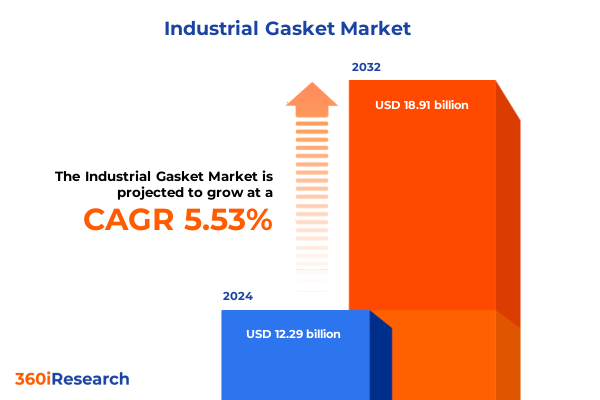

The Industrial Gasket Market size was estimated at USD 12.94 billion in 2025 and expected to reach USD 13.63 billion in 2026, at a CAGR of 5.57% to reach USD 18.91 billion by 2032.

A concise orientation to how industrial gaskets anchor operational reliability and why strategic sourcing, materials choice, and trade policy now define competitive advantage

The industrial gasket sector sits at the intersection of mechanical reliability, materials science and global supply chains, and it is increasingly central to the continuity of heavy industry, process engineering and advanced mobility systems. This executive summary distills the structural forces reshaping demand, supply and distribution for gasket technologies, allowing commercial leaders and technical buyers to see how product portfolios, materials selection and manufacturing footprints interact with evolving policy and trade regimes. The intent is to provide a succinct, actionable orientation that highlights where commercial risk is concentrated, where value can be reclaimed through operational changes, and where product and channel strategies will need recalibration to maintain service levels and cost competitiveness.

Across multiple end-use industries, gaskets function as low-visibility but high-consequence components: failures translate directly into safety incidents, environmental non-compliance, and significant downtime. Consequently, decisions about sourcing, qualification and aftermarket logistics are closely tied to capital planning and maintenance regimes. This report frames these operational realities against recent macroeconomic and trade developments, supply-chain reconfiguration trends, and innovations in materials and precision manufacturing. It is designed for executives weighing sourcing strategy, product managers updating specifications, and procurement teams tasked with balancing resilience and cost. The following sections move from the broad shifts in the competitive landscape through tariff-driven disruptions and segmentation-by-technology, concluding with prioritized recommendations and a clear path to acquire the full dataset and analysis.

How trade policy volatility, manufacturing automation, and heightened specification demands are reorganizing supplier economics and customer expectations in the gasket industry

The landscape for industrial gaskets is undergoing transformative shifts driven by three interlinked vectors: trade policy volatility, material and process innovation, and a renewed emphasis on supply-chain resilience. Trade interventions and the prospect of higher levies on metal inputs have materially altered procurement calculus, prompting engineering teams to re-examine material specifications and qualify alternative composites and semi-metallic constructions at scale. Concurrently, advances in waterjet cutting, CNC precision, and automated inspection are compressing lead times and elevating the value of localized, higher-precision manufacturing - changes that benefit suppliers who can pair technical capability with flexible capacity.

At the same time, customers across oil & gas, chemical processing, power generation, and transportation demand tighter tolerances and documented traceability as regulatory regimes intensify focus on safety and environmental stewardship. This has elevated the commercial importance of supply-chain transparency, certificate-of-conformance workflows and aftermarket readiness. As a result, competitive advantage increasingly accrues to manufacturers that can demonstrate controlled material provenance, rapid engineering-to-production cycles, and robust aftermarket support. Taken together, these shifts are creating a bifurcated market: commodities-based suppliers that compete largely on price, and technology-forward partners that win on specification assurance, shorter qualification cycles and service integration. Transitioning across that spectrum requires deliberate investment in process control, materials sourcing, and contractual frameworks that align incentives with end-user reliability objectives.

