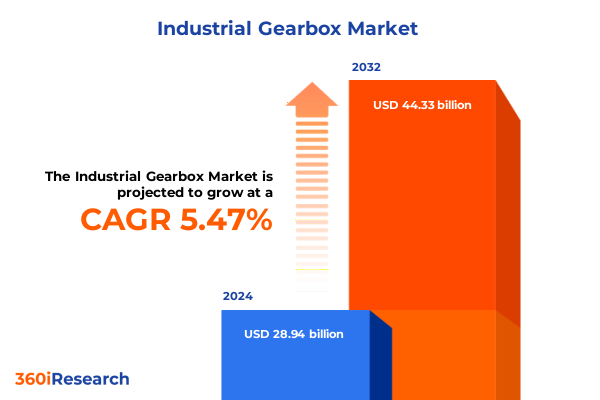

The Industrial Gearbox Market size was estimated at USD 30.46 billion in 2025 and expected to reach USD 32.08 billion in 2026, at a CAGR of 5.50% to reach USD 44.33 billion by 2032.

Unveiling the Pillars of Industrial Gearbox Innovation and Market Dynamics to Set the Stage for Strategic Decision Making and Growth

The industrial gearbox sector functions as the backbone of modern power transmission, enabling precise speed and torque control across manufacturing, energy, and transportation industries. As global production demands evolve and process automation intensifies, decision-makers are under mounting pressure to adopt reliable, efficient, and adaptable gearbox solutions. The rapid integration of digital monitoring and advanced analytics has ushered in a new era in which predictive maintenance and real-time performance optimization are no longer optional, but essential facets of competitive strategy.

Delving into the intricacies of this dynamic market, it becomes evident that supply chain stability, regulatory frameworks, and material innovation collectively shape the evolution of gearbox technology. Heightened emphasis on sustainability and energy efficiency spurs research into lightweight alloys and low-friction coatings, driving engineering breakthroughs. Simultaneously, geopolitical uncertainties and shifting trade policies introduce fresh complexities for procurement and cost management. Consequently, executives must foster agility by aligning product roadmaps and investment decisions with broader industry transformations.

This executive summary frames the strategic landscape with clarity and depth. It equips leaders to navigate trade headwinds, harness emerging digital capabilities, and leverage segmentation nuances across product types, applications, and regions. By grounding the analysis in both qualitative insights and robust industry context, this introduction sets the foundation for informed decision-making and sustainable growth.

Examining How Digitalization Automation and Sustainable Practices Are Reshaping the Industrial Gearbox Landscape Across Critical Manufacturing Sectors

Advancements in digitalization, coupled with the proliferation of the Industrial Internet of Things, have catalyzed a paradigm shift in how gearbox performance is monitored and optimized. Traditional maintenance schedules are giving way to condition-based strategies driven by sensor networks and machine learning algorithms. This transition not only minimizes unplanned downtime but also reduces lifecycle costs and extends equipment longevity. Moreover, the convergence of automation platforms and robotics demands gearboxes capable of seamlessly integrating into modular, programmable architectures, heightening the importance of standardized communication protocols and interoperable components.

Simultaneously, the push for decarbonization across heavy industries has spurred research into novel materials and lubrication technologies that reduce frictional losses. Manufacturers are exploring advanced composites and eco-friendly lubricants to meet stringent emissions targets and energy-efficiency guidelines. A growing preference for electric drive systems further influences gearbox design, prompting the development of compact, high-torque configurations tailored to electric motors. Driven by customer expectations for customization, modular design principles are gaining traction, allowing end-users to configure gear ratios, mounting orientations, and sealing options with unprecedented flexibility.

Collectively, these transformative shifts redefine competitive benchmarks by blending mechanical excellence with digital intelligence and environmental stewardship. As manufacturers embrace collaborative engineering models, the ability to co-innovate with end-users and technology partners emerges as a critical differentiator, fueling the next wave of gearbox innovation.

Assessing the Compound Effects of Recent United States Tariff Measures on Global Supply Chains Procurement Costs and Competitive Positioning in 2025

In 2025, a complex tapestry of trade measures in the United States exerts a multifaceted influence on the industrial gearbox supply chain. Tariffs initially introduced under national security provisions on steel and aluminum continue to cascade through component pricing, elevating raw material costs by a significant margin. Concurrently, broader Section 301 duties on specific imported machinery categories have been expanded, applying additional duties to gearbox imports from key manufacturing hubs. These cumulative levies directly impact landed costs, prompting OEMs and distributors to reassess global sourcing strategies and inventory buffers.

