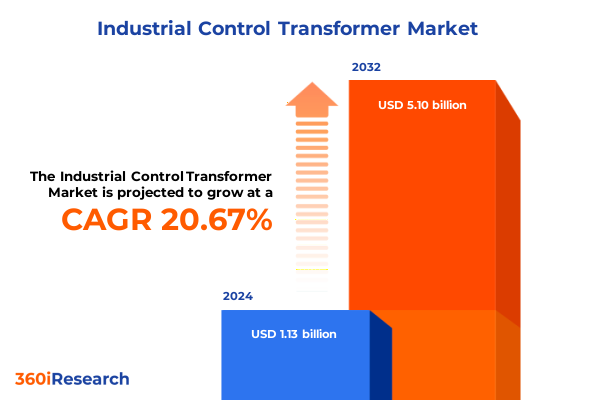

The Industrial Control Transformer Market size was estimated at USD 1.36 billion in 2025 and expected to reach USD 1.65 billion in 2026, at a CAGR of 20.70% to reach USD 5.10 billion by 2032.

Industrial Control Transformers Are Critical Voltage Regulation Components Supporting Automated and Digitalized Process Industries

Industrial control transformers are indispensable components that regulate voltage and protect critical equipment in automated and process-driven environments. As industries increasingly adopt digitalization and electrification, the demand for high-performance transformers capable of supporting advanced control systems has intensified. These devices serve as the backbone for applications ranging from distributed control systems to safety circuits, ensuring operational continuity and safeguarding against electrical faults. Amid this backdrop, manufacturers and end users are prioritizing reliability, efficiency, and compact designs that integrate seamlessly with programmable logic controllers and supervisory control platforms.

Moreover, the reliance on imported units underscores the importance of strategic sourcing and domestic capacity expansion. For example, more than 80% of large power transformers deployed in the United States have historically been sourced from Mexico, Canada, and Asia, exposing utilities and industrial operators to supply chain volatility and tariff fluctuations. In parallel, global energy demands-particularly from data centers and renewables-are projected to drive grid modernization efforts, prompting key original equipment manufacturers to invest in local production facilities to mitigate import dependencies and enhance lead-time resilience.

Rapid Progress in Digital Automation and Energy Transition Mandates High-Performance and Connected Industrial Control Transformer Solutions

The industrial control transformer landscape has undergone transformative shifts driven by the convergence of digital automation, energy transition imperatives, and evolving demand patterns. Smart manufacturing initiatives now require transformers that can interface with IoT platforms for real-time health monitoring and predictive maintenance, elevating the importance of embedded sensors and communication modules. Concurrently, the proliferation of data-intensive workloads in artificial intelligence and cloud computing has intensified power grid requirements, with AI servers capable of rapid load swings challenging transformer performance and reliability under dynamic conditions.

At the same time, decarbonization targets are reshaping transformer applications across renewables integration and electric vehicle charging infrastructure. Grid operators are deploying synchronous condenser solutions, advanced distribution transformers, and robust control panels to accommodate intermittent generation from wind and solar farms. This transition has heightened the need for energy-efficient, low-loss designs that comply with international eco-design directives, balancing system stability with sustainable operations. As a result, industry leaders are prioritizing R&D investments into next-generation transformer technologies that deliver both superior electrical characteristics and digital connectivity to support the evolving demands of modern power systems.

Recent U.S. Tariff Measures on Steel, Aluminum, and Electronics Imports Are Driving Strategic Shifts in Transformer Supply Chain Economics

In 2025, a series of U.S. tariff measures targeting steel, aluminum, and electronic components has cumulatively reshaped the economics of industrial control transformer supply chains. On March 12 2025, a 25% Section 232 tariff on all steel and aluminum imports came into force, applying uniformly to materials regardless of prior exemptions and compelling manufacturers to reassess material sourcing and inventory strategies to manage cost pressures. Shortly thereafter, reciprocal tariffs of 10% on all imports and higher country-specific duties were introduced in early April, further complicating cross-border procurement for mills and component suppliers.

