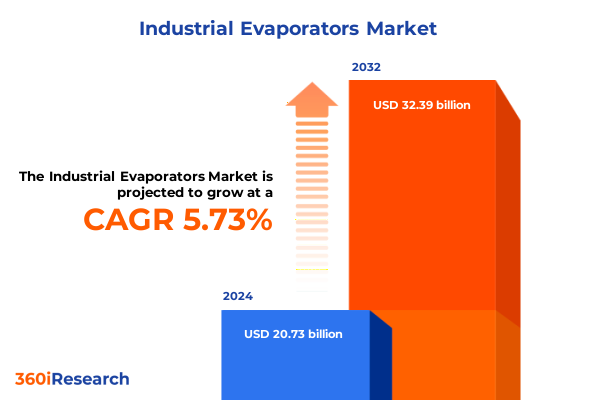

The Industrial Evaporators Market size was estimated at USD 21.87 billion in 2025 and expected to reach USD 23.08 billion in 2026, at a CAGR of 5.76% to reach USD 32.39 billion by 2032.

Setting the Stage for Industrial Evaporator Solutions by Highlighting Core Principles, Critical Drivers, and Emerging Market Dynamics

The industrial evaporator sector serves as a critical backbone for a wide array of process industries, enabling efficient concentration, separation, and recovery of valuable constituents across diverse applications. At its core, this technology harnesses phase-change principles to remove solvents or moisture from liquids, thereby enhancing product purity, reducing transportation costs, and improving energy efficiency. In recent years, the demand for advanced evaporative solutions has surged, driven by escalating sustainability requirements and the need to optimize resource utilization. Consequently, stakeholders are increasingly prioritizing systems that balance high throughput with minimal environmental footprint.

As the global manufacturing landscape becomes more intricate, the role of industrial evaporators continues to evolve. Industries such as chemical and petrochemical refinement, food and beverage processing, pharmaceutical synthesis, and wastewater treatment now rely on these systems not solely for performance but also for compliance with stringent regulatory standards. Moreover, technological advancements in materials science and instrumentation have unlocked novel configurations, enabling more compact designs and enhanced thermal performance. This introduction provides the gateway to a comprehensive executive summary, delineating the strategic forces, regulatory factors, and competitive imperatives shaping the future of industrial evaporator solutions.

Unveiling the Technological Disruptions and Operational Innovations Reshaping Industrial Evaporator Market Dynamics

The industrial evaporator landscape is undergoing a profound metamorphosis, spurred by converging technological and operational forces. Digitalization initiatives have introduced predictive maintenance algorithms and real-time performance monitoring, enabling operators to detect deviations before they escalate into costly downtime. Simultaneously, the integration of advanced materials-such as corrosion-resistant alloys and fouling-resistant coatings-is extending equipment longevity and reducing maintenance cycles. These shifts not only optimize throughput but also elevate overall equipment effectiveness, redefining expectations for reliability and uptime.

In parallel, sustainability considerations have galvanized the adoption of energy recovery strategies. From mechanical vapor recompression to thermal vapor recompression modules, systems are now configured to recapture latent heat, significantly reducing overall energy consumption. Furthermore, modular and skid-mounted designs are proliferating, allowing for rapid deployment and flexibility in expansion or relocation. Such adaptability proves invaluable in fast-paced industrial settings, where production priorities frequently pivot. Consequently, the landscape is characterized by heightened competition among suppliers to deliver customizable, future-proof solutions that can dynamically respond to evolving process demands.

Analyzing the Aggregate Consequences of New U.S. Tariff Policies Enacted in 2025 on Evaporator Supply Chains and Cost Structures

The introduction of new tariff measures by the United States in 2025 has cast a notable shadow over industrial evaporator supply chains and input cost structures. With increased duties levied on imports of key components-particularly specialized heat exchanger materials and precision-fabricated parts-manufacturers have encountered elevated material procurement expenses. As a result, strategic sourcing decisions have shifted, prompting several original equipment manufacturers to explore domestic supplier partnerships or to diversify their vendor base across regions with favorable trade agreements.

