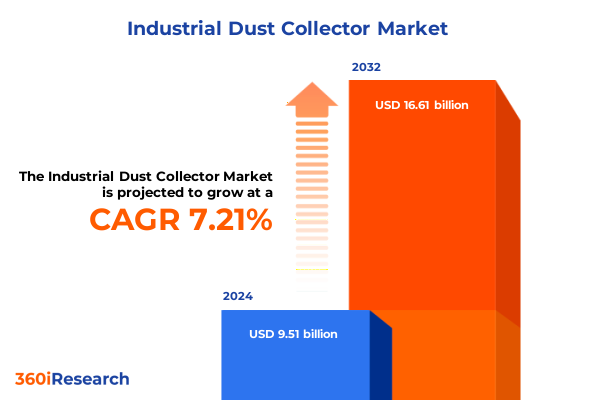

The Industrial Dust Collector Market size was estimated at USD 10.04 billion in 2025 and expected to reach USD 10.61 billion in 2026, at a CAGR of 7.44% to reach USD 16.61 billion by 2032.

Empowering Industrial Air Quality Management with Innovative Dust Collector Solutions for Enhanced Workplace Safety and Environmental Compliance

Industrial operations across manufacturing, processing, and energy generation consistently confront the challenge of airborne particulate matter that can compromise both human health and equipment longevity. Dust collection systems serve as a critical barrier, preventing the release of hazardous particles into the workplace, ensuring compliance with stringent emissions regulations, and safeguarding the surrounding environment. By capturing fine and coarse particulates at the source, these systems not only uphold air quality standards but also reduce potential liabilities associated with operator exposure and fines for noncompliance.

In recent years, technological advancements have transformed the capabilities of dust collectors far beyond basic filtration. Integrating digital sensors for real-time performance monitoring enables predictive maintenance, minimizing unplanned downtime and extending filter lifespan. Enhanced filter media, including specialized synthetic fibers and high-performance polyester blends, deliver superior particulate capture across a broad range of industrial dust types. As operators adopt advanced control algorithms and automation, system responsiveness improves, driving operational efficiency while reducing energy consumption and overall lifecycle costs.

This executive summary synthesizes the most pertinent industry developments, examining transformative market shifts, the cumulative impact of the 2025 tariff environment, detailed segmentation analysis, and regional dynamics. Strategic insights into leading company initiatives and actionable recommendations will empower stakeholders to make informed decisions. A transparent research methodology underpins these findings, followed by a concise conclusion that distills core imperatives. Finally, an invitation to connect with our expert liaison provides a direct path to secure the full report and customized consultation.

Navigating Evolving Market Dynamics Driven by Digital Transformation Sustainability Imperatives and Regulatory Intensification in Dust Collection Technology

The industrial dust collection landscape is undergoing a profound transformation driven by digital integration, heightened regulatory pressures, and a collective shift toward sustainable practices. Operators are increasingly embedding Internet of Things (IoT) capabilities into filtration equipment, enabling continuous data collection on airflow, pressure differentials, and particulate buildup. These insights fuel predictive maintenance programs that anticipate filter replacement needs, thereby optimizing uptime and reducing unplanned service costs. In parallel, cloud-based platforms facilitate remote monitoring, allowing central teams to oversee multiple sites and rapidly respond to anomalies without onsite intervention.

Sustainability imperatives are reshaping how organizations evaluate equipment performance. Extended filter life through advanced synthetic media and low-emission fan technologies contributes to lower energy footprints and reduced waste. As carbon reduction targets tighten, plant managers are prioritizing systems that not only meet compliance thresholds but also demonstrate measurable improvements in operational efficiency. This focus extends beyond the equipment itself to encompass the full lifecycle, including disposal or recycling protocols for spent filter elements, reinforcing a circular approach to industrial maintenance.

Concurrently, regulatory frameworks continue to evolve with stricter particulate emission limits and more rigorous enforcement across key manufacturing hubs. In response, vendors are accelerating research into multi-stage filtration architectures and hybrid systems that combine mechanical and electrostatic capture techniques. As these transformative shifts unfold, stakeholders must navigate an increasingly complex ecosystem of technological options, environmental mandates, and performance expectations to secure competitive advantage and maintain adherence to emerging standards.

