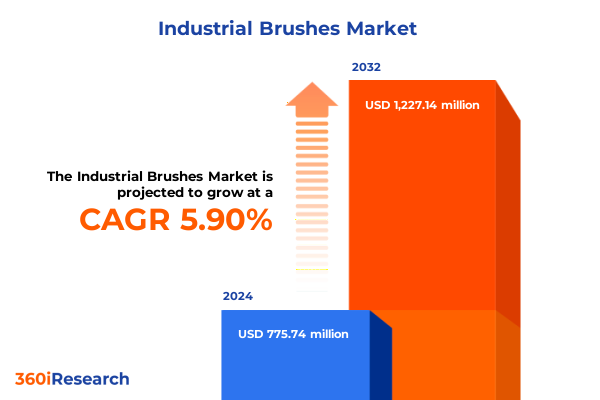

The Industrial Brushes Market size was estimated at USD 818.71 million in 2025 and expected to reach USD 870.37 million in 2026, at a CAGR of 5.95% to reach USD 1,227.13 million by 2032.

Exploring the Critical Role of Industrial Brushes in Modern Manufacturing and Surface Treatment Operations Across Diverse Sectors

Industrial brushes serve as fundamental enablers of high-quality surface preparation and finishing across manufacturing sectors. In automotive production, cup brushes and wheel brushes meticulously remove scale, rust and residual coatings to ensure paint adhesion and corrosion resistance in critical body panels. Meanwhile, aerospace manufacturers deploy specialized abrasive brushes to deburr turbine components and condition composite surfaces, safeguarding stringent airworthiness standards and extending engine life cycles.

The deburring capabilities of industrial brushes help eliminate sharp edges and machining burrs, playing a pivotal role in maintaining precision in mechanical assemblies and minimizing the risk of component failure. Abrasive filament materials deliver consistent edge rounding and chamfering, enhancing both safety and functionality in complex parts processing environments. In parallel, the adoption of automated brush-blasting and robotic brush integration has increased operational throughput while reducing manual labor demands, reflecting a broader trend toward Industry 4.0 workflows within manufacturing plants.

Recent developments in material science have accelerated the evolution of brush filaments, driving innovations in composite and bio-based fibers that offer tailored abrasion profiles and improved durability. Leading players in the market are investing in sustainable formulations that align with circular economy objectives and regulatory imperatives around environmental stewardship. These dynamic forces underscore the critical importance of industrial brushes as both functional workhorses and vectors for process optimization across a diverse array of production and maintenance applications.

Unveiling the Transformative Shifts in Technology Integration Sustainability Trends and Customization That Are Reshaping the Industrial Brush Industry

The industrial brushes landscape is undergoing profound transformation as digital connectivity, sustainability mandates and customization imperatives converge to reshape product portfolios and go-to-market strategies. Manufacturers are incorporating sensor-embedded brush technologies that enable real-time monitoring of filament wear and process consistency, facilitating predictive maintenance regimes and minimizing unplanned downtime.

Customization has emerged as a key differentiator, with on-demand manufacturing platforms delivering brush solutions precisely tailored to unique surface treatment requirements and geometries. This shift toward bespoke brush design is driven by increasing customer expectations for rapid prototyping and low-volume, high-value production runs that demand agile supply chain responses.

Sustainability considerations are accelerating the adoption of eco-friendly materials within brush construction, including natural fiber blends and recycled composites that reduce lifecycle environmental impact. Industry leaders are responding to tightening regulatory frameworks and customer demand for green products by integrating recyclable components and non-toxic binders, underscoring a strategic pivot toward circular economy models within industrial consumables.

Assessing How the 2025 United States Tariff Measures on Steel Aluminum and Related Imports Are Reverberating Across the Global Industrial Brushes Supply Chain

In February 2025, Section 232 tariffs were restored to enforce a full 25 percent ad valorem duty on steel imports and elevated to a 25 percent tariff on aluminum, followed by a June 4 proclamation that increased the rate to 50 percent for steel and aluminum contents of imported products. These tariff adjustments directly affect the cost structures of wire-filament and metal-component production, which underpin the manufacturing of high-performance industrial brushes.

