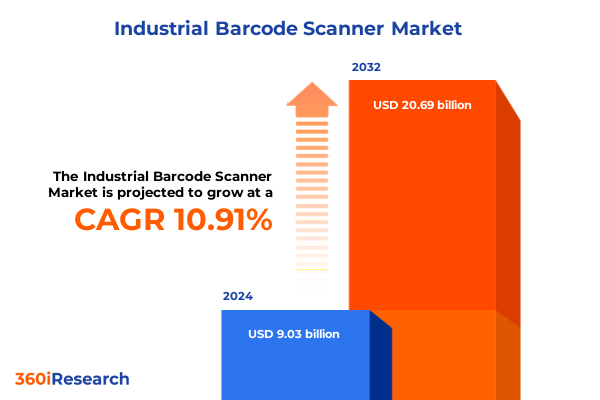

The Industrial Barcode Scanner Market size was estimated at USD 10.01 billion in 2025 and expected to reach USD 11.09 billion in 2026, at a CAGR of 10.92% to reach USD 20.69 billion by 2032.

An overview of how intelligent scanning solutions are redefining operational efficiency, data capture accuracy, and strategic decision making across diverse industrial environments

The industrial landscape is undergoing a rapid metamorphosis as enterprises embrace digital transformation to enhance operational efficiency and accuracy. Barcode scanners, once simple tools for tracking inventory, have evolved into sophisticated devices that support real-time data capture, seamless system integration, and advanced analytics. This evolution reflects the growing demands of modern supply chains, where speed and precision directly influence profitability and customer satisfaction.

Innovations in imaging technology, data processing, and wireless communication have converged to create intelligent scanning solutions capable of operating in challenging environments. From dusty manufacturing floors to bustling retail warehouses, these devices now offer resilience against extreme temperatures, contamination, and constant motion. As a result, decision-makers are presented with a pivotal opportunity to upgrade legacy equipment and harness actionable insights that drive productivity gains and strategic decision making.

Fundamentally, the trajectory of barcode scanning technology underscores a broader shift toward connected ecosystems where every data point contributes to a cohesive operational picture. Integration with cloud-based platforms and enterprise resource planning systems empowers organizations to monitor workflows, reduce manual errors, and adapt swiftly to market dynamics. The introduction of advanced computer vision capabilities further elevates the role of scanners from mere data collectors to intelligent edge devices that proactively optimize processes and trigger automated responses.

Emergence of AI-driven image processing, advanced laser scanning precision, and wireless connectivity breakthroughs driving unprecedented flexibility and real-time insight generation in industrial operations

The barcode scanning sector is witnessing a series of transformative shifts as artificial intelligence, edge computing, and connectivity innovations reshape its foundational capabilities. AI-driven image processing now empowers devices to decode challenging codes at high speeds, while machine learning algorithms continuously adapt to new symbology standards and environmental variables. This progression elevates the reliability of data capture even in scenarios with damaged or obscured labels.

Simultaneously, the precision of laser-based scanners has advanced to deliver micron-level accuracy, enabling manufacturers to track small components throughout intricate assembly lines. These precision improvements reduce waste and minimize rework, translating into substantial cost savings. Moreover, the integration of multiple scanning modes within a single device permits seamless switching between image-based and laser-based workflows without manual intervention, enhancing operational flexibility.

Wireless connectivity breakthroughs have equally profound implications, as Bluetooth, radio frequency, and Wi-Fi integrations enable uninterrupted real-time communication between scanners and central data repositories. This connectivity agility supports mobile workflows, such as wearable scanners that free operators’ hands for complex tasks, and handheld units that transmit scanned information instantly to cloud dashboards. Consequently, businesses can orchestrate dynamic resource allocation and gain situational awareness across global operations.

Edge computing capabilities layered within modern scanning hardware further accelerate processing times by executing analytics locally rather than relying solely on remote servers. This decentralized approach reduces latency, ensures continuous operation during network disruptions, and safeguards sensitive data. Collectively, these transformative shifts are forging a new paradigm in which barcode scanners act as intelligent nodes within a larger industrial Internet of Things ecosystem, delivering unprecedented levels of visibility and responsiveness.