Consequently, the cumulative effects of these tariffs extend beyond direct cost impacts. Extended lead times and complex customs processes have amplified the importance of robust inventory strategies, compelling companies to bolster buffer stocks to mitigate supply chain volatility. In response, a growing number of organizations are investing in nearshoring initiatives, relocating critical production stages closer to end-use markets to circumvent tariff barriers. These adaptations underscore the industry’s resilience, yet they also highlight the delicate balance between cost management and operational agility in an environment defined by evolving trade policies.

Examining Multifaceted Segmentation Insights to Clarify Differentiation Across Evaporator Types, Heating Media, Technologies, Capacities, and End Uses

Industrial evaporator market segmentation illuminates the diverse typologies and functional configurations that cater to specific processing requirements. Based on unit type, systems are categorized into agitated thin film evaporators, falling film evaporators, forced circulation evaporators, and rising film evaporators. Within falling film technology, further differentiation arises through horizontal versus vertical orientation, each offering distinct advantages in terms of heat transfer efficiency and footprint optimization. This segmentation underscores how design variations enable precise adaptation to feed characteristics and space constraints.

Heating medium selection further refines the applicability of evaporative systems, with steam-based and thermal oil-based configurations dominating the landscape. Steam heating remains a mainstay where plant-wide boiler utilities are available, delivering consistent thermal input for high-capacity operations. In contrast, thermal oil systems provide stable temperature control for processes requiring narrow thermal windows or when steam generation is impractical. The choice between these media reflects both infrastructure considerations and the thermal sensitivity of target products.

Technological differentiation also plays a pivotal role, as mechanical vapor recompression, multi-effect configurations, and thermal vapor recompression each offer unique energy profiles. Multi-effect arrangements subdivide the evaporation sequence into multiple stages-ranging from single-effect through double- and triple-effect-to leverage cascading temperature gradients for reduced energy consumption. Mechanical vapor recompression enhances efficiency by recompressing vapor to elevate its temperature, whereas thermal vapor recompression integrates motive steam to recycle latent heat. These options enable stakeholders to prioritize either capital expenditure minimization or operational energy savings, depending on long-term objectives.

Capacity-based segmentation further categorizes industrial evaporators into small, medium, and large scales, aligning with the throughput demands of varying production environments. Small-scale units find favor in pilot plants and specialized applications, while medium-scale equipment serves targeted process lines. Large-scale installations, on the other hand, anchor continuous high-volume operations, where economies of scale are critical. Meanwhile, the end use industry dimension spans chemical and petrochemical facilities, food and beverage processors, oil and gas refineries, pharmaceutical manufacturers, and wastewater treatment plants. Each sector imposes distinct purity, throughput, and regulatory criteria, driving the selection of tailored evaporator architectures to fulfill its operational imperatives.

This comprehensive research report categorizes the Industrial Evaporators market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Component

- Construction

- Heating Medium

- Capacity Range

- Technology

- Operating Mode

- End-Use Application

- Distribution Channel

Highlighting How Americas, Europe Middle East Africa, and Asia Pacific Regional Imperatives Shape Evaporator Adoption Patterns

Regional dynamics exert profound influence on the adoption and customization of industrial evaporator solutions. In the Americas, a pronounced focus on nearshoring and domestic manufacturing has spurred demand for modular and skid-mounted systems that can be rapidly deployed in localized plants. Regulatory emphasis on environmental compliance, particularly in the food and beverage and wastewater sectors, has further elevated the importance of designs that minimize effluent discharge and maximize water reuse. Consequently, North American operators increasingly seek turnkey solutions that integrate advanced monitoring with sustainable process optimization.

Within Europe, the Middle East, and Africa, regulatory stringency and energy efficiency mandates are driving a surge in multi-effect and mechanical vapor recompression installations. European refineries and chemical complexes prioritize technologies that deliver both high performance and minimal carbon footprint, often retrofitting legacy assets with state-of-the-art energy recovery modules. Meanwhile, emerging markets in the Middle East are investing heavily in large-scale installations to support petrochemical expansions, leveraging ample energy resources to justify capital-intensive evaporator projects. Across Africa, demand is more nuanced, with wastewater treatment and niche agro-processing applications fueling selective deployments of compact, cost-effective systems.

