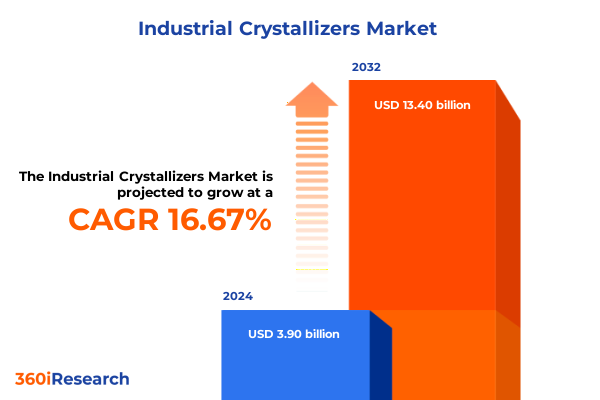

The Industrial Crystallizers Market size was estimated at USD 4.50 billion in 2025 and expected to reach USD 5.20 billion in 2026, at a CAGR of 16.85% to reach USD 13.40 billion by 2032.

Setting the Stage for the Evolution of Industrial Crystallization Solutions Amid Rising Efficiency Demands and Technological Advancements

Industrial crystallization stands at the heart of purification and separation processes across a multitude of industries, offering crucial capabilities for achieving high product quality and consistency. From pharmaceutical active ingredients to refined sugar production, the selection and optimization of crystallization equipment directly shape yield, purity, and operational cost structures. As global demand intensifies for more sustainable and efficient manufacturing, crystallizers have evolved from simple batch vessels to advanced systems integrating process controls, energy recovery, and specialized surface technologies.

Against this backdrop, equipment providers and process engineers are challenged to balance capacity requirements with environmental footprints and regulatory compliance. Emerging materials and process innovations drive the need for modular and scalable crystallizer platforms that can adapt quickly to varying feedstocks and product specifications. At the same time, cross-industry convergence around digitalization, predictive analytics, and circular economy principles has created a fertile ground for collaborative technology development.

This executive summary introduces the transformative forces reshaping the industrial crystallizers landscape. With a focus on equipment typologies, end-use sectors, regional dynamics, and company strategies, it sets the stage for a deeper exploration of the critical factors influencing procurement, process design, and competitive positioning. Decision makers seeking to optimize crystallization operations will find an integrated view of recent advancements, market drivers, and strategic imperatives woven throughout this report.

Navigating Revolutionary Shifts in Industrial Crystallization Through Sustainability, Digitization, and Process Intensification

The industrial crystallizers market is experiencing a confluence of transformative shifts driven by environmental sustainability, digital integration, and process intensification. Manufacturers are adopting advanced materials and surface treatments to optimize crystal morphology and reduce energy consumption. These eco-centric innovations are complemented by sophisticated controls and real-time monitoring systems, enabling predictive maintenance and dynamic process adjustments that translate to more stable crystal size distribution and lower downtime.

In parallel, the proliferation of continuous crystallization techniques is redefining equipment design philosophies. By replacing traditional batch operations with continuous flow models, producers achieve tighter process control, enhanced product consistency, and reduced operational footprints. This shift is accompanied by the rise of hybrid systems that blend cooling, evaporative, and vacuum methods to unlock novel yield and purity thresholds previously unattainable in large-scale manufacturing.

Moreover, digital twins and machine learning algorithms are being deployed to simulate crystallization kinetics under varying conditions, accelerating development cycles and mitigating scale-up risks. Coupled with modular equipment platforms, these tools empower process engineers to rapidly reconfigure crystallizer arrays in response to evolving feed properties or production targets. The result is a dynamic market landscape where agility and innovation converge to deliver next-generation crystallization solutions.