Analysis of how the latest United States trade measures enacted in 2025 are reshaping sourcing strategies, cost structures, and supplier relationships within the barcode scanning ecosystem

The United States’ tariff measures implemented in early 2025 have created ripple effects throughout the industrial barcode scanner market, compelling manufacturers and end-users to recalibrate sourcing strategies. Increased duties on imported components, including semiconductor sensors and optical modules, have driven many global suppliers to reconsider production footprints and explore regional manufacturing partnerships to maintain cost competitiveness.

In response to higher input costs, some scanner producers have intensified efforts to localize assembly operations within North America, mitigating exposure to fluctuating tariff schedules. This strategic reorientation has also prompted a reevaluation of bill-of-materials composition, with a focus on incorporating domestically sourced electronic elements where performance trade-offs are minimal. Although these adjustments introduce upfront capital investments, they ultimately strengthen supply chain resilience by shortening lead times and reducing geopolitical risk.

On the purchasing side, enterprises are adopting more comprehensive total cost analyses that factor in the impact of tariffs on maintenance contracts and spare-part pricing. Procurement teams are negotiating longer-term agreements with preferred suppliers to secure stable pricing and volume discounts that counterbalance additional duties. Meanwhile, some organizations are deferring large-scale scanner refresh initiatives in favor of incremental hardware upgrades, optimizing budget allocations without compromising essential operational capabilities.

Beyond cost implications, the 2025 tariff landscape has accelerated regional collaboration among North American technology providers. Joint ventures and cross-border research partnerships are emerging as companies seek to pool resources for next-generation scanner development, emphasizing modular designs that can flexibly accommodate localized component substitutions. As a result, the ecosystem is evolving toward greater interdependence and innovation, despite external trade pressures.

Insights into product, industry, technology, connectivity, and sales channel dimensions revealing critical preferences and performance drivers influencing purchasing decisions in industrial scanning

Examining the industrial barcode scanner market through the lens of product type reveals distinct performance and application criteria across fixed mount devices embedded into production lines, handheld units enabling operator mobility and rapid on-demand scanning, presentation scanners that streamline point-of-sale and kiosk environments with minimal manual input, and wearable form factors that empower workers to capture data hands free. Each configuration offers tailored ergonomic and throughput characteristics for specific workflow challenges, driving the selection process based on speed requirements, mounting constraints, and operator preference.

When viewed by industry vertical, healthcare applications demand sterile design considerations and high-resolution image scanning capable of accurately reading small patient identification labels. In contrast, manufacturing environments prize rugged durability and compatibility with legacy automation systems, while retail settings focus on scan speed to minimize checkout times. Transportation and logistics sectors prioritize end-to-end traceability with seamless integration into warehouse management software and vehicle-mounted configurations designed for continuous motion and temperature fluctuations.

Delving into technology, image-based scanners leverage high-resolution cameras and sophisticated decoding software to handle a vast array of symbology and to capture images for downstream analytics. Laser-based alternatives continue to offer exceptional performance in reflective or low-contrast conditions, making them well suited for certain industrial parts tracking scenarios. The choice between image and laser technology hinges on code density, label condition, and environmental factors such as ambient light and surface reflectivity.

Connectivity options further segment the market between wired scanners offering consistent power and uninterrupted data transfer through cable connections, and wireless solutions that offer Bluetooth, RF, or Wi-Fi communications. Wireless configurations enable flexible network topologies, whether grouping scanners by Bluetooth mesh, leveraging RF for long-range warehouse coverage, or integrating into existing Wi-Fi infrastructures for centralized data management. This versatility enhances deployment agility in facilities undergoing frequent layout changes.

Finally, sales channels bifurcate into offline and online pathways. Offline channels encompass direct sales agreements with enterprise integrators, distribution networks that span multiple reseller levels, and retail partners serving smaller end users. Online pathways include manufacturer websites providing direct procurement portals, and third-party e-commerce platforms offering expedited delivery and broader product comparison options. The convergence of these channels underscores the importance of omnichannel strategies to meet diverse customer preferences and procurement protocols.

This comprehensive research report categorizes the Industrial Barcode Scanner market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product

- Industry

- Technology

- Connectivity

- Sales Channel

A comprehensive exploration of regional dynamics across the Americas, Europe Middle East and Africa, and Asia-Pacific markets highlighting unique adoption patterns and regulatory influences

The Americas region exhibits strong demand for advanced barcode scanning solutions driven by extensive warehousing and logistics operations, robust manufacturing sectors, and a deep commitment to digital transformation. North American enterprises are increasingly integrating scanners within comprehensive automation frameworks, leveraging local research partnerships to tailor devices to regional regulatory standards and labor practices. Meanwhile, Latin American markets are demonstrating emerging interest in mobile scanning capabilities to support informal retail segments and last-mile delivery services, though budget constraints and infrastructure variability present ongoing challenges.

