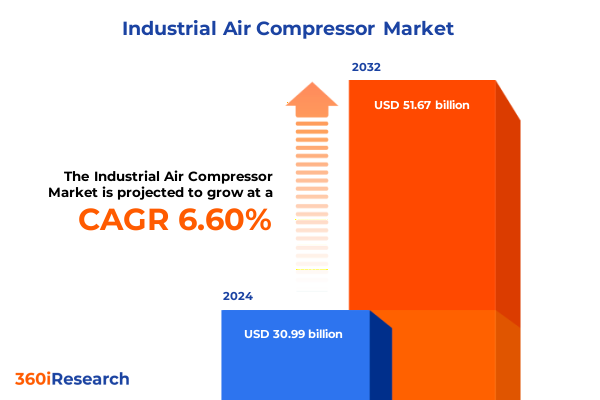

The Industrial Air Compressor Market size was estimated at USD 32.96 billion in 2025 and expected to reach USD 35.06 billion in 2026, at a CAGR of 6.63% to reach USD 51.67 billion by 2032.

Unveiling the dynamic evolution and driving forces reshaping the industrial air compressor ecosystem in an era of innovation and operational excellence

Industrial air compressors serve as the backbone of countless manufacturing processes, delivering critical pneumatic power to assembly lines, production equipment, and facility maintenance systems. As global industries pursue enhanced productivity and reliability, the demand for cutting-edge compressed air solutions has intensified. More than ever, technological innovation and operational efficiency sit at the forefront of industrial competitiveness, positioning compressors not merely as utilities but as strategic assets.

Throughout recent years, manufacturers have responded to escalating energy costs and sustainability mandates by integrating intelligent monitoring and control systems directly into compressor architectures. Embedded sensors capture performance data in real time, enabling predictive maintenance that reduces unplanned downtime and extends equipment life. Moreover, the adoption of variable speed drive technology dynamically aligns motor output with demand profiles, delivering substantial energy savings across diverse operational environments.

Simultaneously, end users increasingly prioritize air purity and environmental stewardship in their procurement criteria. The surge in oil-free compressor installations in sectors such as pharmaceuticals, food and beverage, and electronics manufacturing underscores this shift. These platforms eliminate contamination risks and align with rigorous regulatory and quality standards, reinforcing the strategic importance of compressor selection in product integrity and compliance initiatives.

Furthermore, globalization has reshaped supply chain architectures, prompting OEMs to diversify component sourcing and expand aftermarket service networks. As businesses navigate complex trade policies and fluctuating logistics costs, the agility to pivot between local production and international partnerships becomes a defining factor in sustaining competitive advantage. Consequently, industrial air compressors are evolving beyond mechanical devices into digitally enabled, service-oriented systems that underpin modern manufacturing resilience.

How digital transformation, sustainability mandates, and advanced automation are converging to redefine the future industrial air compression landscape

The industrial air compressor landscape is undergoing a paradigm shift fueled by the convergence of digital technologies and smart systems. Building upon the foundational role of compressed air, next-generation compressors now embed Internet of Things connectivity to deliver continuous performance insights and facilitate proactive maintenance interventions. Real-time analytics detect emerging faults and optimize operational parameters, driving reliability improvements and minimizing energy waste.

In parallel, advanced control architectures leveraging artificial intelligence and machine learning are revolutionizing how compressors respond to variable demand cycles. Algorithms calibrate pressure output and motor speed with unprecedented precision, harmonizing with broader facility control networks to ensure seamless integration. Variable speed drives not only enhance energy efficiency but also reduce mechanical stress, extending the service life of critical components and lowering lifecycle costs.

Environmental and regulatory pressures are accelerating the transition to sustainable compressor designs. Heat recovery systems reclaim waste thermal energy for process heating or water preheating, while emerging low-carbon drive alternatives explore electric and hybrid powertrains. Such innovations align with corporate decarbonization agendas and support compliance with increasingly stringent emissions targets across jurisdictions.

Moreover, modular and scalable compressor platforms are redefining capital deployment strategies. Manufacturers offer customizable configurations that accommodate expanding production requirements without full system overhauls, facilitating rapid capacity upgrades. Together, these transformative shifts underscore a new era in which compressed air is not only a utility resource but a strategic lever for energy management, quality assurance, and operational agility.

