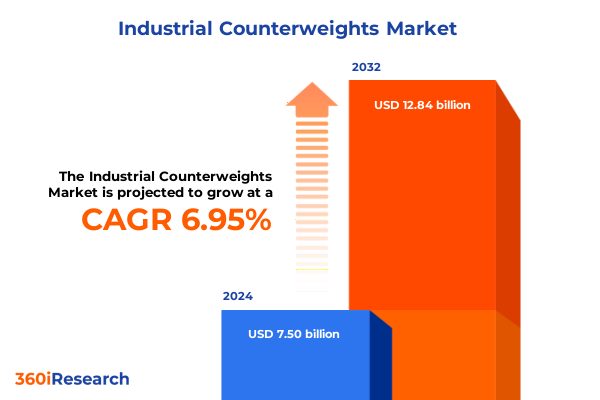

The Industrial Counterweights Market size was estimated at USD 8.00 billion in 2025 and expected to reach USD 8.53 billion in 2026, at a CAGR of 6.99% to reach USD 12.84 billion by 2032.

Setting the Stage for Industrial Counterweights in an Era of Rapid Technological Advancement and Heightened Regulatory Scrutiny

Industrial counterweights have evolved from rudimentary ballast solutions into precision-engineered components that underpin the safety, efficiency, and performance of heavy machinery across diverse sectors. As infrastructure projects expand globally and automation technologies continue to proliferate across manufacturing floors, the demand for counterbalances capable of meeting exacting load requirements has never been more critical. This executive summary sets out to explore the myriad forces reshaping this specialized segment of material handling and lifting equipment, offering a concise yet thorough overview of the market’s current state and its near-term trajectory.

Against a backdrop of supply chain volatility and escalating trade tensions, manufacturers and end users alike are navigating an environment in which material selection, production agility, and compliance with evolving regulatory frameworks are paramount. Key innovations in metallurgy and composite fabrication are intersecting with digital monitoring tools, enabling real-time tracking of weight distribution and wear factors. In addition, new sustainability mandates are pressuring stakeholders to reduce carbon footprints and embrace recyclable or low-emission alternatives without compromising on density or strength.

This introduction frames the detailed analysis that follows, laying out how transformative market shifts, tariff implications, segmentation nuances, regional variations, and competitive strategies coalesce to define the contemporary counterweight landscape. By synthesizing these elements, readers will gain a holistic understanding of where opportunity lies and how to anticipate challenges in an increasingly dynamic and interconnected market.

Embracing Material Innovation and Digital Integration to Transform Counterweight Manufacturing and Application Industry Dynamics

The industrial counterweight sector is undergoing fundamental changes driven by the convergence of material science breakthroughs and the digitalization of manufacturing operations. Advanced composite formulations are emerging alongside traditional metals, offering significant reductions in weight while retaining requisite density and durability. In tandem, additive manufacturing techniques have begun to accelerate prototyping cycles, allowing design teams to iterate complex geometries that optimize center-of-gravity parameters for specialized lifting equipment.

Moreover, the integration of sensor-based monitoring platforms is enabling proactive maintenance regimes, as stakeholders can now track load distribution, fatigue cycles, and microfracture developments in real time. This shift from reactive replacement to predictive servicing is not only enhancing equipment uptime but also extending the lifecycle of counterweights under rigorous operational demands. Sustainability considerations are further propelling research into eco-friendly binder systems and recycled aggregate mixtures, reflecting broader industry commitments to reduce environmental impact without sacrificing performance.

Consequently, the landscape is shifting from a commodity-driven model toward a technology-forward paradigm in which differentiation through innovation is a key competitive lever. As partnerships between material developers, software integrators, and equipment OEMs deepen, the counterweight sector stands at the forefront of a broader transformation in how heavy machinery aligns mechanical precision with digital intelligence.

Assessing the Cumulative Repercussions of Expanded United States Tariffs on Steel and Aluminum for Counterweight Supply Chains

The recent escalation of U.S. steel and aluminum tariffs under Section 232 has imposed a significant cost burden on industrial counterweight producers and end users alike. With duties on imported steel and aluminum rising to 50 percent from the prior 25 percent threshold as of June 4, 2025, many manufacturers have faced sharply higher input expenses for both primary metals and derivative products such as structural components and fabricated weights. This policy adjustment reflects national security priorities aimed at bolstering domestic capacity, but it has concurrently triggered supply chain realignments as companies reassess sourcing strategies and inventory buffers to mitigate margin erosion.