Assessing the Ongoing Influence of United States Tariffs on Industrial Crystallizer Supply Chains and Competitive Dynamics in Twenty Twenty Five

United States import tariffs enacted in twenty twenty five have imposed additional levies on steel, aluminum, and related components integral to crystallizer fabrication. The cumulative effect has been a noticeable uptick in capital expenditure for new equipment acquisitions as manufacturers grapple with increased material and shipping costs. Many end users have responded by reexamining sourcing strategies, opting for domestic fabrication partners or alternative alloy suppliers to mitigate the financial impact.

These tariffs have also catalyzed strategic realignments among global equipment vendors. Leading manufacturers are establishing localized production hubs and forging joint ventures to circumvent import duties and preserve competitive pricing. At the same time, extended lead times for critical components have underscored the importance of robust supply chain visibility and collaborative inventory planning between OEMs and spare parts distributors.

Consequently, the tariff environment has accelerated the adoption of aftermarket and maintenance service offerings, with service providers bundling condition monitoring and spare parts packages to enhance operational resilience. While upfront costs have risen, end users are increasingly willing to invest in full-service maintenance agreements to safeguard production continuity and contain long-term capital outlays under a more volatile trade framework.

Exploring How Equipment Modalities, Industry Applications, Material Choices, Capacity Tiers, and Sales Networks Define the Crystallizer Market Landscape

A nuanced understanding of market segmentation reveals the diverse equipment modalities, industry applications, material preferences, capacity tiers, and distribution pathways that define the industrial crystallizer arena. Equipment typologies span centrifugal units prized for rapid separation, cooling crystallizers favored for precise temperature control, draft tube baffle systems optimized for uniform crystal growth, fluidized bed platforms that offer gentle handling of friable materials, and vacuum crystallizers designed for low-temperature operations. Within cooling crystallization, specialized subtypes such as expanded surface, plate, and shell-and-tube configurations address unique thermal exchange requirements, while vacuum systems may be deployed in batch vacuum or continuous vacuum modes to suit varying process scales.

End-use industries include chemical and petrochemical sectors-from fertilizers to specialty chemicals-alongside food and beverage applications encompassing confectionery, dairy, and sugar processing. Mineral processing operations leverage crystallizers for minerals and ore recovery, whereas pharmaceutical manufacturing relies on crystallization for both active pharmaceutical ingredients and excipients. Material selections range from inorganic metals, minerals, and salts to organic segments involving polymers and pharmaceutical compounds, each demanding tailored crystallizer designs.

Capacity considerations drive differentiation among large-scale, medium-scale, and small-scale installations that correspond to project footprints and throughput expectations. Meanwhile, sales channels bifurcate into original equipment manufacturer direct sales and distributor networks, and aftermarket services covering maintenance support and spare parts provisioning. Together, this layered segmentation underscores the market’s complexity and opportunities for targeted value propositions.

This comprehensive research report categorizes the Industrial Crystallizers market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Material

- Capacity

- End Use Industry

- Sales Channel

Analyzing Regional Drivers and Emerging Trends Across Americas, Europe Middle East Africa, and Asia Pacific Industrial Crystallization Markets

Regional dynamics play a pivotal role in shaping industrial crystallizer strategies. Within the Americas, established manufacturing hubs in North America benefit from policy incentives for reshoring and upgrades to legacy process plants. The region’s strong pharmaceutical and food sectors continually seek energy-efficient crystallization technologies that comply with stringent environmental regulations, driving steady demand for both new installations and retrofit packages. Latin American sugar and petrochemical refiners are also investing in modular and mobile crystallizer units to support decentralized production.

Across Europe, the Middle East, and Africa, a combination of mature markets and emerging economies presents a dual-track growth trajectory. Western European end users prioritize carbon footprint reduction and process digitalization, while Middle Eastern petrochemical complexes focus on scale and integration with adjacent separation units. African mining operations are increasingly adopting fluidized bed and draft tube systems to improve mineral recovery efficiency under challenging feed conditions. Collaborative efforts among governments and technology providers are fostering innovation clusters that accelerate the deployment of advanced crystallization solutions.

