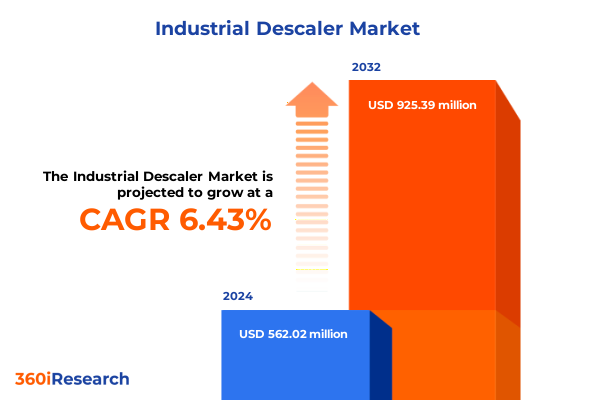

The Industrial Descaler Market size was estimated at USD 596.25 million in 2025 and expected to reach USD 633.04 million in 2026, at a CAGR of 6.48% to reach USD 925.39 million by 2032.

Understanding the Growing Importance of Industrial Descaler Solutions in Modern Maintenance and Operational Efficiency and Equipment Longevity Across Industrial Sectors

The industrial maintenance sector is increasingly prioritizing the adoption of descaler solutions to mitigate the pervasive challenge of mineral scale accumulation on critical equipment surfaces. Scale formation, driven by water hardness and process residues, can significantly impede heat transfer, elevate energy consumption and accelerate material degradation. As operational cost pressures and sustainability mandates intensify, maintenance teams are under escalating scrutiny to reduce unplanned downtime and extend asset service life without compromising environmental compliance. Industrial descalers therefore have ascended from auxiliary chemical treatments to essential enablers of reliability and efficiency, supporting diverse industries in maintaining continuous production and preserving capital assets.

In response to these evolving demands, the landscape for industrial descalers has broadened to encompass advanced formulations, process-integrated delivery mechanisms and specialized application protocols. Today's market participants seek solutions that not only eliminate scale but also minimize corrosion risks and residual toxicity. Concurrently, technology providers are integrating digital monitoring and remote dosing control to streamline maintenance workflows. This Executive Summary synthesizes the overarching trends that define the sector, clarifies the segments through which manufacturers and end users engage, and highlights the strategic considerations essential for stakeholders aiming to harness the full potential of descaling interventions.

Navigating the Shift Toward Sustainable and Digitally Augmented Descaling Practices That Are Redefining Industrial Maintenance Paradigms

The industrial descaler field is undergoing a fundamental shift toward sustainable chemistries and digitally augmented maintenance practices. Driven by regulatory constraints on hazardous substances and customer demand for eco-efficient interventions, formulators are replacing traditional acid-based blends with biodegradable, low-residue alternatives that deliver comparable performance. These greener chemistries are complemented by process analytics tools that continuously monitor scale deposition metrics and automate dosing cycles, reducing manual intervention and human error.

Simultaneously, predictive maintenance platforms are leveraging sensor data and machine learning to anticipate scale buildup before it impacts operations. Real-time diagnostics feed into cloud-based dashboards, empowering maintenance teams to schedule descaling events during planned outages and avoid unforeseen stoppages. This convergence of green chemistry and smart technology is not only redefining product development roadmaps but also reshaping service delivery models, prompting a transition from one-time applications to outcome-based maintenance contracts that guarantee process uptime.

Assessing the Far-Reaching Consequences of United States Tariff Adjustments in 2025 on the Industrial Descaler Commodity Supply Chains

In 2025, adjustments to United States tariff policy have introduced new complexities for the industrial descaler market, particularly regarding raw material procurement and cross-border supply chains. Tariffs levied on imported phosphoric acid and specialty surfactants have compelled several manufacturers to reassess their sourcing strategies. Domestic producers have gained leverage to negotiate longer-term contracts, yet they face the challenge of scaling capacity while ensuring product consistency. End users, in turn, are experiencing variations in procurement lead times, prompting some to explore backward integration or strategic partnerships with local chemical producers to secure supply stability.

Beyond procurement dynamics, the tariff landscape is reshaping pricing negotiations and total cost of ownership calculations for maintenance teams. While protective measures on imported intermediates aim to stimulate domestic manufacturing, the ripple effects include a need for transparent cost breakdowns and a heightened emphasis on lifecycle analysis. Industry leaders are responding by optimizing logistics networks and diversifying supplier portfolios, ensuring that descaling solutions remain both accessible and cost-effective despite fluctuating trade policies.

