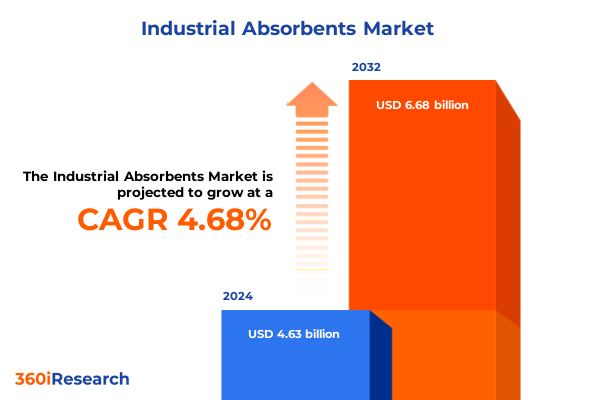

The Industrial Absorbents Market size was estimated at USD 4.84 billion in 2025 and expected to reach USD 5.07 billion in 2026, at a CAGR of 4.70% to reach USD 6.68 billion by 2032.

Exploring the Critical Role of Industrial Absorbents in Enhancing Operational Efficiency and Environmental Compliance in Diverse Industries

The industrial absorbents market sits at the crossroads of operational efficiency and environmental stewardship, serving as a critical component in the management of fluid spills, leaks, and moisture control across a spectrum of industries. As manufacturing processes grow more complex and regulations around workplace safety and environmental protection become increasingly stringent, end users rely on high-performance absorbent solutions to minimize downtime, mitigate hazards, and ensure compliance. From automotive plants where hydraulic fluid containment is paramount to food and beverage facilities aiming to prevent cross-contamination, the right absorbent products can mean the difference between a safe, uninterrupted production line and costly disruptions or regulatory penalties.

Against this backdrop of heightened demand and evolving regulatory frameworks, this report delivers an incisive introduction to the drivers, challenges, and strategic imperatives shaping the industrial absorbents landscape. It unveils how material innovation-ranging from advanced inorganic composites to bio-based cellulose formulations-is unlocking new performance thresholds, while digitalization and supply chain resilience emerge as vital catalysts for growth. By setting the stage with an overview of market context and key themes, this opening section equips decision-makers with the foundational insights needed to navigate an increasingly competitive and sustainability-driven environment.

Identifying Pivotal Technological Advancements and Sustainability-Driven Transformations Reshaping the Industrial Absorbents Landscape Globally

In recent years, the industrial absorbents arena has witnessed transformative shifts driven by a convergence of technological breakthroughs and mounting sustainability expectations. Novel materials such as nanostructured cellulose derivatives and engineered inorganic composites are delivering up to 30 percent greater absorption capacity and enhanced chemical selectivity, enabling targeted response to diverse spill profiles. At the same time, the integration of smart sensors and IoT-enabled monitoring systems is beginning to streamline inventory management and spill-response protocols, allowing real-time detection of leaks and automated reordering of absorbent supplies to minimize operational disruptions.

Beyond material and digital innovation, a broader sustainability revolution is reshaping stakeholder priorities. Manufacturers and end users alike are placing greater emphasis on circular economy models, seeking absorbent products manufactured from reclaimed materials or designed for efficient end-of-life disposal and recycling. These imperatives are prompting strategic collaborations between chemical producers, waste management firms, and research institutions to fast-track the development of next-generation absorbents that balance performance with environmental accountability. Together, these transformative shifts are forging a more dynamic, responsive, and sustainable industrial absorbents ecosystem.

Analyzing the Far-Reaching Effects of 2025 United States Tariff Policies on Industrial Absorbent Supply Chains and Competitive Dynamics in the Market

The 2025 tariff adjustments implemented by the United States have introduced new cost variables that reverberate throughout the industrial absorbents supply chain. With incremental duties applied to key raw materials-ranging from imported activated carbon fines to specialty silica gel granules-the baseline cost of production has increased, prompting manufacturers to reevaluate sourcing strategies. These cost pressures have, in turn, influenced purchase decisions among end users, who face the choice of absorbing higher unit prices or seeking alternative suppliers and materials that can deliver comparable performance at reduced total cost of ownership.