Assessing the Far-Reaching Consequences of the 2025 United States Tariff Regime on Industrial Dust Collector Supply Chains and Cost Structures

In early 2025, the United States implemented a series of tariffs targeting imported equipment and components used in industrial dust collectors, aiming to bolster domestic manufacturing and protect critical supply chains. These measures imposed additional duties on steel fabrication, filter media substrates, and complete dust collection units originating from key export markets. As a result, original equipment manufacturers and end users have faced heightened input costs, prompting a reassessment of supplier relationships and procurement strategies.

The cumulative impact of these tariffs has manifested in two primary ways: first, manufacturers have encountered margin pressure as pass-through costs challenge traditional pricing structures; second, end users are recalibrating their capital expenditure timelines to account for increased acquisition expenses. Several suppliers have responded by localizing production, partnering with domestic steel mills, and investing in regional filter media plants to mitigate duties and restore competitive pricing. Others are collaborating with international distributors to explore tariff mitigation programs, leveraging free trade agreements and tariff exclusion petitions to preserve access to specialized technologies.

As the tariff environment stabilizes, stakeholders must continue monitoring policy shifts, tracking potential renegotiations of trade agreements, and evaluating the viability of reshoring strategies. Maintaining a diversified supplier base and investing in flexible manufacturing techniques can buffer against future trade volatility. Companies that proactively adapt to this new cost landscape are positioned to secure supply resilience, optimize total cost of ownership, and sustain growth amid evolving trade policy dynamics.

Uncovering Strategic Differentiators Through Multifaceted Segmentation Insights on Product Types End-User Industries and Operational Parameters

Analyzing the market through a product type lens reveals divergent adoption rates across solution architectures. Bag filters have retained broad appeal due to their scalability and ease of maintenance, with pulse jet configurations dominating high-volume operations, reverse air systems supporting intermittent dust loads, and shaker models serving smaller installations. Cartridge filters, prized for compact footprints and high surface area, are increasingly specified in space-constrained facilities, with pleated cartridges favored for fine dust capture and spin clone designs selected for applications demanding rapid pulse cleaning cycles. Cyclone collectors, encompassing multicyclone arrays for pre-filtration and single cyclone units for coarse particulate separation, are valued for simplicity and low operating costs when handling dry, granular materials.

End-user industries display distinct preferences driven by process requirements and regulatory frameworks. Cement & mining sites prioritize robust systems capable of withstanding abrasive environments and elevated temperatures, while chemicals & pharmaceuticals facilities require contamination-resistant housings and filter materials compatible with corrosive particulates. Food & beverage operations often specify stainless steel wet scrubbers and high-efficiency particulate air elements to meet stringent hygiene standards. In metal & mining sectors, ferrous processing favors electrostatic precipitators with plate or tubular configurations to manage high-temperature fume loads, whereas non-ferrous workflows utilize cyclone solutions. Power generation plants balance renewable turbine emissions against thermal boiler ash control, opting for wet scrubbers in biomass contexts and dry collectors in coal-fired units.

Performance characteristics further segment demand based on airflow capacity tiers. Systems engineered for less than 5000 M3/H airflow address artisanal and specialty applications, mid-range units spanning 5000–10000 M3/H serve general manufacturing, and high-capacity assemblies exceeding 10000 M3/H support heavy industrial operations. Filter material innovation-from traditional glass fiber matrices to advanced polyester blends and novel synthetic fiber composites-drives efficiency gains and extended service intervals. Mobility requirements divide portable solutions, suited for mobile welding booths and maintenance tasks, from stationary installations anchored within production lines. Finally, operational modes split the market between batch processes with discrete dusty events and continuous systems handling steady-state dust generation, underscoring the need for tailored control strategies and maintenance cycles.

