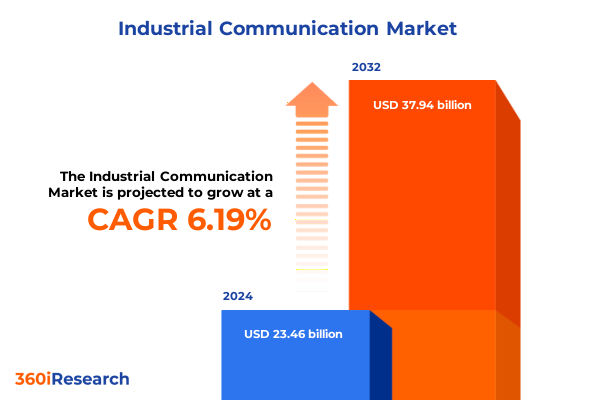

The Industrial Communication Market size was estimated at USD 24.86 billion in 2025 and expected to reach USD 26.35 billion in 2026, at a CAGR of 6.22% to reach USD 37.94 billion by 2032.

Establishing a Comprehensive Overview of Industrial Communication to Illuminate the Critical Role and Expanding Horizons of Connected Operations

Industrial communication encompasses the systems, protocols, and network infrastructures that enable seamless data exchange among machines, control systems, and enterprise applications within manufacturing and process-driven environments. As industries accelerate toward highly automated, data-centric operations, the demand for connectivity solutions that deliver low-latency performance, uncompromising reliability, and robust cybersecurity has intensified. These networks form the foundation for real-time monitoring, predictive maintenance, and adaptive control strategies, driving a new era of operational efficiency and competitive differentiation.

In recent years, the convergence of information technology and operational technology has reshaped the communication landscape. Developments in industrial Ethernet, time-sensitive networking, and deterministic wireless protocols have introduced unprecedented levels of precision and flexibility. Moreover, the proliferation of edge computing has redistributed processing closer to the data source, reducing latency and enabling autonomous decision-making at the device level. This combination of advanced networking and distributed intelligence is empowering manufacturers to optimize resource utilization, enhance safety, and unlock novel service models.

This executive summary establishes the context for understanding how industrial communication underpins modern digital transformation initiatives. It outlines key technological drivers, evaluates emerging use cases, and highlights the strategic importance of integrated connectivity solutions. By framing these insights, decision-makers can navigate the complexities of evolving network architectures and prioritize investments that foster resilience, scalability, and sustainable growth.

Navigating Revolutionary Technological Paradigm Shifts Reshaping Industrial Communication Through Intelligence Automation and Converged Connectivity

Industrial communication is undergoing a seismic transformation fueled by the rapid integration of digital technologies. The shift from siloed, proprietary systems to open architectures has catalyzed innovation, enabling faster interoperability and streamlined data flows. As industry standards evolve, organizations are adopting unified communication frameworks that support cross-vendor compatibility and future-proof interoperability. This trend is redefining network design principles, with modular, software-defined approaches enabling dynamic reconfiguration to meet shifting production demands.

Alongside architectural convergence, the rise of wireless technologies is reshaping connectivity models. Low-Power Wide-Area Networks (LPWAN) are extending reach into remote or distributed assets, while Wireless Local Area Networks (WLAN) and Wireless Personal Area Networks (WPAN) are enabling flexible, untethered deployments on the factory floor. Coupled with edge analytics and AI-driven orchestration, these wireless solutions are enhancing visibility into asset performance, facilitating condition monitoring and predictive diagnostics without rigid cabling constraints.

Furthermore, the integration of 5G and private cellular networks is accelerating the adoption of mission-critical, low-latency use cases such as robotic coordination and automated guided vehicles. This evolution is supported by advances in network slicing and quality-of-service management, which guarantee deterministic performance for industrial workloads. Collectively, these transformative shifts are propelling a new generation of smart factories, where adaptive communication systems underpin real-time optimization, self-healing processes, and collaborative human-machine ecosystems.

