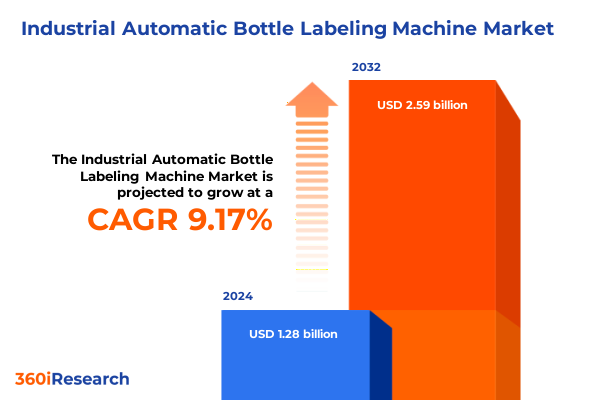

The Industrial Automatic Bottle Labeling Machine Market size was estimated at USD 1.38 billion in 2025 and expected to reach USD 1.52 billion in 2026, at a CAGR of 9.37% to reach USD 2.59 billion by 2032.

How Cutting-Edge Automatic Bottle Labeling Solutions Are Driving Agility Quality and Regulatory Compliance on Modern Production Lines

Across manufacturing floors worldwide, automatic bottle labeling systems have transitioned from niche automation tools to mission-critical assets driving both production agility and brand consistency. As consumer expectations intensify for rapid product innovation and flawless packaging aesthetics, packaging engineers and operations leaders alike must adopt technologies that bridge speed with precision. Today’s cutting-edge labeling machines harness advanced sensors, machine vision, and sophisticated control algorithms to apply labels on containers of diverse shapes and materials without sacrificing throughput or quality.

Amid global supply chain disruptions and labor market constraints, these systems serve as pivotal enablers of resilient operations. By minimizing manual intervention and reducing packaging errors, enterprises can accelerate cycle times and redeploy skilled workers to higher-value tasks. Simultaneously, regulatory requirements around traceability and anti-counterfeiting stipulate exact labeling accuracy, further propelling the shift toward automated solutions. This introduction explores how the convergence of industrial Internet of Things connectivity, data analytics, and modular robotics is forging a new era in bottle labeling-one where adaptability and insight go hand in hand.

Major Transformations in Labeling Technology Sustainability and Customization Redefining Industry Efficiency

The automatic bottle labeling landscape has undergone transformative shifts driven by both technological innovation and evolving market needs. First, the proliferation of smart factory initiatives has accelerated the integration of real-time monitoring and predictive maintenance into labeling equipment. Modern labelers not only execute high-speed operations but also stream operational metrics to cloud-based platforms, enabling maintenance teams to anticipate and address wear-related issues before they escalate.

Second, sustainability imperatives have catalyzed the adoption of eco-friendly label materials and energy-efficient machinery. Manufacturers increasingly favor pressure-sensitive films and paper grades that reduce plastic waste while ensuring durable adhesion under diverse temperature and humidity profiles. Concurrently, equipment designers optimize energy consumption through regenerative braking systems and variable-frequency drives that scale power usage to actual demand.

Lastly, customization and rapid changeover have become nonnegotiable requirements in markets characterized by frequent product launches and seasonal promotions. To remain competitive, suppliers are introducing modular labeling platforms that allow swift swapping of dispensing heads, quick-adjust mechanical guides, and operator-friendly HMI interfaces. These shifts collectively signify a fundamental redefinition of efficiency benchmarks and service expectations within the labeling ecosystem.

Strategic Sourcing and Supply Chain Adaptations in Response to Elevated United States Tariffs on Industrial Machinery

In 2025, the landscape of United States tariffs has materially influenced strategic sourcing and deployment decisions for automatic bottle labeling machinery. Recent tariff adjustments targeting imports of industrial machinery components have altered landed costs and compelled procurement teams to reevaluate supplier portfolios. Sourcing from domestic original equipment manufacturers (OEMs) has gained renewed appeal as tariff-inclusive cost models increasingly favor nearshore procurement, even when base machinery pricing appears higher.

Moreover, suppliers with globally diversified manufacturing footprints have become better positioned to mitigate tariff impacts. By maintaining assembly operations across regions not subject to elevated duties, equipment producers can reallocate orders and fulfill client demands with minimal cost escalation. Meanwhile, end users are leveraging total cost of ownership analyses that factor in potential duty fluctuations and supply chain reconfiguration expenses.

These tariff-driven dynamics are also accelerating conversations around vertical integration and local production partnerships. Forward-thinking enterprises are exploring joint ventures with machinery builders to establish assembly lines within tariff-exempt zones, thereby securing tariff advantages while cultivating local expertise. As trade policies evolve, labeling equipment stakeholders must remain vigilant to tariff trajectories and adapt sourcing strategies to sustain competitive performance.

