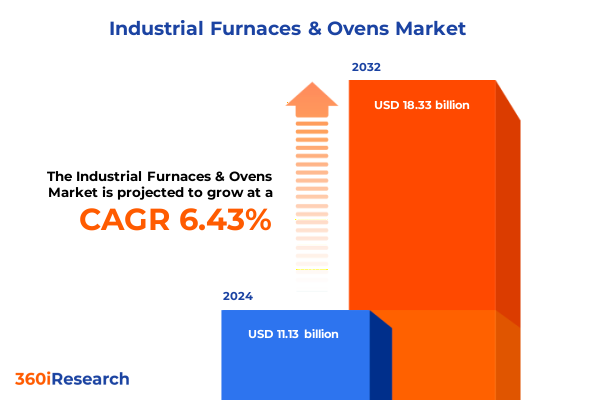

The Industrial Furnaces & Ovens Market size was estimated at USD 13.38 billion in 2025 and expected to reach USD 14.47 billion in 2026, at a CAGR of 8.61% to reach USD 23.87 billion by 2032.

Discover the Evolving Dynamics of Industrial Furnaces and Ovens Shaping the Landscape for Manufacturers and Decision-Makers in 2025 and Beyond

The industrial furnaces and ovens sector has emerged as a cornerstone of modern manufacturing, offering critical capabilities across metalworking, ceramics, food processing, and chemical industries. As global supply chains evolve and production demands intensify, manufacturers increasingly rely on advanced thermal processing equipment to maintain competitive advantages and meet stringent quality standards. The market’s resilience is evident in its ability to adapt to shifting raw material costs, evolving environmental regulations, and the integration of digital technologies to optimize throughput and energy consumption.

Throughout recent years, the convergence of Industry 4.0 practices with sustainable operations has propelled industrial furnace adoption, particularly within automotive, aerospace, and metallurgical applications. Companies are investing in smarter control systems and modular designs to accommodate diverse production requirements, from heat treatment cycles in aerospace alloys to sintering processes in advanced ceramics. This dynamic landscape underscores the strategic importance of thermal processing assets as manufacturers seek to enhance product quality, reduce operational risks, and achieve long-term cost savings.

Uncover the Technological and Operational Innovations Revolutionizing Industrial Furnaces and Ovens for Enhanced Efficiency, Sustainability, and Precision

The industrial furnace and oven market is undergoing transformative shifts driven by an unprecedented fusion of digitalization, sustainability imperatives, and advanced materials science. First, the integration of AI-driven predictive maintenance solutions is revolutionizing uptime strategies. By leveraging real-time sensor data, manufacturers can anticipate potential equipment failures before they occur, transitioning from reactive repairs to proactive servicing and maximizing operational efficiency.

Second, digital twin technologies are enabling virtual replicas of furnace operations, allowing engineers to simulate and optimize thermal profiles without disrupting live production. This real-time modeling capability accelerates process innovation, reduces energy consumption, and improves product consistency, particularly in energy-intensive sectors such as glass melting and cement production.

Third, the adoption of hybrid and induction heating methods is reshaping equipment portfolios. Electric and induction furnaces are experiencing rapid uptake due to stricter emissions regulations and the pursuit of higher energy efficiencies exceeding 90 percent, driving innovations in power supply and refractory materials.

Finally, automation and IoT integration have become standard practice, with smart control systems enhancing responsiveness to variable production demands. According to the U.S. Department of Energy, such advanced technologies can boost manufacturing energy efficiency by around 30 percent, underscoring their pivotal role in achieving sustainability objectives and cost reductions across industrial segments.

Assess the Combined Effects of Evolving Section 232 Tariffs and Trade Actions on Industrial Furnace Supply Chains, Material Costs, and Competitive Positioning in 2025

Since the initial implementation of Section 232 tariffs in 2018, the United States maintained a 25 percent ad valorem tariff on steel imports and a 10 percent tariff on aluminum imports, aiming to protect domestic producers under national security provisions. On February 10, 2025, Presidential proclamations expanded these measures by eliminating country exemptions, terminating product exclusion processes, and raising the aluminum tariff to 25 percent while broadening coverage to downstream derivative articles. This action also introduced a new exemption process for steel “melted and poured” and aluminum “smelted and cast” domestically, significantly increasing compliance complexity for importers.

Subsequently, on June 3, 2025, the tariffs were further amplified to 50 percent for both steel and aluminum imports entered on or after June 4, 2025, aiming to strengthen protection for U.S. metal producers and address surging imports. The uniform 50 percent rate applies broadly, with limited exemptions, and extends to downstream products assessed on content value rather than total product value.

These cumulative tariff actions have intensified raw material cost pressures across thermal processing equipment manufacturing. Increased steel and aluminum input costs have driven up capital expenditures for new furnace construction and retrofits, prompting many firms to reassess supply chain strategies, explore domestic sourcing alternatives, and accelerate investments in material-efficient furnace designs. Additionally, the heightened tariffs have elevated the urgency for industry stakeholders to navigate legal and compliance landscapes, as retaliatory measures and shifting trade relationships amplify market uncertainties.