The ripple effects of these tariff structures manifest in elongated lead times as suppliers adjust production schedules and explore alternative material suppliers. Increased cost volatility has driven many market participants to pursue nearshoring models, establishing assembly partnerships in Mexico and the southeastern United States to mitigate exposure. This shift not only addresses tariff burdens but also enhances supply chain visibility and responsiveness. Additionally, heightened scrutiny around customs classification necessitates more rigorous compliance protocols, with companies investing in enhanced documentation and audit capabilities to avoid unexpected duties and penalties.

Despite short-term headwinds, these policy-driven disruptions also create catalysts for market differentiation. Suppliers that demonstrate agility through localized manufacturing, strategic stock positioning, and digital procurement platforms can preserve margin integrity and reinforce customer trust. Ultimately, the tariff landscape in 2025 underscores the necessity for a proactive, data-informed approach to procurement and manufacturing planning within the industrial gearbox sector.

Deriving Strategic Insights from Multifaceted Segmentation Spanning Gearbox Types Stages Mounting Materials Operations and End Use Applications

Segment analysis reveals critical insights that inform product development and go-to-market strategies across the gearbox spectrum. By type, helical and planetary gearboxes remain prominent due to their balance of efficiency and load-handling capacity, whereas worm and bevel units cater to niche applications requiring high torque and compact form factors. Spur configurations continue to serve cost-sensitive applications, while emerging demand for modular planetary systems highlights a shift toward scalable, interchangeable assemblies.

Exploring stage segmentation, single stage designs dominate applications where simplicity and affordability are prioritized, yet two stage and multi-stage configurations are gaining traction in heavy-duty environments demanding higher gear ratios and torque multiplication. Mounting insights indicate that foot mounted units prevail in stationary infrastructure, whereas flange mounted variants support inline motor integration, and shaft mounted options deliver streamlined assembly in confined spaces. Lubrication choices bifurcate between grease and oil systems, with grease favored for maintenance-restricted installations and oil lubrication selected where temperature management and longevity are paramount.

Material composition further underscores performance trade-offs: cast iron remains the staple for its robustness and cost efficiency, steel alloys are preferred for high-stress scenarios, and aluminum emerges as a lightweight alternative in mobile and commercial vehicle contexts. Operation modes split between continuous and intermittent use cases, each dictating specific thermal and fatigue considerations. Application segmentation covers automotive-spanning commercial vehicles heavy-duty and passenger platforms-marine including commercial vessel naval and recreational crafts-material handling encompassing conveyors cranes elevators and hoists-mining across surface and underground operations-oil and gas within downstream and upstream sectors-as well as power generation in hydro thermal and wind installations. Finally, sales channel dynamics differentiate aftermarket services, which drive long-term maintenance revenues, from OEM partnerships focused on integrated solutions and initial equipment placements.

This comprehensive research report categorizes the Industrial Gearbox market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Stage

- Mounting

- Lubrication

- Material

- Operation Mode

- Application

- Sales Channel

Highlighting Regional Dynamics and Growth Drivers Across Americas Europe Middle East Africa and Asia Pacific to Uncover Emerging Market Opportunities

Regional performance profiles underscore divergent growth catalysts and operational dynamics that shape strategic planning. In the Americas, the drive toward industrial modernization in the United States, coupled with rapid expansion of renewable energy infrastructure in Brazil, delivers robust demand for advanced gearbox solutions. Companies capitalize on government incentives for clean energy projects and bolster local manufacturing footprints to minimize tariff exposure and strengthen service networks.

Across Europe, Middle East, and Africa, strict regulatory mandates on emissions and noise propagate demand for low-loss gearbox technologies, while major petrochemical and infrastructure projects in the Gulf Cooperation Council and North Africa spur demand for high-torque, corrosion-resistant designs. Manufacturers in this region navigate a complex mosaic of standards, necessitating adaptive engineering to satisfy diverse compliance regimes. Meanwhile, in sub-Saharan markets, investments in mining and material handling support long-term infrastructure growth.

