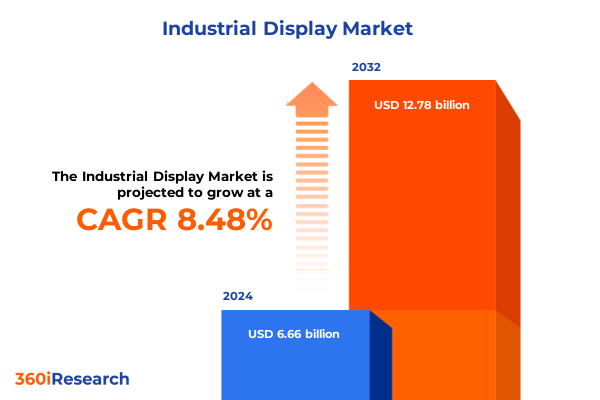

The Industrial Display Market size was estimated at USD 7.14 billion in 2025 and expected to reach USD 7.67 billion in 2026, at a CAGR of 8.65% to reach USD 12.78 billion by 2032.

Unveiling the dynamic convergence of material breakthroughs, connectivity, and edge intelligence propelling the evolution of industrial display solutions

The industrial display market is undergoing rapid transformation as emerging technologies converge with evolving customer demands to unlock new capabilities. Material innovations such as microLED and flexible substrates are enhancing brightness, durability, and custom form factors, while advances in semiconductor processes are driving down power consumption and enabling higher pixel densities. At the same time, the integration of connectivity protocols and edge computing modules is turning standalone screens into intelligent nodes within broader automation and analytics ecosystems. As a result, industrial displays are no longer passive indicators but active participants in real-time decision making and performance optimization.

In parallel, the shift toward modular architectures and open standards is fostering greater interoperability between displays and peripheral devices, reducing integration timelines and total cost of ownership. Collaborative ecosystems among panel manufacturers, system integrators, and software platform providers are accelerating go-to-market cycles for specialized solutions, from ruggedized control panels in harsh environments to high-contrast signage in outdoor settings. This dynamic convergence of material science, electronics, and software is setting the stage for a new era of industrial display deployments, characterized by agility, resilience, and data-driven intelligence.

Exploring how edge AI, next-generation touch interfaces, and digital twins are revolutionizing industrial display applications

Recent years have witnessed transformative shifts reshaping the industrial display landscape. Edge AI has migrated from conceptual frameworks into operational reality, with microcontrollers embedding machine learning capabilities directly on the display hardware to enable predictive maintenance and quality inspection at the point of action. For instance, STMicroelectronics’ STM32N6 series microcontrollers integrates AI accelerators to perform image and audio analysis locally, minimizing latency and bandwidth requirements for industrial systems. Concurrently, leading semiconductor manufacturers are repositioning AI inference from centralized data centers to the edge, as highlighted by AMD’s CTO, marking a pivot toward on-device intelligence that enhances responsiveness and data privacy.

Meanwhile, the push for seamless human-machine interaction is intensifying, with manufacturers embedding capacitive and optical touch technologies alongside advanced gesture recognition APIs. This fusion of tactile and visual feedback is elevating operator ergonomics across manufacturing floors, transportation hubs, and healthcare facilities. In addition, digital twin frameworks are leveraging high-fidelity displays as real-time mirrors of physical assets, enabling remote diagnostics and collaborative troubleshooting across global networks. As each of these shifts interlocks with wider Industry 4.0 initiatives and smart factory deployments, industrial displays are evolving into versatile hubs at the intersection of automation, data analytics, and operational excellence.

Assessing the multifaceted impact of evolving U.S. tariffs on industrial display supply chains, cost structures, and strategic sourcing paradigms

The 2025 United States tariff landscape has introduced significant headwinds and strategic considerations for industrial display supply chains. At the start of the year, the USTR increased tariffs on semiconductors under HTS headings 8541 and 8542 from 25% to 50%, affecting key driver ICs and panel-driving components imported from China and other regions. While this measure aimed to bolster domestic production, it also elevated input costs for manufacturers reliant on specialized glass substrates, backplane electronics, and optical films.