Gain Insights into the Key Market Segments Defining Industrial Furnace and Oven Demand across Types, Methods, Applications, Industries, and Temperature Ranges

Analysis of furnace type segmentation reveals that continuous systems hold the majority share due to their ability to deliver uninterrupted thermal processing and consistent product quality for high-volume operations. In contrast, batch furnaces are gaining traction where precision and customization are paramount, such as in specialty heat treatment and small-batch sintering applications. Continuous furnaces excel in heavy industries requiring constant throughput, while box, cabinet, and pit batch configurations accommodate flexible scheduling and varied load sizes.

Within heating method segmentation, electric furnaces have witnessed a 34 percent adoption increase, driven by the transition away from combustion-based systems and the desire to meet stringent emissions targets. Induction furnaces, noted for direct material heating and efficiency rates above 90 percent, are particularly favored for metal melting and hardening processes that demand rapid temperature ramps and minimal heat losses. Gas-fired configurations, including direct and indirect designs, along with dual-fuel burners supporting both gas and oil, continue to serve cost-sensitive operations with established infrastructure.

Application segmentation demonstrates diverse thermal requirements: ceramics manufacturers employ drying and sintering cycles to control microstructure; chemical processors rely on precise calcination and drying conditions to ensure reaction completeness; food processors use baking and drying ovens for consistent texture development; heat treatment applications utilize annealing, quenching, and tempering profiles to tailor metallurgical properties; and metal fabrication sectors depend on annealing, brazing, forging, and hardening furnaces to achieve final part specifications, each demanding specialized atmospheric controls and chamber designs.

Control system analysis highlights a clear shift toward automatic and semi-automatic interfaces, which facilitate real-time adjustments and remote monitoring, reducing manual interventions and enhancing safety. Finally, the growing interest in portable furnace solutions, including movable heating systems, underscores the need for adaptable installations that can be deployed rapidly across changing production zones, reflecting a broader trend toward agile manufacturing environments.

This comprehensive research report categorizes the Industrial Furnaces & Ovens market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Furnace Type

- Heating Method

- Fuel Type

- Temperature Range

- Installation Type

- Control System

- Application

- End User Industry

Understand Regional Market Dynamics and Growth Drivers Impacting Industrial Furnace Adoption Across the Americas, EMEA, and Asia-Pacific Regions

Regional analysis underscores Asia-Pacific as the largest market for industrial furnaces and ovens, holding a 41 percent share due to robust steel, automotive, and electronics manufacturing in China, India, and Southeast Asia. Rapid industrialization and infrastructure expansion in these economies underpin sustained equipment investments and technology upgrades. Government incentives and low-cost fabrication hubs further strengthen regional demand.

In the Americas, North American manufacturing benefits from nearshoring trends and significant aerospace, automotive OEM, and defense investments. Despite tariff-induced cost volatility, the U.S. and Canada continue to adopt advanced thermal solutions to meet stringent regulatory requirements and maintain global competitiveness. Robust R&D ecosystems and service networks support continuous innovation and aftermarket services.

Europe, Middle East & Africa (EMEA) is characterized by early adoption of sustainable furnace technologies and compliance-driven equipment upgrades. Stricter emissions standards in the European Union have accelerated the shift toward electric, induction, and low-NOx combustion systems, while the Middle East’s petrochemical and metallurgy sectors drive demand for high-temperature solutions. Africa’s emerging markets present growth opportunities in mining and cement applications, though infrastructure constraints can impact adoption timelines.

This comprehensive research report examines key regions that drive the evolution of the Industrial Furnaces & Ovens market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examine Strategic Moves and Innovation Portfolios of Leading Industrial Furnace and Oven Manufacturers Shaping Competitive Advantages Globally

Leading companies in the industrial furnace and oven market are advancing through technological innovation, strategic collaborations, and global expansion. Andritz has introduced a hybrid dual-mode vacuum and atmosphere furnace capable of reducing thermal cycle times by 30 percent and cutting energy usage by 20 percent, targeting aerospace and specialty alloy manufacturers. Tenova’s H₂-ready industrial furnace platform enables full hydrogen operation, offering a 40 percent emissions reduction versus conventional gas-fired systems, positioning the company for decarbonization initiatives in heavy industries.

Ipsen recently launched a next-generation vacuum furnace equipped with AI-assisted flow control, improving batch uniformity by 28 percent, and enhancing throughput for critical medical and aerospace components. SECO/WARWICK’s compact IoT-connected furnace solutions have achieved over 20 percent maintenance time reductions in European installations, increasing uptime for heat treatment providers. Inductotherm Corporation, with more than 38,500 systems installed globally, continues to lead the induction furnace segment by pairing proven melt technologies with enhanced service support and modular power supply units to meet diverse foundry requirements.

This comprehensive research report delivers an in-depth overview of the principal market players in the Industrial Furnaces & Ovens market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AICHELIN GmbH

- ALD Vacuum Technologies GmbH

- Carbolite Gero Limited

- Davron Technologies, Inc.

- Eastman Manufacturing Ltd.

