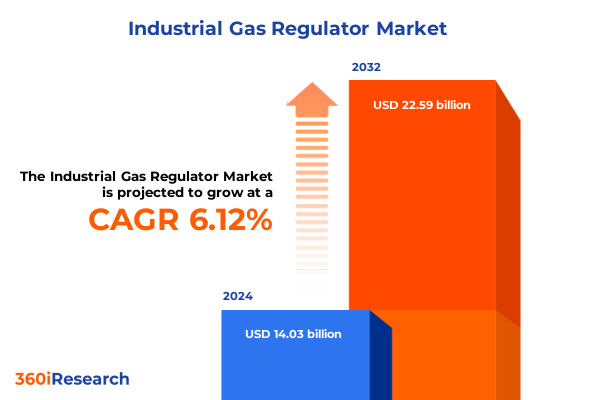

The Industrial Gas Regulator Market size was estimated at USD 14.84 billion in 2025 and expected to reach USD 15.69 billion in 2026, at a CAGR of 6.18% to reach USD 22.59 billion by 2032.

Exploring the Strategic Significance and Fundamental Functions of Industrial Gas Regulators Driving Operational Integrity and Compliance Across Industries

Industrial gas regulators play an indispensable role in managing pressure, flow, and safety across a broad spectrum of industrial processes. From high-purity applications in semiconductor fabrication to robust delivery systems in chemical plants, these devices ensure that gaseous media are delivered at precise pressures to optimize process performance. In highly regulated industries such as healthcare and food and beverage production, maintaining consistent gas delivery not only safeguards product quality but also upholds stringent safety and compliance standards. Consequently, the reliability and precision of gas regulators have become foundational to operational integrity in sectors where even minor deviations in pressure can lead to costly downtime or safety incidents.

Over the past several decades, the evolution of industrial gas regulators has closely mirrored the trajectory of industrial innovation. Early mechanical regulators, while durable, often lacked the fine-tuning capabilities required for today’s high-specification processes. Modern iterations integrate advanced materials, refined engineering tolerances, and enhanced sealing technologies to minimize leakage and extend service life. Furthermore, the growing emphasis on energy efficiency and workplace safety has catalyzed the adoption of regulators that offer reduced emissions, faster response times, and integrated monitoring functions. As industries continue to embrace automation and data-driven operations, gas regulators have emerged not simply as passive components but as active enablers of process transparency and control.

Unveiling the Major Technological Advancements and Sustainability-Focused Trends Redefining Industrial Gas Regulator Performance and Market Dynamics

In recent years, transformative shifts have reshaped the industrial gas regulator landscape by fusing digital connectivity with traditional mechanical robustness. Regulators equipped with built-in sensors now relay real-time pressure and flow data to centralized control systems, enabling proactive maintenance and rapid response to anomalies. This connectivity reduces unplanned outages and extends equipment lifespan by predicting valve wear before it leads to failure. Simultaneously, advancements in sensor miniaturization and wireless communication protocols have lowered the adoption barrier, allowing end users to retrofit existing installations rather than undertake costly system-wide replacements.

Alongside digital integration, material science breakthroughs have introduced corrosion-resistant alloys and composite polymers that withstand aggressive gas chemistries and extreme temperatures. These novel materials protect internal regulator components from degradation, which prolongs operational cycles and mitigates downtime in corrosive environments like oil and gas extraction or chemical processing. Coupled with stringent environmental regulations, these durable designs address both performance and sustainability objectives by minimizing leaks and material waste. As a result, manufacturers are now prioritizing lightweight, high-strength regulator bodies that deliver consistent performance while reducing the carbon footprint associated with frequent replacements and maintenance operations.