In practical terms, the tariffs extend beyond raw metal billets to encompass semicustom and finished components, including elevator rails, crane frames, and specialized counterweight assemblies. Consultations with global trade advisors have revealed a trend toward nearshoring steel procurement and increasing reliance on U.S.-based mills to moderate duties, although domestic producers are now experiencing heightened order volumes that risk capacity constraints. At the same time, several key trading partners, notably the European Union and Canada, have instituted retaliatory tariffs on a broad range of U.S. exports, raising concerns about reciprocal trade frictions that could unsettle project timelines and equipment delivery commitments.

Furthermore, analysis from leading consultancies underscores that downstream industries-such as automotive, construction, and machinery manufacturing-are poised to absorb a portion of these incremental costs, with some organizations already revising pricing models or exploring alternative materials like high-density concrete composites or polymer-metal hybrids. While the full financial impact remains subject to negotiation outcomes and potential tariff rollbacks, the immediate reality is a more complex procurement landscape in which cost management, supplier diversification, and advanced material substitution have become imperative for sustained operational viability.

Illuminating Key Segmentation Insights to Reveal Underlying Demand Drivers and Performance Differentials Across Counterweight Market Dimensions

A nuanced examination of the counterweight market reveals that material choice is at the heart of performance optimization, with cast iron variants-both ductile and grey-continuing to offer unmatched density for static applications, while composite alternatives deliver notable weight savings that facilitate mobile lifting operations. Concrete solutions, whether cast in situ for custom counterbalance installations or precast for modular deployment, have found favor in cost-sensitive infrastructure projects. Meanwhile, steel counterweights, available in both carbon and stainless grades, strike a balance between robustness and versatility across demanding environments.

The application dimension further segments demand, as the mobile crane sector leverages engineered counterweights to stabilize dynamic loads, while tower cranes depend on compact, stackable units that integrate seamlessly into urban construction logistics. Elevators and forklifts utilize precision-machined ballast calibrated for smooth operation and wear reduction, whereas railway cars require large-scale fixed weights engineered to withstand continuous vibration and thermal cycling.

End-use considerations add another layer of complexity: aerospace operators insist on exacting standards for both fixed-wing and rotary platforms, driving the adoption of ultra-high density alloys, whereas the automotive realm balances passenger vehicle comfort and commercial vehicle payload requirements. Commercial and residential construction projects differ in installation cadence and maintenance access, shaping counterweight configurations accordingly. Marine applications span commercial shipping and naval vessels, each imposing unique corrosion and fatigue criteria, and mining operations specify different formulations for drilling equipment versus excavation machinery.

Distribution pathways are equally diverse, with direct OEM contracts ensuring specification compliance for aftermarket replacements, national and regional distributors facilitating rapid stock replenishment, and online channels-ranging from manufacturer portals to third-party platforms-providing agility for urgent order fulfillment. Weight classifications, from compact systems below 250 kilograms to massive assemblies exceeding ten metric tons, dictate handling protocols and shipping logistics, underscoring the need for tailored supply chain frameworks at every scale.

This comprehensive research report categorizes the Industrial Counterweights market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Material

- Weight Class

- Application

- End Use

- Sales Channel

Uncovering Regional Market Nuances to Drive Strategic Priorities in the Americas, Europe Middle East Africa, and Asia Pacific

Regional landscapes are characterized by divergent priorities and market drivers that shape counterweight consumption patterns. In the Americas, substantial investments in infrastructure rehabilitation and energy projects are underpinning robust demand for cast iron and steel counterbalances, particularly in North America, where regulatory incentives favor domestically sourced materials. Moreover, the rise of renewable energy installations in Latin America has spurred interest in concrete-based solutions for wind turbine foundation ballast, reflecting a shift toward sustainable material applications.

