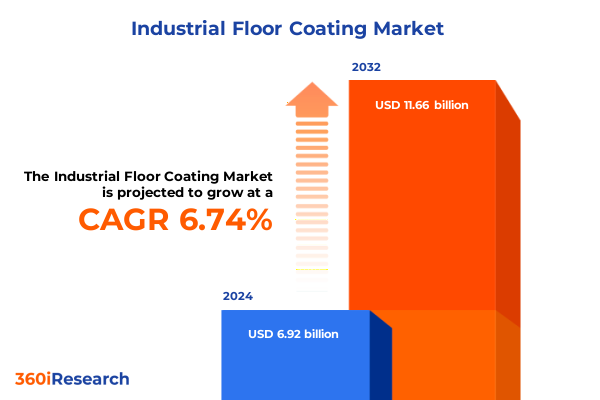

The Industrial Floor Coating Market size was estimated at USD 7.39 billion in 2025 and expected to reach USD 7.90 billion in 2026, at a CAGR of 6.73% to reach USD 11.66 billion by 2032.

Unveiling the Critical Drivers and Strategic Opportunities Shaping Industrial Floor Coating Evolution in Today’s Competitive Environment

Industrial floor coatings have evolved from rudimentary protective layers to advanced surface systems that enhance operational safety, chemical resistance, and structural resilience across manufacturing plants, warehouses, and commercial facilities. As facilities managers and procurement specialists navigate heightened demands for extended service life and rapid-curing applications, the convergence of performance requirements and regulatory mandates is reshaping the priorities of coating formulation and application. This introduction situates industrial floor coatings within the broader context of productivity optimization and asset preservation, underscoring how enhanced abrasion resistance and slip mitigation contribute directly to reduced downtime and lower total cost of ownership.

Building on this context, the report defines its analytical scope by integrating multi-dimensional research approaches. It maps resin chemistries, end user verticals, installation methodologies, and substrate interactions into a cohesive narrative, while also examining the influence of macroeconomic factors such as raw material price fluctuations and supply chain constraints. By establishing these foundational elements, the introduction prepares stakeholders to explore the subsequent analysis of disruptive innovations, tariff impacts, market segmentation, regional performance divergences, and strategic recommendations that together form a holistic executive summary of the industrial floor coating domain.

Exploring Groundbreaking Innovations and Emerging Sustainability Trends Transforming Industrial Floor Coating Practices Across Global Operations and Regulatory Milestones

Over the past decade, industrial floor coating has undergone transformative shifts driven by breakthroughs in resin technology, sustainability considerations, and digitalization of application processes. The advent of high-solid and low-VOC formulations has enabled formulators to meet stringent environmental regulations while maintaining mechanical performance, spurring widespread adoption of epoxy-polyurethane hybrids and bio-based additives. Concurrent advancements in rapid-curing methyl methacrylate and polyaspartic systems now allow operations to resume within hours, minimizing labor costs and facility downtime. Furthermore, the integration of digital monitoring tools-ranging from moisture sensors to infrared thermal imaging-has elevated quality assurance practices, ensuring more consistent cure profiles and reducing rework.

At the same time, global sustainability imperatives have catalyzed a shift toward circular economy principles, prompting manufacturers to develop reclaimable and recyclable coating chemistries. This environmental focus intersects with regulatory developments that mandate traceability of raw materials and reduction of hazardous emissions. As a result, supply chains are being restructured around transparency and risk mitigation, with procurement teams prioritizing partnerships that emphasize cradle-to-cradle certification. These collective shifts are setting a new baseline for performance, compliance, and cost efficiency, fundamentally redefining how stakeholders evaluate and integrate floor coating solutions.

Assessing the Comprehensive Impact of 2025 United States Tariff Measures on Industrial Floor Coating Supply Chains and Cost Structures

In 2025, the implementation of revised United States tariff measures on key resin precursors and specialty additives has introduced a new layer of complexity to the industrial floor coating supply chain. Tariffs on specific monomers and curing agents have effectively elevated landed costs for domestically produced epoxy, acrylic, and polyurethane systems. Coating manufacturers have responded by negotiating dual-sourcing agreements, repatriating certain compound steps, and exploring regional trade agreements to mitigate incremental cost pressures. Despite these adjustments, certain end users have experienced extended lead times as alternative supply routes are qualified and validated.

The ripple effects extend to raw material recyclers and logistics providers, who face heightened volatility in import duties and documentation requirements. This environment has accelerated the adoption of nearshoring strategies, with some formulators shifting procurement toward domestic chemical producers and free trade areas. Moreover, the tariff landscape has heightened focus on resin efficiency and waste reduction, encouraging R&D teams to optimize solids content and reduce off-grade production. Collectively, these measures illustrate how tariff policy can serve as a catalyst for supply chain resilience, process innovation, and strategic realignment within the industrial floor coating sector.

