects of these policies have been particularly pronounced for indoor positioning systems, which depend on specialized hardware such as ultra-wideband chipsets and BLE modules manufactured in tariff-affected regions. Production costs for UWB transceivers and proximity beacon components have surged, prompting price adjustments for end-users and compressing vendor margins. Moreover, lead times for integrated location kits have extended by six to nine months in some cases, creating deployment delays for time-sensitive projects in retail openings, facility expansions, and logistics rollouts.

To navigate this challenging environment, many solution providers and enterprises have accelerated the shift toward software-centric approaches that reduce reliance on high-duty hardware. Cloud-based geospatial analytics, AI-driven signal processing algorithms, and smartphone-native positioning frameworks are gaining prominence as businesses seek to mitigate tariff impacts and maintain project timelines. Nonetheless, the cumulative burden of trade policies continues to reshape cost structures and strategic planning horizons for all participants in the indoor location ecosystem.

Unearthing Key Segmentation Insights to Illuminate Use Cases and Technology Preferences Across the Indoor Location Ecosystem

The indoor location based services market is often analyzed through multiple lenses, each revealing distinct use-case priorities and technology preferences. When viewed through the prism of type-based segmentation-encompassing Analytics & Insights, Automotive Services, Campaign Management, Consumer Services, Enterprise Services, Location & Alerts, Location-based Advertising Services, Maps, Precision Geo-targeting, Proximity Beacons, and Secure Transactions and Redemptions-it becomes clear that data-driven decision-making underpins every application. Analytics & Insights solutions enable organizations to transform raw location data into actionable patterns, while Automotive Services harness real-time positioning to optimize fleet operations and parking guidance. Campaign Management capabilities leverage location triggers for time-sensitive promotions, and consumer-facing offerings such as Location-based Advertising Services and Precision Geo-targeting deliver personalized experiences based on proximity. Concurrently, enterprise-grade Location & Alerts platforms support safety notifications and operational alerts, and Secure Transactions and Redemptions models facilitate contactless payments and loyalty interactions at point of interaction.

Equally illuminating is a vertical-based perspective that spans Automotive, BFSI (Banking, Financial Services, and Insurance), Education, Healthcare, Hospitality & Tourism, Manufacturing & Industrial, Retail & E-commerce, Smart Cities & Public Infrastructure, Sports & Entertainment, and Transportation & Logistics. Automotive applications extend beyond navigation to include connected parking and service reminders, while BFSI institutions evaluate location signals for fraud detection and branch optimization. On college campuses, education stakeholders implement wayfinding and safety monitoring, and healthcare facilities adopt patient flow management and asset tracking. Hospitality venues use indoor navigation to enhance guest experiences, and manufacturing sites apply location intelligence to streamline assembly lines and inventory control. Retailers and e-commerce platforms integrate in-store mapping with mobile apps to guide shoppers, and municipal authorities incorporate indoor positioning into public infrastructure to improve wayfinding in transit hubs and government complexes. Sports arenas and entertainment venues use micro-location to enrich fan engagement and operational logistics, while logistics providers deploy advanced positioning to automate warehouse management and cargo handling.

This comprehensive research report categorizes the Indoor Location Based Services market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Application

- Deployment Mode

- Organization Size

- End User Industry

Comparing Regional Developments to Reveal the Dynamics Shaping Indoor Location Services in Key Global Markets

Regional dynamics play a pivotal role in shaping the adoption and innovation of indoor location based services. In the Americas, strong demand in retail, healthcare, and logistics has been a major growth engine, bolstered by a tech-savvy consumer base and an extensive push toward digital transformation in enterprise operations. Major North American players are driving deployments at scale, particularly in large-format retail chains and healthcare systems seeking real-time asset tracking and patient navigation solutions. As a result, the region leads in both volume of projects and diversity of use-case experimentation.

Across Europe, Middle East & Africa, regulatory considerations around data privacy and interoperability have influenced deployment strategies and platform architectures. In large metropolitan districts and major international airports, indoor mapping has become integral to passenger wayfinding, while shopping centers and cultural venues leverage context-aware services to enrich visitor engagement. Collaborative initiatives to establish common standards are fostering greater cross-border compatibility, setting the stage for broader expansion of secure, compliant location services across the territory.

The Asia-Pacific region stands out as the fastest-growing market for indoor location based services, driven by ambitious smart city programs in China, Japan, and South Korea, as well as rapid uptake in India’s retail and manufacturing sectors. Regional governments and private consortiums are investing heavily in indoor navigation systems to support large-scale infrastructure projects, from high-speed rail stations to integrated shopping complexes. This influx of investment, coupled with high smartphone penetration and localized innovation hubs, is accelerating the deployment of multi-technology positioning platforms throughout densely populated urban centers.

This comprehensive research report examines key regions that drive the evolution of the Indoor Location Based Services market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Leading Vendors and Innovative Entrants Driving the Evolution of the Indoor Position Based Services Market

A diverse ecosystem of established technology providers and emerging specialists is propelling the indoor location based services market forward. At the forefront, global heavyweights such as Google and Apple are leveraging their mobile operating systems and chipset integrations to offer native positioning capabilities, exemplified by Apple’s U1 ultra-wideband chip and support for Indoor Mapping Data Format. Cisco’s DNA Spaces platform integrates Wi-Fi-based positioning with network management, while Zebra Technologies has introduced enterprise-grade solutions that leverage Wi-Fi Round Trip Time protocols for sub-meter accuracy in asset tracking and worker safety applications. These incumbents continue to invest in research and partnerships to strengthen their ecosystem footprints and extend platform interoperability.

