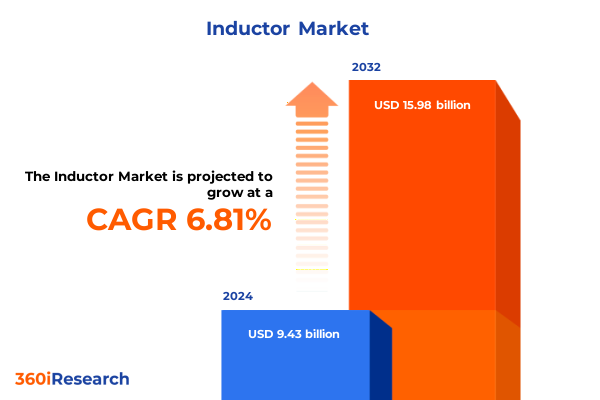

The Inductor Market size was estimated at USD 10.05 billion in 2025 and expected to reach USD 10.72 billion in 2026, at a CAGR of 6.84% to reach USD 15.98 billion by 2032.

Unlocking the Critical Importance of Inductors in Modern Technology and Power Management Applications Across Diversified Industries Worldwide

Inductors are fundamental passive components that store energy within a magnetic field when electrical current passes through them. As conductive coils wound around a core, inductors smooth voltage fluctuations, filter electromagnetic interference, and stabilize current in a vast array of electronic systems. From the simplest power supplies to advanced telecommunications infrastructure, these components underpin reliable performance and efficiency, making them indispensable in modern electronic design.

Driving the demand for inductors is the relentless pursuit of energy-efficient electronics across sectors. In power conversion circuits, the ability of inductors to minimize energy loss has become a critical differentiator in device performance and sustainability. The rapid expansion of IoT deployments and the increasing complexity of consumer gadgets place new demands on compact, high-performance inductors that can operate seamlessly in constrained form factors without sacrificing electrical characteristics.

Moreover, the automotive electrification wave has fundamentally reshaped inductor utilization. Electric and hybrid vehicles integrate multiple inductors within battery management systems, onboard chargers, and power distribution networks, emphasizing reliability under harsh thermal and mechanical conditions. As a result, manufacturers are innovating with new materials and winding techniques to enhance current handling and thermal tolerance, ensuring inductors meet the stringent standards of next-generation mobility solutions.

Examining Fundamental Technological and Market Transformations Driving Inductor Innovation from Miniaturization to Sustainable Manufacturing Practices in 2025

The inductor landscape has evolved through transformative technological shifts that continue to reshape design strategies and market priorities. Foremost among these is the trend toward miniaturization coupled with high-efficiency demands. As electronic devices grow ever smaller and more powerful, component designers focus on reducing inductor size while enhancing current-handling capabilities to support high-frequency switching applications in consumer electronics, industrial automation, and telecommunications networks.

Emerging alongside miniaturization is the proliferation of wireless power transfer systems. Innovations such as Qi-compliant planar charging coils leverage novel copper patterning and coil geometries to deliver high-efficiency inductive power transfer in smartphones, wearables, and automotive interiors. By integrating these wireless charging solutions, original equipment manufacturers are redefining user experiences and expanding the roles of inductors beyond traditional energy storage functions.

In parallel, the global shift toward electrified transportation has driven the development of discrete inductors capable of sustaining high currents and extreme environmental conditions. Automotive-grade SMD coils and ferrite beads now populate converter and inverter circuits in electric vehicles, ensuring EMI suppression and power stability in critical safety and propulsion systems. This electrification trend has heightened collaboration between automotive OEMs and component suppliers to optimize inductor performance and reliability under multi-physical stressors.

Digital infrastructure expansion, particularly the global rollout of 5G, has introduced new performance thresholds for inductors deployed in base station power supplies and edge data centers. With annual 5G infrastructure investments exceeding $200 billion through 2025, the demand for precision-graded inductors that maintain stable performance in harsh outdoor environments has surged.

Finally, sustainability initiatives are driving manufacturers to reduce carbon footprints through renewable energy sourcing, eco-friendly materials, and waste minimization. Leading producers are retrofitting facilities to operate on green power, setting benchmarks for responsible manufacturing that resonate with environmentally conscious buyers and regulatory frameworks alike.

