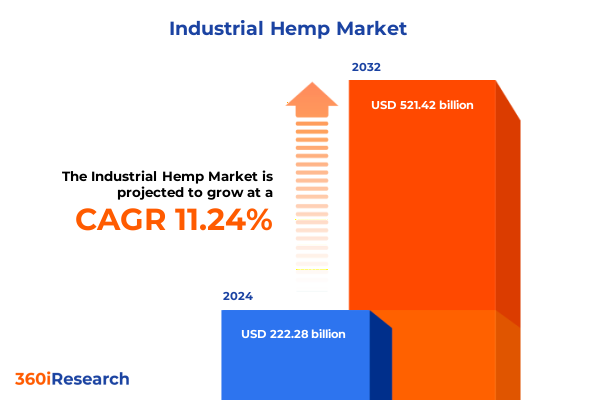

The Industrial Hemp Market size was estimated at USD 246.02 billion in 2025 and expected to reach USD 272.30 billion in 2026, at a CAGR of 11.32% to reach USD 521.42 billion by 2032.

Understanding the Emergence of Industrial Hemp As a Cornerstone Crop Fueling Sustainable Growth and Innovation in Modern Agribusiness and Manufacturing

Industrial hemp has rapidly evolved from a niche agricultural commodity to a strategic enabler for sustainable manufacturing, resilient supply chains, and diversified industrial applications. Driven by growing consumer demand for eco-friendly materials and regulatory frameworks that now recognize hemp’s negligible psychoactive properties, the crop has secured a prominent place in economic development agendas across multiple nations. This introduction delineates how shifting policy landscapes, technological strides in cultivation and processing, and heightened awareness of environmental imperatives are converging to position hemp as a pillar of modern agribusiness and advanced manufacturing.

At its core, the resurgence of industrial hemp reflects broader societal trends prioritizing circularity and low-carbon solutions. Innovations in breeding have produced cultivars tailored for high fiber yield and oil content, while advances in agronomic practices-such as precision irrigation, integrated pest management, and no-till farming-have significantly enhanced per-acre productivity. Concurrently, governments are rolling out incentive programs, streamlined licensing protocols, and research grants, thereby lowering entry barriers and catalyzing private sector investment. As we embark on this executive summary, it is crucial to appreciate industrial hemp’s dual role as both a versatile raw material and a driver of regenerative economic models.

Tracing the Transformative Shifts in Cultivation Practices and Regulatory Frameworks that Are Redefining Industrial Hemp’s Role Across Multiple Value Chains

The industrial hemp sector is undergoing profound transformation, marked by evolutions in regulatory policy and ground-breaking cultivation practices. In numerous jurisdictions, revised agricultural statutes now permit large-scale hemp cultivation under rigorous quality controls and testing regimes, signaling a departure from the restrictive frameworks of the past. These policy reforms are complemented by a new generation of processing facilities equipped with advanced decortication, degumming, and pulping technologies-improvements that yield higher fiber purity, lower waste streams, and increased throughput.

Moreover, consumer preferences have spurred companies to invest in vertically integrated models that span seed genetics, field production, and downstream manufacturing. Material science breakthroughs are enabling the extraction of high-purity cellulose for biocomposite panels, hemicellulose-derived adhesives, and lignin-based resins, each reinforcing hemp’s appeal across industries. The synergy between research institutions, ag-tech startups, and established agricultural enterprises is fostering an ecosystem in which best practices diffuse rapidly, making the sector more resilient, adaptive, and poised for continued expansion.

Analyzing the Cumulative Effects of Recent United States Tariff Policies on Import Dynamics, Domestic Pricing, and Supply Chain Resilience for Hemp Markets

In 2025, cumulative tariff adjustments implemented by the United States have exerted a multifaceted influence on the industrial hemp supply chain. Targeted levies on imported hemp products have elevated entry costs for finished goods and intermediate materials, prompting downstream manufacturers to reassess sourcing strategies. As a result, importers are seeking tariff classification optimizations and exploring free-trade zone benefits to minimize duty liabilities. This recalibration is accentuating the competitive edge of domestic producers who can align with regulatory standards while averting import penalties.