Deep Dive into Market Segmentation Revealing Resin Type End User Installation and Substrate Dynamics Fueling Strategic Decision Making

A nuanced understanding of industry segmentation provides critical clarity on where growth and innovation converge. Analysis based on resin type reveals that durable and versatile systems such as epoxy dominate high-traffic environments, while methyl methacrylate and polyaspartic coatings gain traction in rapid-return applications. Acrylic formulations maintain a presence in UV-stable installations, and emerging bio-based polyurethanes attract sustainability-driven buyers. Meanwhile, end user segmentation underscores divergent demand profiles: the automotive sector requires coatings with superior chemical and thermal resilience, food and beverage facilities prioritize hygienic finishes with FDA compliance, and healthcare environments demand antimicrobial and easy-to-clean surfaces. In the commercial arena, Hospitality, Offices, and Retail each impose unique aesthetic and performance prerequisites, while industrial verticals such as Chemical Plants, Energy and Utilities, Logistics, and Manufacturing invest heavily in abrasion-resistant and spill-containment solutions. Institutional, pharmaceutical, and residential end users further diversify product specifications and budgetary expectations.

Installation type segmentation differentiates between new construction projects and maintenance and repair contracts, the latter comprising both Corrective Maintenance and Preventive Maintenance cycles. These installation modalities dictate cure time requirements and substrate preparation protocols. Lastly, substrate type analysis spans Concrete, Metal, and Wood, each presenting distinct adhesion challenges and moisture management considerations. By synthesizing these intersecting segmentation frameworks, stakeholders can tailor product development, marketing strategies, and customer engagement models to unlock targeted growth opportunities.

This comprehensive research report categorizes the Industrial Floor Coating market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Resin Type

- Installation Type

- Substrate Type

- End User

Unraveling Geographic Performance Insights Highlighting Americas Europe Middle East & Africa and Asia Pacific Variations in Industrial Floor Coating Demand

Geographic insights shed light on divergent growth trajectories and regulatory influences across key regions. In the Americas, demand is buoyed by infrastructure renewal and expanding logistics networks, with the United States market leading adoption of high-performance epoxy and polyaspartic systems for warehousing and manufacturing. Canada’s focus on sustainable construction has accelerated uptake of low-VOC and bio-based formulations. Turning to Europe, the Middle East, and Africa, regulatory frameworks such as the European Chemical Agency’s REACH guidelines drive stricter adherence to hazardous substance limits, positioning the region at the forefront of green coating technologies. Rapid industrialization in the Middle East, particularly within energy and utilities sectors, fuels demand for fire-resistant and chemical-proof floor coatings, while Africa’s nascent manufacturing hubs prioritize cost-effective solutions.

In the Asia-Pacific, robust expansion of electronics manufacturing, automotive assembly, and food processing facilities propels the need for versatile systems that balance cost efficiency with specialized performance. Southeast Asian markets show accelerating investment in hygienic coatings to support growing pharmaceutical and food processing exports. Across all regions, the interplay of local regulations, infrastructure development, and sustainability agendas shapes diverse adoption curves, underscoring the importance of regionalized strategies for market participants.

This comprehensive research report examines key regions that drive the evolution of the Industrial Floor Coating market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Key Competitive Strategies and Innovation Drivers Shaping the Success of Prominent Industrial Floor Coating Manufacturers

Competitive dynamics within the industrial floor coating domain continue to intensify as leading manufacturers pursue innovation, strategic alliances, and vertical integration. Established chemical majors have leveraged their global distribution networks and R&D capabilities to introduce next-generation formulations, while specialized coating houses focus on niche applications such as antimicrobial and self-leveling systems. Partnerships between resin suppliers and applicators are becoming more common, enabling end-to-end accountability from formulation to installation. Several market leaders have also invested in digital platforms that facilitate remote diagnostics and predictive maintenance, providing clients with data-driven insights into coating performance and lifecycle management.

In parallel, strategic mergers and acquisitions have reshaped the competitive landscape, with larger entities absorbing regional specialists to enhance their footprint in high-growth markets. Innovation pipelines are increasingly oriented toward sustainable chemistries, with an emphasis on renewable feedstocks and closed-loop recycling. Additionally, companies are differentiating through service-based models that integrate technical training, maintenance scheduling, and warranty management. This multifaceted competitive environment underscores the necessity for agile strategies and customer-centric solutions in maintaining market leadership.