Understanding How Recent US Trade Measures on Communication Hardware Are Reshaping Supply Chains Cost Structures and Acquisition Models

In 2025, a series of United States tariff adjustments targeting imported communication hardware has introduced new cost considerations and supply chain complexities across the industrial sector. The imposition of elevated duties on gateways, routers, switches, and interface cards has increased landed costs for critical hardware components. Organizations are now reevaluating procurement strategies to mitigate tariff-driven inflation, seeking alternative sourcing and negotiating volume-based concessions with domestic suppliers.

This tariff environment has prompted supply chain realignment, as manufacturers explore nearshoring to minimize exposure to unpredictable trade policies. By repositioning production closer to end-use markets, companies aim to reduce transit times and inventory buffers, thereby lowering overall working capital requirements. However, this shift also entails investments in local manufacturing capabilities and workforce training to replicate specialized production processes previously housed abroad.

Moreover, the cumulative impact of tariffs has intensified the focus on service-based models, with firms turning to system integration and managed services to amortize hardware costs over multi-year contracts. This trend is fueling growth in network maintenance, remote monitoring, and lifecycle support offerings, as enterprises prioritize operational continuity and cost predictability. As a result, the tariff-driven landscape is accelerating the transition from CapEx-intensive procurements to OpEx-oriented consumption models, reshaping how industrial communication solutions are acquired and deployed.

Unveiling Deep Diversification Dynamics Across Communication Types Components and Industry Verticals That Drive Strategic Connectivity Choices

A closer examination of industrial communication segmentation reveals critical insights across communication types, component categories, and end-user verticals. Within communication types, the juxtaposition of wired and wireless solutions highlights a balance between deterministic performance and deployment flexibility. While wired Ethernet remains the backbone for latency-sensitive control applications, LPWAN, WLAN, and WPAN technologies are unlocking new use cases in asset tracking, environmental monitoring, and mobile robotics.

Component segmentation underscores the interplay between hardware platforms, software intelligence, and support services. Gateways, interface cards, routers, and switches form the physical layer, enabling network connectivity and data aggregation at the edge. Layered atop this infrastructure, network management and security software deliver visibility, policy enforcement, and threat mitigation across distributed networks. Complementing these offerings, system integration services and maintenance support ensure that complex communication architectures remain optimized and secure throughout their lifecycle.

Across end-user verticals, diverse industrial segments from aerospace and defense to consumer electronics exhibit unique connectivity requirements. High-reliability environments such as energy and power plants demand fault-tolerant networks, whereas agricultural and automotive applications prioritize long-range, low-power wireless links. In process-heavy industries like chemicals, oil and gas, and food and beverages, compliance, safety, and real-time control drive investments in hardened communication protocols. As industrial operations evolve, understanding these segmentation dynamics empowers stakeholders to tailor solutions that align with specific performance criteria, regulatory regimes, and operational constraints.

This comprehensive research report categorizes the Industrial Communication market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Communication Type

- Component

- End Users

Exploring How Diverse Regional Ecosystems and Regulatory Landscapes Shape Industrial Communication Adoption and Infrastructure Dynamics

Regional dynamics play a pivotal role in shaping industrial communication strategies as market maturity, regulatory landscapes, and technological adoption vary significantly across major geographies. In the Americas, established manufacturing hubs have embarked on large-scale modernization initiatives, leveraging industrial Ethernet and private cellular networks to upgrade legacy systems. Ongoing investments in infrastructure and favorable trade agreements have accelerated the deployment of smart manufacturing pilot projects, particularly in automotive and aerospace clusters.

Conversely, the Europe, Middle East & Africa region presents a tapestry of regulatory and economic conditions that influence connectivity adoption. Stringent data sovereignty rules in certain European nations are prompting localized data processing and edge computing solutions, while Middle East investment in digital transformation is spurring the rollout of large-scale industrial IoT platforms. Across Africa, nascent manufacturing ecosystems are gradually migrating from manual processes to automated lines, creating opportunities for modular wireless implementations that bypass traditional cabling challenges.