In May 2025, a 90-day reciprocal tariff reduction agreement with China temporarily lowered select duties from 125% to 10%, offering a brief reprieve for importers of Chinese-origin display modules. However, existing Section 301 and IEEPA tariffs ranging from 7.5% to 25% remained intact, sustaining lingering uncertainty for supply chain planning. Price volatility and potential stockpiling became common tactics, as companies weighed the cost of storage against the risk of future rate increases.

Adding to the complexity, tariff uncertainty has exerted downward pressure on demand and strained relationships with material suppliers. TrendForce reports that elevated duties on AMOLED organic light-emitting materials and optical components are set to drive up production costs, potentially dampening end-user demand unless pass-through price adjustments occur. In response, some brands have secured exemptions or shifted production to tariff-free jurisdictions, while digital signage integrators await clarity on scope extensions and long-term policy outcomes. This confluence of measures underscores the critical need for agile sourcing strategies and diversified manufacturing footprints.

Deep-dive segmentation analysis revealing how panel type, display size, touch technology, resolution, and end-user industry define distinct market niches

A comprehensive segmentation lens reveals distinct niches and competitive dynamics across the industrial display market. Panel types range from traditional twisted nematic (TN) modules to advanced rigid and flexible OLED solutions, with monochrome and color configurations serving specialized instrumentation and operator guidance applications. Flexible OLED panels, in particular, are carving out opportunities in curved, wearable, and embedded scenarios where conformality and thin-film durability are paramount. Each panel technology must be evaluated in terms of response time, contrast ratio, and environmental tolerance to align with sector-specific requirements.

Display size further refines the landscape, spanning miniature screens under 3.5 inches for handheld diagnostics to expansive video walls exceeding 30 inches for command-center visualization. Mid-tier segments between 7 and 20 inches remain the workhorses for human-machine interface deployments, and manufacturers often tailor bezel profiles and mounting architectures to streamline integration into enclosures and control cabinets.

Touch technology is another axis of differentiation, encompassing resistive, surface acoustic wave, infrared, optical, and capacitive options. Projected capacitive and surface capacitive solutions dominate interactive kiosks and high-traffic environments, while frame-based infrared and optical imaging touchscreens excel in rugged or high-glove settings. Meanwhile, mechanical 4-wire and 5-wire resistive touch panels persist in legacy installations and cost-sensitive projects.

Resolution choices-from standard HD through Full HD, QHD, and 4K-play a critical role in balancing image fidelity against bandwidth constraints and power consumption. Ultra-high resolutions are increasingly adopted for detailed machine vision feedback and advanced control-room displays, while HD and Full HD panels continue to satisfy basic monitoring applications.

End-user industries form the final segmentation layer, with automotive, energy, healthcare, manufacturing, military & defense, retail, and transportation each driving distinct performance and regulatory requirements. Automotive HMIs leverage aftermarket and OEM variants for in-vehicle telematics, while oil & gas and renewable energy projects demand intrinsically safe, explosion-proof displays. Healthcare environments require diagnostic-grade luminance and clean-room compliance, and military platforms impose stringent MIL-STD vibration, shock, and temperature tests. Retail and e-commerce digital signage must balance vibrant color reproduction with remote management capabilities, and rail, aviation, and marine sectors call for high-visibility, sunlight-readable interfaces.

This comprehensive research report categorizes the Industrial Display market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Panel Type

- Display Size

- Touch Technology

- Resolution

- End User Industry

Uncovering regional industrial display dynamics influenced by localized incentives, regulatory frameworks, and automation initiatives across key global markets

Regional nuances fundamentally shape the evolving industrial display market, creating tailored demand vectors across the Americas, the Europe-Middle East & Africa cluster, and Asia-Pacific. In the Americas, legacy manufacturing hubs and extensive infrastructure modernization programs drive retrofit projects that replace aging CRTs and low-contrast panels with energy-efficient glass surfaces. Localized manufacturing clusters and government incentives have reinforced nearshore supply chains, enabling rapid fulfillment of defense-grade and medical-certified displays for mission-critical applications.

Within Europe, Middle East & Africa, a blend of sustainability mandates and usability standards elevates interest in eco-friendly, ergonomic display modules. Industry 4.0 initiatives in Germany, France, and the UK emphasize human operators’ well-being through user-centric HMI designs that comply with ISO 9241-210 standards, while Gulf region oil and gas projects demand explosion-proof screens built to IEC 60079-2025 protocols. Smart city deployments across the EMEA corridor further amplify demand for large-format digital signage and interactive kiosks that integrate seamlessly with public infrastructures.

