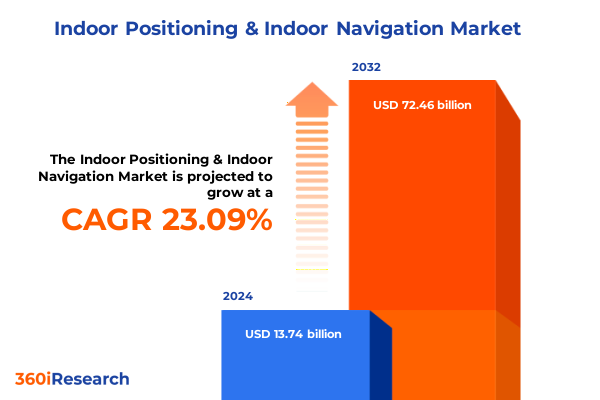

The Indoor Positioning & Indoor Navigation Market size was estimated at USD 16.90 billion in 2025 and expected to reach USD 20.77 billion in 2026, at a CAGR of 23.11% to reach USD 72.46 billion by 2032.

Pioneering the Next Frontier of Indoor Positioning and Navigation with Cutting-Edge Technologies and Integration Strategies to Transform Operational Efficiency Across Diverse Sectors Globally

Indoor positioning and navigation systems have rapidly evolved from niche technologies to indispensable tools that streamline operations, enhance user experiences, and drive operational efficiencies across diverse environments. Initially conceived to address the challenge of locating assets and personnel within complex indoor spaces, these systems now harness sophisticated algorithms, sensor fusion, and advanced connectivity to deliver real-time location intelligence with unprecedented precision. Organizations in sectors ranging from healthcare and manufacturing to retail and transportation have begun to recognize the transformative potential of indoor navigation solutions, laying the groundwork for a new era of spatially aware services and applications.

Fueling this transformation is the convergence of multiple technologies designed to overcome the limitations of standalone solutions. By integrating Bluetooth Low Energy beacons, ultra-wideband transceivers, Wi-Fi access point triangulation, magnetic field mapping, and RFID readers, modern indoor positioning platforms achieve centimeter-level accuracy even in signal-challenged environments. Simultaneously, the infusion of artificial intelligence and machine learning capabilities enables these systems to adapt dynamically to changes in physical layouts, user behaviors, and environmental conditions, thereby elevating their reliability and contextual awareness while reducing deployment complexity and ongoing maintenance requirements.

Together, these technological advances are positioning indoor navigation as a foundational element of the broader Internet of Things ecosystem, empowering organizations to harness location data for a spectrum of innovative use cases. The accelerated adoption of smart building concepts, digital twins, and autonomous mobile robots further underscores the critical role of precise indoor positioning in shaping future-ready operations and delivering differentiated experiences that enhance safety, productivity, and customer satisfaction.

Emerging Breakthroughs in Augmented Reality, 5G Connectivity, and Sensor Fusion Are Reshaping the Indoor Navigation Ecosystem for Enhanced Precision and Engagement

In recent years, the indoor navigation landscape has undergone transformative shifts driven by technological breakthroughs and evolving user expectations. Foremost among these is the integration of augmented reality overlays, which bridge the gap between digital wayfinding cues and physical environments. By superimposing directional arrows, contextual annotations, and interactive elements onto live camera feeds, augmented reality not only simplifies navigation in large complexes but also enriches user engagement with immersive, real-time guidance experiences. As enterprises seek to differentiate their services, AR-enabled navigation has emerged as a critical value-add in retail, hospitality, and cultural venues, offering personalized journeys that blend exploration with convenience.

Another significant shift stems from the adoption of 5G connectivity, which is unlocking new possibilities for high-bandwidth, low-latency communications within indoor environments. The advent of 5G small cells and private networks has made it feasible to transmit vast volumes of location sensor data in real time, support large-scale deployments of Internet of Things devices, and enable advanced applications such as live video analytics, virtual assistants, and edge-driven machine learning. This connectivity revolution is particularly impactful in mission-critical settings like hospitals and warehouses, where instantaneous, reliable location updates can mean the difference between operational bottlenecks and seamless workflows.

Concurrently, sensor fusion techniques have matured to combine inputs from inertial measurement units, geomagnetic field sensors, Wi-Fi signal strength, ultrasound, and other modalities. By synthesizing data from these diverse sources, modern indoor navigation solutions can maintain accuracy even in challenging scenarios such as multi-story buildings, metallic-dense industrial zones, and areas with fluctuating radio interference. This multi-sensor fusion approach is not only enhancing positioning precision but also reducing dependency on extensive infrastructure retrofits, thus lowering total cost of ownership and speeding up time to value for end users.