However, the tariff environment has also introduced complexity for raw-material processors reliant on cross-border logistics. Supply chain managers are grappling with increased lead times and fluctuating cost structures, compelling them to diversify supplier portfolios and enhance inventory buffers. In response, some stakeholders are forging long-term contracts with regional growers and investing in onshore decortication and degumming capacities to insulate operations from future policy shifts. This strategic pivot underscores the growing importance of supply chain resilience and the value of integrated production networks in sustaining price stability and product availability.

Revealing Strategic Segmentation Insights That Illuminate How Product Types, Processing Techniques, Material Compositions, Sources, Channels, and End Users Drive Market Complexity

Market segmentation in the industrial hemp arena reveals nuanced growth drivers across various axes. When examining product categories, fiber and seed derivatives have emerged as high-value segments, while oil and hurd applications continue to expand in response to consumer and industrial needs. Turning to processing methodologies, decortication facilities operating at scale achieve superior fiber separation, degumming units refine bast fiber for textile and composite use, and pulping lines integrate seamlessly with paper and packaging supply chains. Inspections of material composition highlight the growing importance of cellulose-rich fractions for biopolymer applications, while hemicellulose and lignin byproducts are unlocking new use cases in adhesives and bioplastics.

Source differentiation between conventional and organic cultivation has also gained prominence, with organic hemp commanding premium pricing in health, personal care, and food sectors. The interplay between offline and online sales channels demonstrates that while established distribution networks maintain strong footholds in B2B procurement, e-commerce platforms accelerate market reach for niche product offerings and end-user goods. Finally, end-use segmentation underscores the breadth of hemp’s applicability, as manufacturers in automotive, construction, food & beverages, personal care & cosmetics, pharmaceuticals, and textiles integrate hemp derivatives into their value propositions to satisfy evolving performance and sustainability requirements.

This comprehensive research report categorizes the Industrial Hemp market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Processing Technique

- Material Composition

- Source

- Sales Channel

- End User

Exploring Distinct Regional Dynamics in the Hemp Market Across the Americas, Europe, Middle East & Africa, and Asia-Pacific with Focus on Demand Drivers and Policy Trends

Regional dynamics in the industrial hemp landscape display a mosaic of regulatory approaches, consumer attitudes, and infrastructure readiness. In the Americas, the United States and Canada have established robust licensing frameworks, research initiatives, and public-private partnerships that underpin rapid scaling of cultivation and processing. Meanwhile, Latin American nations are in various stages of policy harmonization, with some exploring hemp as a rural development catalyst. Transitioning to Europe, Middle East & Africa, the European Union’s Common Agricultural Policy is fostering cross-border consistency, although member states diverge on allowable THC thresholds and regional subsidies. In the Middle East and Africa, nascent markets are driven by investment in sustainable textiles and building materials, albeit constrained by developing regulatory frameworks.

Asia-Pacific markets display significant heterogeneity, with China retaining its place as a major fiber producer and exporter while India’s textile industry experiments with hemp blends to reduce water usage. Australia’s shift toward organic hemp cultivation for nutraceuticals highlights a strategic emphasis on high-margin end uses, while Japan and South Korea focus on research into advanced composites and biopharmaceutical applications. These regional variations underscore the need for tailored market entry strategies and region-specific value propositions to capitalize on hemp’s diverse use cases and regulatory landscapes.

This comprehensive research report examines key regions that drive the evolution of the Industrial Hemp market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Innovators and Established Players Shaping the Competitive Landscape Through Technological Advancements, Partnerships, and Strategic Investments

The competitive terrain of the industrial hemp sector is shaped by pioneering agricultural enterprises, specialized technology providers, and innovative downstream processors. Key players are distinguished by their integrated cultivation capabilities, proprietary seed genetics, and investments in high-efficiency decortication and pulping equipment. Additionally, alliances between biotech firms and material science companies are emerging to co-develop hemp-derived polymers and resins. These collaborations are supplemented by strategic joint ventures that link regional growers with global manufacturing networks, ensuring consistent quality standards and volume commitments.