According to the Congressional Budget Office, the 2025 tariff measures are projected to raise inflation by an average of 0.4 percentage points, thereby elevating input costs for consumer and capital goods, including brush assemblies that incorporate steel wire and machined steel parts. As a result, procurement teams have faced heightened pricing pressure and have revisited sourcing strategies to mitigate tariff-related cost escalations.

The Budget Lab at Yale highlights that all 2025 U.S. tariffs combined with potential foreign retaliation could reduce real GDP growth by 0.8 percentage points in 2025 and limit payroll employment by approximately 594,000 jobs, underscoring the broader economic headwinds influencing industrial capital expenditures and maintenance outlays.

In response to these dynamics, manufacturing, construction, mining and utilities firms have accelerated efforts to diversify supply chains, expand domestic sourcing options and front-load purchases of steel-content goods, yet persistent uncertainty continues to stifle long-term investment planning and strategic operational enhancements across industrial brush value chains.

Distilling Crucial Insights from Type Material Composition Channel Application and End Use Segmentation in the Industrial Brushes Sector

Within the industrial brushes sector, type segmentation reveals that cup and cylinder brushes maintain strong adoption for surface cleaning and coating removal tasks, while roller and wire brushes are preferred for more rigorous deburring and heavy-duty surface conditioning applications. Material composition segmentation shows that metal-filament brushes continue to dominate when durability and abrasive performance are paramount, whereas composite and natural fiber variants are gaining traction in applications requiring gentle abrasion profiles or enhanced environmental credentials. Synthetic filament brushes fill crucial roles where consistent performance and chemical resistance are required.

Sales channel segmentation indicates that traditional offline retail outlets, including industrial supply stores and maintenance shops, remain critical for immediate brush replenishment, but the trajectory of online retail platforms is reshaping procurement approaches as buyers leverage digital catalogs for rapid part customization and expedited delivery, reflecting global ecommerce sales of $6.86 trillion and projected U.S. online retail turnover of $1.27 trillion in 2025.

Application segmentation underscores that surface cleaning and coating removal functions demand brushes engineered for consistent debris removal without substrate damage, whereas deburring and polishing tasks rely on abrasive and soft-filament configurations to achieve precise edge blending and finish quality. In dusting scenarios, finer filament materials are essential for delicate operations that require minimal particulate generation.

End-use industry segmentation highlights that aerospace and automotive sectors command the largest demand for high-precision brushes tailored to stringent performance criteria, construction industries utilize robust wire-brush solutions for heavy maintenance tasks, food & beverage operations depend on hygienic synthetic brushes for cleaning and finishing, and mining and oil & gas environments require corrosion-resistant brush designs to withstand abrasive and chemically aggressive operating conditions.

This comprehensive research report categorizes the Industrial Brushes market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Material Composition

- Sales Channel

- Application

- End-Use Industry

Revealing Regional Nuances and Growth Drivers Across the Americas EMEA and Asia Pacific That Are Shaping Industrial Brush Demand Dynamics

In the Americas, industrial brush demand remains underpinned by resilient manufacturing activity, a resurgence in automotive production and the accelerating impact of online procurement. The expansion of e-commerce platforms has catalyzed industrial real estate growth and heightened demand for logistics-grade brushes used in warehousing and distribution center maintenance, reinforcing North America’s role as a major consumer market for industrial consumables.

Europe, the Middle East and Africa are navigating elevated production costs and trade policy uncertainty, as U.S. tariff measures and potential retaliatory actions exert pressure on import-reliant manufacturers. Nonetheless, established automotive and aerospace hubs in Germany and France continue to drive demand for advanced brush solutions, while regional suppliers are diversifying operations into Middle Eastern and African markets to offset fluctuating European demand patterns amidst energy price volatility.

Asia-Pacific represents the fastest-growing regional market for industrial brushes, fueled by large-scale industrialization in China, India and Southeast Asia. Rapid capacity expansions in automotive, electronics and heavy machinery manufacturing are elevating brush consumption, with regional producers and multinational suppliers investing in localized production facilities to deliver tailored solutions that meet stringent quality standards and just-in-time delivery requirements in high-volume production environments.