In the Asia-Pacific region, rapid industrial expansion is accompanied by a diverse maturity curve. Advanced economies such as Japan and South Korea are pioneering 5G-enabled production lines and advanced robotics, while Southeast Asian and South Asian markets are embracing cost-effective wireless networks to support burgeoning electronics and food and beverage sectors. This regional mosaic underscores the importance of tailoring communication architectures to local regulatory frameworks, resource availability, and adoption readiness, ensuring that solutions are both scalable and compliant.

This comprehensive research report examines key regions that drive the evolution of the Industrial Communication market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Strategic Partnerships Technological Leadership and Specialized Offerings That Propel Top Industrial Communication Firms Ahead

Leading providers of industrial communication solutions are simultaneously advancing their portfolios through strategic partnerships, technology investments, and ecosystem collaborations. These companies are integrating cybersecurity capabilities into core offerings, embedding intrusion detection and encryption functionalities directly within hardware platforms. By aligning with global standards bodies, key players are also contributing to interoperability frameworks that facilitate seamless integration across heterogeneous networks.

Innovation pipelines are increasingly focused on software-defined networking and artificial intelligence-driven management, enabling predictive maintenance and automated performance optimization. These organizations are expanding their services footprints by offering comprehensive managed network solutions, remote diagnostics, and lifecycle support, thereby strengthening customer engagement and recurring revenue streams. Furthermore, academic and industrial research collaborations are fueling the development of next-generation industrial wireless protocols, ensuring that emerging applications can rely on deterministic, high-bandwidth communication channels.

Competitive differentiation also stems from the development of industry-specific offerings tailored to the stringent requirements of sectors such as pharmaceuticals and chemicals. By delivering certified, silicone-based connectors, explosion-proof enclosures, and protocol-specific gateways, these companies are addressing the exacting demands of regulated environments. As a result, the competitive landscape continues to evolve, driven by a combination of technological leadership, service excellence, and adherence to the highest safety and quality standards.

This comprehensive research report delivers an in-depth overview of the principal market players in the Industrial Communication market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aaeon Technology Inc.

- ABB Ltd.

- Advantech Co., Ltd.

- B+M Blumenbecker GmbH

- Belden Inc.

- Cisco Systems, Inc.

- General Electric Company

- Honeywell International Inc.

- IFM Electronic GmbH

- Industrial Communications, LLC

- Intel Corporation

- International Business Machines Corporation

- Microsoft Corporation

- Mitsubishi Electric Corporation

- Molex, LLC

- Moxa Inc.

- Nokia Corporation

- Omron Corporation

- Pepperl+Fuchs SE

- Phoenix Contact Gmbh & Co. Kg

- Renesas Electronics Corporation

- Robert Bosch AG

- Rockwell Automation, Inc.

- SAP SE

- Schneider Electric SE

- Sick AG

- Siemens AG

- STMicroelectronics N.V.

- Telefonaktiebolaget LM Ericsson

- Texas Instruments

- Tridon Communications

Empowering Industry Leaders with Actionable Strategies to Strengthen Resilience Drive Innovation and Harmonize Diverse Connectivity Architectures

Industry leaders must adopt a multifaceted approach to navigate ongoing technological disruptions and geopolitical uncertainties. To enhance resilience, organizations should diversify their supplier base and explore nearshore manufacturing partnerships, thereby mitigating tariff risks and reducing lead times. Concurrently, integrating advanced network security measures-such as zero-trust architectures and encrypted telemetry-will safeguard critical operations against evolving cyber threats.

In parallel, decision-makers should prioritize investment in converged communication platforms that harmonize wired, wireless, and cellular networks under unified management. This strategy supports flexible production layouts and mobile asset coordination, which are essential for rapid reconfiguration in response to market fluctuations. Moreover, embracing open standards and participating in industry consortiums will ensure interoperability, reduce integration costs, and accelerate innovation cycles.

Finally, fostering a culture of continuous learning and cross-functional collaboration is vital. By blending IT and OT expertise within center-of-excellence teams, organizations can champion best practices in data analytics, predictive maintenance, and edge computing. These initiatives will not only optimize asset performance but also create new service-based revenue streams, transforming connectivity investments into strategic enablers of sustainable competitive advantage.