Evolving U.S. Trade Policies and 2025 Tariff Measures Are Exerting Unprecedented Pressure on Smart Device Supply Chains and Cost Structures

The landscape of indoor positioning and navigation has been significantly influenced by the cumulative effects of United States tariff measures implemented in 2025. As the administration sought to bolster domestic manufacturing and secure supply chains for strategic technologies, new levies were introduced on a range of electronic components, including semiconductors, printed circuit boards, and connectivity modules. These policy decisions have reverberated across the industry, prompting manufacturers to reconsider production footprints while navigating higher input costs and complex compliance requirements. The imposition of up to a 50% tariff on imported chips and a 30% levy on certain electronic assemblies has led to recalibrated pricing strategies and inventory management practices that prioritize resilience and agility.

In response to rising component prices, many indoor positioning solution providers have accelerated efforts to diversify their supplier networks and localize key manufacturing activities. Companies have explored partnerships with domestic foundries and circuit manufacturers in states with favorable incentive programs, while also establishing buffer inventories to mitigate short-term disruptions. Although these measures help maintain continuity, they often come with higher labor and operational expenses, which must be judiciously managed to preserve competitive pricing for end users. Such strategic adjustments illustrate the delicate balance between pursuing supply chain sovereignty and maintaining cost-effective, high-quality hardware production.

Furthermore, the tariff-driven environment has spurred innovation in component design and material sourcing. To counteract the impact of levies, research teams are exploring alternative semiconductor processes, miniaturized architectures, and advanced packaging techniques that reduce reliance on tariff-affected imports. Simultaneously, accelerated R&D initiatives are focusing on open-standard protocols and chip-agnostic hardware platforms, enabling solution providers to switch between suppliers with minimal reengineering. This trend is fostering a more modular ecosystem where interoperability and vendor neutrality become core design principles, ultimately fortifying the indoor navigation industry against future trade policy fluctuations.

Holistic Segmentation Insights Reveal Multifaceted Technology, Application, Industry, and Service Perspectives Driving Indoor Positioning Adoption

A comprehensive view of the indoor positioning and navigation market reveals multifaceted segmentation that informs targeted solution strategies. When considering technology, solutions span from Bluetooth Low Energy beacons and ultra-wideband radios to magnetic field mapping, infrared systems, RFID tags, ultrasound ranging, and legacy Wi-Fi triangulation. Each technology brings distinct strengths: Bluetooth Low Energy excels in energy efficiency and cost-effective deployment; ultra-wideband delivers centimeter-level accuracy in dense environments; while magnetic and infrared methods can operate infrastructure-free, leveraging existing physical characteristics of indoor spaces.

Diverse application segments further shape market dynamics, encompassing analytics and optimization dashboards, real-time asset tracking platforms, emergency response coordination, location-based consumer services, navigation and guidance interfaces, personnel safety monitoring, and proximity marketing campaigns. Providers often tailor their offerings by integrating data analytics to inform space utilization or by embedding customizable APIs that seamlessly interface with enterprise resource planning and customer engagement systems.

End-user industries also present unique demands, with financial services and insurance firms leveraging indoor navigation for secure branch operations, educational institutions deploying wayfinding tools across sprawling campuses, government and defense agencies prioritizing secure personnel tracking, healthcare organizations employing solutions for patient and equipment monitoring, manufacturing plants integrating precise location data to optimize line workflows, retail environments delivering personalized in-store experiences, and transportation and logistics hubs orchestrating efficient material movement.

Service offerings complement these segments through consulting and training programs that guide deployment best practices; installation and integration services that range from site surveys and system design to commissioning and testing; and support and maintenance agreements that ensure ongoing performance, software updates, and hardware calibration. This layered segmentation approach enables stakeholders to align investment decisions with specific use-cases, technical requirements, and operational readiness levels.

This comprehensive research report categorizes the Indoor Positioning & Indoor Navigation market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Technology

- Services

- Application

- End-User Industry

Regional Dynamics across the Americas, EMEA, and Asia-Pacific Highlight Distinct Drivers Propelling Indoor Positioning and Navigation Innovations

Regional dynamics in the indoor navigation sector vary markedly across the Americas, Europe Middle East & Africa, and Asia-Pacific regions, each shaped by distinct market drivers and infrastructural priorities. In the Americas, early adoption is propelled by strong investments in smart building initiatives and high penetration of enterprise IoT strategies. North American organizations are leveraging indoor positioning for use cases such as automated warehouse robotics, patient workflow management in hospitals, and location-aware customer experiences in retail, supported by collaborative ecosystems between technology providers and channel partners to accelerate deployment timelines.