Analyzing the Comprehensive Effects of United States Tariffs Implemented Through 2025 on Inductor Supply Chains Procurement Costs and Strategic Sourcing

The United States has maintained a complex tariff framework on electronic components, including inductors, which has shaped procurement strategies and supply chain configurations through 2025. Under the longstanding Section 301 tariffs, semiconductors and related materials face duties as high as 50 percent, while solar wafers and polysilicon attract 50 percent and tungsten products 25 percent. These measures, initially enacted to counter unequal trade practices, have persisted alongside reciprocal tariffs introduced in early 2025 that briefly reached 125 percent on China-origin goods before a May 12, 2025, agreement reduced the reciprocal rate to 10 percent.

This layered tariff environment has compelled electronics manufacturers to reassess supplier relationships, prompting multi-sourcing strategies to mitigate cost exposure. Companies have invested in regional capacity expansions and sought tariff exclusion exemptions to safeguard high-volume inductors for critical applications. While these efforts have attenuated short-term price shocks, they have also elevated the complexity of customs compliance and extended lead times for specialized inductors, especially those manufactured under unique AEC-Q200 automotive standards.

Despite these challenges, the cumulative tariff pressures have catalyzed a parallel trend of domestic reshoring and expanded partnerships with non-Chinese suppliers. Major inductor producers are accelerating capital expenditures on North American and European production facilities to guarantee uninterrupted supply for sectors with stringent reliability requirements, such as automotive and aerospace. In tandem, some buyers are redesigning circuit topologies to accommodate locally sourced inductors, reinforcing the drive for supply chain resilience amid shifting trade policies.

Igniting Segmentation Insights Revealing How Inductance Type Core Material Mounting Techniques Applications and Distribution Channels Shape the Market

Segmentation based on inductance illuminates two broad categories: fixed inductors, which offer stable inductance values in power management circuits, and variable inductors, which afford tunable performance for RF applications. These distinctions guide designers in selecting components that match circuit specifications, whether in smoothing DC outputs or adjusting resonance frequencies in communication modules.

Further refinement emerges from type segmentation, which distinguishes low-frequency inductors suited for power supplies from miniature power inductors that excel in compact consumer devices. Shielded inductors address EMI-sensitive environments, while small inductors balance size constraints with performance, making them ideal for portable electronics and on-board chargers.

Core material segmentation differentiates air core inductors, which eliminate core losses at high frequencies, from ferrite core variants prized for high permeability and saturation characteristics, and iron core inductors valued for robust energy storage in heavy-current applications.

Mounting technique segmentation categorizes inductors into surface mount technology, enabling high-density PCB designs, and through-hole variants favored for mechanical stability in ruggedized power modules.

Application segmentation further defines market needs, encompassing inductors in automotive systems, consumer electronics platforms, power supply units, and telecommunications infrastructures, each demanding tailored electrical and environmental attributes.

Finally, distribution channel segmentation contrasts offline retail, where technical support and local inventory play pivotal roles, with online retail, which offers rapid global access and flexible order quantities, facilitating just-in-time procurement models.

This comprehensive research report categorizes the Inductor market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Core Type

- Type

- Mounting Technique

- Construction Type

- Application

- End User

- Distribution Channel

Unveiling Key Regional Perspectives on Inductor Demand Growth and Innovation in the Americas EMEA and Asia-Pacific Power Electronics Ecosystems

In the Americas, demand for inductors is propelled by aggressive electrification efforts and grid modernization projects. Electric vehicle manufacturing hubs in the United States and Canada draw heavily on automotive-grade inductors for battery management and power conversion modules, while renewable energy installations in the region rely on robust inductors to enhance inverter efficiency. Trade measures aimed at bolstering domestic production have further stimulated investments in local component manufacturing, reinforcing supply chain resilience and reducing reliance on distant sources.

Europe, the Middle East, and Africa (EMEA) showcase a diverse landscape where stringent regulatory frameworks for energy efficiency and emissions drive inductor innovation. Nations leading the EV transition, such as Germany and Norway, demand inductors capable of operating under extreme thermal conditions in powertrain electronics. Concurrently, booming renewable energy infrastructures across Europe, the Gulf Cooperation Council, and North Africa utilize inductors optimized for high-voltage and high-current applications in solar inverters and wind turbines, reflecting a convergence of reliability and performance standards.

