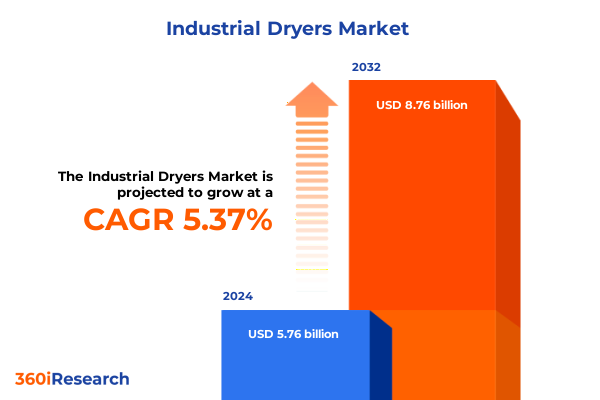

The Industrial Dryers Market size was estimated at USD 6.07 billion in 2025 and expected to reach USD 6.40 billion in 2026, at a CAGR of 5.38% to reach USD 8.76 billion by 2032.

Understanding the Fundamentals of Advanced Industrial Drying Technologies and Their Role in Modern Manufacturing and Processing Environments

The industrial drying sector encompasses a diverse array of technologies designed to remove moisture from solids, liquids, and gases across multiple applications. From the gentle sublimation of freeze dryers to the high-throughput capacities of spray dryers, each dryer type is engineered to meet specific processing requirements, whether preserving heat-sensitive pharmaceutical ingredients or rapidly dehydrating minerals for cement production. The evolution of these technologies has been driven by the dual imperative of energy efficiency and product quality, prompting a shift toward hybrid systems that integrate thermal, mechanical, and vacuum mechanisms. As manufacturers face tighter environmental regulations and rising energy costs, the demand for sophisticated control systems and low-emission energy sources has never been greater.

In parallel, innovation in automation and process analytics has enabled real-time monitoring of moisture content, thermal profiles, and airflow dynamics, enhancing consistency and reducing waste. These advances herald a new era of responsive drying solutions that adapt to feedstock variations and optimize throughput. Moreover, digital twins and predictive maintenance are transforming equipment reliability, minimizing downtime, and extending service life. This introduction lays the foundation for understanding how industrial dryers are pivotal to operational efficiency, product integrity, and sustainability in today’s manufacturing landscape.

Exploring the Convergence of Sustainability, Digitization, and Collaborative Innovation Redefining Industrial Dryers Performance

Recent years have witnessed transformative shifts reshaping the industrial dryer landscape, catalyzed by accelerating sustainability mandates and the integration of Industry 4.0 principles. Manufacturers are increasingly adopting energy sources such as electric induction, resistive heating, and solar thermal to reduce carbon footprints and comply with stringent emissions standards. Simultaneously, the convergence of automation, data analytics, and Internet of Things connectivity has redefined equipment performance benchmarks. Smart sensors now track parameters like moisture gradients and heat distribution, enabling adaptive control strategies that dynamically adjust thermal inputs and airflow rates for optimal drying efficiency.

On the competitive front, strategic partnerships between technology providers and end-use operators are driving co-development initiatives focused on modular, scalable solutions. This collaborative approach accelerates time to market for customized systems, whether batch fluid bed dryers designed for specialty chemicals or multi-pass tunnel dryers tailored to high-volume food processing. Additionally, growing demand for flexible manufacturing is propelling the rise of hybrid configurations, where conduction, convection, and radiation modes are combined to address diverse material properties. These transformative shifts underscore a paradigm where agility and sustainability are paramount, setting the stage for tariff impacts and segmentation trends to further influence market trajectories.

Assessing How Revised United States Tariffs on Critical Dryer Components Are Driving Supply Chain Resilience and Domestic Sourcing Strategies

In 2025, the United States implemented a revised tariff regime targeting key components and raw materials used in industrial dryer manufacturing. These measures have introduced incremental cost pressures for equipment producers that rely on imported stainless steel, specialized control electronics, and advanced thermal insulation materials. As a result, some manufacturers have sought to localize supply chains, forging alliances with domestic steel mills and electronics fabricators to mitigate exposure to import levies. This reshoring trend has contributed to shorter lead times but has also intensified competition among local suppliers, driving further negotiations on material quality, delivery schedules, and cost efficiencies.

Meanwhile, importers of complete dryer systems have responded by reassessing procurement strategies, consolidating orders to negotiate volume discounts, and exploring alternative materials that offer comparable thermal performance. In certain cases, end-use operators have opted to refurbish existing dryers through retrofit programs that incorporate energy recovery modules and smart controls, thereby extending asset lifecycles and offsetting elevated capital expenditures. Though the tariff changes have temporarily dampened growth for some segments, they have also accelerated innovation in domestic manufacturing capabilities and underscored the strategic importance of supply chain resilience.