The Europe, Middle East & Africa region presents a blend of public-sector-led smart city projects and private investments in digital transformation. European Union data privacy regulations have spurred secure and compliant indoor navigation systems within government facilities, public transportation hubs, and healthcare networks. Meanwhile, the Middle East leverages sovereign wealth fund allocations to integrate advanced navigation technologies into flagship infrastructure developments, such as next-generation airports and cultural landmarks. African markets are gradually embracing these solutions as digitalization initiatives gain momentum, often prioritizing mobile-first and cloud-centric models due to limited legacy infrastructure.

Across Asia-Pacific, rapid urbanization and the proliferation of e-commerce platforms drive expansive deployments in retail, logistics, and smart hospitality. China, Japan, India, and Southeast Asian nations are investing heavily in digital infrastructure, while local OEMs and system integrators develop customized, low-cost beacon and sensor solutions to address region-specific requirements. Government support for smart city frameworks, coupled with a burgeoning middle class, is fueling demand for sophisticated indoor wayfinding services, asset tracking in manufacturing hubs, and digital twin-enabled facility management across the region.

This comprehensive research report examines key regions that drive the evolution of the Indoor Positioning & Indoor Navigation market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiled Market Leaders Are Leveraging Diversified Portfolios and Strategic Partnerships to Dominate the Indoor Positioning and Navigation Landscape

Leading companies are charting diverse strategic paths to solidify their positions within the indoor positioning and navigation market. Zebra Technologies has consistently asserted its leadership by offering a comprehensive portfolio that spans ultra wideband, Bluetooth Low Energy, RFID, visible light communication, ultrasound, and motion-sensing technologies. Named a Leader for five consecutive years in Gartner’s Magic Quadrant for Indoor Location Services, Zebra differentiates itself through its PartnerConnect channel network and enterprise-grade solutions that transform location data into actionable insights, particularly in high-reliability environments like manufacturing and healthcare.

Cisco, leveraging its robust networking heritage, integrates Wi-Fi-based positioning platforms with existing enterprise infrastructure, enabling seamless connectivity for large-scale deployments. By infusing analytics tools and edge computing capabilities within its Catalyst access points, Cisco empowers organizations to extend indoor navigation features without installing dedicated hardware, thus reducing implementation complexity and accelerating time to value.

Apple drives consumer-grade indoor navigation through its U1 ultra-wideband chip and ARKit-enabled software frameworks. The company has expanded its indoor positioning capabilities in major airports and retail environments, providing developers with APIs that support high-precision wayfinding and location services directly on iOS devices. This approach not only enhances the end-user experience but also cultivates a vast ecosystem of location-aware mobile applications.

Microsoft, with its Azure Maps Creator and Azure Digital Twins platforms, is fostering the convergence of indoor mapping, real-time sensor ingestion, and digital twin orchestration. By enabling enterprises to convert CAD floor plans into interactive map data and integrate IoT telemetry for dynamic wayfinding, Microsoft offers a scalable, cloud-native solution for creating smart building environments. These interoperable services are increasingly adopted for facility management, secure access control, and immersive employee experiences on corporate campuses.

This comprehensive research report delivers an in-depth overview of the principal market players in the Indoor Positioning & Indoor Navigation market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Acuity Brands, Inc.

- Apple Inc.

- CenTrak, Inc.

- Cisco Systems, Inc.

- Environmental Systems Research Institute, Inc.

- HERE Global B.V.

- Hewlett Packard Enterprise Development LP

- HID Global Corporation by Assa Abloy AB

- indoo.rs GmbH

- IndoorAtlas

- Infsoft GmbH

- Inpixon

- Juniper Networks Inc.

- Link Labs, Inc.

- Microsoft Corporation

- Navenio Ltd.

- Nextome

- Pointr Limited

- Pozyx NV

- Senion AB by Verizon Communications Inc.

- sensewhere Ltd.

- Situm Technologies, S.L.

- Sonitor Technologies

- Steerpath Oy

- Ubisense Ltd.

- Zebra Technologies Corporation

Strategic Imperatives Emphasize Technology Integration, Supply Chain Resilience, and User-Centric Design to Drive Sustainable Growth

To capitalize on emerging opportunities and mitigate operational risks, industry leaders should prioritize the integration of multi-technology platforms that blend ultra-wideband, Bluetooth Low Energy, RFID, and sensor fusion capabilities. This unified approach enhances resilience against single-point failures and optimizes accuracy across diverse environments, while supporting seamless upgrades as new standards and protocols emerge.

Diversification of supply chains is another imperative in light of recent tariff-driven cost pressures. By establishing relationships with multiple component vendors across geographies and investing in design architectures that accommodate site-agnostic module replacements, solution providers can maintain consistent production while safeguarding margins. Simultaneously, exploring partnerships with domestic manufacturing facilities and leveraging government incentive programs will help reduce lead times and buffer against trade policy volatility.