A pragmatic review of how recent United States tariff proclamations and Section 301 adjustments have reshaped input costs, sourcing behavior, and compliance burdens for gasket manufacturers

The cumulative impact of recent and announced United States tariff actions has materially reweighted cost structures for any gasket component that contains steel, aluminum, copper, or other tariffed inputs, creating immediate pressure on manufacturers that rely on imported raw materials or finished gaskets. Proclamations in early 2025 that tightened Section 232 measures and removed prior exemptions have broadened the set of derivative and downstream products subject to elevated duties, while separate adjustments to Section 301 tariffs have raised rates on targeted critical inputs and technology-adjacent components. These measures have two practical effects: first, they raise landed input costs and compress margins for manufacturers who cannot rapidly re-source or vertically integrate; second, they incentivize near-shore investment and inventory strategies designed to minimize exposure to unpredictable duty changes. The net result is a reallocation of risk from suppliers with long, low-margin global supply chains toward firms offering localized manufacturing and traceable melt-and-pour provenance for metal content.

Beyond direct duty impacts, the tariff environment has reshaped commercial behavior among buyers. Procurement teams now incorporate scenario-based duty stress tests into supplier qualification, and long-term contracts increasingly include force majeure and tariff pass-through clauses. Some global OEMs and aftermarket distributors have accelerated supplier dual-sourcing, while others have begun qualifying alternative materials that reduce reliance on tariffed metals. In parallel, several non-U.S. suppliers have announced investments in onshore facilities or joint ventures intended specifically to mitigate tariff exposure and maintain access to major accounts. This strategic relocation response, while capital intensive, offers a structural hedge that can preserve market access and shorten logistics chains, but it also raises the cost baseline for new entrants and for customers unwilling to accept the price of onshoring.

Finally, the tariff landscape introduces new compliance burdens that affect time-to-market and cost of qualification. Expanded coverage of derivative steel and aluminum articles means customs classification and the documentation of melt-and-pour or smelted-and-cast origin are now primary commercial controls. Companies must invest in customs expertise, detailed bill-of-materials traceability, and, where feasible, audit-ready supplier agreements to limit surprise duties. Those companies that implement robust tariff-risk governance and integrate it into product design and procurement cycles will be better positioned to maintain delivery performance and defend margins under continuing policy unpredictability.

In-depth segmentation analysis showing how product families, material types, production technologies, industry end uses, and distribution channels interact to shape commercial advantage for gasket suppliers

Segmentation insight requires translating product, material, manufacturing and channel characteristics into commercial implications for each customer type. Based on Product Type, corrugated gaskets remain preferred where thermal cycling and flanged interface conformity are paramount, while jacketed gaskets serve high-pressure heat exchanger applications and soft gaskets provide economical sealing solutions for lower-pressure systems; spiral wound gaskets and ring type joint gaskets occupy the intersection of high-pressure, high-temperature service and flange standardization, commanding tighter qualification but offering broader reuse across industries. Based on Material Type, metallic gaskets continue to dominate applications that require extreme temperature tolerance and mechanical strength; non-metallic gaskets are chosen for chemical compatibility and cost-sensitive sealing needs; semi-metallic constructions are increasingly used to balance resilience and compliance requirements. Based on Manufacturing Process, CNC cutting delivers high dimensional repeatability for complex profiles, die cutting supports high-volume sheet-based production, extrusion enables continuous-profile seals and waterjet cutting provides burr-free contours for advanced composites and layered constructions; each method carries distinct unit-cost and lead-time implications. Based on End-Use Industry, automotive demands prioritize high-volume, tightly toleranced seals and just-in-time distribution, chemical processing emphasizes material compatibility and safety certification, food & beverage specifies hygienic materials and traceability, oil & gas and power generation call for high-temperature and pressure-rated constructions, pharmaceuticals demand validated supply chains, pulp & paper relies on abrasion-resistant solutions, and water & wastewater treatment focuses on corrosion and chemical resistance. Based on Distribution Channel, aftermarket suppliers must provide rapid lead times, engineering support and small-batch flexibility, whereas OEM channels prioritize long-term qualifications, predictable pricing and collaborative design-for-manufacture. Synthesizing across these segmentation axes shows that the most durable competitive positions will combine depth in one or two product/material niches with process excellence that keeps qualification cycles short and aftermarket responsiveness high.