In the Asia-Pacific region, rapid industrialization in China, India, and Southeast Asia has spurred significant capacity additions across chemical, food, and pharmaceutical segments. Local fabrication capabilities and competitive labor costs support cost-effective production of large-scale cooling and vacuum crystallizers. However, rising environmental standards and energy prices are prompting a shift toward heat recovery systems and hybrid configurations that can optimize utility consumption and reduce overall operating costs.

This comprehensive research report examines key regions that drive the evolution of the Industrial Crystallizers market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Strategic Movements, Innovation Portfolios, and Competitive Positioning Among Leading Industrial Crystallizer Manufacturers

The competitive landscape is defined by a blend of global conglomerates and specialized engineering firms that continuously expand their service portfolios and technological capabilities. Leading suppliers have bolstered their positions through strategic acquisitions aimed at integrating advanced process control software, filtration technologies, and maintenance service networks. Partnerships with materials science innovators have led to the commercialization of corrosion-resistant alloys and high-efficiency heat exchanger designs tailored for crystallization applications.

Several major players have also invested heavily in research and development centers focused on digital twin creation, machine learning modeling, and pilot-scale test facilities to validate novel crystallization approaches. This emphasis on innovation has enabled them to offer turnkey solutions that combine reactor design, automation systems, and ongoing performance monitoring under comprehensive service agreements. At the same time, nimble regional manufacturers remain competitive by offering rapid customization, localized support, and cost-effective solutions for small to mid-scale projects.

Emerging entrants specializing in modular and skid-mounted crystallization units have begun to capture niche segments where agility and speed to market are critical. By leveraging collaborative partnerships with engineering procurement and construction firms, these companies bridge gaps in existing service offerings and underscore the importance of adaptable business models in a market characterized by shifting trade policies and evolving process demands.

This comprehensive research report delivers an in-depth overview of the principal market players in the Industrial Crystallizers market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Anssen Metallurgy Group Co., Ltd.

- Chemin Enviro Systems Pvt. Ltd.

- Condorchem Envitech

- DCI, Inc.

- Ebner GmbH & Co. KG

- Ekato Holding GmbH

- Excel Engineering

- GEA Group

- Katsuragi Industry Co., Ltd.

- KEP Engineering Services Pvt. Ltd.

- Moretto S.p.A.

- Motan Colortronic Ltd.

- Paul Mueller Company

- Radhe Techno

- RCM Engineering Group

- Rosenblad Design Group, Inc.

- Shail Vac Engineers

- Sumitomo Heavy Industries, Ltd.

- Sunrise Machination LLP

- Swenson Technology, Inc.

- Technoforce Solutions Private Limited

- Tsukishima Kikai Co., Ltd.

- Veolia Water Solutions & Technologies

- Veranova, L.P.

- Vobis, LLC

- Whiting Equipment Canada, Inc.

Empowering Decision Makers with Strategies to Boost Process Efficiency, Drive Innovation, and Address Compliance Challenges in Crystallization Operations

Industry leaders aiming to capture market share and drive margin improvements should prioritize the integration of digital process controls and predictive maintenance platforms. Such systems not only reduce unplanned downtime but also enable proactive optimization of crystal growth parameters, translating to consistent product quality and lower utility costs. In parallel, forming alliances with local fabrication and service providers can mitigate the impact of trade restrictions while accelerating response times for installation and support.

Investment in sustainability initiatives, including heat recovery loops and alternative energy integration, will resonate with end users facing tighter emissions targets and escalating energy prices. Companies that embed lifecycle service offerings-from spare parts provisioning to remote monitoring-can differentiate themselves by delivering end-to-end value and fostering long-term customer relationships. Additionally, the development of modular and mobile crystallizer platforms tailored for pilot experiments and rapid capacity expansions can unlock new market segments in mining, specialty chemicals, and food processing.