This comprehensive research report examines key regions that drive the evolution of the Industrial Brushes market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industrial Brush Manufacturers Highlighting Innovation Strategies Partnerships and Competitive Differentiators in a Crowded Global Market

Market leadership in the industrial brushes landscape is concentrated among a cadre of established players that differentiate themselves through proprietary technology, manufacturing scale and targeted R&D investments. Osborn leverages its patented abrasive filament technology across a decentralized network of global production hubs, enabling localized customization and rapid delivery to high-demand sectors such as electric vehicle battery manufacturing and precision surface finishing. Germany’s Pferd distinguishes itself by channeling over 8 percent of annual revenue into developing IoT-enabled brushes equipped with sensors for real-time wear monitoring and process optimization.

3M Co. capitalizes on its diversified industrial solutions portfolio to deliver metal and synthetic brush products that emphasize sustainability and performance enhancements, while Weiler Abrasives Group strengthens its market position through rigorous quality control and investment in eco-friendly manufacturing processes that align with tightening environmental regulations. Spiral Brushes and Tanis Brush excel by offering highly customizable brush configurations supported by agile manufacturing models, allowing for rapid response to bespoke project requirements and ensuring customer-specific design flexibility.

Specialized firms such as Gordon Brush and Carolina Brush leverage deep domain expertise in sectors like defense, food & beverage and medical device manufacturing to secure long-term contracts for custom brush assemblies that meet exacting regulatory and hygiene standards. Meanwhile, Robert Bosch integrates brush solutions into comprehensive automation and assembly systems, bundling brushes with robotic end-effectors to provide end-to-end workflow optimizations. Regional leaders such as Precision Brush and Brookfield Wire Company capitalize on their localized supply agility and technical service capabilities, meeting just-in-time procurement demands in North American brush markets.

This comprehensive research report delivers an in-depth overview of the principal market players in the Industrial Brushes market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- Aoqun Brush Industry Co., Ltd.

- Associated Industrial Brush Co., Ltd

- Braun Brush Co.

- Carolina Brush

- Cazzola Spazzole s.r.l.

- Cepial, SL

- Cocker-Weber Brush Company

- Fuller Industries Inc.

- GORDON BRUSH MFG. CO., INC.

- Guangzhou Aoqun Brush Industry Co., Ltd.

- Ibex Industrial Brushes

- Jenkins Brush Company

- JHX Brush

- Justman Brush Company

- KOTI Group

- MR.SIGA

- Osborn GmbH

- Schaefer Brush

- Spiral Brushes, Inc.

- TeCsolum Industrial Brushes Sp. z o.o.

- The Industrial Brush Company, Inc.

- The Mill-Rose Company

- Thomas C. Wilson, LLC

- Unimade Industry Co., Limited

Strategic Imperatives for Industry Leaders to Strengthen Resilience Leverage Innovation and Optimize Supply Chains in the Ever Evolving Industrial Brushes Market

Industry leaders must invest in sensor-embedded brush technologies that enable real-time monitoring of filament wear and process quality, thereby facilitating predictive maintenance initiatives that reduce unplanned downtime and optimize line efficiency in automated production environments.

Prioritizing the diversification of raw material sourcing is critical to mitigate cost volatility arising from Section 232 tariff adjustments on steel and aluminum. Establishing multi-supplier frameworks for metal and composite filaments safeguards supply continuity and reduces exposure to geopolitical disruptions.

Organizations should expand their digital channel strategies by partnering with leading industrial e-commerce platforms and incorporating AI-driven recommendation engines to enhance buyer engagement, streamline procurement workflows and capture the growing share of industrial consumables sold online, supported by global e-commerce sales projections of $6.86 trillion in 2025.

Accelerating research and development efforts focused on sustainable filament materials and eco-friendly brush designs will align product offerings with evolving regulatory requirements and customer demand for circular economy solutions, reinforcing brand leadership in environmental responsibility.