This comprehensive research report categorizes the Industrial Dust Collector market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Airflow Capacity

- Filter Material

- Mobility

- Operation

- Application Area

- End-User Industry

Deciphering Diverse Regional Market Nuances and Growth Drivers Spanning Americas Europe Middle East Africa and Asia-Pacific

The Americas region continues to lead in technological adoption and regulatory enforcement, with the United States and Canada driving demand for advanced dust collection solutions. Stringent air quality standards, such as those enforced by the Environmental Protection Agency and provincial bodies, encourage capital investments in filtration systems that exceed minimum compliance thresholds. In Latin America, growing manufacturing hubs in Mexico and Brazil are investing in modernized facilities, spurred by nearshoring trends and rising domestic consumption, thus expanding opportunities for both established vendors and emerging local manufacturers.

Europe, the Middle East, and Africa constitute a fragmented yet dynamic market characterized by diverse regulatory regimes and varying investment capacities. Western Europe’s focus on decarbonization and emissions control supports the adoption of hybrid filtration systems that integrate mechanical and electrostatic technologies. In the Middle East, petrochemical and cement industries are expanding amid infrastructure development, prioritizing rugged equipment with high thermal resilience. Across Africa, nascent industrial zones seek cost-effective dust collection solutions, often balancing initial capital constraints against long-term operational reliability.

Asia-Pacific remains the fastest-growing region, driven by rapid industrialization in China, India, and Southeast Asia. Stringent urban air quality initiatives in major metropolitan areas are catalyzing equipment upgrades in cement, metal processing, and chemical sectors. Additionally, governmental incentives for local manufacturing and renewable energy projects support the deployment of dust collectors in biomass and solar component fabrication facilities. As supply chain realignment progresses, regional OEMs and international players are forging joint ventures to capture market share and address localized service requirements.

This comprehensive research report examines key regions that drive the evolution of the Industrial Dust Collector market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining Competitive Strategies and Innovation Pathways Adopted by Leading Manufacturers to Secure Advantage in Dust Collection Landscape

Leading manufacturers are leveraging a combination of product innovation, strategic partnerships, and service differentiation to secure competitive advantage. Companies have increased R&D investments to develop next-generation filter media that deliver enhanced capture efficiency and longer operational lifecycles, while minimizing pressure drop and energy consumption. At the same time, several vendors have entered collaborative agreements with sensor technology providers to embed condition monitoring capabilities directly into collectors, enabling real-time performance analytics and predictive maintenance offerings.

Beyond technological strides, service ecosystems have emerged as a critical battleground. Market leaders are expanding aftermarket support through rapid-response maintenance networks, filter refurbishment programs, and performance-based service contracts that align vendor compensation with uptime metrics. In parallel, some firms are establishing regional manufacturing footprints to shorten delivery lead times, address local content requirements, and mitigate tariff exposure. These strategic moves are complemented by value-added engineering services, such as system design optimization and turnkey installation support, reinforcing vendor roles as trusted partners rather than mere equipment suppliers.

This comprehensive research report delivers an in-depth overview of the principal market players in the Industrial Dust Collector market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- ANDRITZ AG

- Babcock & Wilcox Enterprises, Inc.

- Bharat Heavy Electricals Limited

- Camfil AB

- China National Materials Group Corporation Ltd. (Sinoma)

- Donaldson Company, Inc.

- Eaton Corporation plc

- Filtration Group Corporation

- FLSmidth & Co. A/S

- Fujian Longking Co.,Ltd

- Hamon Group

- KC Cottrell Co., Ltd.

- Kelin Environmental Protection Technology Co., Ltd.

- MANN+HUMMEL GmbH

- Mitsubishi Heavy Industries, Ltd.

- Nederman Holding AB

- Parker-Hannifin Corporation

- Sumitomo Heavy Industries, Ltd.

- Thermax Limited

Implementing Forward-Looking Strategic Initiatives to Maximize Operational Efficiency Expand Market Access and Enhance Competitive Resilience

To stay ahead in a rapidly evolving environment, industry leaders should prioritize the integration of advanced sensing and automation platforms within dust collection systems. By deploying Internet of Things networks and artificial intelligence–powered analytics, organizations can transition from reactive maintenance to proactive asset management, significantly reducing unplanned downtime and associated costs. Moreover, investing in modular system architectures that can be scaled quickly in response to changing production demands will improve agility and facilitate faster time to value.