The Asia-Pacific region remains a powerhouse of production and consumption, with China and India driving uptake in automotive and construction equipment, while emerging Southeast Asian markets invest heavily in power generation and maritime logistics. Local content policies incentivize joint ventures and technology transfers, prompting global gearbox suppliers to forge strategic alliances with regional OEMs. As supply chain agility becomes paramount, leveraging proximity to end-markets and optimizing cross-border distribution frameworks emerge as key competitive differentiators.

This comprehensive research report examines key regions that drive the evolution of the Industrial Gearbox market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Global Players and Their Strategic Initiatives in Technology Innovation Partnerships and Service Offerings to Stay Ahead of Market Shifts

Competitive positioning in the gearbox sector is defined by a mix of legacy manufacturers and disruptive innovators, each deploying unique strategies to capture market share. Major conglomerates, leveraging vast R&D budgets and global service networks, focus on integrated drive systems and digital service offerings to create value beyond core hardware. These players emphasize turnkey projects and comprehensive maintenance contracts, ensuring long-term customer engagement.

Meanwhile, specialized manufacturers capitalize on niche expertise, delivering customized configurations and rapid prototyping for emerging applications such as electric vehicle drivetrains and offshore wind turbines. Partnerships with automation suppliers and software developers enable these agile firms to bundle predictive analytics and condition monitoring into their product portfolios. In turn, aftermarket specialists differentiate through extensive repair and refurbishment capabilities, helping end-users maximize asset utilization and extend equipment lifecycles.

Collaboration through strategic alliances, joint ventures, and targeted acquisitions further intensifies competitive dynamics. Firms looking to broaden their reach in Asia-Pacific often pursue local partnerships, while North American suppliers invest in regional service hubs to enhance proximity to key customers. Ultimately, market leadership now hinges on the ability to offer hybrid value propositions that blend mechanical reliability with data-driven performance management and end-to-end service commitments.

This comprehensive research report delivers an in-depth overview of the principal market players in the Industrial Gearbox market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd.

- Bondioli & Pavesi S.p.A

- Bonfiglioli Riduttori S.p.A.

- Bosch Rexroth AG

- Dana Incorporated

- David Brown Santasalo

- Delta Electronics, Inc.

- Flender GmbH

- Flender GmbH

- Hansen Industrial Transmissions Ltd.

- Kavitsu Transmissions Pvt. Ltd.

- Kissling AG

- Konic Gearbox

- Liebherr-International Deutschland GmbH

- Motion Control Products Ltd.

- Neugart GmbH

- Nidec Corporation

- NORD Drivesystems GmbH & Co. KG

- Reggiana Riduttori S.R.L.

- Rossi S.p.A.

- SEW-EURODRIVE GmbH & Co. KG

- Sumitomo Heavy Industries, Ltd.

- WANSHSIN SEIKOU CO., LTD.

- WEG S.A.

- Wilhelm Vogel GmbH

- ZF Friedrichshafen AG

Presenting Actionable Strategies for Industry Leaders to Navigate Disruption Leverage Technological Advances and Strengthen Supply Chain Resilience Effectively

Leaders in the industrial gearbox market should prioritize investment in digital twins and predictive maintenance platforms to drive operational efficiency and preempt equipment failures. Embedding advanced sensor arrays and harnessing real-time analytics will enable condition-based interventions, reducing unplanned downtime and Total Cost of Ownership. In parallel, cultivating strategic supply chain diversification through regional assembly hubs and dual-sourcing frameworks can mitigate tariff risks and logistical disruptions.

Aligning product portfolios with sustainability imperatives involves accelerating the adoption of lightweight materials, low-viscosity lubricants, and high-efficiency gear profiles. Investing in research partnerships with materials science institutions and lubricant innovators can yield competitive differentiation in energy-sensitive applications. Moreover, establishing collaborative development programs with key end-use sectors ensures that future gearbox designs seamlessly integrate with evolving automation and electrification requirements.

To capitalize on regional growth, organizations should strengthen aftermarket services by deploying mobile service units and digital customer portals, enhancing responsiveness and deepening client relationships. Finally, fostering a culture of continuous improvement through cross-functional teams and data-driven decision-making will empower companies to pivot swiftly in response to emerging market signals and regulatory developments.