- Fives Group

- Harper International Corporation

- Ipsen International GmbH

- JPW Ovens & Furnaces

- Nabertherm GmbH

- Seco/Warwick S.A.

- Tenova S.p.A.

- Thermcraft Inc.

- Wisconsin Oven Corporation

Explore Actionable Strategies for Industry Leaders to Optimize Operations, Navigate Tariff Pressures, and Capitalize on Emerging Technological Trends

Industry leaders should prioritize investment in digital monitoring and predictive maintenance solutions to mitigate downtime risks and optimize energy consumption. Deploying AI-driven analytics can transform maintenance schedules from calendar-based to condition-based, unlocking significant cost savings and reliability improvements.

Organizations must also adapt supply chain strategies to mitigate the impact of evolving tariffs. Localizing critical steel and aluminum procurements and engaging in long-term agreements with domestic mills can reduce exposure to fluctuating duties and safeguard capital project budgets.

Accelerating the adoption of electric and induction heating systems will support sustainability goals and regulatory compliance. Companies should evaluate hybrid furnace configurations and hydrogen-ready platforms to future-proof assets against tightening emissions standards and energy cost volatility.

Finally, collaboration with technology partners to integrate digital twins and advanced control systems can streamline process development, shorten time-to-market for new applications, and enhance overall equipment effectiveness, positioning stakeholders to lead in innovation and operational excellence.

Learn the Rigorous Research Methodology Combining Primary Insights, Secondary Data, and Expert Analyses Underpinning This Comprehensive Industry Study

This research leveraged a multi-tiered methodology to ensure rigor and reliability. Primary insights were gathered through in-depth interviews with equipment OEMs, end-users in key industries, and regulatory experts, providing firsthand perspectives on operational challenges, investment drivers, and adoption barriers.

Secondary research encompassed an exhaustive review of trade association publications, government tariff documentation, and peer-reviewed studies, including Section 232 proclamations and U.S. Department of Energy efficiency assessments. Quantitative data were triangulated against proprietary industry databases to validate segment shares, adoption rates, and regional trends.

Analytical frameworks such as Porter’s Five Forces, value chain analysis, and scenario modeling underpinned the competitive and strategic assessments. The integration of qualitative interview findings with quantitative market data facilitated robust cross-validation, ensuring that conclusions and recommendations are both actionable and aligned with emerging market realities.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Industrial Furnaces & Ovens market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Industrial Furnaces & Ovens Market, by Furnace Type

- Industrial Furnaces & Ovens Market, by Heating Method

- Industrial Furnaces & Ovens Market, by Fuel Type

- Industrial Furnaces & Ovens Market, by Temperature Range

- Industrial Furnaces & Ovens Market, by Installation Type

- Industrial Furnaces & Ovens Market, by Control System

- Industrial Furnaces & Ovens Market, by Application

- Industrial Furnaces & Ovens Market, by End User Industry

- Industrial Furnaces & Ovens Market, by Region

- Industrial Furnaces & Ovens Market, by Group

- Industrial Furnaces & Ovens Market, by Country

- United States Industrial Furnaces & Ovens Market

- China Industrial Furnaces & Ovens Market

- Competitive Landscape

- List of Figures [Total: 20]

- List of Tables [Total: 3816 ]

Summarize the Critical Takeaways Highlighting Market Shifts, Industry Challenges, and Opportunities for Stakeholders in the Industrial Furnace and Oven Sector

In conclusion, the industrial furnaces and ovens market stands at the nexus of technological innovation and global trade dynamics. The shift toward digitalization, driven by AI, IoT, and digital twins, is redefining operational paradigms and boosting energy efficiency. Concurrently, evolving tariff landscapes, particularly Section 232 expansions in 2025, underscore the importance of supply chain resilience and strategic sourcing.

Key segments-from continuous high-throughput systems to precision batch configurations-offer tailored solutions for diverse application needs, while regional variations highlight unique growth drivers across the Americas, EMEA, and Asia-Pacific. Leading OEMs are responding with hybrid, H₂-ready, and smart furnace platforms, setting new benchmarks in performance and sustainability.

By embracing actionable strategies around digital maintenance, tariff mitigation, and cleaner heating technologies, industry stakeholders can navigate uncertainties and capitalize on opportunities. This dynamic environment rewards those who integrate advanced thermal solutions with agile operational models, ensuring competitiveness in a rapidly evolving manufacturing landscape.

Connect with Ketan Rohom to Access a Detailed Industrial Furnaces and Ovens Market Research Report Tailored to Drive Strategic Decision-Making and Growth

Thank you for exploring these critical insights on the Industrial Furnaces & Ovens market. To access the full-depth analysis, data tables, and strategic guidance tailored to your specific needs, please reach out to Ketan Rohom, Associate Director of Sales & Marketing. Ketan is ready to guide you through the report’s comprehensive findings and help you leverage these insights to strengthen your market positioning and accelerate growth. Connect today to secure your copy and empower your decision-making with the definitive market research report.

- How big is the Industrial Furnaces & Ovens Market?

- What is the Industrial Furnaces & Ovens Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?