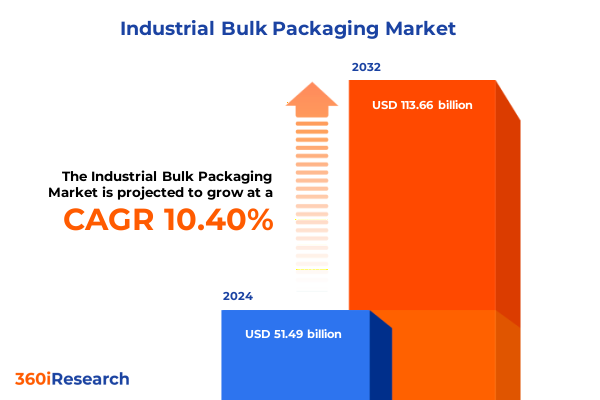

The Industrial Bulk Packaging Market size was estimated at USD 56.25 billion in 2025 and expected to reach USD 61.46 billion in 2026, at a CAGR of 10.56% to reach USD 113.66 billion by 2032.

Setting the Stage for Industrial Bulk Packaging Excellence with Insights into Market Dynamics and Essential Strategic Imperatives

The industrial bulk packaging sector operates at the intersection of global supply chains, stringent regulatory standards, and evolving consumer demands. As companies navigate increasingly complex logistics networks, the choice of packaging solutions transcends mere containment and protection. These industrial-grade containers play a pivotal role in minimizing product loss, ensuring regulatory compliance, and enhancing operational efficiency. In today’s environment of heightened sustainability expectations and cost pressures, decision-makers across agriculture, chemicals, food processing, oil and gas, pharmaceuticals, and water treatment seek holistic answers that extend beyond traditional packaging paradigms.

Against this backdrop, a comprehensive understanding of market dynamics is essential for stakeholders poised to capitalize on emerging opportunities and mitigate nascent risks. This executive summary distills the critical shifts reshaping the landscape, analyzes the cumulative impact of recent United States tariffs, and unveils key segmentation, regional, and competitive insights. Coupled with actionable recommendations and a transparent research methodology, this document equips C-suite and functional leaders with the strategic clarity required to navigate an evolving ecosystem characterized by digitalization, sustainability mandates, and geopolitical volatility. By engaging with these insights, organizations can refine their strategic roadmaps and assert a competitive advantage in an increasingly demanding market.

Navigating Technological Advancements Sustainability Drives and Cost Optimization Strategies Reshaping the Industrial Bulk Packaging Landscape

In recent years, technological innovation has become a catalyst for transformative shifts within industrial bulk packaging. Internet of Things sensors now enable real-time tracking of intermediate bulk containers, offering unparalleled visibility into transit conditions and reducing spoilage risks. Automation in loading and unloading processes is streamlining operations at manufacturing plants and distribution centers, accelerating cycle times and lowering labor costs. Concurrently, the rise of advanced materials science has introduced next-generation composite solutions that marry strength with lightweight design, directly aligning with the broader industry push toward carbon footprint reduction.

Sustainability considerations are also driving profound change, as brands and regulators alike demand circular economy models that minimize waste and maximize reuse. Pioneering closed-loop systems have emerged, in which returnable drums and IBC units are collected, refurbished, and redeployed, thus curbing resource consumption and solidifying corporate ESG commitments. At the same time, cost optimization strategies leveraging digital twin simulations and predictive maintenance are further elevating operational resilience. By adapting to these converging trends, industry participants are redefining traditional roles, shifting from mere suppliers of containers to integrated partners delivering end-to-end packaging ecosystems.