Comprehensive Segmentation Analysis Illuminates Industrial Control Transformer Variations by Application, Industry, Ratings, and Installation Requirements

Segmentation analysis reveals how application-specific requirements, end-user industry needs, capacity constraints, voltage preferences, cooling methods, phase configurations, and mounting options define diverse market niches. Automation systems encompass DCS-, PLC-, and SCADA-based platforms, demanding transformers with precise regulation and seamless integration into control loops. Control panels, including MCC, operator, and PLC panels, require compact units designed for panel mounting and bench or DIN-rail installations. Machine tools such as CNC machines, lathes, and milling machines rely on robust transformers to ensure consistent voltage under dynamic loading, while safety circuits integrate e-stop systems and light curtains to maintain fail-safe protection at critical junctures.

End-user industries present further differentiation: automotive assembly lines and paint shops necessitate both three-phase and single-phase transformers optimized for high-throughput operations, whereas food and beverage packaging machinery and process ovens call for units that tolerate thermal cycling. HVAC systems deploy transformers within air handling units and compressor stations, emphasizing reliability in fluctuating ambient conditions. Paper and pulp operations leverage rugged transformers for paper machines and pulp processors, while pharmaceuticals demand precision in bioreactors and cleanrooms. Capacity segmentation from sub-100 VA through multi-kVA ranges highlights applications from control panels to industrial substations, with 120 V to 600 V voltage ratings aligning with global power standards. Cooling options span dry-type for indoor installations and oil-immersed for outdoor resilience, complementing single-phase and three-phase variants across bench-, DIN-rail-, and panel-mounted formats.

This comprehensive research report categorizes the Industrial Control Transformer market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Application

- End-User Industry

- Capacity Range

- Voltage Rating

- Cooling Method

- Phase

- Mounting Type

Distinct Regional Dynamics in Americas, Europe, Middle East & Africa, and Asia-Pacific Define Unique Growth Drivers and Supply Priorities

Regional market dynamics in the Americas are shaped by robust infrastructure investments and reshoring efforts. The United States is accelerating domestic transformer production to reduce dependence on imports, driven by grid modernization programs and industrial automation deployment. Simultaneously, Canada and Mexico are expanding regional manufacturing footprints to serve North American demand, leveraging nearshoring advantages to offset U.S. tariff exposure and minimize lead times for critical control applications.

This comprehensive research report examines key regions that drive the evolution of the Industrial Control Transformer market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Leading Manufacturers Are Investing in Capacity Expansion and Strategic Partnerships to Enhance Supply Resilience and Meet Advanced Demand Profiles

Industry leaders are intensifying investments to address capacity constraints and evolving demand profiles. Siemens Energy has announced plans to localize large transformer production in Charlotte, North Carolina, by 2027, aiming to reduce import reliance and enhance supply resilience for the U.S. market. Hitachi Energy is committing over €30 million to expand its Bad Honnef, Germany facility, reflecting strategic capacity scaling to meet Europe’s clean energy and grid modernization needs.

Meanwhile, major original equipment manufacturers are forming partnerships with regional fabricators and component suppliers to accelerate lead-time reductions and deliver tailored solutions. These collaborations often focus on integrating digital monitoring, optimizing transformer designs for specific industrial processes, and ensuring compliance with local certification standards. Such joint ventures and strategic alliances are central to maintaining competitive differentiation and meeting the intricate performance requirements of advanced automation systems.

This comprehensive research report delivers an in-depth overview of the principal market players in the Industrial Control Transformer market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd.

- Boardman Transformers Ltd.

- Dongan Electric Manufacturing Company

- Eaton Corporation plc

- Emerson Electric Co.

- Foster Transformer Company

- Fuji Electric Co., Ltd.

- General Electric Company

- Hammond Power Solutions, Inc.

- Hitachi, Ltd.

- Hubbell, Inc.

- Hyosung Heavy Industries Corporation

- Legrand SA

- MCI Transformer Corporation

- Mitsubishi Electric Corporation

- Rockwell Automation, Inc.

- Schneider Electric SE

- Shihlin Electric and Engineering Corporation

- Siemens AG

- SNC Manufacturing Co., Inc.