Moreover, the tariff-induced repricing dynamic has catalyzed regional reshoring initiatives, as domestic producers seek to capitalize on local manufacturing incentives and mitigate exposure to cross-border duties. While this trend enhances onshore capacity and supply chain visibility, it also raises concerns about the scalability of domestic feedstock availability, particularly for high-purity inorganic media. As end users grapple with these shifts, maintaining robust supplier diversification, engaging in long‐term off-take agreements, and exploring material substitutions emerge as essential tactics to preserve both cost competitiveness and operational continuity under the new tariff regime.

Unlocking In-Depth Market Segmentation Insights That Illuminate Product, Material, Industry-Specific, Application-Focused, and Sales Channel Dynamics

A nuanced understanding of market segmentation is fundamental to addressing the diverse requirements of industrial absorbents end users. By product type, the landscape ranges from loose absorbents that offer rapid spill coverage and flexible dosing to pads and rolls that facilitate targeted cleanup with minimal waste, and pillows and cushions engineered for high-capacity containment around pipe penetrations and machinery bases. Each format addresses distinct spill profiles, enabling stakeholders to optimize performance criteria such as absorbency rate, handling ease, and disposal logistics.

Delving into material distinctions reveals a bifurcated market where inorganic media, including activated carbon, clay-based substrates, and silica gel, compete alongside organic options like cellulose and peat moss. Activated carbon continues to dominate scenarios involving hydrocarbon containment due to its high adsorption affinity, while clay-based and silica gel materials find traction in caustic or acidic applications. Meanwhile, cellulose and peat moss are increasingly favored in applications demanding biodegradable or renewable solutions. End user industries spanning automotive, chemical, food & beverage, healthcare, manufacturing, and oil & gas each exhibit unique preferences, influenced by spill composition, safety protocols, and sustainability mandates. Application-driven considerations-whether for routine maintenance, emergency spill control, or structured waste management-further shape product selection, while sales channel dynamics via direct sales, distributor networks, and expanding online retail platforms guide accessibility and service support models.

This comprehensive research report categorizes the Industrial Absorbents market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Material Type

- End User Industry

- Application

- Sales Channel

Revealing Crucial Regional Dynamics Across the Americas, Europe Middle East Africa, and Asia-Pacific That Drive Industrial Absorbent Adoption and Growth

Regional dynamics within the industrial absorbents domain reveal distinct growth drivers and adoption patterns across the Americas, Europe Middle East Africa, and Asia-Pacific. In the Americas, stringent North American regulatory frameworks and robust automotive and oil & gas sectors have driven strong demand for absorbent solutions, fostering advanced distribution networks and service-oriented supply models. Meanwhile, Latin American markets are increasingly leveraging these innovations as they accelerate industrialization and bolster environmental compliance infrastructure.

In Europe Middle East Africa, heightened emphasis on spill prevention within chemical processing and pharmaceutical operations has elevated requirements for high-performance absorbents, while regional sustainability directives are pushing manufacturers toward eco-friendly and recyclable products. The Middle East’s expansive oil & gas operations continue to anchor demand, with service providers seeking rapid-response absorbent kits to safeguard sensitive ecosystems. Across Asia-Pacific, rapid industrial expansion coupled with growing environmental awareness is fueling adoption of both inorganic and organic absorbent solutions, as manufacturing hubs in Southeast Asia and India prioritize efficient spill control to maintain production integrity and meet evolving environmental regulations.

This comprehensive research report examines key regions that drive the evolution of the Industrial Absorbents market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining Leading Stakeholders and Competitive Leadership Strategies Reshaping Industrial Absorbents Through Collaboration and Innovative Solutions

Leading participants in the industrial absorbents arena are forging strategies that blend technological differentiation and strategic partnerships. For example, New Pig Corporation has expanded its product portfolio to include next-generation bio-based pads, leveraging research collaborations to enhance sustainability credentials. Oil-Dri Corporation of America continues to invest in proprietary clay formulations with superior oil retention performance, while forging alliances with logistics providers to streamline global delivery.

Proteus Industries has set itself apart by integrating smart inventory management tools into its direct‐sales model, empowering clients with data-driven reorder automation. Brady Worldwide combines absorbent solutions with safety signage and training programs, positioning itself as a turnkey provider for spill response compliance. Together, these companies exemplify how focused innovation, integrated service offerings, and targeted partnerships are reshaping competitive dynamics and elevating customer expectations within the industrial absorbents sector.

This comprehensive research report delivers an in-depth overview of the principal market players in the Industrial Absorbents market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- Abatix Corp.

- Ansell Ltd.

- BASF SE

- Bennett Mineral Company

- Brady Corporation

- Decorus Europe Ltd.