Asia Pacific presents a heterogeneous landscape characterized by rapid industrialization in economies such as India and Southeast Asia alongside mature markets in Japan and Korea. Expansion of food and beverage capacity, coupled with stringent discharge regulations, is catalyzing adoption of falling film and forced circulation solutions that balance throughput with operational reliability. At the same time, major process conglomerates in China are pioneering integrated evaporator- crystallizer systems to optimize resource recovery in chemical production. Consequently, regional strategies emphasize scalability and localization, with global OEMs forging partnerships to address distinct requirements across diverse subregions.

This comprehensive research report examines key regions that drive the evolution of the Industrial Evaporators market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Key Industrial Evaporator Providers on Their Innovations, Strategic Alliances, and Service Excellence Initiatives

Leading equipment providers are differentiating through strategic investments in digitalization, sustainability, and aftermarket services. Established global players have augmented their portfolios with proprietary control platforms that enable remote monitoring and performance benchmarking. These systems offer predictive alerts, trend analysis, and energy auditing capabilities, empowering end users to proactively manage maintenance and drive continuous process improvements. Moreover, collaborations with software developers and IoT specialists have accelerated the rollout of cloud-based solutions that integrate evaporator data with broader plant management systems, reinforcing supplier value propositions.

Meanwhile, a cadre of innovative challengers is gaining traction by specializing in modular and skid-mounted offerings tailored to niche applications. Their agility in engineering preconfigured packages has shortened project timelines, reducing installation complexity and commissioning risk. Startups are further pushing the envelope by exploring additive manufacturing for custom heat exchanger components, enabling bespoke surface geometries that enhance heat transfer while streamlining supply chains. In parallel, strategic partnerships between OEMs and energy service companies are facilitating performance contracting models, wherein energy savings deliver shared returns on investment.

Amidst this competitive tapestry, aftermarket service excellence emerges as a defining differentiator. Leading suppliers have expanded their global service networks, providing 24/7 technical support, spare parts availability, and field engineering expertise. These initiatives not only bolster uptime but also reinforce long-term customer relationships. Additionally, R&D alliances between equipment manufacturers and academic institutions are paving the way for advanced materials research, exploring fouling-resistant coatings and novel alloy compositions that promise to elevate evaporator reliability under the most demanding operating conditions.

This comprehensive research report delivers an in-depth overview of the principal market players in the Industrial Evaporators market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3V Tech S.p.A.

- Alfa Laval AB

- ANDRITZ Group

- Belmar Technologies Ltd.

- Bucher Industries AG

- Büchi Labortechnik AG

- Caloris Engineering, LLC

- Carel Industries S.p.A.

- Colmac Coil Manufacturing, Inc.

- Daikin Industries Ltd.

- Dedert Corporation

- Ecodyst

- ECOVAP, Inc.

- ENCON Evaporators

- EVAPCO, Inc.

- Fives Group

- GEA Group AG

- H2O GmbH

- Hebei Leheng Energy Saving Equipment Co. Ltd.

- Heidolph Scientific Products GmbH by ATS Corporation

- IKA-Werke GmbH & Co. KG

- Inproheat Industries Ltd.

- IWE

- John Bean Technologies Corporation

- Kovalus Separation Solutions, Inc.

- KWS Evaporators Pvt Ltd

- Labconco Corporation

- LCI Corporation

- Mitsubishi Heavy Industries, Ltd.

- Praj Industries Limited

- RCM Technologies, Inc.

- SPX Flow, Inc.

- Sulzer Ltd

- Sumitomo Heavy Industries, Ltd.

- Swenson Technology, Inc.

- Thermax Limited

- Veolia Environnement SA

- Vobis, LLC

- Yamato Scientific Co., Ltd.

- Zhejiang Taikang Evaporator Co., Ltd.

Delivering Actionable Strategies That Drive Digital Integration, Supply Chain Agility, and Sustainability Excellence in Evaporator Operations

To successfully navigate the evolving evaporator ecosystem, industry leaders should adopt a multi-pronged strategic approach that balances innovation with operational resilience. First, integrating digital twins and advanced analytics into process design can yield significant gains in thermal efficiency and predictive maintenance accuracy. By simulating dynamic behavior under variable feed conditions, organizations can optimize design parameters before committing to capital outlays.