Assessing the cascading effects of reinstated United States tariffs and expiring exclusions on industrial air compressor supply chains and procurement strategies

Since the imposition of Section 301 tariffs on Chinese imports in 2018, industrial air compressor manufacturers and end users have navigated a landscape marked by fluctuating duty exclusions and elevated import costs. While certain pandemic-related machinery classifications secured temporary exclusions through May 31, 2025, numerous compressor components remain subject to a 25 percent duty under the Trade Act of 1974. The recent extension of exclusions for select categories until mid-2025 provides short-term relief but signals the eventual reinstatement of full tariff burdens.

These levies have prompted strategic realignments across compressor supply chains. Buyers are shifting toward domestically manufactured units to mitigate tariff exposure, while OEMs have accelerated localization efforts for critical modules. Concurrently, distributors are reevaluating inventory strategies to balance landed cost volatility against service level expectations, forcing a reevaluation of buffer stock policies.

In practical terms, the return of full duties on Chinese-origin compressors and spare parts will increase total acquisition costs and compress margins for downstream users. Energy-efficient and oil-free models imported under expired exclusions will face upward price pressures, impacting sectors where high-purity air is essential. Businesses will need to weigh the trade-off between immediate procurement savings via exclusions and long-term tariff-inclusive budgeting.

Looking ahead, industry participants can leverage the exclusion request process and anticipate potential relief windows by engaging proactively with U.S. Trade Representative filings. Meanwhile, diversifying supplier portfolios and investing in domestic manufacturing capacity remain critical to hedge against tariff-driven cost escalations and ensure resilient compressed air availability.

Deep-dive segmentation intelligence revealing critical insights across product architectures, power classes, cooling technologies, and end-user verticals

A nuanced understanding of market segmentation is vital to identifying growth vectors and optimizing product roadmaps. Among product classifications, dynamic compressors excel in high-flow applications, offering continuous air delivery via impeller acceleration, whereas positive displacement units, leveraging reciprocating or rotary mechanisms, achieve higher discharge pressures for demanding process environments. These divergent attributes dictate application suitability across diverse operational contexts.

Within the compressor archetypes, axial machines provide high volumetric output for centralized systems, while centrifugal variants deliver sustained performance in large-scale facilities. Reciprocating compressors, prized for high-pressure precision, remain integral to intermittent process needs. Rotary technologies, encompassing screw and vane designs, strike a balance between energy efficiency and steady-state operation. The duality of oil-free and oil-lubricated categories further differentiates offerings, with oil-free configurations ensuring contamination-free air streams for sectors with stringent purity requirements, and oil-lubricated units offering cost-effective robustness for general industrial use.

Output power tiers shape procurement decisions as well. Smaller up to 50 kW units serve localized workshops and light industrial tasks, midsize 51–500 kW platforms undergird manufacturing lines and utility operations, while above 500 kW installations form the backbone of large-scale process plants and infrastructure facilities. Cooling methods-air-cooled models prized for installation flexibility versus water-cooled systems offering enhanced heat rejection-further refine solution selection.

Distribution channels have equally evolved, with traditional offline retail complemented by growing online retail frameworks that facilitate rapid quoting and direct-to-site delivery. Lastly, end-user verticals spanning architecture & construction, chemicals, energy & power, food & beverage, healthcare, mining, and oil & gas each impose unique performance, uptime, and regulatory stipulations. Understanding these intersecting segments enables tailored value propositions and targeted channel engagement.

This comprehensive research report categorizes the Industrial Air Compressor market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product

- Type

- Category

- Output Power

- Cooling Method

- Distribution Channel

- End-User Industry

Probing regional market dynamics to evaluate unique drivers and opportunities across the Americas, EMEA territories, and the high-growth Asia-Pacific sphere

Regional dynamics shape the trajectory of industrial air compressor adoption and investment in distinct ways. In the Americas, end-users grapple with the dual imperatives of nearshoring and energy management, fostering demand for versatile compressor platforms that can be quickly deployed across diversified manufacturing sites. U.S. incentives for energy efficiency bolster interest in variable speed drive solutions, while Canadian and Mexican markets emphasize robust service networks to support critical infrastructure maintenance.

