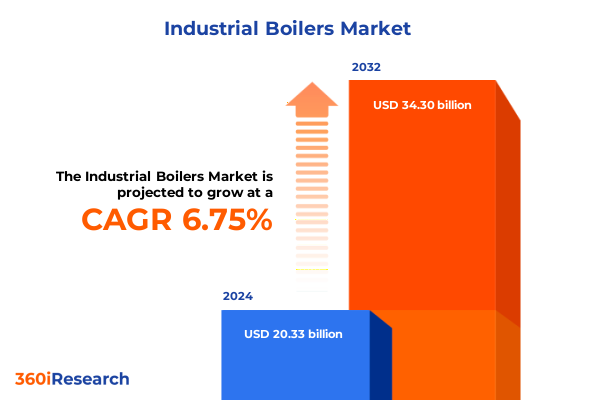

The Industrial Boilers Market size was estimated at USD 21.62 billion in 2025 and expected to reach USD 22.99 billion in 2026, at a CAGR of 6.81% to reach USD 34.30 billion by 2032.

Comprehensive Overview of Industrial Boiler Market Dynamics Highlighting Key Drivers, Challenges, and Emerging Trends Shaping the Future Landscape

Industrial boilers serve as the backbone of energy conversion in a breadth of industries, from power generation facilities to petrochemical plants and food processing operations. By delivering reliable thermal energy and process steam, these systems underpin critical manufacturing processes, heating applications, and large-scale utility support. In recent years, rising concerns over energy efficiency, emissions control, and supply chain resilience have amplified the strategic importance of boiler technology, elevating it from a commoditized component to a pivotal factor in operational competitiveness.

Against a backdrop of tightening environmental regulations and shifting fuel economics, industry stakeholders are challenged to optimize performance while curbing carbon footprints. The interplay between stringent emission standards and evolving corporate sustainability goals has catalyzed significant innovation within the boiler market, fostering developments such as advanced burner controls, waste heat recovery integration, and digital monitoring platforms. Simultaneously, the ongoing globalization of supply chains and the reconfiguration of trade flows are reshaping procurement strategies for core boiler components.

This executive summary synthesizes the key drivers, emerging trends, and strategic implications shaping the industrial boiler landscape. It examines the transformative shifts that are redefining competitive boundaries, evaluates the cumulative impact of United States tariffs enacted in 2025, and offers a nuanced view of market segmentation and regional dynamics. The ensuing sections present in-depth insights into leading corporate strategies, actionable recommendations for industry leaders, and a transparent research methodology underpinning the analysis.

Emerging Transformative Forces Redefining Industrial Boiler Sector Including Digitalization, Decarbonization Pressures, and Evolving Service Innovation Models

The industrial boiler sector is navigating a wave of transformative shifts that are redefining market dynamics and value propositions. Digitalization has emerged as a central force, with advanced sensors and cloud-based analytics enabling real-time performance monitoring and predictive maintenance. These capabilities are enhancing asset reliability and extending service intervals, thereby reducing unplanned downtime and total cost of ownership. Alongside digital adoption, the urgency of decarbonization is steering investments toward low-carbon fuels and emission-control technologies, prompting a notable uptick in biomass boiler deployments and hybrid heating systems that integrate electric elements and heat pumps.

At the same time, regulatory pressures are intensifying across major jurisdictions, mandating stricter emission thresholds for nitrogen oxides, sulfur oxides, and particulate matter. These evolving compliance requirements are driving innovation in burner design, exhaust gas treatment, and system integration, as operators seek to align with environmental targets without compromising throughput. Service offerings are also evolving, with manufacturers and service providers moving toward performance-based contracting models that tie fees to uptime guarantees, energy savings, or emission reductions, thereby aligning their incentives more closely with end-user objectives.

Supply chain resilience has assumed elevated importance following recent disruptions in raw material availability and component shortages. Manufacturers are reevaluating sourcing strategies, pursuing near-shoring initiatives, and exploring modular construction approaches to mitigate delivery risks. Concurrently, financing and leasing solutions are gaining traction, enabling end users to upgrade aging boiler fleets with minimal capital outlay by leveraging performance contracting and green financing structures.

Assessing the Comprehensive Impact of 2025 United States Tariff Measures on Industrial Boiler Supply Chains, Pricing Dynamics, and Competitive Positioning

In 2025, a suite of United States tariff measures targeting steel, specialized alloy components, and imported boiler assemblies has generated a cascade of cost increases and supply chain adjustments. These levies have elevated landed costs for key inputs such as boiler tubes, pressure vessels, and burner hardware, prompting many operators to reassess procurement strategies. The cumulative effect has been a recalibration of vendor selection criteria, with a growing emphasis on domestic suppliers that can absorb tariff impacts more effectively and offer shorter lead times.