Moving into Europe, the Middle East, and Africa, regulatory mandates on carbon emissions are accelerating the adoption of lightweight composites and recycled metal blends. European nations, under stringent EU directives, have prioritized the integration of traceable supply chains and circular economy principles, prompting counterweight manufacturers to certify material provenance and invest in closed-loop reclamation systems. Meanwhile, Middle Eastern and African markets, buoyed by infrastructure modernization initiatives, are driving growth in modular precast concrete units and stainless steel assemblies designed to withstand harsh climatic conditions and corrosive environments.

In Asia-Pacific, the convergence of megaproject construction and rapid industrialization is sustaining elevated requirements for high-capacity counterweights. China’s ongoing expansion of high-rise developments and port facilities has created scale advantages for local foundries that specialize in volumetric cast iron production, while regional hubs such as Southeast Asia are emerging as key sites for composite innovation, leveraging partnerships between equipment OEMs and research institutes to pilot graphene-enhanced ballast systems.

Consequently, regional strategies must be tailored to local regulatory landscapes, material availability, logistics infrastructure, and end-user expectations to capture the full spectrum of opportunity across the Americas, Europe Middle East Africa, and Asia Pacific markets.

This comprehensive research report examines key regions that drive the evolution of the Industrial Counterweights market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Evaluating Leading Industry Players and Strategic Initiatives Shaping the Competitive Battlefield of Counterweight Manufacture and Distribution

Market leadership in the counterweight sector is strongly influenced by strategic vertical integration, technology partnerships, and geographic reach. For example, Terex Corporation has leveraged its in-house casting facilities alongside exclusive agreements with Nucor Corporation to secure advantaged steel supply agreements that reinforce cost competitiveness in primary and derivative counterweight offerings. This integration has enabled Terex to maintain a robust production pipeline for ultra-large counterweights used in mining and infrastructure equipment without incurring the volatility of spot market pricing.

Similarly, Caterpillar Inc. has distinguished itself through proprietary casting innovations, such as the CAST-FORM™ technology that reduces material waste by a significant margin compared to traditional sand-casting processes. By partnering with SSAB to develop fossil-free steel solutions, the company is aligning its product portfolio with emerging low-carbon standards while expanding its footprint into hybrid excavator and material handling systems.

Specialized foundries like Bradken Limited (part of Hitachi Construction Machinery) have leveraged their strategic location near key maritime nodes to integrate blockchain-enabled logistics that guarantee rapid deliveries of zinc-aluminum composite counterweights to European project sites. This capability, combined with recent acquisitions, has positioned Bradken to address the growing demand for corrosion-resistant solutions in offshore and marine applications.

Emerging players, including Sarens Group in partnership with leading research institutions, are piloting next-generation ballast composites reinforced with advanced nanomaterials, targeting mobile crane applications where weight reduction and rapid deployment are critical. Meanwhile, raw material suppliers like Rio Tinto are developing automated foundries that provide high-purity pig iron to aerospace and defense contractors, ensuring consistent alloy composition and enabling the production of counterweights that meet the stringent standards of satellite launch platforms.

This comprehensive research report delivers an in-depth overview of the principal market players in the Industrial Counterweights market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Blackwood Engineering

- Caterpillar Inc.

- Crescent Foundry

- Komatsu Ltd.

- Konecranes Plc

- Liebherr-International Deutschland GmbH

- Sany Heavy Industry Co., Ltd.

- Tadano Ltd.

- Terex Corporation

- The Manitowoc Company, Inc.

- Vulcan Global Manufacturing Solutions, Inc.

- Xuzhou Construction Machinery Group Co., Ltd.

- Zoomlion Heavy Industry Science & Technology Co., Ltd.

Actionable Strategic Recommendations to Enhance Operational Agility and Competitive Resilience in the Counterweight Sector

Industry leaders should prioritize the development of an agile supply chain network that incorporates dual-sourcing strategies to mitigate the impact of trade policy shifts and local capacity constraints. Engaging in collaborative forecasting with steel and composite material suppliers can facilitate more accurate lead-time planning and buffer stock management, thereby minimizing production bottlenecks during tariff or logistical disruptions.