Illuminating Critical Segmentation Trends Based on Form Distribution Channels Composition Type and Multifaceted Applications Driving Descaler Adoption

A nuanced segmentation framework reveals the diverse pathways through which industrial descaler offerings reach end users and generate value. When examining product form, the choice between liquid and powder presentations shapes handling protocols, storage requirements and application methods. Liquid formulations enable rapid deployment through inline dosing systems, while powder variants offer dosage flexibility and extended shelf stability in remote or seasonal facilities. Distribution channels further differentiate market engagement, as direct sales teams foster close technical partnerships with large end users, whereas distributors provide broader geographic coverage and consolidated procurement services for midsize operations.

Exploring product types uncovers distinct efficacy and compatibility profiles. Acidic descalers excel at dissolving carbonate-based scale but demand careful material compatibility assessments to prevent corrosion. Alkaline solutions, on the other hand, target oil, grease and organic residues, often serving as preparatory steps before acid treatments. Chelating agents offer a balanced approach, encapsulating multivalent ions to mitigate scale formation with minimal pH disturbance. Application contexts range from cooling towers and heat exchangers-spanning plate and shell & tube configurations-to industrial boilers and intricate pipeline networks. End user industries exhibit similarly layered requirements: chemical plants differentiate between bulk and specialty processes, food and beverage facilities address brewery and dairy hygiene standards, oil and gas operators navigate upstream, midstream and downstream complexities, pharmaceutical manufacturers reconcile branded and generic production protocols, and power generation facilities balance fossil fuel, nuclear and renewable system maintenance priorities.

This comprehensive research report categorizes the Industrial Descaler market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Form

- Deposit Type

- Concentration Level

- Distribution Channel

- Application

- Industry Vertical

Unveiling Distinct Regional Dynamics and Opportunities Across Americas Europe Middle East Africa Complexities and Growth Drivers in Asia-Pacific Markets

Regional variations underscore how regulatory landscapes, infrastructure maturity and industrial portfolios influence descaling strategies. In the Americas, stringent environmental regulations in the United States and Canada have elevated the prioritization of low-emission and nonhazardous descaler chemistries, while Latin American markets gravitate toward cost-efficient powder blends that align with variable utility infrastructures. The interplay of advanced regulatory frameworks and robust manufacturing hubs in North America fosters a deep technical services ecosystem, whereas supply constraints in remote regions spur reliance on distributors to bridge logistical gaps.

Across Europe, Middle East and Africa, harmonized chemical safety directives in the European Union drive demand for REACH-compliant descalers, prompting formulators to innovate with green solvents and renewable feedstocks. Middle Eastern desalination plants and power stations often seek high-capacity acidic formulations to address brine-induced scaling, while African mining and industrial parks prioritize modular dosing solutions that can adapt to intermittent grid access. In Asia-Pacific, burgeoning industrialization in China, India and Southeast Asia catalyzes heightened investment in both sophisticated inline monitoring systems and scalable descaler portfolios. This region’s dynamic growth trajectory is matched by local manufacturers tailoring solutions to diverse water chemistries and evolving regulatory requirements.

This comprehensive research report examines key regions that drive the evolution of the Industrial Descaler market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Global Manufacturers and Innovators Driving Competitive Advancements in Industrial Descaler Technology and Services

Leading stakeholders in the industrial descaler domain are refining their competitive positions through portfolio diversification, strategic collaborations and regional expansion. Global specialty chemical producers are fortifying their presence by introducing multifunctional formulations that integrate scale inhibition and corrosion protection, while leveraging their R&D infrastructures to fast-track product approvals. At the same time, service-oriented enterprises are partnering with automation specialists to deliver turnkey maintenance solutions, bundling dosing equipment, remote monitoring and technical advisory under unified service level agreements.

Smaller niche players are carving out differentiated value propositions by focusing on high-purity chelating systems and targeted niche applications such as ultra-high purity steam boilers or pharmaceutical process lines. These companies often collaborate with research institutions to validate performance under strict regulatory regimes and establish credibility in specialized markets. Collectively, these competitive advancements signal a market environment where both scale and agility determine success, encouraging cross-sector alliances and technology licensing agreements.

This comprehensive research report delivers an in-depth overview of the principal market players in the Industrial Descaler market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Apex Engineering Products Corporation

- Ases Chemical Works.

- chempace corporation

- Chemtrol Industrial Compounds

- CLR Brands by Jelmar, LLC.

- Delta Products Group.

- Ecolab Inc.

- ELI.CHEM S.r.l.

- Environmental Fluid Systems Pty Ltd

- Goodway Technologies corp.

- Guardian Chemicals Inc.

- Henkel AG & Co. KGaA

- Jayne Products Inc.

- LK CHEMICALS PVT LTD

- NCH Corporation

- Novel Surface Treatments.