- Sunten Electric Equipment Co., Ltd.

- TEMCo Industrial, Inc.

- TMEIC Corporation

- WEG S.A.

- Wilson Power Solutions Ltd.

Strategic Imperatives for Industry Leaders to Strengthen Supply Resilience, Optimize Costs, and Accelerate Digital and Sustainability Goals

Industry leaders should prioritize diversification of material sourcing strategies by engaging multiple qualified suppliers and leveraging tariff exclusion programs to mitigate cost volatility and regulatory uncertainty. Investing in inventory buffering for critical components-such as core steel laminations and high-voltage insulation materials-can reduce exposure to sudden tariff escalations.

Digitalization of ordering and inventory management processes, including real-time tracking of supply chain disruptions and demand forecasts, will enable procurement teams to make data-driven decisions. Collaborative relationships with original equipment manufacturers and end users can facilitate co-development of transformer designs that optimize material usage and improve efficiency, addressing both sustainability objectives and operational performance requirements.

Finally, forming public–private partnerships to advocate for targeted tariff relief and infrastructure funding can drive strategic policy outcomes. By demonstrating the critical role of industrial control transformers in digital and green transformation projects, industry coalitions can shape regulatory frameworks that support domestic manufacturing investments and secure long-term supply chain stability.

Rigorous Methodological Framework Integrating Primary Stakeholder Interviews and Secondary Regulatory and Industry Intelligence

This research combines primary interviews with key stakeholders across the transformer supply chain-including component suppliers, equipment manufacturers, and end-user facilities-with extensive secondary analysis of trade publications, regulatory filings, and corporate press releases. Quantitative data on tariff schedules and policy changes were sourced from government agencies and industry compliance advisories.

Each segmentation insight was developed by mapping application and end-user requirements against technical specifications obtained through expert consultations. Regional dynamics were assessed through analysis of major infrastructure investment programs, import–export statistics, and capacity expansion announcements. Company profiles were compiled using verified press releases and public financial disclosures to ensure accuracy and impartiality.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Industrial Control Transformer market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Industrial Control Transformer Market, by Application

- Industrial Control Transformer Market, by End-User Industry

- Industrial Control Transformer Market, by Capacity Range

- Industrial Control Transformer Market, by Voltage Rating

- Industrial Control Transformer Market, by Cooling Method

- Industrial Control Transformer Market, by Phase

- Industrial Control Transformer Market, by Mounting Type

- Industrial Control Transformer Market, by Region

- Industrial Control Transformer Market, by Group

- Industrial Control Transformer Market, by Country

- United States Industrial Control Transformer Market

- China Industrial Control Transformer Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 3180 ]

Industrial Control Transformer Market Poised for Continued Evolution Alongside Digital Automation, Sustainability Mandates, and Trade Policy Shifts

The industrial control transformer market is poised to navigate a complex interplay of digital transformation, energy transition imperatives, and evolving trade policies. Technological advancements in smart monitoring, low-loss materials, and modular designs will continue to drive product differentiation, while tariff measures and supply chain strategies will shape manufacturing footprints and sourcing decisions.

As end users demand higher reliability, sustainability, and integration capabilities, manufacturers that successfully align R&D investments with regional policy landscapes and customer requirements will secure competitive advantage. Partnerships across the value chain and proactive engagement with regulatory bodies will be instrumental in mitigating external risks and capturing growth opportunities in a dynamic market environment.

Engage with Our Associate Director to Acquire the Complete Industrial Control Transformer Market Research Report for Informed Strategic Decisions

To explore this comprehensive research and secure the insights essential for strategic decision-making, reach out to Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch. Engage directly to discuss how this report can be tailored to your organization’s priorities and gain immediate access to detailed analysis, supplier intelligence, and customized recommendations. Empower your team with the deep market expertise needed to navigate evolving trade policies, optimize supply chains, and capitalize on emerging opportunities in the industrial control transformer landscape

- How big is the Industrial Control Transformer Market?

- What is the Industrial Control Transformer Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?