A user-centric design philosophy must also guide product roadmaps. Stakeholders should deploy pilot programs that capture real-world operational insights and refine user interfaces to minimize training requirements. This iterative feedback loop not only improves adoption rates but also unlocks new use cases as end-user expectations evolve. Coupling these efforts with scalable SaaS-based analytics platforms will enable continuous performance monitoring and service innovation, fostering long-term customer relationships and driving incremental revenue streams.

Rigorous Research Methodology Employs Mixed-Method Approaches with In-Depth Interviews, Quantitative Analysis, and Data Triangulation for Unbiased Market Clarity

The research methodology underpinning this analysis employed a structured, mixed-method approach to ensure comprehensive and objective insights. Initially, secondary research was conducted by examining publicly available industry reports, whitepapers, corporate press releases, and regulatory filings to identify prevailing market trends, technology evolutions, and policy impacts. This phase provided a macro-level understanding of the indoor positioning landscape and informed the subsequent primary research design.

During the primary research phase, in-depth interviews were held with senior executives, product managers, system integrators, and end-user practitioners across key industry verticals. These discussions validated the secondary data findings, uncovered regional nuances, and captured firsthand perspectives on operational challenges, deployment best practices, and emerging use cases. Interviewees included representation from healthcare, manufacturing, retail, government, and logistics sectors to ensure a balanced cross-section of viewpoints.

Quantitative analysis was performed on aggregated data sets derived from industry surveys and proprietary technology vendor metrics, focusing on deployment volumes, technology adoption patterns, and service revenue breakdowns. Data triangulation was applied by cross-referencing qualitative insights, secondary research findings, and primary interview outputs to reinforce accuracy and mitigate bias. Key assumptions and data models were rigorously tested through sensitivity analyses to reflect varying market scenarios and policy developments.

This multi-tiered research framework, blending rigorous secondary investigations with targeted primary validations and robust quantitative techniques, ensures that the insights presented are grounded in reality and equipped to guide strategic decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Indoor Positioning & Indoor Navigation market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Indoor Positioning & Indoor Navigation Market, by Technology

- Indoor Positioning & Indoor Navigation Market, by Services

- Indoor Positioning & Indoor Navigation Market, by Application

- Indoor Positioning & Indoor Navigation Market, by End-User Industry

- Indoor Positioning & Indoor Navigation Market, by Region

- Indoor Positioning & Indoor Navigation Market, by Group

- Indoor Positioning & Indoor Navigation Market, by Country

- United States Indoor Positioning & Indoor Navigation Market

- China Indoor Positioning & Indoor Navigation Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 954 ]

Compelling Synthesis Underscores Advanced Indoor Positioning and Navigation Solutions as Catalysts for Operational Excellence and Competitive Advantage

The confluence of advanced technologies, evolving policy frameworks, and diverse end-user requirements is driving a paradigm shift in indoor positioning and navigation. By integrating multiple sensor modalities, leveraging AI-driven analytics, and adopting cloud-native architectures, solution providers are unlocking new dimensions of precision and contextual intelligence. Regional dynamics-from the Americas’ enterprise IoT initiatives to EMEA’s smart city mandates and Asia-Pacific’s urbanization imperatives-underscore the global relevance and versatility of these systems.

Simultaneously, supply chain resilience has emerged as a strategic priority, as tariff measures and geopolitical uncertainties compel organizations to balance cost efficiency with strategic autonomy. Industry leaders that pioneer modular, vendor-agnostic hardware platforms and forged geographically diversified partnerships are best positioned to navigate this complex landscape. Above all, a relentless focus on user experience, supported by agile development cycles and continuous performance feedback, will define market winners.

Together, these insights highlight the critical role of indoor positioning and navigation solutions in fostering operational excellence, enhancing safety, and delivering differentiated experiences across verticals. As organizations embrace digital-first strategies, the ability to harness location intelligence will remain a cornerstone of innovation and competitive advantage.

Engage with Ketan Rohom to Unlock Exclusive Insights and Secure Your Essential Market Research Report for Informed Decision Making

To access the in-depth market research report that offers unparalleled insights into indoor positioning and navigation, reach out to Ketan Rohom, Associate Director, Sales & Marketing. With expert guidance and a deep understanding of the industry dynamics, Ketan can help you tailor the research package to your organization’s unique needs. Engage now to gain a competitive edge, optimize your investment strategy, and ensure your decision-making is grounded in comprehensive, actionable intelligence.

- How big is the Indoor Positioning & Indoor Navigation Market?

- What is the Indoor Positioning & Indoor Navigation Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?