Furthermore, integrating advanced data analytics into procurement and production workflows can deliver actionable insights on material performance and lifecycle costs. By investing in condition-monitoring platforms that provide real-time visibility into weight distribution and microfracture progression, companies can transition from calendar-based replacement to predictive maintenance models, unlocking efficiency gains and reducing unplanned downtime.

In addition, forging research alliances with universities and specialty chemical firms can accelerate the commercialization of sustainable binder systems and high-density composite formulations. Such partnerships can yield competitive differentiation, particularly in markets with stringent environmental regulations or where weight reduction translates directly to operational fuel savings.

Finally, market participants are encouraged to adopt modular counterweight designs compatible with both traditional and emerging equipment architectures. This approach not only enhances scalability across diverse applications-from tower cranes to autonomous material handling systems-but also streamlines aftermarket support through standardized handling and installation protocols.

Detailing a Rigorous Multi-Stage Research Methodology to Ensure Robust Data Integrity and Analytical Precision for Market Insights

This research project was structured around a multi-stage methodology combining primary interviews, secondary literature reviews, and data triangulation to ensure the highest levels of analytical rigor. Initially, exploratory discussions were conducted with a cross-section of stakeholders, including OEM engineers, foundry operations managers, and end-user maintenance leads, to map core performance criteria and emerging pain points across the counterweight lifecycle.

Subsequently, extensive secondary research was undertaken to collate regulatory updates, trade policy announcements, and patent filings relevant to material advancements and production technologies. This phase incorporated publicly available government documents, industry white papers, and scholarly publications, ensuring a comprehensive understanding of both macro-level trends and granular technical innovations.

Data triangulation was achieved by cross-referencing supply chain metrics, shipment data, and confirmed project orders to validate manufacturer output and adoption rates. Quantitative insights were supplemented with qualitative field observations from facility visits and virtual plant tours, providing real-time assessments of casting processes and quality control measures. The resulting dataset was rigorously reviewed through multiple quality gates, including peer validation and expert advisory panels, to confirm consistency and mitigate bias.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Industrial Counterweights market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Industrial Counterweights Market, by Material

- Industrial Counterweights Market, by Weight Class

- Industrial Counterweights Market, by Application

- Industrial Counterweights Market, by End Use

- Industrial Counterweights Market, by Sales Channel

- Industrial Counterweights Market, by Region

- Industrial Counterweights Market, by Group

- Industrial Counterweights Market, by Country

- United States Industrial Counterweights Market

- China Industrial Counterweights Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1908 ]

Synthesis of Strategic Implications and Forward-Looking Perspectives for Stakeholders in the Evolving Counterweight Ecosystem

In summary, the industrial counterweight arena is at a pivotal juncture, shaped by transformative material technologies, digital integration, and evolving trade frameworks. The interplay of these factors underscores the importance of strategic foresight in sourcing, design innovation, and operational execution. As regional markets diverge in regulatory focus and infrastructure investment profiles, organizations must tailor strategies that leverage local strengths while maintaining global resiliency.

Competitive advantage will be conferred to those entities that balance the agility to adapt procurement networks in response to tariff fluctuations with the vision to invest in next-generation composite and digital monitoring capabilities. By aligning technical excellence with rigorous sustainability objectives, market participants can drive both performance gains and environmental stewardship.

Ultimately, the capacity to anticipate shifts-whether in material availability, policy developments, or end-use requirements-will define success in this evolving landscape. Armed with the insights and recommendations presented herein, stakeholders are positioned to navigate complexity, unlock operational efficiencies, and capitalize on emerging opportunities across the counterweight value chain.

Engaging Directly with Ketan Rohom to Unlock Comprehensive Counterweight Market Intelligence and Drive Data-Informed Strategic Decisions

For a comprehensive deep dive into the latest counterweight market dynamics, including granular segmentation insights and rigorous regional analysis, connect with an expert who can guide you to data-driven strategies. Ketan Rohom, Associate Director of Sales & Marketing, is ready to discuss how tailored research intelligence can empower your decision-making and help you stay ahead of industry shifts. Reach out today to secure your access to the full report and unlock the strategic clarity needed to optimize counterweight sourcing, design innovation, and supply chain resilience.

- How big is the Industrial Counterweights Market?

- What is the Industrial Counterweights Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?