Assessing the Collective Effects of New United States Trade Tariffs Enacted in 2025 on Supply Chains Pricing Structures and Global Competitiveness

The introduction of new United States tariffs in early 2025 has reverberated across supply chains, prompting organizations to reassess sourcing and pricing models. Tariffs imposed on imported plastic resins, metal drums, and composite materials have inflated landed costs, triggering a ripple effect throughout manufacturing and distribution channels. Consequently, many end-use industries faced steeper input expenses, fueling negotiations between packaging suppliers and their clients over cost-sharing mechanisms and contract realignments. In response, some suppliers have pursued nearshoring initiatives, realigning production closer to demand centers and mitigating exposure to long-haul freight fluctuations.

Moreover, the cumulative tariff impact has reinforced the imperative for robust supplier diversification strategies. Organizations are increasingly leveraging alternative material streams-such as regionally sourced HDPE and corrugated fibreboard-to buffer against price volatility. Meanwhile, investment in in-house compounding capabilities has enabled certain players to maintain margin stability by internalizing critical resin processing steps. These strategic pivots underscore a broader trend toward supply chain agility. As businesses integrate tariff considerations into their capital planning, the resultant shifts in procurement and manufacturing footprints will continue to shape competitive dynamics and influence the viability of various packaging formats.

Unveiling Critical Market Segmentation Perspectives Spanning Packaging Types Materials Capacities End Use Industries Applications and Distribution Channels

An essential lens for understanding the bulk packaging market is segmentation, which reveals nuanced performance patterns across product and service categories. When examining packaging types, it becomes clear that bags and sacks maintain strong relevance in lighter-capacity applications, whereas IBC units and drums dominate medium to high-capacity liquid handling. Boxes frequently serve as versatile solutions for powdered or semi-solid goods, providing structural integrity alongside stackability. Each format’s economics and operational fit vary significantly, with choices influenced by factors such as payload density, handling equipment, and cleaning requirements.

Delving deeper into material segmentation, composite constructions have gained traction, with metal-lined variants offering superior barrier properties for sensitive chemicals and food ingredients, while plastic-lined composites deliver cost advantages and corrosion resistance. Fiber-based alternatives, spanning corrugated fibreboard and paperboard, are emerging in lower-weight sectors where recyclability and end-of-life processing are paramount. Metal containers, encompassing aluminum and steel drums, continue to address high-pressure and temperature environments, reflecting their durability and regulatory acceptance. In the plastics domain, both HDPE and LDPE frameworks exhibit distinct use cases: HDPE for robust chemical resistance and LDPE for cost-effective tri-layer packaging requiring high flexibility.

Capacity segmentation illuminates divergent growth trajectories, with sub-500-litre packages favored for modular batch processing, 500-to-1000-litre units serving mid-scale operations, and above-1000-litre IBCs underpinning large-volume distribution networks. End-use industries further refine this picture: agricultural applications prioritize moisture control and UV resistance; chemical manufacturing demands compliance with strict hazard classifications; food processing hinges on food-grade certification and contaminant management; oil and gas players seek high-pressure resilience; paints and coatings require anti-corrosive linings; pharmaceutical manufacturing emphasizes sterility; while water treatment facilities focus on inertness and durability. Application areas echo these distinctions, cascading across agriculture, chemicals, food and beverage, oil and gas, paints and coatings, pharmaceuticals, and water treatment, each segment demanding tailored feature sets. Finally, distribution channels in this arena reflect a blend of direct sales partnerships for strategic accounts alongside distributor networks that deliver regional reach, complemented by the rising influence of online sales platforms that streamline procurement for lower-volume or specialty buyers.

This comprehensive research report categorizes the Industrial Bulk Packaging market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Packaging Type

- Material

- Capacity

- End Use Industry

- Application

- Distribution Channel

Highlighting Regional Dynamics and Growth Drivers Across Americas Europe Middle East Africa and Asia Pacific Markets for Bulk Packaging Solutions

Regional analysis uncovers a tapestry of growth drivers and operational challenges. In the Americas, emphasis on reshoring and domestic manufacturing incentives has bolstered demand for locally supplied IBCs and plastic drums. North American environmental regulations continue to push adoption of reusable systems, while supply chain resilience efforts have prioritized container standardization to facilitate inter-state logistics.