Deep Dive into Industry Application Equipment Automation Speed Container and Label Substrate Variations Shaping Solution Choices

The automatic bottle labeling sector reveals nuanced opportunities when examined through the prism of application, equipment type, automation sophistication, throughput speed, container composition, and label format. In chemicals manufacturing, agrochemical and industrial chemical producers demand robust labeling systems capable of withstanding corrosive environments and ensuring compliance with stringent safety regulations. Cosmetics and personal care brand owners pursue machines that can handle delicate hair care and skincare packaging, balancing gentle product proximity with high decorative finish requirements. Food and beverage producers across beverages, confectionery and snacks, and dairy products necessitate hygienic designs that enable frequent sanitation while maintaining uninterrupted high-speed labeling.

Different labeling machine architectures also shape adoption: front and back labelers excel in dual-surface applications, top and bottom machines address tamper-evident requirements, and wrap-around systems-whether compact models for pilot lines or high-speed variants for mass production-deliver full-coverage label options. Automation level further differentiates suppliers, as fully automatic platforms integrate load-and-unload robotics for hands-off operations, while semi-automatic solutions cater to mid-tier operations requiring occasional operator intervention.

Throughput demands introduce additional segmentation. Lines running up to 100 bottles per minute prioritize flexibility for limited runs, whereas operations exceeding 500 units per minute necessitate high-capacity machinery with advanced in-line inspection. Container material considerations likewise influence machine configuration: composite bottles and glass receptacles require gentler handling, metal cans demand precise label alignment under rapid acceleration, and plastic bottles-whether high-density polyethylene or polyethylene terephthalate-benefit from optimized label dispensing angles to avoid material stretching. Finally, label substrate choices between glued facestocks, pressure-sensitive films, and paper variants affect applicator selection, drive mechanics, and environmental controls.

This comprehensive research report categorizes the Industrial Automatic Bottle Labeling Machine market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Machine Type

- Automation Level

- Speed Range

- Bottle Material

- Label Material

- End-User Industry

How Diverse Regional Regulatory Dynamics End-User Demands and Infrastructure Shape Labeling Equipment Investments Globally

Regional dynamics profoundly influence adoption patterns and investment priorities for automatic bottle labeling systems. In the Americas, demand is driven by large-scale beverage and pharmaceutical production hubs, where operators seek turnkey solutions that integrate seamlessly with existing packaging lines and comply with local safety standards. Latin American agriculture and personal care producers are also pivoting toward semi-automatic platforms as a cost-effective entry point to automation.

Across Europe, Middle East and Africa, stringent regulatory frameworks around product traceability and environmental stewardship position advanced labeling machines as critical enablers of sustainable manufacturing. European beverage conglomerates focus on energy-efficient equipment that supports recyclability objectives, while Middle Eastern pharmaceutical clusters prioritize tamper-evident features and serial number traceability to meet regional health authority requirements. In Africa, a growing cosmetics sector is adopting flexible compact wrap-around machines to cater to artisanal brand proliferation.

Asia-Pacific remains the fastest-growing region, driven by robust consumer packaged goods demand in Southeast Asia, expanding dairy processing in South Asia, and advanced pharmaceutical manufacturing in Northeast Asia. Here, high-speed wrap-around solutions featuring inline inspection systems and seamless ERP integration are increasingly common. Across all regions, end users value local service networks, spare parts availability, and training programs that enhance uptime and accelerate return on investment.

This comprehensive research report examines key regions that drive the evolution of the Industrial Automatic Bottle Labeling Machine market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Competitive Battles Unfold Around Technological Innovation Aftermarket Excellence and Strategic Global Partnerships

Leading equipment providers continuously vie on technology, service excellence, and global footprint to capture evolving growth opportunities. Established European and North American OEMs leverage decades of application expertise and rigorous quality control to deliver reliable machines with robust service networks. They invest heavily in R&D, introducing vision-guided labeling heads and AI-powered fault detection to minimize downtime and ensure consistent label placement accuracy.

Simultaneously, emerging suppliers from Asia are differentiating on cost competitiveness and rapid innovation cycles. By capitalizing on modular design principles, these providers can bring new features to market faster, offering customizable control software and intuitive user interfaces that require minimal training. Many also form strategic alliances with local system integrators to bundle packaging line solutions, thereby addressing end-to-end operational challenges beyond individual label application.

Across the board, aftermarket services have become critical differentiators. Top-tier players offer comprehensive service-level agreements that include remote diagnostics, predictive maintenance dashboards, and on-site technical support within guaranteed response windows. In addition, training programs and certification initiatives help customer teams develop in-house expertise, reducing reliance on external support and fostering long-term partnerships.

This comprehensive research report delivers an in-depth overview of the principal market players in the Industrial Automatic Bottle Labeling Machine market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Accutek Packaging Equipment Companies, Inc.

- ALtech Labelers Co., Ltd.

- Axon Labelling Systems Ltd.

- Barry-Wehmiller, Inc.

- Coesia S.p.A.