Finally, cultivating strong stakeholder engagement through joint pilot projects and collaborative research with academia and industry consortia will position organizations as innovation partners. This approach accelerates technology validation, shortens commercialization timelines, and ensures alignment with evolving regulatory and sustainability requirements, ultimately strengthening competitive positioning in a dynamic market environment.

Outlining the Holistic Research Methodology Integrating Data Collection, Stakeholder Engagement, and Robust Analytical Frameworks Underlying the Study

The findings presented in this report are grounded in a rigorous research methodology that integrates both primary and secondary data sources. In-depth interviews were conducted with key stakeholders across OEMs, end users, and aftermarket service providers to capture firsthand perspectives on technological advancements, procurement criteria, and competitive dynamics. These qualitative insights were complemented by comprehensive reviews of industry white papers, patent filings, regulatory documentation, and technical literature to validate and enrich the analysis.

Quantitative data were collected through surveys targeting process engineers, operations executives, and procurement specialists to ensure robust representation of end-use industry needs and purchasing behaviors. Data triangulation techniques were employed to cross-verify information across multiple sources and enhance analytical accuracy. Specialized frameworks, including SWOT and PESTEL analyses, were applied to structure the assessment of market drivers, opportunities, and risk factors within varied regional contexts.

To reinforce the credibility of the report, key findings underwent peer review by subject matter experts in process engineering and supply chain management. The methodological approach emphasizes transparency and replicability, providing decision makers with confidence in the comprehensiveness and reliability of the insights.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Industrial Crystallizers market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Industrial Crystallizers Market, by Type

- Industrial Crystallizers Market, by Material

- Industrial Crystallizers Market, by Capacity

- Industrial Crystallizers Market, by End Use Industry

- Industrial Crystallizers Market, by Sales Channel

- Industrial Crystallizers Market, by Region

- Industrial Crystallizers Market, by Group

- Industrial Crystallizers Market, by Country

- United States Industrial Crystallizers Market

- China Industrial Crystallizers Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2544 ]

Closing Reflections on Strategic Imperatives and Emerging Opportunities in the Evolving World of Industrial Crystallization Technologies and Strategies

The landscape of industrial crystallizers is defined by rapid technological evolution, shifting trade environments, and diverse end-use demands that collectively shape competitive strategies and investment decisions. As manufacturers navigate the complexities introduced by tariffs, sustainability mandates, and escalating energy costs, the ability to deploy modular, digitally enabled, and energy-optimized equipment will be a key differentiator.

Moreover, regional dynamics underscore the necessity for localized support networks and agile supply chain arrangements that can adapt to varying regulatory regimes and customer expectations. Companies that successfully integrate advanced analytics, pilot-scale validation, and aftermarket services into their offerings will be well positioned to capture growth opportunities across chemical, food and beverage, mineral processing, and pharmaceutical sectors.

Ultimately, collaboration between equipment vendors, end users, and technology partners-backed by rigorous data-driven methodologies-will drive the next wave of innovation in crystallization processes. By embracing a holistic view of market segmentation and prioritizing operational excellence, stakeholders can transform crystallization from a traditional unit operation into a strategic platform for competitive advantage.

Unlock Exclusive Crystallizer Market Intelligence Through Direct Collaboration with the Associate Director of Sales and Marketing

Unlock Industry-leading insights into crystallizer technologies and market dynamics by collaborating with Ketan Rohom the Associate Director of Sales and Marketing to purchase the full market research report. Engage directly to secure access to comprehensive analysis, strategic perspectives, and actionable data that will inform critical investment and operational decisions. This report delivers an unparalleled synthesis of trends and competitive intelligence, empowering your organization to stay ahead in a rapidly evolving landscape. Connect with the sales leadership to discuss tailored solutions and ensure your team has the knowledge to drive efficiency and innovation in crystallization processes.

- How big is the Industrial Crystallizers Market?

- What is the Industrial Crystallizers Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?