This comprehensive research report categorizes the Industrial Gasket market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Material Type

- Manufacturing Process

- End-Use Industry

- Distribution Channel

Comparative regional outlook highlighting how regulatory regimes, manufacturing depth, and customer priorities across the Americas, EMEA, and Asia-Pacific determine strategic sourcing and investment choices

Regional dynamics are central to strategic planning because policy, logistics and end-market demand differ materially across geographies. Americas demand patterns are shaped by a concentration of mature end markets such as automotive, oil & gas, and power generation together with a heavy emphasis on regulatory compliance and onshoring momentum that favors localized supply and inventory. In contrast, Europe, Middle East & Africa presents a patchwork of regulatory regimes and an elevated premium on documented environmental and safety performance; the region’s advanced process industries and renewables investments make high-specification gaskets and traceability services particularly valuable. Asia-Pacific combines manufacturing depth, rapid adoption of production automation, and a varied spectrum of end users: some markets favor cost-efficient, high-volume supply while others push for higher-specification materials for petrochemical and power projects. These regional distinctions drive where capital should be allocated: in the Americas and selected Asia-Pacific hubs for near-term capacity and speed-to-market, and in EMEA for technical partnerships and compliance-driven product development. When layered with tariff and trade friction dynamics, regional strategy must prioritize diversified supply nodes, flexible logistics corridors, and localized value propositions tied to the unique regulatory and end-use needs of each geography.

This comprehensive research report examines key regions that drive the evolution of the Industrial Gasket market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

How vertical integration, technical specialization, and digital traceability are becoming the primary levers for industrial gasket companies to defend margin and accelerate customer qualification

Company-level dynamics in the gasket industry now reflect two enduring trends: consolidation through vertical integration and strategic differentiation via technical specialization. Larger manufacturers that control material sourcing, precision manufacturing and global aftermarket networks are using integration to stabilize supply and to offer turnkey qualification packages to major OEMs. Mid-sized and smaller firms are carving defensible niches by investing in specialized materials, proprietary coatings, and rapid-response aftermarket services that reduce end-user downtime. Across the board, successful companies are investing in digital traceability, certificate-of-conformance automation, and in-process quality analytics that lower the total cost of qualification and support premium pricing for performance-critical applications.

Supplier partnerships and channel structures are also evolving. Distributors and aftermarket specialists who provide engineering support, rapid cross-docking and local stocking points are increasingly valuable to plant operators seeking to minimize outage risk. OEM-focused suppliers are emphasizing design-for-manufacture collaboration and long-term tooling commitments that shorten validation cycles. Competitive differentiation often comes from the ability to combine materials expertise with consistent manufacturing tolerances and integrated quality documentation. In short, leadership now accrues to firms that can both reduce exposure to trade-policy shocks through diversified sourcing and add measurable value through materials science, process control and aftermarket engineering services.

This comprehensive research report delivers an in-depth overview of the principal market players in the Industrial Gasket market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- A.W. Chesterton Company

- Angst+Pfister Group

- Apex Sealing Solutions Pvt. Ltd.

- Dana Incorporated

- DONIT TESNIT, d.o.o.

- Dätwyler Holding Inc.

- Eaton Corporation plc

- EGC Enterprises Inc.

- Flexitallic LP

- Freudenberg Sealing Technologies SE & Co. KG

- Garlock Sealing Technologies LLC by Enpro Company

- Gasco Inc.

- Gasket Engineering Company

- Goodrich Gasket Private Limited by Flosil Group

- Jai Gasket Industries

- James Walker & Co. Ltd.

- John Crane Inc. by Smiths Group plc

- KLINGER Holding GmbH

- Packwell Gaskets Pvt Ltd

- Parker-Hannifin Corporation

- SKF Group

- TEADIT

- Trelleborg AB by Yokohama Rubber Co., Ltd.

- W.L. Gore & Associates, Inc.

Actionable three-track plan for industry leaders to secure materials, compress qualification cycles, and redesign commercial frameworks to share tariff and supply risks with customers

Industry leaders should adopt a three-track action plan that simultaneously secures supply, accelerates qualification, and re-prices commercial contracts for resilience. First, secure inputs by diversifying material suppliers and by pursuing targeted near-shore manufacturing or toll-processing agreements that provide documented melt-and-pour provenance for metal content; this reduces both duty exposure and lead-time variability. Second, accelerate qualification by investing in high-fidelity digital inspection, material characterization and standardized engineering validation packages that can be delivered to customers as part of a qualification kit; shortening time-to-approval materially increases win rates for higher-margin products. Third, re-price and re-contract by embedding tariff contingency clauses, dynamic cost-pass mechanisms, and joint inventory models with key customers so that both parties share risk and align incentives for resilience.