Outlining a Robust and Transparent Research Methodology That Ensures Data Integrity Comprehensive Analysis and Reliable Insights for Informed Decision Making

This analysis was developed through a rigorous, multi-phase research framework combining both qualitative and quantitative methods. Primary insights were obtained via structured interviews with senior executives, design engineers, and procurement specialists across leading manufacturing and end-use organizations, ensuring firsthand perspectives on market drivers and technology adoption. Secondary data was collected from regulatory filings, industry journals, technical white papers, and company publications to construct a comprehensive baseline of historical and current market dynamics.

Data triangulation techniques were applied to reconcile divergent estimates and validate thematic trends. Advanced analytics tools facilitated pattern recognition across pricing, trade flows, and engineering specifications to enhance the robustness of segmentation analysis. Further, an expert advisory panel, comprising industry veterans and academic researchers, reviewed preliminary findings to refine interpretation and eliminate potential biases.

Scenario modeling incorporated variables such as policy shifts, raw material volatility, and innovation adoption rates, providing stress-tested projections for critical market scenarios. Quality assurance protocols included audit trails of data sources, consistency checks, and peer reviews, ensuring methodological transparency and reliability. This holistic approach underpins the depth and credibility of the findings presented throughout this report.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Industrial Gearbox market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Industrial Gearbox Market, by Type

- Industrial Gearbox Market, by Stage

- Industrial Gearbox Market, by Mounting

- Industrial Gearbox Market, by Lubrication

- Industrial Gearbox Market, by Material

- Industrial Gearbox Market, by Operation Mode

- Industrial Gearbox Market, by Application

- Industrial Gearbox Market, by Sales Channel

- Industrial Gearbox Market, by Region

- Industrial Gearbox Market, by Group

- Industrial Gearbox Market, by Country

- United States Industrial Gearbox Market

- China Industrial Gearbox Market

- Competitive Landscape

- List of Figures [Total: 20]

- List of Tables [Total: 2385 ]

Synthesizing Critical Findings to Provide a Cohesive Perspective on Industrial Gearbox Trends Challenges and Strategic Imperatives for Future Growth

The landscape of industrial gearboxes has evolved into a high-tech arena where mechanical precision converges with digital intelligence and sustainability mandates. Strategic realignments driven by import tariffs have reshaped supply chains, compelling companies to establish localized manufacturing and refine procurement strategies. Technological innovations in predictive maintenance, lightweight materials, and modular designs are setting new performance benchmarks across applications from automotive to power generation.

Segmentation insights reveal that product customization and application-specific engineering are critical to capturing diverse market niches, while regional dynamics underscore the importance of tailored go-to-market models in the Americas, EMEA, and Asia-Pacific. Competitive advantage now accrues to organizations that can seamlessly integrate hardware reliability with data-driven services and responsive aftermarket support. Furthermore, collaborative ecosystems that connect manufacturers, software providers, and end-users are accelerating the pace of innovation.

Moving forward, success in the industrial gearbox sector will hinge on a holistic strategy that balances agility and scale, innovation and compliance, as well as global reach and local responsiveness. Companies that embrace a continuous learning mindset, underpinned by rigorous data analysis and strategic foresight, will be best positioned to navigate uncertainties and capture emerging growth opportunities.

Engaging Directly with Key Decision Makers to Secure Customized Industrial Gearbox Research Solutions and Unlock Competitive Intelligence for Enhanced Performance

For organizations seeking to transform their understanding of the industrial gearbox market, engaging directly with an experienced associate director can catalyze strategic advantage. Ketan Rohom, Associate Director of Sales & Marketing, stands ready to guide decision-makers through tailored insights and actionable intelligence. By scheduling a consultation, executives can explore in-depth analyses, customized data sets, and priority research add-ons designed to address unique operational challenges and growth objectives.

This one-on-one engagement will delve into market dynamics, competitor moves, regulatory shifts, and emerging technologies to help craft a roadmap aligned with corporate goals. Whether optimizing supply chain resilience, accelerating digital adoption, or capitalizing on regional expansion, this personalized approach empowers stakeholders to make informed investments with confidence. Reach out to Ketan Rohom today to secure your copy of the comprehensive market report and unlock a competitive edge that drives innovation, profitability, and long-term success.

- How big is the Industrial Gearbox Market?

- What is the Industrial Gearbox Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?