Forging strategic alliances with key end-use industry leaders in automotive, aerospace and energy sectors will facilitate the co-development of application-specific brush solutions, enabling early-adopter positioning and securing long-term supply agreements that enhance market share resilience.

Detailing Rigorous Research Design Data Collection Techniques and Analytical Frameworks Underpinning the Comprehensive Industrial Brushes Market Study

The research methodology combined an extensive primary research phase featuring structured interviews with procurement managers, manufacturing engineers and maintenance specialists to capture firsthand insights on brush performance requirements and supply chain challenges, ensuring grounded validation of emerging market trends.

Secondary research efforts encompassed analysis of trade data, government proclamations on Section 232 tariffs, economic impact assessments from the Congressional Budget Office and the Budget Lab at Yale, as well as technical literature on brush materials and automation technologies to map regulatory, economic and technological landscapes.

Quantitative analytics involved the triangulation of tariff exposure metrics, global e-commerce growth projections and manufacturing output indicators to evaluate segment-level demand trajectories and regional consumption patterns, achieving robust validation of qualitative findings through empirical data.

Geographic coverage included case analyses and feedback loops across the Americas, Europe, Middle East & Africa and Asia-Pacific regions, ensuring the research captured nuanced drivers, regulatory dynamics and adoption rates in diverse economic environments.

Rigorous peer reviews and iterative validation sessions with academic experts and industry veterans reinforced the credibility and objectivity of the research, establishing a solid foundation for the comprehensive conclusions presented in this executive summary.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Industrial Brushes market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Industrial Brushes Market, by Type

- Industrial Brushes Market, by Material Composition

- Industrial Brushes Market, by Sales Channel

- Industrial Brushes Market, by Application

- Industrial Brushes Market, by End-Use Industry

- Industrial Brushes Market, by Region

- Industrial Brushes Market, by Group

- Industrial Brushes Market, by Country

- United States Industrial Brushes Market

- China Industrial Brushes Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 954 ]

Synthesizing Critical Findings and Strategic Implications from the Analysis to Illuminate Future Opportunities and Challenges in the Industrial Brushes Industry

The confluence of digital integration, material innovation and evolving supply chain dynamics has elevated the strategic importance of industrial brushes in modern manufacturing ecosystems. As firms grapple with cost pressures from tariff realignments and shifting regulatory landscapes, the adoption of sensor-enabled, sustainable brush solutions emerges as a cornerstone for operational resilience.

Segmentation analysis reveals that distinct performance profiles across brush types, material compositions, sales channels, applications and end-use industries demand tailored product strategies to meet precise technical requirements and procurement models. Regional insights further underscore divergent demand drivers-Americas’ sustained industrial activity and e-commerce growth, EMEA’s realignment amid trade uncertainties, and APAC’s rapid industrial scale-up.

Leading manufacturers are responding through targeted R&D investment, agile customization capabilities and digital channel enhancements that align closely with end users’ imperatives around quality, environmental responsibility and efficiency. These strategic approaches are shaping a competitive landscape where the ability to anticipate disruptive shifts and adapt product offerings rapidly determines market leadership.

Ultimately, stakeholders who integrate data-driven decision-making, forge collaborative partnerships and champion sustainable innovations will be best positioned to harness the opportunities and navigate the challenges of the industrial brushes market moving forward.

Engage Directly with Associate Director Ketan Rohom to Unlock Customized Industrial Brushes Market Intelligence and Secure Your Comprehensive Research Report Today

For decision-makers seeking to deepen their strategic understanding of the industrial brushes ecosystem, connect directly with Associate Director Ketan Rohom to explore tailored market insights and unlock comprehensive analysis on segmentation, regional dynamics, tariff impacts and competitive strategies.

Engage with Ketan to secure exclusive access to the full industrial brushes market research report, empowering your organization to make informed investment decisions, anticipate disruptive shifts and drive operational excellence.

Contact Ketan to arrange a personalized briefing and discover how the latest data-driven recommendations can elevate your approach to product development, supply chain resilience and market expansion initiatives.

- How big is the Industrial Brushes Market?

- What is the Industrial Brushes Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?