Furthermore, expanding supply chain resilience through geographic diversification and dual-sourcing agreements can insulate operations from trade policy volatility. Near-shoring select manufacturing processes and forging collaborative relationships with regional fabricators will minimize exposure to import duties and logistical disruptions. In addition, embedding sustainability targets into procurement frameworks-such as prioritizing components manufactured with low-carbon energy sources-will align capital projects with corporate environmental objectives.

Operationally, leaders should cultivate cross-functional expertise by investing in workforce development programs that encompass advanced process control and data science skills. Equipping technical teams with the ability to interpret real-time performance metrics fosters proactive decision-making and accelerates continuous improvement cycles. Finally, strategic partnerships with energy service providers and academic research centers can unlock co-development opportunities for next-generation evaporator technologies, ensuring that organizations remain at the forefront of breakthrough innovations.

Elucidating the Comprehensive Mixed-Method Research Process Underpinning the Industrial Evaporator Insights

This research is founded on a robust combination of primary and secondary methodologies designed to capture both quantitative and qualitative dimensions of the industrial evaporator market. Primary research involved in-depth interviews with industry practitioners, including process engineers, procurement leaders, and maintenance specialists, who provided firsthand insights into operational challenges and emerging priorities. Interactive workshops with technical experts were conducted to validate technology roadmaps and segmentation frameworks.

Secondary research leveraged peer-reviewed journals, industry white papers, and specialized engineering publications to contextualize market developments and benchmark technological advancements. Trade association reports and regulatory filings were examined to ascertain the impact of policy shifts on equipment specifications and compliance requirements. Furthermore, comparative analysis techniques were applied to evaluate supplier capabilities, throughput metrics, and energy efficiency standards across different evaporator configurations. Data triangulation ensured alignment between empirical findings and expert perspectives.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Industrial Evaporators market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Industrial Evaporators Market, by Type

- Industrial Evaporators Market, by Component

- Industrial Evaporators Market, by Construction

- Industrial Evaporators Market, by Heating Medium

- Industrial Evaporators Market, by Capacity Range

- Industrial Evaporators Market, by Technology

- Industrial Evaporators Market, by Operating Mode

- Industrial Evaporators Market, by End-Use Application

- Industrial Evaporators Market, by Distribution Channel

- Industrial Evaporators Market, by Region

- Industrial Evaporators Market, by Group

- Industrial Evaporators Market, by Country

- United States Industrial Evaporators Market

- China Industrial Evaporators Market

- Competitive Landscape

- List of Figures [Total: 21]

- List of Tables [Total: 2862 ]

Summarizing Critical Findings and Reinforcing Strategic Imperatives for Stakeholders in the Industrial Evaporator Arena

In summary, the industrial evaporator domain is experiencing a profound transformation driven by digital innovation, sustainability mandates, and shifting trade policies. As tariff measures reshape supply chains and compel strategic sourcing adaptations, manufacturers are prioritizing resilience and energy efficiency to maintain competitive advantage. Diverse segmentation dimensions-from unit type and heating medium to capacity and end use industry-underscore the criticality of tailored solutions that address specific process demands across regional markets. The competitive landscape is equally dynamic, combining the strengths of established global players with the agility of niche innovators.”

Engage with Ketan Rohom for a Tailored Briefing to Unlock Comprehensive Industrial Evaporator Market Intelligence

To explore the exhaustive findings of this industrial evaporator report and unlock tailored insights that drive strategic growth, connect directly with Ketan Rohom, Associate Director of Sales & Marketing. Ketan Rohom is ready to provide a personalized briefing that aligns with your organization’s unique objectives and offers clarity on the most impactful opportunities. Engage today to secure comprehensive analysis, expert perspectives, and detailed action plans designed to elevate your decision-making and ensure you stay ahead in the evolving industrial evaporator landscape.

- How big is the Industrial Evaporators Market?

- What is the Industrial Evaporators Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?