Asia-Pacific emerges as the largest and most dynamic region, benefitting from extensive manufacturing capabilities and rapid technology adoption. China, Japan, South Korea, and Australia spearhead 5G network deployments, creating substantial demand for high-frequency inductors in base stations. Additionally, the consumer electronics boom in the region has made it a central hub for inductor production and export, with low labor costs and supportive government incentives catalyzing capacity expansions. The region’s leadership in EV component sourcing further cements its pivotal role in the global inductor ecosystem.

This comprehensive research report examines key regions that drive the evolution of the Inductor market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Strategic Company Profiles and Technological Leadership of Major Inductor Manufacturers Shaping Industry Innovation and Competitive Dynamics

Several multinational corporations anchor the competitive landscape with robust R&D pipelines and integrated supply chains. TDK Corporation continues to lead with its ADL4532VK series of AEC-Q200 high-current inductors, delivering thermal stability from –55 °C to +155 °C for demanding automotive applications. The company’s vertical integration in ferrite core production and advanced quality assurance systems underpin its market leadership.

Murata Manufacturing has distinguished itself through breakthroughs in miniaturized, high-frequency inductors tailored for 5G infrastructure and IoT devices. The expansion of its DFE2MCPH_JL series supports automotive electronics, while innovations in inductors that double as heat sinks exemplify the company’s commitment to thermal management excellence.

Vishay Intertechnology leverages a diversified portfolio that spans high-current power inductors and EMI-shielded components such as the IHLE-4040DDEW-5A. Strategic acquisitions and global manufacturing flexibility enable Vishay to serve automotive, industrial, and telecommunications sectors with tailored solutions that prioritize energy storage and noise suppression.

Emerging players like Shenzhen Microgate Technology and Sunlord Electronics bring competitive cost structures and agile design support to the smartphone and consumer electronics segments. These firms are rapidly scaling production to meet dynamic sourcing requirements, signaling a shift in the established order as regional suppliers capture greater design wins in premium devices.

This comprehensive research report delivers an in-depth overview of the principal market players in the Inductor market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABC Taiwan Electronics Corp.

- Abracon LLC

- Bourns, Inc.

- Coilcraft Inc.

- Delta Electronics, Inc.

- Eaton Corporation PLC

- Hitachi, Ltd.

- Inductor Supply, Inc.

- KOA Corporation

- Kyocera Corporation

- Laird Technologies, Inc. by Qnity Electronics, Inc.

- Littelfuse, Inc.

- MinebeaMitsumi Inc.

- Murata Manufacturing Co., Ltd.

- NIC Components Corp.

- Panasonic Holdings Corporation

- PICO Electronics, Inc.

- Regal Rexnord Corporation

- Sagami Elec Co., Ltd.

- Samsung Electro-Mechanics Co., Ltd.

- Sumida Corporation

- Taiyo Yuden Co., Ltd.

- TDK Corporation

- TE Connectivity Ltd.

- Texas Instruments Incorporated

- Transko Electronics, Inc.

- Triad Magnetics by Axis Corporation

- Viking Tech Corporation

- Vishay Intertechnology, Inc.

- Würth Elektronik Group

- Yageo Group

Actionable Strategies for Industry Leaders to Bolster Competitive Advantage With Supply Diversification Technological Innovation and Sustainable Initiatives

Industry leaders should prioritize the diversification of supply chains by establishing alternate sourcing agreements with suppliers across multiple regions. This approach will minimize the impact of fluctuating tariff regimes and geopolitical uncertainties while ensuring consistent access to critical inductor technologies. Concurrently, investing in domestic manufacturing capabilities can provide greater control over lead times and quality standards, thereby reducing operational risk in power electronics production.

Technological innovation must remain at the forefront of strategic planning. Allocating resources to develop inductors optimized for emerging applications, such as high-frequency 5G infrastructure, wireless power transfer, and wide-bandgap semiconductor systems, will secure competitive differentiation. Collaborative R&D partnerships between component manufacturers and end-user companies can expedite the advancement of specialized inductors, fostering early design wins and market share gains.