Unveiling In-Depth Perspectives on Type, Energy Source, Material, Heat Transfer Mode, and End-Use Industry Segmentation of Industrial Dryers

The industrial dryers market is distinguished by a rich tapestry of product types, each addressing specific drying challenges. Drum dryers such as single and double drum variants excel in continuous, high-viscosity processing, while tray dryers, available in static and conveyor configurations, offer gentle heat treatment for temperature-sensitive materials. Rotary dryers, whether direct or indirect, handle bulk solid drying with precise residence time control, and tunnel dryers accommodate high-volume food processing through single or multi-pass designs. Spray dryers, featuring single and two-stage atomization, are indispensable for fine particulate generation, whereas vacuum and freeze dryers, including shelf, cabinet, manifold, and tray models, preserve molecular integrity in pharmaceutical and biotech applications. Fluid bed dryers, in both batch and continuous formats, leverage controlled aeration to achieve uniform moisture reduction.

Energy sources further refine system selection, with biomass options like agricultural waste and wood chips offering renewable heat, and gas-fired systems utilizing LPG or natural gas for versatile thermal profiles. Electric dryers harness induction or resistive heating for precise temperature modulation, and solar-powered units leverage photovoltaic or thermal collectors in off-grid setups. Materials spanning food and beverage, ceramics, chemicals, minerals, and biomass feedstocks each impose unique drying kinetics, influencing equipment geometry and heat transfer modes-conduction, convection, or radiation. End-use industries from agriculture to cement, textiles to power generation shape performance criteria, driving tailored solutions that reflect the intersection of type, energy, material, transfer mode, and industry-specific requirements.

This comprehensive research report categorizes the Industrial Dryers market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Energy Source

- Material

- Heat Transfer Mode

- End Use Industry

Highlighting How Regional Regulations, Industrial Growth Patterns, and Energy Incentives Shape Technology Preferences Across Key Global Markets

Regional dynamics exert a profound influence on industrial dryer adoption and development. In the Americas, mature manufacturing hubs in the United States and Canada prioritize advanced automation and regulatory compliance, prompting widespread integration of smart sensor networks and emissions-control upgrades. Latin American markets are characterized by growth in food processing and mineral drying, leveraging cost-effective rotary and tunnel dryer solutions to address export-driven agricultural and mining sectors.

Across Europe, Middle East & Africa, stringent environmental legislation and aggressive carbon-neutral targets have accelerated uptake of biomass and electric heating technologies, complemented by government incentives for waste-to-energy initiatives. The Middle East’s expanding petrochemical and fertilizer industries are driving demand for high-capacity spray and fluid bed dryers, while African mining operations increasingly invest in robust rotary and tray dryer installations to optimize mineral beneficiation workflows.

In Asia-Pacific, the convergence of rapid industrialization and sustainability commitments has sparked significant investment in solar thermal and waste heat recovery systems across China, India, and Southeast Asia. Growth in pharmaceuticals, food processing, and textiles is propelling adoption of freeze and spray dryers, supported by regional OEMs expanding localized production to meet stringent quality and hygiene standards. These regional variations shape technology preferences and supply chain configurations, underscoring the need for market participants to align offerings with localized performance expectations and regulatory frameworks.

This comprehensive research report examines key regions that drive the evolution of the Industrial Dryers market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing How Leading Equipment Manufacturers Combine R&D, Strategic Partnerships, and Service Excellence to Dominate the Industrial Dryers Market

The competitive landscape of industrial dryers is defined by firms that combine engineering excellence with service depth and global reach. Industry leaders are distinguished by their ability to deliver turnkey solutions, encompassing design consultation, installation, and lifecycle maintenance. Companies investing heavily in R&D have introduced modular platforms that accommodate hybrid heating modes and integrate digital twins for simulation-based optimization. Strategic acquisitions have bolstered portfolios, enabling key players to offer end-to-end process lines that include pre-drying, energy recovery, and robotics‐enabled material handling.

Service quality remains a critical differentiator, with top manufacturers providing remote diagnostics, predictive maintenance contracts, and performance benchmarking to minimize downtime. Collaboration with academic and governmental research institutions accelerates the development of next-generation insulation materials, advanced heat exchangers, and low-emission burners. As aftermarket services gain prominence, firms with extensive spare parts networks and local field service teams are gaining an edge in markets where uptime and regulatory compliance are non-negotiable.

This comprehensive research report delivers an in-depth overview of the principal market players in the Industrial Dryers market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Andritz AG

- B&C Technologies

- Bühler AG

- BÜTTNER Energy and Drying Technology GmbH

- Changzhou Yibu Drying Equipment Co., Ltd.

- Coperion GmbH

- Fanqun Drying Equipment Co.,Ltd

- GEA Group Aktiengesellschaft

- GEM MACHINERY & ALLIED INDUSTRIES

- Godfrey & Wing, LLC

- HEINKEL Process Technology GmbH

- Hosokawa Micron Corporation

- Jiangsu Jinling Drying Technology Co., LTD

- Spooner Industries Limited

- SPX FLOW, Inc.