Europe, Middle East & Africa present a diverse mix of maturity levels, with Western Europe leading in circular economy models and regulatory alignment around extended producer responsibility. The Middle East has leveraged its petrochemical infrastructure to supply plastic resin feedstocks domestically, underpinning cost-competitive packaging solutions. Meanwhile, Africa’s nascent industrial base is rapidly adopting flexible, low-capital packaging formats, particularly plastic sacks and corrugated fiberboard boxes, to support agricultural exports and expanding consumer goods markets.

Asia-Pacific remains the largest regional contributor, driven by rapid industrialization in China, India, and Southeast Asia. Chemical manufacturing hubs in these economies demand high-performance containers, catalyzing investments in local steel drum and composite IBC production. Moreover, the shift toward export-oriented food processing has spurred the uptake of food-grade packaging lines, while digital distribution channels have begun to penetrate tier-2 and tier-3 markets, reshaping procurement dynamics.

This comprehensive research report examines key regions that drive the evolution of the Industrial Bulk Packaging market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining Leading Enterprises Driving Innovation Sustainability and Operational Excellence in the Industrial Bulk Packaging Sector

Within this landscape, a handful of leading enterprises are charting the course for innovation and operational excellence. Established legacy players have doubled down on sustainable product lines, launching advanced HDPE IBCs incorporating post-consumer recycled content, as well as modular drum systems that facilitate cleaning and refurbishment cycles. These initiatives not only address tightening environmental regulations but also resonate with corporate decarbonization commitments.

Simultaneously, specialized manufacturers have carved out differentiators by integrating digital services such as RFID tagging and predictive maintenance dashboards. By offering real-time condition monitoring, they provide end-use customers with data-driven insights that optimize turnover rates and minimize downtime. Partnerships between packaging producers and e-commerce platforms have also emerged, accelerating delivery times and broadening market access for smaller batch sizes.

Furthermore, strategic mergers and acquisitions are redefining market boundaries. Several medium-sized enterprises have been absorbed by global conglomerates seeking to expand geographic footprint and diversify product portfolios. At the same time, investment in regional manufacturing capacity underscores a dual aim of reducing lead times and hedging against tariff uncertainties. Collectively, these moves demonstrate a convergence of scale, specialization, and technological capability as the primary competitive levers in the industrial bulk packaging sector.

This comprehensive research report delivers an in-depth overview of the principal market players in the Industrial Bulk Packaging market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Amcor plc

- Balmer Lawrie & Co. Ltd.

- Bemis Company, Inc.

- Berry Global Group, Inc.

- Bulk Lift International, Inc.

- Büscherhoff Spezialverpackung GmbH & Co. KG

- Cleveland Steel Container, Inc.

- DS Smith plc

- Environmental Packaging Technologies, Inc.

- Greif, Inc.

- Hoover Ferguson Group, Inc.

- Industrial Packaging Ltd.

- International Paper Company

- Mauser Packaging Solutions GmbH

- Mondi plc

- My Flexitank Industries Sdn Bhd

- Nefab AB

- Schaefer Werke GmbH

- Schoeller Allibert Groupe N.V.

- SCHÜTZ GmbH & Co. KGaA

- Sealed Air Corporation

- Snyder Industries, LLC

- Thielmann Group GmbH

- Time Technoplast Ltd.

- WERIT Kunststoffwerke GmbH & Co. KG

Formulating Targeted Strategies for Industry Leaders to Enhance Sustainability Resilience and Competitive Edge in Bulk Packaging Operations

Industry leaders must adopt a multifaceted strategy to maintain competitive advantage. First, embedding sustainability into product design and value propositions will be instrumental in securing new contracts as clients elevate their own ESG ambitions. By prioritizing materials that enable closed-loop systems and investing in refurbishment capabilities, companies can lower total cost of ownership for end users while aligning with evolving regulations.