Alongside the technology giants, a cadre of innovative entrants is carving out niche leadership in specialized domains. Beacon manufacturers such as Kontakt.io and Estimote offer compact, battery-efficient devices optimized for proximity notifications and micro-location analytics. UWB-focused providers like Ubisense and Sewio are delivering high-precision tracking for industrial automation and robotics applications, often combining radio-based measurements with sensor fusion algorithms to achieve centimeter-level accuracy. This growing vendor diversity fosters competitive differentiation and drives end-users to adopt best-of-breed solutions tailored to their unique operational requirements.

This comprehensive research report delivers an in-depth overview of the principal market players in the Indoor Location Based Services market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Apple Inc.

- Broadcom Inc.

- CenTrak, Inc.

- Cisco Systems, Inc.

- CommScope, Inc.

- Ericsson AB

- Google LLC

- HERE Global B.V.

- HID Global Corporation

- Honeywell International Inc.

- IndoorAtlas Ltd.

- Juniper Networks, Inc.

- Mapsted Corporation

- Microsoft Corporation

- Navigine Corporation

- Nokia Corporation

- Qualcomm Incorporated

- Siemens AG

- SITUM TECHNOLOGIES, S.L.

- Sonitor Technologies

- Trimble Inc.

- Ubisense Limited

- YOOSE Pte. Ltd.

Actionable Recommendations to Propel Industry Leaders Toward Successful Deployment and Competitive Advantage in Indoor Location Services

To successfully navigate the complex indoor location landscape, industry leaders should prioritize a technology-agnostic approach that balances accuracy, cost, and integration complexity. Evaluating multi-sensor fusion architectures can mitigate the limitations of individual positioning methods and deliver robust performance across varying environmental conditions. Collaborating with network and IT teams early in the planning phase ensures seamless connectivity and data flow, while engaging privacy and compliance stakeholders helps align deployments with regulatory requirements.

Furthermore, organizations are advised to conduct proof-of-concept pilots in representative real-world settings, gathering empirical performance data before committing to full-scale rollouts. Such pilots not only validate technical feasibility but also reveal operational nuances related to installation, maintenance, and user adoption. Finally, establishing a clear roadmap for iterative enhancements-leveraging cloud-based analytics and modular hardware upgrades-enables continual refinement of service offerings and preserves organizational agility as new standards and capabilities emerge.

Detailing a Rigorous Multi-Phase Research Methodology to Ensure Comprehensive Coverage and Robust Validation in Indoor Location Services Analysis

This research was underpinned by a rigorous, multi-phase methodology designed to deliver comprehensive coverage and robust validation. Initially, an extensive secondary research phase reviewed academic literature, patent filings, and industry publications to identify prevailing technology trends, standards developments, and competitive landscapes. Key insights were synthesized from peer-reviewed surveys and technical whitepapers to ensure accuracy and depth of analysis.

Building on this foundation, primary research activities included in-depth interviews with technology providers, end-users, and domain experts across target verticals. These firsthand perspectives enriched our understanding of deployment challenges, selection criteria, and value levers. Quantitative data was supplemented by case study reviews and real-world performance benchmarks, enabling nuanced segmentation and cross-comparison of solution offerings.

Finally, all findings underwent a stringent validation process involving expert panel reviews and consensus workshops. This step ensured that conclusions accurately reflect current market realities and future trajectories. The result is a thoroughly vetted, actionable research framework that empowers stakeholders to make informed decisions regarding indoor location based service strategies.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Indoor Location Based Services market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Indoor Location Based Services Market, by Component

- Indoor Location Based Services Market, by Application

- Indoor Location Based Services Market, by Deployment Mode

- Indoor Location Based Services Market, by Organization Size

- Indoor Location Based Services Market, by End User Industry

- Indoor Location Based Services Market, by Region

- Indoor Location Based Services Market, by Group

- Indoor Location Based Services Market, by Country

- United States Indoor Location Based Services Market

- China Indoor Location Based Services Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2862 ]

Drawing Conclusions on the Strategic Imperatives and Future Outlook of Indoor Location Based Services Across Diverse Use Cases

As the indoor location based services ecosystem continues to mature, strategic imperatives are emerging that will shape its future trajectory. Enterprises must reconcile a growing range of technological options with evolving regulatory requirements and shifting cost dynamics, particularly in light of tariff-induced supply chain pressures. Aligning solution architectures with core business objectives-whether unlocking new customer engagement models or enhancing operational efficiencies-will be essential for sustainable success.

Looking ahead, advancements in sensor miniaturization, AI-powered signal processing, and open data standards are poised to further democratize indoor positioning capabilities. The convergence of these innovations will open doors to novel applications in sectors as varied as augmented reality, autonomous robotics, and context-aware facilities management. Organizations that proactively invest in scalable, interoperable platforms will be best positioned to capitalize on these emerging opportunities, forging a competitive advantage in an increasingly connected world.

Take the Next Step Today by Securing Expert Guidance and Accessing the Comprehensive Indoor Location Services Market Research Report

For decision-makers seeking to harness the full potential of indoor location based services and transform operational efficiency, now is the moment to take action. Reach out to Ketan Rohom, Associate Director, Sales & Marketing, who can guide you through the comprehensive research findings and tailored insights that align with your strategic objectives.

By connecting with Ketan Rohom, you will gain access to in-depth analysis, exclusive data breakdowns, and expert recommendations that can inform your next phase of investment and implementation. His expertise in translating complex market research into actionable business strategies will ensure you maximize ROI and secure a competitive edge in the evolving indoor location ecosystem.

Don’t let uncertainty delay your progress. Engage with Ketan Rohom today to explore purchasing options and secure the detailed market research report that will empower your organization to navigate challenges and seize emerging opportunities.

- How big is the Indoor Location Based Services Market?

- What is the Indoor Location Based Services Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?