Asia-Pacific continues to lead in capacity expansion and volume uptake, underpinned by robust factory automation in China, electronics manufacturing clusters in Taiwan and South Korea, and burgeoning industrial investment in India. National capex incentives have accelerated panel plant expansions, and ecosystem partnerships among glass fabricators, semiconductor fabs, and system integrators facilitate rapid innovation cycles. As a result, Asia-Pacific not only commands the largest share of module shipments but also serves as the proving ground for next-generation OLED and microLED rollouts.

This comprehensive research report examines key regions that drive the evolution of the Industrial Display market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Strategic profiles of leading panel, systems integration, and platform providers spearheading innovation in industrial display solutions

Leading organizations are actively defining the future of industrial displays through strategic investments and collaborative ecosystems. Panel suppliers such as Samsung Display and LG Display are advancing OLED and microLED capabilities, focusing on miniaturized pixel pitches and flexible form factors to meet the stringent requirements of automotive dashboards and wearable HMIs. TrendForce highlights Samsung’s dominance in large-sized microLED video walls and underscores ongoing partnerships between Chinese chipmakers and global brands to optimize cost structures.

Systems integrators and embedded computing pioneers like Kontron are differentiating through integrated edge AI modules and robust cybersecurity features. At Embedded World 2025, Kontron showcased its AI-based intrusion detection firewall and high-performance KBox industrial PCs designed for NIS-2 compliance and real-time monitoring in hazardous environments. Similarly, Advantech’s EdgeAI SDK platform exemplifies how edge AI developer tools accelerate AI inference deployment on industrial motherboards, enhancing on-device intelligence for quality control and predictive maintenance.

Platform providers such as Siemens leverage their MindSphere IoT ecosystem to integrate high-brightness open-frame modules into broader automation workflows, enabling synchronized video walls and remote diagnostics. Meanwhile, operators like ELO Touch and Planar Systems capitalize on capacitive touch innovations to deliver scalable, multi-touch HMIs for retail kiosks and command centers. Collectively, these companies are converging display hardware with software ecosystems and data platforms to offer end-to-end solutions tailored for mission-critical industrial environments.

This comprehensive research report delivers an in-depth overview of the principal market players in the Industrial Display market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AAEON Technology Inc.

- ABB Ltd.

- ADLINK Technology Inc.

- AU Optronics Corp.

- Axiomtek Co., Ltd.

- Barco N.V.

- BOE Technology Group Co., Ltd.

- Coretronic Corporation

- EIZO Corporation

- General Electric Company

- HannStar Display Corporation

- Hope Industrial Systems, Inc.

- Innolux Corporation

- Japan Display Inc.

- Kontron AG

- LG Display Co., Ltd.

- NEC Display Solutions, Ltd.

- Pepperl + Fuchs SE

- Samsung Display Co., Ltd.

- Sharp Corporation

- Sparton Corporation

- TCL China Star Optoelectronics Technology Co., Ltd.

- Tianma Microelectronics Co., Ltd.

- Winmate Inc.

Actionable strategies to reinforce supply chain resilience, accelerate next-generation display adoption, and align solutions with regional regulatory imperatives

To capitalize on emerging opportunities and navigate ongoing disruptions, industry leaders should adopt an integrated technology and supply chain strategy. First, prioritize sourcing agreements that encompass tariff-diverse jurisdictions, combining localized manufacturing with strategic partnerships to mitigate cost exposure and maintain inventory agility. Concurrently, embed modular edge AI architectures directly into display units to unlock on-device analytics for predictive maintenance and quality control, reducing reliance on centralized computing infrastructures.

Second, accelerate the adoption of higher-performance panel technologies by initiating pilot programs for flexible OLED and microLED displays in niche use cases, such as curved control panels and transparent signage. These pilots will yield real-world data on cost-benefit tradeoffs and inform broader rollout strategies. Simultaneously, harmonize touch interface standards across product lines to streamline software integration and reduce certification overhead, thereby enhancing time to market.