Detailing the Rigorous Methodological Framework Combining Qualitative Interviews Quantitative Analysis and Expert Validation Protocols

The research underpinning this report combines rigorous qualitative and quantitative methodologies to ensure a comprehensive analysis of the industrial communication landscape. Secondary research involved an exhaustive review of technical publications, industry whitepapers, and regulatory frameworks to map the evolution of communication standards and emerging protocols. Primary research consisted of structured interviews with C-level executives, system integrators, and technology specialists to validate trends, quantify adoption barriers, and gauge investment priorities.

Data synthesis employed triangulation techniques, cross-verifying insights across multiple sources to enhance accuracy and reliability. Advanced analytics were applied to unstructured interview transcripts and market data sets, enabling thematic clustering and correlation analyses that informed segmentation insights. In addition, scenario modeling was utilized to assess the potential repercussions of tariff fluctuations and regulatory shifts on supply chain dynamics and cost structures.

Throughout the research process, strict data governance protocols and confidentiality agreements safeguarded proprietary information. Expert review panels provided iterative feedback on draft findings, refining the analytical framework and ensuring alignment with real-world operational challenges. This methodological rigor delivers a robust foundation for strategic decision-making, offering stakeholders a clear lens through which to anticipate future developments in industrial communication.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Industrial Communication market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Industrial Communication Market, by Communication Type

- Industrial Communication Market, by Component

- Industrial Communication Market, by End Users

- Industrial Communication Market, by Region

- Industrial Communication Market, by Group

- Industrial Communication Market, by Country

- United States Industrial Communication Market

- China Industrial Communication Market

- Competitive Landscape

- List of Figures [Total: 15]

- List of Tables [Total: 1272 ]

Concluding Synthesis Emphasizing Critical Insights and the Evolving Imperatives Guiding Future Investments in Industrial Communication

The insights presented in this summary underscore the critical role of advanced communication networks in driving the next wave of industrial innovation. The intersection of wired and wireless technologies, accelerated by edge computing and AI, is redefining how organizations monitor, control, and optimize complex operations. Meanwhile, geopolitical headwinds and trade policies are reshaping procurement strategies, prompting a shift toward service-centric models and localized manufacturing.

Segmentation analyses reveal that diverse application requirements-from latency-critical aerospace environments to long-range agricultural deployments-necessitate tailored connectivity approaches. Regional dynamics further highlight the need for adaptable architectures that respect regulatory constraints and capitalize on local infrastructure investments. Concurrently, leading companies are setting benchmarks through integrated cybersecurity, software-defined networking, and vertical-specific solutions that address the nuanced demands of regulated industries.

As technology and market forces continue to evolve, stakeholders who embrace open standards, foster cross-functional collaboration, and maintain flexibility in their connectivity strategies will secure a sustainable competitive edge. This conclusion serves as a call to action for decision-makers to leverage these comprehensive insights, aligning their investments with the imperatives of agility, resilience, and innovation in industrial communication.

Take the Next Step in Leveraging Comprehensive Industrial Communication Insights by Partnering with Ketan Rohom for Tailored Report Access

Engage with Ketan Rohom, Associate Director of Sales & Marketing, to gain exclusive access to the full industrial communication market research report tailored to your organization’s strategic needs. By collaborating directly, you will receive customized insights, detailed analysis, and a clear roadmap to navigate the complexities of emerging technologies, regulatory shifts, and supply chain disruptions. Ketan Rohom’s expertise in aligning technical data with impactful business decisions ensures that you obtain a comprehensive understanding of communication architectures, segmentation dynamics, and regional nuances. This personalized engagement empowers you to make informed investment choices, accelerate digital transformation initiatives, and enhance operational resilience. Reach out today to secure your copy of the report, unlock immediate value, and position your organization at the forefront of industrial communication innovation.

- How big is the Industrial Communication Market?

- What is the Industrial Communication Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?