Next, digital transformation should be viewed as a core competency rather than a peripheral upgrade. Integrating IoT sensors across packaging fleets will provide actionable data on usage patterns and performance, allowing proactive maintenance scheduling and inventory optimization. This data-driven approach can unlock new revenue streams through service contracts and loyalty-focused programs.

Lastly, leaders should foster resilient supply chains through diversification and strategic nearshoring. By establishing regional manufacturing hubs closer to key markets, businesses can reduce exposure to freight volatility and mitigate tariff impacts. Collaborations with material suppliers to co-develop advanced resins and fiber solutions will also secure preferential access to critical inputs. Taken together, these strategies will enhance organizational agility and fortify market positioning under shifting geopolitical and regulatory landscapes.

Detailing Comprehensive Research Approaches Including Data Collection Validation and Analytical Techniques Underpinning the Industrial Bulk Packaging Study

The foundations of this analysis rest on a dual-track research approach combining primary insights with rigorous secondary validation. In the first phase, in-depth interviews with executives across manufacturing, logistics, and sustainability functions provided firsthand perspectives on emerging market pressures and strategic priorities. These conversations were complemented by consultations with procurement specialists and regulatory experts, ensuring a holistic understanding of compliance drivers and sourcing challenges.

Secondary research encompassed a review of industry publications, trade association data, and company disclosures to map historical trends and benchmark leading practices. Quantitative data points-ranging from trade flow statistics to material cost indexes-were triangulated against primary findings to minimize bias and enhance reliability. Case studies of pioneering circular economy implementations and digital integration pilots further illustrated practical applications of thematic insights.

Throughout the process, methodological rigor was maintained via iterative validation workshops, cross-referencing initial hypotheses with subject matter experts to refine conclusions. Quality assurance protocols ensured that all data sources met stringent credibility criteria, resulting in a robust evidence base that underpins the strategic recommendations and market interpretation presented herein.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Industrial Bulk Packaging market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Industrial Bulk Packaging Market, by Packaging Type

- Industrial Bulk Packaging Market, by Material

- Industrial Bulk Packaging Market, by Capacity

- Industrial Bulk Packaging Market, by End Use Industry

- Industrial Bulk Packaging Market, by Application

- Industrial Bulk Packaging Market, by Distribution Channel

- Industrial Bulk Packaging Market, by Region

- Industrial Bulk Packaging Market, by Group

- Industrial Bulk Packaging Market, by Country

- United States Industrial Bulk Packaging Market

- China Industrial Bulk Packaging Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1749 ]

Synthesizing Key Findings to Illuminate Strategic Pathways and Future Directions in the Evolving Industrial Bulk Packaging Ecosystem

A synthesis of the findings points to a market at the crossroads of sustainability imperatives and digital evolution. Material innovation, circular economy adoption, and technological integration are no longer optional augmentations but essential pillars for market leadership. Simultaneously, geopolitical shifts and tariff regimes have elevated supply chain resilience from a risk mitigation tactic to a core strategic enabler.

Looking ahead, organizations that proactively embed environmental stewardship, data-driven decision-making, and agility into their operational DNA will be best positioned to capture emerging opportunities. The convergence of these strategic levers will inform the next wave of competitive differentiation, defining the blueprint for future success in the industrial bulk packaging ecosystem.

Engage with Ketan Rohom to Gain Exclusive Access to Actionable Insights and Empower Your Strategic Decisions with Industrial Bulk Packaging Intelligence

To explore how these comprehensive insights can be tailored for your organization, reach out to Ketan Rohom, who stands ready to guide you through the depths of this market research and unlock strategic pathways uniquely aligned with your operational priorities. With his expertise in sales and marketing leadership, Ketan can facilitate customized deliverables, ensuring you leverage every nuance of industry intelligence to inform critical decisions and drive sustainable growth. Engage with him today to secure your copy of the full report and elevate your competitive positioning in the industrial bulk packaging landscape.

- How big is the Industrial Bulk Packaging Market?

- What is the Industrial Bulk Packaging Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?