Higher input costs have exerted upward pressure on turnkey boiler solution pricing, challenging original equipment manufacturers to innovate in design efficiency and component standardization. In response, several leading producers have accelerated development of standardized module platforms that can be configured across multiple capacity ranges, reducing engineering variance and assembly costs. This trend toward modularization is further supported by collaborative joint ventures between domestic machinery builders and component specialists, enabling the pooling of production capabilities to offset tariff-induced margin compression.

Downstream end-use industries have similarly felt the reverberations of these trade measures. Chemical and petrochemical processors are exploring alternative heat integration schemes, including waste heat recovery boilers and supplementary electric heating, to hedge against elevated natural gas and LPG boiler costs. Power generators have revised maintenance cycles to extend service intervals and prioritize digital diagnostics that preempt costly repairs. Meanwhile, service providers are leveraging localized service networks and regional warehousing of spare parts to mitigate the impact of cross-border delays and safeguard critical uptime commitments.

In-Depth Segmentation Insights Revealing Strategic Implications Across Boiler Types, Fuel Choices, Design Variants, Capacities, Technologies, Components, Industries, and Installations

A granular examination of market segmentation reveals distinct strategic implications across multiple classification axes. Based on boiler type, the market is distinguished by fire-tube boilers, which continue to serve low- to medium-pressure applications; waste heat recovery boilers, which are increasingly integrated into combined cycle and industrial exhaust systems to enhance overall plant efficiency; and water-tube boilers, which dominate high-pressure, high-capacity installations due to their superior thermal performance. Based on fuel type, diverse trajectories are emerging among biomass boilers as sustainability mandates gain traction, coal-fired boilers as legacy assets face decommissioning pressures, electric boilers as emergent solutions for decarbonized heat, natural gas & LPG boilers as the prevailing mid-market choice, and oil-fired boilers as niche solutions in regions with established fuel infrastructure.

The distinction between horizontal boilers and vertical boilers, determined by design type, informs space-efficient solutions versus ease-of-maintenance configurations, particularly in retrofit scenarios or constrained plant footprints. Capacity segmentation highlights shifting demand across installations ranging up to 10 MMBtu/hr for small-scale process heat, the 10 to 100 MMBtu/hr band serving municipal and light industrial applications, the 101 to 500 MMBtu/hr range catering to heavy industrial and commercial heating needs, and above 500 MMBtu/hr for large-scale power generation and petrochemical processing.

Technological segmentation underscores the continued relevance of circulating fluidized bed boilers in handling low-grade fuels and maintaining stable combustion, pulverized fuel boilers for high-efficiency steam production, and stoker boilers for applications with variable feedstock characteristics. Components segmentation, which encompasses air preheaters, burners, economizers, feed pumps, superheaters, and the core boiler vessel, illustrates the growing aftermarket opportunity for performance upgrades and aftermarket retrofits. End-use industry segmentation traverses chemicals & petrochemicals, food & beverage, HVAC, metals & mining, oil & gas, pharmaceuticals, power generation, and pulp & paper, each presenting unique thermal and regulatory requirements. Finally, installation type segmentation differentiates new installations aimed at capacity expansion or modernization from replacement projects focused on asset life extension and emission compliance.

This comprehensive research report categorizes the Industrial Boilers market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Boiler Type

- Fuel Type

- Design Type

- Technology

- Components

- End-Use Industry

- Installation Type

Evaluation of Key Regional Disparities and Growth Drivers Across Americas, Europe Middle East & Africa, and Asia Pacific Industrial Boiler Markets

Regional dynamics in the industrial boiler market are shaped by distinct growth drivers and regulatory environments. In the Americas, demand is buoyed by sustained investments in power generation infrastructure and petrochemical processing capacity. The United States leads in the adoption of modular boiler designs and digital control systems, while Canada emphasizes biomass and waste heat recovery installations to support its forest product sector. Latin American markets present opportunities in oil & gas and pulp & paper, driven by expanding refinery capacities and modernization of mills.

Europe, Middle East & Africa (EMEA) is characterized by rigorous environmental regulations and an accelerating shift toward low-carbon heating solutions. Western European nations prioritize retrofits with advanced emission-control packages and electrification support, whereas Eastern Europe balances legacy coal-fired boiler optimization with growing natural gas networks. In the Middle East, demand is stimulated by large-scale petrochemical complexes and utility expansions, with an increasing focus on seawater-cooled waste heat recovery systems. Across the broader region, manufacturers navigate a tapestry of subsidy programs and emissions trading schemes that influence fuel choices and technology adoption.