Analyzing the Implications of the 2025 United States Tariff Framework on Supply Chains Cost Structures and Regulatory Compliance in Industrial Gas Regulation

The introduction of new United States tariffs in early 2025 has had a far-reaching impact on the industrial gas regulator value chain, particularly for companies that rely on imported precision components. Manufacturers have encountered elevated costs for pressure-sensing diaphragms, springs, and specialized valve assemblies sourced from overseas suppliers. In response, several leading producers have accelerated efforts to diversify their component base by qualifying multiple suppliers across different regions. This shift not only mitigates the risk of tariff-related cost volatility but also strengthens resilience against logistical challenges in global supply networks.

Additionally, end users in industries such as chemical processing and semiconductor manufacturing have adjusted procurement strategies to accommodate the revised cost structure. Agile buyers now negotiate longer-term contracts and explore local content options to benefit from tariff exemptions or reduced duties. These measures, while effective in the short term, require close collaboration between purchasing teams, regulatory affairs experts, and engineering departments to ensure that alternative components meet stringent performance and safety criteria. Looking forward, continued monitoring of tariff adjustments will remain critical, as shifting trade policies can swiftly alter the economics of sourcing precision regulator components.

Delving into a Nuanced Segmentation Analysis Revealing How Gas Type Product Variation Distribution Pathways and Industry Applications Shape Market Opportunities

A closer examination of market segmentation reveals that gas regulators must address a diverse range of requirements based on the specific gas type in use. Whether controlling inert gases used in welding applications or maintaining ultra-high-purity oxygen in medical environments, regulators are engineered with calibrated pressure ranges and seal materials tailored to the chemical properties and critical safety factors of each gas. Thus, an argon regulator employed in metal fabrication prioritizes durability under high-flow conditions, while a helium regulator for leak detection emphasizes micro-leak tightness and rapid response.

Similarly, the choice between automatic regulators equipped with self-adjusting valves, dual stage regulators that offer stepped pressure reduction for precise control, manual regulators operated by hand, multi stage regulators for complex pressure management, and single stage regulators depends heavily on the intended process requirements. Multi stage designs find favor in systems demanding incremental pressure adjustments with minimal flow drop, whereas single stage regulators provide straightforward, low-cost solutions for less critical applications.

Distribution channel preferences further shape market dynamics, with offline channels such as authorized distributors and system integrators offering technical consultation and on-site support, while online platforms provide rapid access to standardized regulator models and price transparency. In many cases, larger end users blend both approaches by leveraging distributor value-added services for specialized applications and using e-commerce channels for bulk replenishment of common parts.

End user industries impose additional layers of demand. In chemical processing, regulators must meet aggressive pressure and temperature profiles; in food and beverage production, hygienic designs facilitate easy cleaning and sterilization. The healthcare sector demands ultra-clean interfaces and traceable calibration records, whereas manufacturing applications prioritize throughput and robustness. Oil and gas operations require rugged, explosion-proof regulators to handle volatile hydrocarbons, and semiconductor and electronics production relies on regulators capable of maintaining nanoscopic pressure deviations to ensure yield consistency. These varied industrial imperatives drive continuous product innovation and customization in the regulator market.

This comprehensive research report categorizes the Industrial Gas Regulator market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Gas Type

- Product Type

- End User Industry

- Distribution Channel

Examining the Distinct Demand Drivers Market Characteristics and Strategic Imperatives Across Americas Europe Middle East Africa and Asia Pacific Regions

Regional dynamics in the Americas underscore a mature market landscape characterized by stable regulatory regimes and robust aftermarket service ecosystems. In North America, stringent workplace safety standards and environmental regulations have elevated the importance of certified pressure relief systems and low-emission sealing technologies. Suppliers in this region frequently partner with service providers to deliver predictive maintenance programs, digital calibration records, and on-site training, catering to end users who prioritize operational continuity.

Moving across to Europe, the Middle East, and Africa, regulatory heterogeneity presents both challenges and opportunities. In Western Europe, harmonized standards under the Pressure Equipment Directive foster a competitive environment for advanced, safety-critical regulators. Conversely, emerging markets in Eastern Europe and the Middle East exhibit growing investments in infrastructure development, leading to increased demand for basic but reliable regulator solutions. In African markets, dependence on imported equipment is balanced by rising local fabrication efforts, prompting suppliers to establish regional partnerships to navigate import duties and logistical complexities.