Across Europe, the Middle East, and Africa, adoption patterns reflect a heterogeneous landscape in which Western European countries emphasize eco-friendly designs and energy-efficient scanners aligned with stringent environmental regulations. In parallel, the Gulf Cooperation Council economies are investing in smart logistics corridors and port automation projects, fostering opportunities for industrial scanners capable of withstanding desert climates. The African continent presents a rapidly growing market driven by e-commerce proliferation and efforts to modernize supply chains, albeit hampered by power stability and connectivity limitations that necessitate devices with local processing capabilities.

Asia-Pacific continues to be the largest catalyst for scanning technology uptake, underpinned by expansive manufacturing bases in East Asia, burgeoning e-commerce ecosystems in Southeast Asia, and infrastructure modernization initiatives across India and Oceania. High throughput applications in automotive and electronics assembly lines demand laser-precision scanning, while retail markets in China and India pursue image-based devices that support multi-language code interpretation and embedded payment solutions. Regional investments in 5G networks further accelerate the deployment of wireless scanning solutions, opening new possibilities for real-time analytics and remote device management.

This comprehensive research report examines key regions that drive the evolution of the Industrial Barcode Scanner market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling leading innovators and established suppliers whose strategic investments in research development, smart partnerships, and sustainability initiatives are shaping the future of industrial barcode scanning

Leading industrial barcode scanner providers are investing heavily in research development to differentiate through enhanced decoding algorithms and integrated analytics platforms. Honeywell has expanded its portfolio of ruggedized devices that combine laser and image scanning within a single enclosure and has formed strategic alliances with logistics software vendors to deliver end-to-end visibility solutions. Zebra Technologies has focused on wearable computing integration and voice-activated scanning workflows, delivering productivity boosts in high-velocity distribution centers.

Datalogic has made strides by deploying open-architecture platforms that facilitate rapid customization for vertical-specific applications, while Cognex has concentrated on advanced machine vision capabilities that extend beyond barcode recognition into part orientation verification. SICK has carved a niche by embedding safety sensors alongside scanning units, catering to highly regulated manufacturing environments where operational continuity and worker protection are paramount.

Collaborative ventures are reshaping competitive positioning, as global technology leaders partner with regional system integrators to co-develop solutions that meet localized compliance requirements and infrastructure constraints. Investment in digital services, including cloud analytics subscriptions and remote support contracts, has become a crucial differentiator, enabling vendors to generate recurring revenue while enhancing customer retention. This strategic shift reflects the recognition that hardware performance alone is insufficient; success now hinges on delivering comprehensive, scalable solutions that align with customers’ broader digitalization roadmaps.

This comprehensive research report delivers an in-depth overview of the principal market players in the Industrial Barcode Scanner market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Advantech Co., Ltd.

- Bluebird Inc.

- CipherLab Co., Ltd.

- Cognex Corporation

- Datalogic S.p.A.

- DENSO Corporation

- EUROTECH S.p.A.

- Generalscan Corporation

- Honeywell International Inc.

- Keyence Corporation

- Mexxen Technology Inc.

- Newland Digital Technology Co., Ltd.

- Newland Payment Technology Co., Ltd.

- OMRON Corporation

- Opticon Inc.

- Opticon Sensors Europe B.V.

- Portable Technology Solutions, LLC

- RIOTEC Co., Ltd.

- SICK AG

- Toshiba TEC Corporation

- Unipro Tech Solutions Pvt. Ltd.

- Unitech Computer Co., Ltd.

- ZEBEX Industries, Inc.

- Zebra Technologies Corporation

Targeted strategies for executive leadership to optimize system integration, elevate supply chain resilience, harness data analytics capabilities, and accelerate value creation through data rich scanning deployments

Executive teams must prioritize the adoption of modular scanning platforms that can seamlessly integrate with existing enterprise resource planning and warehouse management systems. By selecting devices with open-API architectures, organizations can future-proof their investments and accommodate evolving data processing requirements without undertaking costly system overhauls. Furthermore, conducting pilot deployments across representative operational zones will surface integration challenges early and reduce roll-out risks.