Asia-Pacific remains the fastest-growing region, propelled by industrialization and urbanization in China, India, and Southeast Asia. China’s commitment to decarbonization has accelerated coal-to-gas boiler conversions and bolstered investment in circulating fluidized bed technology. In India, ongoing infrastructure development and the expansion of chemical, pharmaceutical, and food processing sectors are driving robust demand for both fire-tube and water-tube boilers. Southeast Asian economies, with their rising power needs and manufacturing bases, are increasingly integrating waste heat recovery boilers into new installations to enhance energy efficiency.

This comprehensive research report examines key regions that drive the evolution of the Industrial Boilers market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Strategic Company Profiles Unpacking Competitive Strategies and Innovation Approaches of Leading Players in the Industrial Boiler Industry

Leading industry participants are deploying differentiated strategies to secure competitive advantage. One diversified global player has expanded its portfolio through acquisition of regional boiler manufacturers, combining legacy engineering expertise with localized service networks to meet demand for turnkey solutions. Another major supplier is prioritizing digital transformation, offering cloud-based performance monitoring platforms and predictive analytics services that enable customers to shift from reactive to proactive maintenance regimes.

Strategic partnerships are also reshaping competitive dynamics, as select OEMs collaborate with technology companies to integrate advanced control systems and emissions-control modules. Several companies are investing in dedicated R&D centers focused on next-generation burner technologies and fuel-flexible designs capable of handling hydrogen blends and alternative biofuels. Meanwhile, service providers are establishing outcome-based contracting models, guaranteeing energy savings or emission reductions, thereby deepening customer relationships and unlocking new revenue streams.

Emerging players, particularly in Asia-Pacific, are leveraging lean manufacturing techniques and government incentives to offer cost-competitive boiler systems with rapid delivery timelines. These entrants are also exploring circular economy principles, such as remanufacturing core boiler components and providing spares under subscription models, to differentiate their value proposition. Collectively, these strategies underscore a market in which product innovation, digital capabilities, and flexible service offerings are becoming the primary levers of differentiation.

This comprehensive research report delivers an in-depth overview of the principal market players in the Industrial Boilers market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AC Boilers SpA

- Alfa Laval AB

- Andritz AG

- Bharat Heavy Electricals Limited

- Burnham Commercial LLC.

- Byworth Boilers Limited

- Clayton Industries, Inc.

- Doosan Corporation

- ETA Heiztechnik GmbH

- Fulton Boiler Works, Inc.

- Hangzhou Boiler Group Industrial Boiler Co., Ltd. by Xizi Clean Energy Equipment Manufacturing Co., Ltd.

- Harbin Electric Corporation co.,Ltd

- Hoval Group

- Hurst Boiler & Welding Co, Inc.

- IHI Corporation

- Indeck Power Equipment Company

- Isgec Hitachi Zosen Ltd.

- Mitsubishi Heavy Industries, Ltd.

- Miura Co., Ltd.

- Parker Boiler Company

- Rentech Boiler Systems, Inc.

- Robert Bosch GmbH

- Sitong Boiler Co., Ltd.

- Sofinter S.p.A. by Mutares SE & Co. KGaA

- Superior Boiler Works, Inc.

- Sussman Electric Boilers by Diversified Heat Transfer, Inc.

- Thermal Tech Engineers

- Thermax Limited

- Utica Boilers by ECR International, Inc.

- Viessmann Climate Solutions MEA by Carrier Global Corporation

- Zhejiang Tuff Development Co., Ltd.

Actionable Strategic Recommendations to Drive Competitive Advantage, Regulatory Compliance, and Sustainable Growth in the Industrial Boiler Sector

Industry leaders should prioritize digital and automation technologies to unlock performance gains and cost efficiencies. By embedding sensors throughout boiler systems and leveraging machine learning algorithms, operators can transition from scheduled maintenance to condition-based interventions, reducing unplanned outages and extending equipment life. Concurrently, organizations must accelerate development of low-carbon fuel solutions and emission-control integrations to align with tightening environmental standards and corporate sustainability pledges.

Strengthening supply chain resilience through strategic sourcing, inventory localization, and modular design strategies will be essential to mitigate tariff pressures and raw material volatility. Collaboration with local component manufacturers and investment in regional assembly facilities can reduce lead times and shield project timelines from global disruptions. In parallel, service organizations should expand outcome-based contracting models that align performance incentives with end-user objectives, thereby fostering long-term partnerships and recurring revenue streams.