Third, strengthen regional channels by aligning product roadmaps with local regulatory and sustainability mandates. For North America, emphasize cybersecurity and defense certifications; for EMEA, integrate energy-efficient components and ergonomic designs; for Asia-Pacific, leverage local fabrication incentives and ecosystem collaborations. Finally, invest in co-innovation frameworks with key customers and technology partners, fostering agile pilot deployments that drive iterative improvement. By implementing these measures, leaders can reinforce competitive positioning, accelerate adoption, and future-proof their industrial display portfolios.

Comprehensive methodology synthesizing executive interviews, structured surveys, and multivariate segmentation to underpin robust industrial display insights

This research leverages a multifaceted methodology anchored in rigorous primary and secondary data sources. We conducted in-depth interviews with over 40 senior executives and technical leaders across panel manufacturers, systems integrators, and end-user organizations to capture qualitative insights on technology adoption drivers and pain points. Complementing this, structured surveys of equipment buyers across automotive, energy, and manufacturing sectors provided quantitative validation of adoption curves and feature prioritization.

On the secondary research front, we reviewed industry publications, analyst reports, and regulatory filings to track tariff developments, capacity expansions, and emerging product roadmaps. Patent activity, financial statements, and corporate presentations were systematically analyzed to identify strategic investments and competitive dynamics. Where available, we cross-referenced import/export databases and customs records to map supply chain shifts and assess regional production footprints.

Analytical frameworks employed include multivariate segmentation analysis to delineate niches by panel type, size, resolution, and touch technology, as well as scenario modeling to stress-test tariff impacts on cost structures. We also applied qualitative trend extrapolation techniques to project adoption pathways for microLED, flexible OLED, and edge AI integration over the coming 24–36 months. This comprehensive approach ensures that our findings are both robust and actionable for decision-makers.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Industrial Display market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Industrial Display Market, by Panel Type

- Industrial Display Market, by Display Size

- Industrial Display Market, by Touch Technology

- Industrial Display Market, by Resolution

- Industrial Display Market, by End User Industry

- Industrial Display Market, by Region

- Industrial Display Market, by Group

- Industrial Display Market, by Country

- United States Industrial Display Market

- China Industrial Display Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 4134 ]

Synthesized conclusions highlighting the intersection of material innovation, embedded intelligence, and regional dynamics shaping industrial display strategies

The industrial display market stands at an inflection point defined by the convergence of advanced materials, embedded intelligence, and dynamic regulatory landscapes. As microLED and flexible OLED technologies transition from prototype to production scale, they will unlock new form factors and performance tiers for industrial applications. Edge AI integration within display hardware is poised to redefine real-time analytics, shifting the locus of decision making closer to operational environments and reducing latency in critical processes.

Tariff developments in 2025 have introduced complexity but also underscore the strategic imperative of diversified manufacturing footprints and agile sourcing. Companies that anticipate policy shifts and secure pragmatic exemptions will gain a cost-competitive edge, while others risk margin erosion and supply chain disruptions. Meanwhile, segmentation insights reveal that end-user latitude-from automotive OEMs to military systems integrators-requires purpose-built configurations spanning touch technologies, resolution standards, and durability ratings.

Regionally, the Americas, EMEA, and Asia-Pacific each present unique drivers-from defense certification protocols to smart city initiatives and large-scale factory automation-that demand tailored solutions and localized support infrastructures. Leading display and integration companies are already forging collaborative ecosystems to deliver turnkey offerings that encapsulate hardware, software, and lifecycle services. For industry leaders, the path forward lies in synchronizing technology pilots, regulatory alignment, and strategic partnerships to navigate this dynamic landscape successfully.

Secure personalized access to comprehensive industrial display market insights through direct collaboration with Ketan Rohom

Elevate your strategic positioning in the industrial display sector by securing the full market research report. Engage directly with Ketan Rohom, Associate Director of Sales & Marketing, to discuss tailored insights and exclusive data packages. His expertise will guide you to the precise information you need to inform critical decisions and identify high-impact opportunities. Connect with Ketan to arrange a personalized briefing and gain immediate access to the comprehensive analysis that will empower your organization to navigate market complexities and gain a competitive edge.

- How big is the Industrial Display Market?

- What is the Industrial Display Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?