Europe, Middle East & Africa markets present a tapestry of regulatory stringency and strategic investment. European Union member states drive adoption of low-carbon compressor systems under the REPowerEU plan, prioritizing electrification and heat recovery. Meanwhile, Middle Eastern oil & gas enterprises are modernizing legacy facilities with high-capacity centrifugal compressors, balancing production optimization against rising sustainability commitments. Across Africa, infrastructure expansion projects fuel interest in modular, off-grid compressor packages capable of supporting remote mining and construction activities with minimal downtime risk.

Asia-Pacific continues to register the highest growth momentum, propelled by rapid industrialization and government-led infrastructure programs. China and India lead in both equipment manufacturing and consumption, incentivizing OEMs to establish local production hubs. Southeast Asian economies are likewise expanding compressed air networks to accommodate burgeoning automotive and electronics assembly lines, while development initiatives in Australia focus on energy-efficient mining operations.

Across these regions, distributors and service providers tailor offerings to local regulatory frameworks, climate considerations, and supply chain resilience priorities. This geographic granularity underscores the necessity for adaptive go-to-market strategies aligned with region-specific drivers and risk profiles.

This comprehensive research report examines key regions that drive the evolution of the Industrial Air Compressor market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Exclusive corporate intelligence dissecting competitive positioning, strategic investments, and innovation pipelines of leading global air compressor players

Global leadership in the industrial air compressor domain is characterized by robust portfolios, strategic R&D investments, and expansive aftermarket services. Companies such as Atlas Copco and Ingersoll Rand continue to drive innovation with digital service platforms, offering condition monitoring and remote diagnostics through cloud-based portals. Their commitment to energy optimization and service agreements underpins market credibility and fosters high customer retention.

Kaeser Kompressoren and Gardner Denver distinguish themselves through product modularity and rapid deployment capabilities. By providing flexible compressor skids and containerized solutions, these players address the urgent needs of construction and infrastructure projects, emphasizing ease of installation and mobility. Concurrently, Sullair’s focus on oil-free rotary screw technology has solidified its position in sectors demanding uncompromised air purity, with a global service network that ensures minimal latency in spare parts delivery.

Emerging OEMs like ELGi Equipments are leveraging competitive manufacturing costs and localized production to penetrate markets traditionally dominated by long-established players. Their partnership strategies and aggressive channel expansion in Asia-Pacific and Latin America demonstrate a concerted effort to capture share in both cost-sensitive and premium segments.

Collaborations between OEMs and software providers are also reshaping the competitive landscape. The integration of predictive maintenance algorithms and subscription-based service models creates recurring revenue streams while enhancing customer lock-in. As competition intensifies, strategic mergers, targeted acquisitions, and alliances will continue to define corporate positioning and influence innovation trajectories.

This comprehensive research report delivers an in-depth overview of the principal market players in the Industrial Air Compressor market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Atlas Copco AB

- Bauer AG

- Danfoss A/S

- Doosan Bobcat Inc.

- Dover Corporation

- Ebara Corporation

- Elgi Equipments Limited

- Frank Technologies Pvt Ltd.

- Fusheng Co., Ltd.

- Galaxy Auto Service Equipment Co.,Ltd.

- Gardner Denver Holdings, Inc.

- General Electric Company

- Hitachi, Ltd.

- Howden Group Limited

- IDEX Corporation

- Ingersoll Rand Inc.

- Kaeser Kompressoren SE

- Kirloskar Pneumatic Company Limited

- Kobe Steel, Ltd.

- Mitsubishi Heavy Industries, Ltd.

- Quincy Compressor LLC

- SIEHE Group

- Siemens AG

- Sullair, LLC

- Sullivan-Palatek, Inc.

Actionable strategic imperatives enabling leaders to capitalize on technological advances, market shifts, and regulatory challenges

To thrive amid accelerating technological change and shifting trade environments, industry leaders must adopt a multifaceted strategic approach. First, investing in digital transformation initiatives-including IoT-enabled sensors and AI-driven analytics-can unlock unprecedented operational visibility and facilitate proactive maintenance regimes, reducing lifecycle costs and enhancing uptime.

Simultaneously, diversifying supply chain footprints through nearshoring and dual-sourcing strategies will mitigate tariff exposure and logistics disruptions. Cultivating partnerships with domestic component manufacturers and exploring joint ventures in emerging markets can create supply chain resilience while capitalizing on local incentives.