Sustainability should guide procurement and production decisions by aligning material selection and manufacturing processes with environmental best practices. Companies can leverage renewable energy sourcing, reduce waste through process optimization, and adopt eco-friendly materials to resonate with increasingly conscientious customers and comply with tightening regulatory mandates. By integrating sustainable initiatives across the value chain, businesses will not only mitigate environmental impact but also enhance brand reputation and customer loyalty.

Exploring Research Methodologies Combining Primary Expert Interviews Data Triangulation and Supply Chain Analysis for Comprehensive Inductor Market Insights

The insights presented in this report are grounded in a robust research methodology that synthesizes primary and secondary data sources. Primary research encompassed in-depth interviews with industry experts, including component designers, procurement managers, and technical specialists, to validate market dynamics and emerging trends. These interviews provided firsthand perspectives on supply chain challenges, technology adoption roadmaps, and competitive strategies.

Secondary research involved a thorough review of trade publications, regulatory filings, and corporate press releases to compile data on tariff developments, manufacturing capacities, and product innovations. This process included cross-referencing government tariff schedules, industry news reports, and journal articles to ensure accuracy and relevance.

Data triangulation techniques were employed to reconcile conflicting information and enhance the credibility of findings. Quantitative inputs, such as production volumes and tariff rates, were analyzed alongside qualitative insights to generate a comprehensive view of the inductor market landscape.

Finally, the research outcomes underwent validation by a panel of senior advisors with extensive experience in passive component markets. Their feedback refined the analysis, ensuring that the conclusions and recommendations reflect the practical realities of power electronics supply chains and technology deployment.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Inductor market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Inductor Market, by Core Type

- Inductor Market, by Type

- Inductor Market, by Mounting Technique

- Inductor Market, by Construction Type

- Inductor Market, by Application

- Inductor Market, by End User

- Inductor Market, by Distribution Channel

- Inductor Market, by Region

- Inductor Market, by Group

- Inductor Market, by Country

- United States Inductor Market

- China Inductor Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 1272 ]

Drawing Authoritative Conclusions on Inductor Market Trends Strategic Opportunities and Emerging Challenges to Guide Future Decision Making in Power Electronics

Throughout this analysis, key trends have emerged that define the current and future trajectories of the inductor market. Advanced miniaturization and high-frequency capabilities are no longer optional but essential for supporting next-generation electronics across consumer, automotive, and industrial sectors. Concurrently, the expansion of wireless power transfer and the automotive electrification wave have elevated performance and reliability benchmarks for inductor design.

Trade policy dynamics, particularly the cumulative impact of U.S. tariffs through 2025, have reshaped sourcing strategies and accelerated investments in regional manufacturing ecosystems. Companies that diversify suppliers and pursue tariff mitigation measures will position themselves to navigate the evolving trade environment with greater confidence.

Segmentation analysis underscores the varied requirements across inductance types, core materials, mounting techniques, applications, and distribution channels, all of which inform product development and go-to-market strategies. Regional insights reveal distinct growth drivers in the Americas, EMEA, and Asia-Pacific, highlighting opportunities for localized production and market entry.

Major industry players continue to lead through vertical integration, material innovation, and strategic partnerships, while emerging suppliers challenge incumbents with agile design services and competitive cost structures. Ultimately, companies that align technological innovation, supply chain resilience, and sustainable practices will secure a pathway to long-term growth in this critical segment of power electronics.

Encouraging Engagement with Associate Director Sales and Marketing to Acquire Inductor Market Research Insights to Enable Informed Strategic Decisions

For decision-makers seeking to navigate the complexities of the inductor market, a tailored dialogue offers direct access to critical insights and personalized support. Engaging with Ketan Rohom, Associate Director of Sales and Marketing, you will be guided through the nuanced landscape of component innovations, supply chain considerations, and competitive intelligence. By partnering with an expert who understands both the technical demands and strategic imperatives of inductors, your organization can leverage the full depth of the market research to inform procurement decisions, drive product development roadmaps, and secure a competitive edge. Reach out today to arrange your consultation and transform market data into actionable growth strategies.

- How big is the Inductor Market?

- What is the Inductor Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?