- EarthSafe

- Ecospill Ltd.

- Finite Fiber

- Haritsons Mintech Private Limited

- Johnson Matthey PLC

- Kimberly-Clark Worldwide, Inc.

- Kutch Bento Clay

- Manek Aactive Clay Pvt. Ltd.

- Meltblown Technologies Inc.

- New Pig Corporation

- Oil-Dri Corporation

- Patalia Chem Industries

- Rite-Kem, Inc.

- TOLSA, SA

- U.S. Silica

Proposing Targeted Action Plans for Industry Leaders to Capitalize on Emerging Opportunities and Address Operational Challenges in the Industrial Absorbents

Industry leaders must prioritize investment in research and development to pioneer sustainable absorbent materials that meet stringent environmental standards while maintaining high-performance thresholds. By establishing partnerships with academic institutions and materials science startups, companies can accelerate the commercialization of novel bio-based and reusable media.

At the same time, organizations should diversify supply chains by qualifying multiple raw material sources and exploring domestic production alliances to reduce exposure to international tariff fluctuations. Embracing digital platforms for inventory management and spill monitoring will enhance responsiveness and enable predictive restocking, cutting downtime. Furthermore, aligning product portfolios with evolving regulatory requirements and offering comprehensive training programs to end users will solidify market positioning and foster long-term loyalty.

Detailing a Robust Mixed-Methods Approach Integrating Primary and Secondary Research Techniques to Ensure Rigorous Industrial Absorbents Market Analysis

This analysis employs a robust mixed-methods approach that integrates both primary and secondary research techniques to deliver actionable market insights. Primary research included structured interviews with senior executives across manufacturing, oil & gas, and environmental services sectors, along with surveys capturing purchase drivers and pain points among facility managers. These engagements provided firsthand perspectives on supply chain challenges, material performance requirements, and procurement strategies.

Secondary research involved the systematic review of industry publications, regulatory documents, technical white papers, and patent filings to map technological trajectories and sustainability frameworks. Data triangulation was performed to validate findings, supported by quantitative cross-referencing of corporate disclosures and trade association reports. Throughout, rigorous quality controls and ethical compliance protocols ensured data integrity and confidentiality, resulting in a comprehensive and reliable assessment of the industrial absorbents market landscape.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Industrial Absorbents market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Industrial Absorbents Market, by Product Type

- Industrial Absorbents Market, by Material Type

- Industrial Absorbents Market, by End User Industry

- Industrial Absorbents Market, by Application

- Industrial Absorbents Market, by Sales Channel

- Industrial Absorbents Market, by Region

- Industrial Absorbents Market, by Group

- Industrial Absorbents Market, by Country

- United States Industrial Absorbents Market

- China Industrial Absorbents Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1272 ]

Drawing Comprehensive Conclusions That Synthesize Market Drivers, Challenges, and Strategic Implications for Stakeholders in the Industrial Absorbents Ecosystem

This report synthesizes the critical drivers propelling the industrial absorbents market-namely, heightened environmental regulations, operational risk management imperatives, and the growing emphasis on sustainable materials. It also highlights key challenges, including the 2025 tariff-induced cost pressures, raw material sourcing complexities, and the balance between performance requirements and ecological considerations. Strategic implications for stakeholders encompass the necessity of material innovation, supply chain diversification, digital integration, and compliance-aligned service offerings.

By weaving these insights together, decision-makers can forge strategies that leverage emerging technologies and regional growth opportunities while mitigating cost and regulatory risks. The comprehensive perspective provided here offers a roadmap for companies to strengthen their competitive positioning and deliver high-value solutions that resonate with evolving customer and environmental demands.

Engaging Leaders to Secure Exclusive Access to Comprehensive Industrial Absorbents Market Research with Personalized Support from Our Associate Director

We invite you to connect with Ketan Rohom, Associate Director, Sales & Marketing, to explore how this comprehensive report can address your strategic needs and unlock new growth opportunities in the industrial absorbents sector. Ketan’s deep understanding of market dynamics and client requirements enables him to tailor insights and demonstrate the specific benefits this research brings to your organization. Whether you seek detailed data on emerging materials, regulatory impact analysis, or bespoke segmentation breakdowns, Ketan will guide you through the process of securing the report license that aligns with your objectives. Reach out today to arrange a personalized briefing and take the next step toward making informed, decisive moves in this evolving market

- How big is the Industrial Absorbents Market?

- What is the Industrial Absorbents Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?