Strengthening supply chain resilience requires diversifying component sourcing and establishing strategic inventory buffers for critical scanner parts. Engaging in collaborative forecasting with key technology partners and logistics providers can mitigate the impact of geopolitical disruptions and tariff volatility. Additionally, embedding predictive maintenance capabilities into deployments ensures continuous uptime, as real-time health monitoring triggers proactive service interventions before equipment failures occur.

To maximize return on investment, decision-makers should leverage data analytics to identify process bottlenecks where advanced scanning provides the greatest efficiency gains. Tailored training programs will facilitate rapid user adoption and enable employees to exploit full device functionality. Finally, fostering cross-functional governance structures that bring together IT, operations, and procurement will accelerate decision making and align scanning initiatives with broader digital transformation goals.

An in-depth description of rigorous qualitative and quantitative research methodologies, including stakeholder interviews, field trials, and statistical modeling to ensure data reliability and actionable market intelligence

This study integrates both qualitative and quantitative research methodologies to deliver a comprehensive market perspective. Primary research included in-depth interviews with industry stakeholders such as end users, system integrators, and component suppliers across key regions. These interviews provided contextual understanding of deployment challenges, technology preferences, and procurement strategies that underpin vendor selection criteria.

Supplementing primary insights, extensive secondary research was conducted through review of technical white papers, regulatory filings, and academic journals focusing on imaging technology and wireless communications. Trade publications and market commentary were analyzed to capture recent product announcements and partnership developments. A structured data triage process ensured the exclusion of proprietary vendor marketing materials to maintain objectivity.

On the quantitative front, survey data was collected from operations managers and IT directors to quantify adoption rates, preferred feature sets, and connectivity modalities. Advanced statistical modeling and cross-validation techniques were employed to verify data consistency and mitigate survey bias. The synthesis of qualitative and quantitative findings was validated through a stakeholder advisory panel, ensuring the research outputs reflect real-world decision-making dynamics and are immediately actionable for strategic planning.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Industrial Barcode Scanner market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Industrial Barcode Scanner Market, by Product

- Industrial Barcode Scanner Market, by Industry

- Industrial Barcode Scanner Market, by Technology

- Industrial Barcode Scanner Market, by Connectivity

- Industrial Barcode Scanner Market, by Sales Channel

- Industrial Barcode Scanner Market, by Region

- Industrial Barcode Scanner Market, by Group

- Industrial Barcode Scanner Market, by Country

- United States Industrial Barcode Scanner Market

- China Industrial Barcode Scanner Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1431 ]

A synthesis of critical findings underscoring the accelerating convergence of advanced scanning technologies, digital transformation imperatives, and ecosystem collaboration across diverse industrial sectors

In wrapping up, the industrial barcode scanner sector is at a critical inflection point where technological innovation, trade policy, and evolving customer demands intersect to redefine competitive dynamics. The integration of AI-enhanced image decoding, laser precision, and robust wireless connectivity is transforming scanners into intelligent nodes within an interlinked industrial ecosystem. This evolution underscores the strategic importance of informed procurement decisions and rigorous deployment planning.

Simultaneously, the 2025 tariff landscape has accelerated regionally focused manufacturing strategies and supplier partnerships that bolster resilience against external disruptions. Detailed segmentation and regional analyses illuminate the nuanced requirements across product types, industry verticals, connectivity modalities, and global markets. By leveraging the actionable recommendations provided, industry stakeholders can navigate complexity, capture emerging opportunities, and establish a sustainable path to operational excellence.

Engage directly with Ketan Rohom to explore the comprehensive market intelligence report, unlock tailored insights, and leverage strategic guidance that drives competitive advantage and informed decision making

Unlock unparalleled clarity into market drivers and competitive landscapes by engaging with Ketan Rohom as your dedicated liaison. As Associate Director of Sales & Marketing, Ketan brings deep domain expertise and an unparalleled understanding of how technological trends converge with real-world deployment challenges. By securing your copy of the comprehensive industrial barcode scanner market research report, you will gain access to a wealth of data-driven insights that illuminate segment-specific performance, regional adoption nuances, and strategic imperatives necessary to outpace rivals. Reach out today to harness this strategic resource and propel your organization toward operational excellence and long-term growth.

- How big is the Industrial Barcode Scanner Market?

- What is the Industrial Barcode Scanner Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?