Innovation focus should extend beyond core compressor units to embrace modular designs and heat recovery integrations. Linking compressed air systems with facility energy management platforms fosters holistic efficiency gains and aligns with decarbonization goals. Additionally, launching subscription-based service offerings can generate stable recurring revenues and deepen customer engagement through outcome-based contracts.

Finally, engaging proactively with regulatory bodies and trade associations ensures early intelligence on policy shifts, enabling timely adjustment of product specifications and compliance protocols. By integrating these actionable imperatives, industry participants can position themselves at the forefront of compressed air solutions, capturing market share and driving sustainable growth.

Rigorous mixed-methods research bringing together expert interviews, primary surveys, and secondary data triangulation for robust insights

Our research methodology integrates a rigorous mixed-methods framework to ensure the highest standard of market intelligence. Initially, we conducted in-depth interviews with senior executives, technical experts, and procurement leaders across key end-user industries to capture firsthand insights into demand drivers, technology priorities, and supply chain dynamics.

Concurrently, a structured survey was deployed to facility managers and maintenance engineers, eliciting detailed feedback on performance criteria, service expectations, and investment roadmaps. These primary inputs were supplemented by extensive secondary research, including analysis of trade publications, government policy announcements, and corporate filings.

Data triangulation was employed to reconcile qualitative narratives with quantitative market signals, ensuring consistency and accuracy in our thematic assessments. Key findings underwent validation workshops with industry consortiums, further reinforcing the credibility of conclusions drawn. Finally, regional and application-specific deep dives contextualized global trends, highlighting localized opportunities and risk factors.

This comprehensive approach underpins the strategic recommendations and segmentation insights presented, offering a robust foundation for decision-makers seeking to navigate the complexities of the industrial air compressor market.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Industrial Air Compressor market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Industrial Air Compressor Market, by Product

- Industrial Air Compressor Market, by Type

- Industrial Air Compressor Market, by Category

- Industrial Air Compressor Market, by Output Power

- Industrial Air Compressor Market, by Cooling Method

- Industrial Air Compressor Market, by Distribution Channel

- Industrial Air Compressor Market, by End-User Industry

- Industrial Air Compressor Market, by Region

- Industrial Air Compressor Market, by Group

- Industrial Air Compressor Market, by Country

- United States Industrial Air Compressor Market

- China Industrial Air Compressor Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 1272 ]

Synthesis and forward-looking perspectives emphasizing strategic priorities and emergent opportunities in the evolving industrial air compression arena

Bringing together the threads of technological innovation, trade policy developments, and regional market dynamics reveals a compressed air ecosystem in transition. Digitalization has cemented compressors as intelligent assets, while sustainability imperatives and heat recovery integrations underscore an industry-wide drive toward environmental responsibility. At the same time, Section 301 tariff realignments and expiration of exclusions necessitate agile sourcing and supply chain strategies to maintain cost competitiveness.

Segmentation analysis highlights the criticality of matching compressor typologies-be they dynamic or positive displacement-with specific application requirements. The interplay between power classes, cooling methods, and end-user verticals demands nuanced product positioning and channel alignment. Regional insights further illustrate the need for tailored go-to-market approaches that respect local regulatory landscapes and infrastructure profiles.

Competitive intelligence demonstrates that leading OEMs are differentiating through digital service platforms, energy optimization technologies, and flexible deployment models. Meanwhile, emerging players are leveraging manufacturing scale and regional partnerships to challenge established market hierarchies.

Ultimately, staying ahead in this evolving arena requires a holistic view that integrates innovation pipelines, policy foresight, and customer-centric service models. Organizations that adeptly navigate these intersecting forces will secure operational resilience and unlock new pathways to growth.

Contact Ketan Rohom to Acquire the Definitive Industrial Air Compressor Market Research for Strategic Business Advantage

Ready to leverage deep industry expertise and gain a decisive competitive advantage, connect with Ketan Rohom, the Associate Director for Sales & Marketing, to purchase the comprehensive industrial air compressor market research report. Engage directly to discuss how tailored intelligence can inform your strategic planning, guide your investment decisions, and drive operational excellence within your organization’s compressed air systems initiatives. Take the next step in securing detailed analysis of emerging trends, regulatory impacts, and segmentation insights that will empower you to optimize product portfolios, refine go-to-market strategies, and unlock sustainable growth opportunities in a rapidly evolving market.

- How big is the Industrial Air Compressor Market?

- What is the Industrial Air Compressor Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?