To capture emerging opportunities in dynamic regional markets, companies must cultivate customer-centric product portfolios that accommodate diverse fuel types, capacity requirements, and installation contexts. Cross-functional teams should engage with policymakers to shape favorable regulatory frameworks and advocate for incentive programs that support energy efficiency and emissions reduction. Finally, continuous investment in workforce development will ensure that engineers, technicians, and sales professionals possess the skills needed to drive innovation and deliver on evolving customer expectations.

Robust Research Methodology Ensuring Accuracy and Reliability Through Structured Primary, Secondary, and Data Triangulation Approaches

This research leverages a dual-pillar methodology combining structured primary research with comprehensive secondary data analysis. Primary insights were obtained through in-depth interviews with senior executives at boiler OEMs, component suppliers, regulatory experts, and end-user organizations. These conversations provided qualitative perspective on technology trends, market entry strategies, and tariff impacts. Supplementing the interviews, an online survey of sector stakeholders captured quantitative data on purchasing criteria, maintenance practices, and investment priorities.

Secondary research involved systematic review of industry publications, government regulatory documents, technical whitepapers, and patents. Proprietary databases were queried for historical shipment volumes, pricing indices, and raw material cost trajectories. Data triangulation techniques were employed to reconcile disparities between public data sources and primary interviews, ensuring robustness and consistency. Scenario-based analysis was conducted to assess the potential impact of shifting fuel prices, regulatory changes, and trade measures on market segmentation and regional growth patterns.

Throughout the study, methodological rigor was maintained via a multi-step validation process. Draft findings were reviewed by a panel of technical advisors representing both supply-side and demand-side constituencies, who provided critical feedback on assumptions and interpretations. The final report thus reflects a balanced synthesis of expert opinion, quantitative evidence, and observed market behaviors.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Industrial Boilers market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Industrial Boilers Market, by Boiler Type

- Industrial Boilers Market, by Fuel Type

- Industrial Boilers Market, by Design Type

- Industrial Boilers Market, by Technology

- Industrial Boilers Market, by Components

- Industrial Boilers Market, by End-Use Industry

- Industrial Boilers Market, by Installation Type

- Industrial Boilers Market, by Region

- Industrial Boilers Market, by Group

- Industrial Boilers Market, by Country

- United States Industrial Boilers Market

- China Industrial Boilers Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 1272 ]

Executive Conclusion Synthesizing Core Insights and Strategic Imperatives for Stakeholders in the Industrial Boilers Market

The industrial boiler market is at a nexus of technological innovation, regulatory transformation, and geopolitical realignment. Digitalization and decarbonization imperatives are driving a redefinition of value propositions, while United States tariffs in 2025 have accelerated shifts toward domestic sourcing and modular platform strategies. Detailed segmentation analysis clarifies that opportunities vary substantially by boiler type, fuel choice, design configuration, capacity band, and end-use application. Regional assessments highlight that growth rates and technology adoption will diverge across the Americas, Europe Middle East & Africa, and Asia-Pacific based on local energy policies and infrastructure investment cycles.

Competitive positioning is being reshaped by incumbent manufacturers expanding digital service portfolios, regional players capitalizing on cost efficiencies, and new entrants leveraging circular economy models. To thrive, industry participants must embrace a holistic approach that integrates advanced analytics, sustainable fuel solutions, and flexible service contracts. The research methodology underpinning these insights ensures that recommendations are grounded in both empirical evidence and expert perspectives.

Ultimately, stakeholders equipped with this comprehensive understanding will be better positioned to anticipate market disruptions, optimize capital deployment, and forge resilient partnerships. The insights presented herein serve as a strategic compass for navigating the evolving industrial boiler landscape and capitalizing on the next wave of industry transformation.

Prompt Engagement Invitation to Secure Comprehensive Market Intelligence and Direct Consultation with Ketan Rohom for Enhanced Decision Making

For a deeper dive into the nuances of the 2025 industrial boiler market, we invite you to connect with Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch. His expertise in aligning strategic intelligence with actionable market insights ensures that your organization will be equipped to address both immediate challenges and long-term opportunities. Engaging with Ketan Rohom will provide you with tailored guidance on leveraging the full breadth of the research findings, from tariff implications to regional growth dynamics and technology adoption strategies. Advance your competitive edge by securing the complete market research report today and receive direct consultation that integrates the latest data analysis with sector-specific recommendations. Reach out to Ketan Rohom to schedule a personalized briefing and uncover how these insights can drive superior outcomes for your business.

- How big is the Industrial Boilers Market?

- What is the Industrial Boilers Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?