This comprehensive research report delivers an in-depth overview of the principal market players in the Industrial Floor Coating market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AkzoNobel N.V.

- Ardex GmbH

- BASF SE

- Carboline Company

- Fosroc International Limited

- Hempel A/S

- Jotun Group

- Mapei S.p.A.

- PPG Industries, Inc.

- RPM International Inc.

- Sherwin-Williams Company

- Sika AG

- The Dow Chemical Company

- Titan Group

- Tnemec Company, Inc.

Delivering Actionable Executive Recommendations for Industry Leaders to Enhance Resilience Agility and Profitability in Industrial Floor Coating Sector

Industry leaders must adopt a forward-looking stance that balances innovation with resilience. Prioritizing the development of low-emission and bio-based resin platforms will not only address rising environmental standards but also open doors to new segments such as pharmaceutical and food processing. Strengthening supply chain agility through dual sourcing, nearshoring, and strategic inventory buffers will mitigate the impact of future tariff fluctuations or raw material shortages. Equally critical is the integration of digital quality control mechanisms, including moisture mapping and infrared imaging, which streamline installation workflows and reduce rework.

To capture incremental value, organizations should align product portfolios with end user requirements, offering modular solutions that can be tailored to specific substrate, performance, and aesthetic criteria. Strategic alliances between formulators, applicators, and service providers will foster seamless project delivery and heighten accountability. Finally, embedding circularity principles-such as recyclability of coating waste and reclaimable resin streams-will resonate with both regulatory bodies and environmentally conscious clients, ensuring long-term market relevance.

Outlining Rigorous Research Methodology Integrating Primary Secondary Data and Expert Analyses to Ensure Comprehensive Market Insights

This analysis is built on a rigorous research methodology that merges primary interviews with industry stakeholders and secondary data analysis from peer-reviewed publications, regulatory filings, and market white papers. Experts across resin manufacturing, flooring application, and end user maintenance were consulted to validate performance criteria and adoption drivers. Secondary research involved comprehensive examination of patent filings, sustainability standards, and tariff schedules, ensuring accuracy in regulatory and cost impact assessments.

Quantitative insights were obtained through data triangulation, cross-referencing shipment volumes, raw material import statistics, and end user consumption reports. Qualitative validation included Delphi panels with coating formulators and facility managers to align projected trends with operational realities. Geographic and segmentation breakdowns were refined through regional market studies and competitive benchmarking. The resulting synthesis delivers robust, unbiased insights designed to support strategic decision making in the dynamic industrial floor coating landscape.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Industrial Floor Coating market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Industrial Floor Coating Market, by Resin Type

- Industrial Floor Coating Market, by Installation Type

- Industrial Floor Coating Market, by Substrate Type

- Industrial Floor Coating Market, by End User

- Industrial Floor Coating Market, by Region

- Industrial Floor Coating Market, by Group

- Industrial Floor Coating Market, by Country

- United States Industrial Floor Coating Market

- China Industrial Floor Coating Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1272 ]

Concluding Critical Insights Emphasizing Strategic Imperatives and Future Outlook for Stakeholders in Industrial Floor Coating Ecosystem

As industrial operations seek to maximize asset performance and compliance, the strategic imperative for optimized floor coating solutions becomes ever more pronounced. This executive summary has traversed the evolution of resin technologies, sustainability mandates, tariff-induced supply chain shifts, and detailed segmentation that together delineate the contours of contemporary demand. By coupling this analysis with regional performance nuances and competitive intelligence, stakeholders are positioned to make informed investments in product innovation, strategic partnerships, and digital enablement.

Looking ahead, the success of market participants will hinge on their ability to anticipate regulatory changes, embrace circular economy practices, and harness data-driven tools for process optimization. The insights presented herein serve as a blueprint for aligning corporate strategy with emergent trends, strengthening market resilience, and capturing growth in the dynamic industrial floor coating ecosystem.

Next Steps to Secure In-Depth Industrial Floor Coating Market Analysis and Leverage Competitive Intelligence for Sustainable Growth

Unlock unparalleled access to expert analysis and granular market intelligence by securing the comprehensive industrial floor coating report. Engage directly with Ketan Rohom, Associate Director, Sales & Marketing, to customize your data package and gain strategic foresight. Leverage this opportunity to align your product development roadmaps with emerging trends, preempt supply chain disruptions, and benchmark performance against leading competitors. With personalized consultation, you will be equipped to translate deep market insights into actionable business outcomes. Connect with Ketan Rohom today to explore tailored solutions that drive sustainable growth and competitive differentiation in the industrial floor coating ecosystem.

- How big is the Industrial Floor Coating Market?

- What is the Industrial Floor Coating Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?