Across the Asia-Pacific region, rapid industrialization and expanding manufacturing sectors drive significant growth in regulator demand. Countries such as China, India, and Southeast Asian nations invest heavily in chemical plants, power generation, and renewable energy projects, necessitating a wide range of regulator technologies. Moreover, a rising focus on domestic innovation has led to an uptick in locally designed regulators that integrate digital monitoring with competitive pricing strategies. This dynamic environment encourages global and regional suppliers to collaborate on technology transfer and joint ventures, positioning the Asia-Pacific region as a hotbed for regulator innovation and volume adoption.

This comprehensive research report examines key regions that drive the evolution of the Industrial Gas Regulator market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Industry Participants Strategic Collaborations Technological Innovations and Competitive Positioning in the Industrial Gas Regulator Sector

Leading companies in the industrial gas regulator sector have pursued a combination of organic research and strategic partnerships to maintain technological leadership. Major OEMs have invested in in-house laboratories to conduct accelerated life testing and refine seal designs, ensuring compliance with emerging environmental standards. Some have entered into joint development agreements with sensor manufacturers to embed digital pressure transducers and wireless communication modules directly into regulator assemblies.

Strategic acquisitions have emerged as another key pathway to bolster product portfolios. By acquiring niche specialists in high-purity or explosion-proof regulator segments, established players can quickly expand their addressable applications across industries such as petrochemicals and pharmaceutical manufacturing. Collaborative alliances between control system integrators and regulator manufacturers further enhance system-level solutions, delivering plug-and-play modules that seamlessly integrate into larger automation platforms.

In parallel, a shift toward sustainability has prompted top companies to reengineer regulator components using recycled and bio-compatible materials. This sustainable sourcing not only aligns with corporate environmental commitments but also resonates with end users seeking to reduce cradle-to-grave emissions. The convergence of digital capabilities, strategic M&A activity, and sustainability-driven innovation underscores how key participants are shaping the future of industrial gas regulation.

This comprehensive research report delivers an in-depth overview of the principal market players in the Industrial Gas Regulator market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Advanced Specialty Gases Inc.

- Air Liquide S.A.

- Air Products and Chemicals, Inc.

- BASF SE

- Buzwair Group

- Cavagna Group S.p.A.

- Corbett Industries, Inc.

- DuPont de Nemours, Inc.

- Ellenbarrie Industrial Gases Ltd.

- Emerson Electric Co.

- Gulf Cryo

- Honeywell International Inc.

- Itron, Inc.

- Iwatani Corporation

- Matheson Tri-Gas, Inc.

- Pietro Fiorentini S.p.a.

- Proton Gases (India) Private Limited

- Rotarex S.A.

- Universal Industrial Gases, Inc.

Formulating Strategic Priorities and Actionable Initiatives to Elevate Operational Efficiency Safety Compliance and Sustainability in Industrial Gas Regulation

Industry leaders must prioritize the integration of real-time diagnostic capabilities into regulator portfolios, as proactive fault detection can significantly reduce unplanned downtime and maintenance costs. By implementing predictive analytics, organizations can identify performance degradation patterns early and schedule targeted interventions before critical failures occur. Simultaneously, investing in digital twins of regulator systems provides a virtual test environment for optimization, enabling process engineers to simulate pressure fluctuations and refine control algorithms without risking operational disruption.

Supply chain diversification remains essential in the wake of shifting trade policies and tariff adjustments. Building relationships with multiple component suppliers across different regions safeguards against localized disruptions and price volatility. Moreover, aligning procurement strategies with value-engineered component designs ensures that alternative parts meet or exceed the original specifications, maintaining system integrity and safety.