- Seacole

- Shrioum Chemicals

- Solenis LLC

- Struvite Remover STSR

- Venlar Corporation

Providing Strategic Actionable Recommendations to Empower Industry Stakeholders in Optimizing Descaling Operations and Maximizing Value Realization

To capitalize on emerging trends and fortify market leadership, industry stakeholders should prioritize the integration of digital maintenance platforms with advanced descaler chemistries. By embedding real-time monitoring sensors within process loops, maintenance teams can shift from periodic cleansing campaigns to continuous, data-driven interventions that preempt scale formation. Additionally, organizations must refine their supply chain architectures by cultivating relationships with both domestic producers and specialized distributors, thereby reducing exposure to tariff-induced volatility and logistical bottlenecks.

Product development roadmaps should emphasize cross-functional performance, incorporating corrosion inhibitors and biodegradable solvents to align with evolving environmental regulations. Firms are also encouraged to explore outcome-based contracting models, wherein service providers assume performance risk in exchange for premium pricing tied to uptime guarantees. Finally, collaboration with regulatory bodies and industry associations can accelerate the adoption of standardized testing protocols, fostering greater transparency and trust among end users evaluating descaling alternatives.

Outlining Rigorous Research Methodology Emphasizing Data Integrity Comprehensive Analysis and Validation Procedures for Insights Credibility

This research leverages a multi-tiered approach to ensure comprehensive coverage and analytical rigor. Primary data was collected through structured interviews with over fifty maintenance engineers, procurement specialists and chemical formulators across key industrial verticals. These conversations provided granular insights into current practices, performance pain points and future investment priorities. Supplementing this qualitative input, a wide-ranging survey captured perspectives on formulation preferences, application challenges and service delivery expectations, ensuring statistical robustness across geographic regions and end user categories.

Secondary research entailed an exhaustive review of peer-reviewed journals, industry association publications and regulatory filings, complemented by an analysis of corporate disclosures, whitepapers and technical bulletins. Data triangulation protocols were applied to validate conflicting findings, while expert panel reviews were commissioned to assess methodological soundness and interpret complex technical data. The resulting framework adheres to stringent data integrity standards, providing decision-makers with reliable insights that can inform strategic planning and operational optimization.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Industrial Descaler market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Industrial Descaler Market, by Type

- Industrial Descaler Market, by Form

- Industrial Descaler Market, by Deposit Type

- Industrial Descaler Market, by Concentration Level

- Industrial Descaler Market, by Distribution Channel

- Industrial Descaler Market, by Application

- Industrial Descaler Market, by Industry Vertical

- Industrial Descaler Market, by Region

- Industrial Descaler Market, by Group

- Industrial Descaler Market, by Country

- United States Industrial Descaler Market

- China Industrial Descaler Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 2544 ]

Summarizing Key Findings and Strategic Considerations That Shape the Future Trajectory of Industrial Descaler Solutions and Market Ecosystem

The collective analysis underscores the rising imperative for integrated descaling solutions that unify green chemistries, digital monitoring and service-based delivery models. Segmentation analysis reveals that liquid and powder forms serve distinct operational preferences, while distribution channels dictate the depth of technical support and geographic reach. Type differentiation among acidic, alkaline and chelating agents signals an ongoing need for tailored formulations, and application-specific insights highlight the criticality of equipment compatibility across cooling towers, heat exchangers, boilers and pipelines.

Regional evaluations illustrate that regulatory environments and infrastructure profiles shape product development and supply chain strategies, with the Americas, EMEA and Asia-Pacific each presenting unique opportunities and challenges. Competitive dynamics point to a marketplace where both established chemical conglomerates and specialized innovators vie for advantage through collaborations, technology integration and service excellence. By focusing on actionable recommendations-ranging from digital transformation to strategic sourcing-industry leaders can navigate tariff headwinds, regulatory pressures and evolving customer expectations to secure long-term growth and resilience.

Reach Out to Ketan Rohom Associate Director Sales and Marketing to Unlock Comprehensive Industrial Descaler Market Intelligence for Informed Decision Making

Elevate your organization’s strategic capabilities by partnering with Ketan Rohom, Associate Director of Sales and Marketing, to gain immediate access to the comprehensive Industrial Descaler market research report. Through a personalized consultation, you will explore in depth the critical learnings on product innovation trajectories, regulatory influences and the competitive landscape shaping the descaler market. Ketan will guide you through tailored insights that align with your unique operational challenges and strategic goals, enabling your team to leverage breakthrough applications and secure a leading position in the maintenance solutions arena. This direct engagement ensures your stakeholders receive the latest intelligence and actionable data needed to optimize procurement, refine product portfolios and realize sustainable cost efficiencies. Reach out today to transform your maintenance strategy with unparalleled clarity and confidence.

- How big is the Industrial Descaler Market?

- What is the Industrial Descaler Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?