- Herma Labeling Systems

- IMA Industria Macchine Automatiche S.p.A.

- KHS GmbH

- Krones Aktiengesellschaft

- Label-Aire, Inc.

- Sidel Group S.A.

- Syntegon Technology GmbH

- Yundu Packaging Machinery

Actionable Strategies to Elevate Existing Labeling Assets Integrate Analytics and Safeguard Against Supply Chain Disruptions

Industry leaders aiming to seize new growth avenues should align their labeling automation strategies with digital transformation agendas. They must assess installed base performance and invest in retrofittable vision modules that elevate older machines to current precision standards. By layering advanced analytics onto production data streams, decision-makers can identify bottlenecks in real time and fine-tune line configurations to boost throughput without capital-intensive line rebuilds.

Additionally, executives should prioritize flexible automation platforms that support rapid SKU transitions and seasonal packaging changes. Engaging in collaborative pilot programs with equipment suppliers can unlock early access to emerging technologies such as augmented reality-assisted maintenance and collaborative robot integration. These partnerships not only reduce implementation risk but also foster co-innovation, enabling faster time to value.

Finally, procurement teams need to develop comprehensive duty impact scenarios that account for existing and prospective tariff adjustments. By diversifying supplier bases across multiple regions and exploring local assembly options, organizations can stabilize landed costs and mitigate geopolitical supply chain disruptions. Executing these recommendations will enhance operational resilience and position businesses at the forefront of the industry’s next wave of automation.

Rigorous Integration of Structured Interviews Technical Literature Trade Data and Analytical Modeling Ensuring Objective Labeling Market Insights

Our research approach combined extensive primary and secondary data gathering to ensure comprehensive and objective insights into the automatic bottle labeling domain. We conducted structured interviews with packaging engineers, operations executives, and procurement specialists across a spectrum of end-user industries to understand real-world performance requirements and investment rationales. These discussions informed the identification of key performance indicators, such as labeling accuracy, changeover time, and maintenance frequency.

Secondary research included an exhaustive review of technical white papers, patent filings, regulatory publications, and industry association reports. We analyzed equipment catalogs and user manuals to document machine capabilities and feature differentials. Publicly available trade data and national import–export statistics provided context on tariff dynamics and regional trade flows.

To validate our findings, we performed cross-referencing exercises between primary interview insights and secondary data sets, ensuring consistency and eliminating potential information biases. Advanced analytical techniques, including comparative matrix analyses and scenario modeling, underpinned our segmentation breakdowns and regional evaluations.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Industrial Automatic Bottle Labeling Machine market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Industrial Automatic Bottle Labeling Machine Market, by Machine Type

- Industrial Automatic Bottle Labeling Machine Market, by Automation Level

- Industrial Automatic Bottle Labeling Machine Market, by Speed Range

- Industrial Automatic Bottle Labeling Machine Market, by Bottle Material

- Industrial Automatic Bottle Labeling Machine Market, by Label Material

- Industrial Automatic Bottle Labeling Machine Market, by End-User Industry

- Industrial Automatic Bottle Labeling Machine Market, by Region

- Industrial Automatic Bottle Labeling Machine Market, by Group

- Industrial Automatic Bottle Labeling Machine Market, by Country

- United States Industrial Automatic Bottle Labeling Machine Market

- China Industrial Automatic Bottle Labeling Machine Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2067 ]

Elevating Labeling from Packaging Step to Strategic Operations Pillar Through Technology and Collaboration

As manufacturers navigate the complexities of today’s production environments, automatic bottle labeling solutions stand out as pivotal investments that drive efficiency, compliance, and agility. Technological breakthroughs in smart connectivity, vision systems, and modular design have elevated labeling from a simple packaging step to a strategic operations pillar. Regional variations in regulatory requirements and tariff regimes underscore the importance of adaptable supply chain strategies, while segmentation insights reveal distinct technology preferences across application types, throughput levels, and material specifics.

Equipment providers must continue strengthening their innovation pipelines and service ecosystems to meet rising expectations for rapid changeovers, sustainability, and uptime assurance. Meanwhile, end users can accelerate their digital transformation by upgrading existing assets with retrofit kits and analytics platforms, forging stronger partnerships with suppliers to co-develop next-generation solutions. By implementing the actionable recommendations outlined, organizations can secure a competitive edge, reduce total process variability, and position their packaging operations for enduring success in an increasingly dynamic market landscape.

Unlock Essential Strategic Intelligence on Industrial Automatic Bottle Labeling with a Tailored Research Report from Our Sales Leadership

Are you seeking comprehensive insights to navigate the rapidly evolving landscape of automatic bottle labeling solutions? Reach out to Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch, to secure your copy of a definitive market research report tailored to equip your leadership team with actionable intelligence and a strategic roadmap for sustained competitive advantage.

- How big is the Industrial Automatic Bottle Labeling Machine Market?

- What is the Industrial Automatic Bottle Labeling Machine Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?