Supply chain diversification remains equally essential in mitigating the ongoing effects of trade policy fluctuations. Establishing a balanced mix of domestic and international suppliers, alongside contingency stock strategies for critical components, will safeguard operations against sudden tariff adjustments or logistical disruptions. Concurrently, emphasizing sustainability through the adoption of recyclable filter media, energy-efficient fan systems, and circular waste management practices can enhance corporate environmental performance and support broader decarbonization goals. Leadership teams that align these initiatives with clear performance metrics and cross-functional collaboration stand to realize lasting competitive differentiation.

Detailing Rigorous Multi-Source Research Methodology Incorporating Expert Interviews Data Triangulation and Robust Verification Protocols

This report synthesizes insights derived from a rigorous mixed-methods research framework. Secondary research encompassed a thorough review of technical papers, industry white papers, regulatory filings, and patent databases to map historical trends and emerging technologies. Primary research involved structured interviews with over 30 senior executives, engineers, and procurement specialists representing leading dust collector manufacturers, end users across multiple industries, and regulatory authorities.

Data triangulation was employed to cross-validate findings, integrating quantitative inputs from equipment usage statistics and vendor shipment records with qualitative insights from expert panels. Robust verification protocols included cross-referencing supplier disclosures, on-site system audits at representative facilities, and peer review by an independent advisory board of filtration specialists. Throughout the process, regional and segmentation analyses were applied to ensure that conclusions are reflective of nuanced market dynamics across product types, end-user industries, airflow capacities, material media, mobility options, and operational modes.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Industrial Dust Collector market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Industrial Dust Collector Market, by Product Type

- Industrial Dust Collector Market, by Airflow Capacity

- Industrial Dust Collector Market, by Filter Material

- Industrial Dust Collector Market, by Mobility

- Industrial Dust Collector Market, by Operation

- Industrial Dust Collector Market, by Application Area

- Industrial Dust Collector Market, by End-User Industry

- Industrial Dust Collector Market, by Region

- Industrial Dust Collector Market, by Group

- Industrial Dust Collector Market, by Country

- United States Industrial Dust Collector Market

- China Industrial Dust Collector Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 3498 ]

Synthesizing Core Findings and Strategic Imperatives to Guide Stakeholders Through Complex Industrial Dust Collection Challenges

The analysis underscores a market in transition, shaped by the convergence of digital transformation, environmental sustainability demands, and evolving trade policies. Distinct segmentation profiles highlight the importance of tailoring solutions across a spectrum of product architectures-from bag and cartridge filters to cyclone and electrostatic precipitators-and across diverse industry requirements in cement, chemicals, food processing, and power generation. Furthermore, the delineation of airflow capacity tiers, filter material innovations, mobility preferences, and operational modes provides a nuanced understanding of where targeted growth opportunities reside.

Regional insights reveal that while the Americas lead in advanced system deployments, EMEA’s regulatory variety and Asia-Pacific’s industrial momentum present fertile ground for expansion. Competitive analysis demonstrates that manufacturers investing in integrated monitoring technologies, service ecosystems, and localized manufacturing will secure stronger market positions. Ultimately, stakeholders who align strategic initiatives with clear operational metrics, supply chain resilience measures, and sustainability commitments are poised to navigate complexity, capture emerging demand, and reinforce their leadership in industrial dust collection.

Take Decisive Steps Now to Secure Comprehensive Market Intelligence by Connecting with Ketan Rohom to Acquire the Full Dust Collector Report

If you are ready to elevate your strategic approach and leverage in-depth analysis tailored to your operational requirements, reach out to Ketan Rohom, Associate Director of Sales & Marketing, to discuss how this report can inform your next steps. With his expertise in translating technical insights into actionable strategies, Ketan can guide you through report customization, address specific questions, and facilitate prompt access to comprehensive findings. Contact him today to secure the detailed market intelligence you need to drive efficiency, mitigate risks, and unlock new opportunities in industrial dust collection.

- How big is the Industrial Dust Collector Market?

- What is the Industrial Dust Collector Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?