- Tetra Pak International S.A.

- Ventilex B.V.

- Wuxi Fenghua drying equipment Co. Ltd.

- Yamato Scale Co., Ltd.

Guiding Industry Leaders to Drive Competitive Advantage Through Modularity, Energy Diversification, and Data-Driven Maintenance Strategies

Industry leaders should prioritize the design of flexible, modular dryer platforms capable of seamless integration with existing plant infrastructure. Embracing energy diversification-such as combining solar thermal preheating with natural gas backup-can deliver both cost savings and environmental benefits. Decision makers are advised to forge strategic alliances with local materials suppliers to secure quality components at competitive prices, thereby insulating against tariff fluctuations and supply chain disruptions.

Investing in digital infrastructure, including cloud-based analytics and machine learning algorithms, will enable operators to transition from reactive maintenance to predictive care, reducing unplanned stoppages and extending equipment lifespan. Leadership teams should also assess retrofit opportunities for aging assets, evaluating enhancements like heat recovery economizers and advanced control valves to boost throughput without large capital outlays. Finally, cultivating cross-functional teams that include process engineers, sustainability specialists, and data scientists will foster a culture of continuous improvement and drive accelerated adoption of cutting-edge drying solutions.

Detailing a Robust Multistage Research Methodology Combining Secondary Analysis, Executive Interviews, and Quantitative Surveys for Reliable Insights

This report employed a rigorous multi-stage research methodology to ensure comprehensive coverage and data integrity. Secondary research entailed the examination of regulatory filings, technical whitepapers, and academic journals to identify emerging technology trends and legislative influences. Trade association publications and patent databases provided additional insights into R&D trajectories and intellectual property developments.

Primary research involved structured interviews with C-level executives, process engineers, and procurement managers across key regions to capture firsthand perspectives on equipment performance, sourcing challenges, and sustainability mandates. Quantitative surveys of end users in food processing, pharmaceuticals, mining, and chemical manufacturing yielded statistically significant data on adoption rates, satisfaction levels, and capital expenditure priorities.

Data triangulation was achieved by cross-referencing secondary and primary findings, ensuring consistent validation of market drivers, segmentation dynamics, and regional growth patterns. In addition, expert panel reviews were conducted to stress-test assumptions and refine analytical models. The resulting framework offers robust, actionable intelligence designed to inform strategic planning and investment decisions.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Industrial Dryers market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Industrial Dryers Market, by Type

- Industrial Dryers Market, by Energy Source

- Industrial Dryers Market, by Material

- Industrial Dryers Market, by Heat Transfer Mode

- Industrial Dryers Market, by End Use Industry

- Industrial Dryers Market, by Region

- Industrial Dryers Market, by Group

- Industrial Dryers Market, by Country

- United States Industrial Dryers Market

- China Industrial Dryers Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 5088 ]

Summarizing the Strategic Imperatives of Sustainability, Digitalization, and Supply Chain Resilience That Will Shape the Future of Industrial Dryers Market

Industrial dryers stand at the nexus of operational efficiency, product quality, and environmental stewardship. The interplay of evolving energy sources, advanced control systems, and strategic supply chain realignments underscores a market in flux, driven by sustainability imperatives and digital transformation. Tariff shifts have highlighted the strategic value of domestic sourcing and retrofit initiatives, while segmentation insights reveal the nuanced requirements of diverse end-use sectors. Regional nuances further underscore the importance of tailored solutions, as regulatory landscapes and industrial growth trajectories diverge globally.

For stakeholders seeking to navigate this complex ecosystem, the blend of modular design principles, hybrid energy applications, and predictive analytics offers a compelling path forward. By aligning technology adoption with energy incentives and local market conditions, organizations can unlock new efficiencies and strengthen competitive positioning. As the industrial dryer sector continues to evolve, informed decision making grounded in rigorous research will be essential for sustaining growth and achieving long-term resilience under shifting regulatory and economic pressures.

Unlock Personalized Market Insights and Strategic Expertise by Connecting with Ketan Rohom to Secure Your Comprehensive Industrial Dryers Report

To obtain an in-depth exploration of the global industrial dryers landscape and receive tailored insights that drive strategic decision making, reach out to Ketan Rohom, Associate Director of Sales & Marketing. Ketan’s expertise spans market dynamics, competitive positioning, and end-use requirements, ensuring that each discussion translates into actionable intelligence for your organization. Engaging with Ketan provides direct access to customizable report packages, priority research updates, and bespoke advisory sessions that align with your specific business objectives. Capitalize on the opportunity to transform your understanding of industrial dryer technologies, tariff impacts, segmentation nuances, and regional growth drivers by securing your copy of the comprehensive market research report today. Connect with Ketan Rohom to unlock data-driven insights and maintain a competitive edge across evolving manufacturing and processing sectors.

- How big is the Industrial Dryers Market?

- What is the Industrial Dryers Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?