Operationally, leaders should prioritize incremental capital directed at flexible manufacturing cells - modular CNC or waterjet cells that can switch between product families - rather than single-purpose mass lines. Commercial teams should develop a differentiated aftermarket offering that includes emergency response SLAs, local stocking points and digital re-ordering platforms to capture premium service revenues. Finally, invest in customs and trade-compliance capability as a core commercial competency: accurate classification, origin documentation and proactive engagement with customs authorities reduce unexpected duty exposure and enable smoother cross-border flows. Together, these actions convert policy and supply-chain turbulence from a source of cost into a vector for competitive separation and improved customer lock-in.

Methodology describing how primary interviews, facility audits, secondary regulatory analysis, and data triangulation were combined to validate operational and policy insights for gaskets

This research combined structured primary inquiry with extensive secondary source analysis to ensure a balanced and verifiable view of operational, regulatory and market dynamics. Primary inputs included interviews with procurement leaders, engineering managers, and distribution channel partners to surface real-world qualification timelines, warranty drivers and aftermarket service expectations. These conversations were complemented by manufacturing-facility visits and process audits to validate lead-time, tolerance and capacity assumptions. Secondary analysis synthesized regulatory proclamations, trade-policy filings, customs guidance and contemporary news reporting to capture the most recent tariff measures and their operational consequences.

Data triangulation was used to reconcile sometimes-conflicting observations: supplier-level interviews revealed practical workarounds for tariff exposure, while policy documents and customs notices established the formal compliance requirements that underpin those workarounds. The methodology prioritized traceable source attribution for any statement about trade policy or regulatory change and used scenario stress-testing to show how different tariff outcomes would alter procurement and inventory strategies. Wherever possible, assertions were validated through at least two independent information channels to ensure robustness and to minimize survivorship bias in supplier narratives.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Industrial Gasket market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Industrial Gasket Market, by Product Type

- Industrial Gasket Market, by Material Type

- Industrial Gasket Market, by Manufacturing Process

- Industrial Gasket Market, by End-Use Industry

- Industrial Gasket Market, by Distribution Channel

- Industrial Gasket Market, by Region

- Industrial Gasket Market, by Group

- Industrial Gasket Market, by Country

- United States Industrial Gasket Market

- China Industrial Gasket Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 954 ]

Concluding synthesis that ties tariff-driven sourcing shifts, materials innovation, and manufacturing agility into a unified set of strategic priorities for gasket businesses

In conclusion, the industrial gasket industry is at an inflection point defined by trade policy volatility, material-science evolution and a premium on manufacturing flexibility. Tariff actions and the associated compliance burden have already forced changes in sourcing, justified near-shore investments, and elevated the value of suppliers that can deliver documented material provenance and rapid qualification kits. At the same time, advances in precision cutting, automated inspection and hybrid material constructions are expanding the technical envelope of what is possible, creating opportunities for suppliers who pair technical capability with disciplined supply-chain governance.

For commercial leaders, the imperative is clear: integrate tariff-risk governance into product design and procurement; invest selectively in flexible manufacturing and digital traceability; and redesign commercial agreements so that risk and reward are shared across the value chain. Organizations that move quickly to align materials strategy with compliance capability and aftermarket responsiveness will convert short-term disruption into a durable advantage in reliability-critical markets. The path forward is less about predicting exact policy outcomes and more about building adaptive systems that preserve service, protect margin, and enable faster customer qualification.

Direct purchase pathway and personalized commercial briefing with the Associate Director of Sales & Marketing to secure the complete industrial gasket market report and support

To obtain the full market research report and a tailored briefing that translates strategic findings into executable commercial plans, contact Ketan Rohom, Associate Director, Sales & Marketing. He will coordinate access to the complete report package, arrange a focused walkthrough of sections most relevant to your business questions, and scope bespoke add-ons such as primary interviews, supplier due-diligence, or a tailored regional risk assessment. Acting now accelerates planning cycles and gives procurement, product management, and commercial teams the information needed to redesign supplier networks, validate manufacturing pathways, and defend margin under current trade policy dynamics. Reach out to schedule a confidential consultation and receive a formal proposal and secure purchase instructions to obtain the complete deliverable and supporting datasets.

- How big is the Industrial Gasket Market?

- What is the Industrial Gasket Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?