To elevate sustainability credentials, companies should explore the adoption of eco-friendly seal materials and low-leakage valve designs that minimize greenhouse gas emissions. Engaging in cross-industry working groups and regulatory forums can accelerate the development of standardized testing protocols and environmental benchmarks. Lastly, empowering field technicians through targeted training programs and digital support tools fosters a culture of continuous improvement, ensuring that best practices in installation, calibration, and maintenance are consistently applied across all operations.

Outlining the Rigorous Multistage Research Approach Data Collection Techniques and Analytical Frameworks Underpinning the Industrial Gas Regulator Market Study

This study employed a multistage research approach, beginning with an extensive review of technical whitepapers, regulatory filings, and industry standards to establish a foundational understanding of regulator technologies and compliance obligations. Secondary research encompassed a wide range of public and proprietary sources, including patent databases, corporate annual reports, and trade association publications, to map competitive landscapes and technological milestones.

Subsequently, primary research involved structured interviews with key stakeholders across the value chain. These included design engineers at regulator manufacturers, procurement managers at end user facilities, distributors offering aftermarket services, and regulatory affairs specialists. Insights gleaned from these discussions were triangulated with supply chain data and process performance records to validate trends and identify emerging market pressures.

Quantitative analysis leveraged shipment volumes, import-export data, and component cost indices to assess relative growth pockets, while qualitative methodologies such as expert panel workshops informed scenario planning for tariff impacts and regulatory shifts. Rigorous data cleansing and normalization processes ensured consistency across diverse geographies and product segments. The combined application of these methodologies yielded robust insights into the evolving drivers of demand, competitive dynamics, and strategic imperatives in the industrial gas regulator market.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Industrial Gas Regulator market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Industrial Gas Regulator Market, by Gas Type

- Industrial Gas Regulator Market, by Product Type

- Industrial Gas Regulator Market, by End User Industry

- Industrial Gas Regulator Market, by Distribution Channel

- Industrial Gas Regulator Market, by Region

- Industrial Gas Regulator Market, by Group

- Industrial Gas Regulator Market, by Country

- United States Industrial Gas Regulator Market

- China Industrial Gas Regulator Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 795 ]

Summarizing Key Insights Emerging Trends and Strategic Imperatives to Guide Decision Making and Foster Innovation in Industrial Gas Regulator Markets

As industrial sectors continue to evolve toward higher automation, sustainability, and safety standards, the role of gas regulators becomes ever more pivotal. The convergence of digital monitoring, advanced materials, and adaptive supply chain strategies presents compelling opportunities for manufacturers and end users alike. By capitalizing on segmentation insights-ranging from gas type specificity to end industry requirements-companies can position themselves to deliver tailored solutions that address unique process challenges.

Regional market variations underscore the need for flexible strategies that accommodate local regulations, supply chain realities, and technological readiness levels. Moreover, the cumulative impact of evolving trade policies highlights the importance of agile sourcing and proactive collaboration between procurement and engineering functions. Through strategic investments in digital capabilities, sustainable designs, and cross-industry partnerships, organizations can enhance operational resilience while maintaining a competitive edge.

Ultimately, success in the industrial gas regulator market hinges on the ability to translate technical excellence into tangible business outcomes. By aligning product innovation with customer needs and regulatory landscapes, industry participants will be well-equipped to navigate complex challenges, drive efficiency, and sustain growth in an increasingly demanding operational environment.

Engaging with Our Associate Director of Sales Marketing to Secure Comprehensive Industrial Gas Regulator Market Research and Drive Strategic Business Growth

To access the detailed insights and strategic analyses that can transform your operational decision making in the industrial gas regulator sector, reach out to Ketan Rohom, Associate Director of Sales & Marketing. His expertise in tailoring research solutions ensures that your organization gains the competitive intelligence needed to navigate emerging market dynamics with confidence. Engage directly to explore flexible report packages, custom data modules, and advisory services designed to support your growth objectives. Seize this opportunity to leverage comprehensive market research, deepen your understanding of regulatory shifts, and accelerate your business success in an increasingly complex landscape of industrial gas regulation.

- How big is the Industrial Gas Regulator Market?

- What is the Industrial Gas Regulator Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?