Furthermore, leading companies are leveraging sustainability certifications and traceability platforms to differentiate their offerings in environmentally conscious markets. Some have adopted blockchain-enabled supply chain systems to validate organic sourcing claims, while others are forging partnerships with academic institutions to advance research on lignin-based adhesives and cellulose nanocrystals. The competitive edge in this landscape increasingly hinges on the ability to integrate upstream agronomy with downstream R&D pipelines, securing first-mover advantages in high-growth end-use segments.

This comprehensive research report delivers an in-depth overview of the principal market players in the Industrial Hemp market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Bast Fibre Technologies Inc.

- Boring Hemp Company

- CANAH INTERNATIONAL SRL

- Canopy Growth Corporation

- Colorado Hemp Works, LLC

- CV Sciences, Inc.

- Dun Agro Hemp Group

- Ecofibre Limited

- Elixinol Global Limited

- Fresh Hemp Foods Ltd.

- Hemp Depot

- Hemp Sense Inc.

- HempFlax Group B.V.

- HemPoland sp. z o.o.

- Isodiol International Inc.

- Kazmira LLC

- Konoplex LLC

- Lotus Hemp

- Medical Marijuana, Inc.

- Nutiva, Inc.

- SOUTH HEMP TECNO SRL

- The Hemp Cooperative of America

- Tilray, Inc.

- Valley Bio Ltd.

Empowering Industry Leaders With Actionable Recommendations to Navigate Regulatory Complexities, Optimize Value Chains, and Capitalize on Emerging Hemp Market Opportunities

Industry leaders must adopt a multifaceted approach to capitalize on the momentum of the industrial hemp market. Firstly, engaging proactively with regulatory bodies and participating in standards committees will ensure alignment with evolving compliance requirements and facilitate expedited approvals. Secondly, expanding decentralized processing networks, especially for decortication and degumming, can mitigate tariff-induced pressures and unlock regional cost advantages.

Investment in R&D partnerships focused on material innovation is equally critical. By collaborating with academic and private research institutions, companies can accelerate the development of high-performance composites, specialty chemicals, and biofuels. Additionally, optimizing supply chains through digital traceability platforms will enhance transparency and foster trust among B2B customers and end consumers. Lastly, embracing omnichannel distribution strategies-bridging traditional industrial sales channels with direct-to-consumer e-commerce initiatives-will broaden market reach and accelerate adoption of novel hemp-based products.

Detailing the Robust Research Methodology Employed to Gather Primary Insights, Analyze Secondary Data, and Validate Findings Across the Industrial Hemp Ecosystem

This research employed a rigorous methodology combining primary interviews, secondary data analysis, and field validation to ensure robust insights. Stakeholder interviews spanned licensed cultivators, processing facility managers, regulatory officials, and end-user manufacturers to capture qualitative perspectives on operational challenges and growth opportunities. Secondary research included review of policy documents, peer-reviewed studies, patent filings, and industry whitepapers to corroborate market drivers and technological trends.

Quantitative data were harmonized from multiple reputable sources, followed by cross-verification through triangulation techniques. Regional case studies provided context for divergent regulatory and commercial environments. Competitive profiling analyzed company disclosures, investment announcements, and partnership agreements to map the evolving landscape. Finally, findings were synthesized to deliver actionable frameworks across segmentation, regional analysis, and competitive strategies, ensuring that the report aligns with decision-makers’ need for timely and credible market intelligence.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Industrial Hemp market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Industrial Hemp Market, by Product Type

- Industrial Hemp Market, by Processing Technique

- Industrial Hemp Market, by Material Composition

- Industrial Hemp Market, by Source

- Industrial Hemp Market, by Sales Channel

- Industrial Hemp Market, by End User

- Industrial Hemp Market, by Region

- Industrial Hemp Market, by Group

- Industrial Hemp Market, by Country

- United States Industrial Hemp Market

- China Industrial Hemp Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1113 ]

Synthesizing Key Findings to Outline the Evolving Industrial Hemp Landscape and Emphasize Strategic Imperatives for Sustainable Growth and Innovation

The evolving industrial hemp landscape reflects a convergence of agricultural innovation, policy reform, and shifting end-user demand toward sustainable materials. From enhanced cultivation techniques to advanced decortication and material extraction processes, stakeholders across the value chain are embracing hemp’s versatility. While tariffs have introduced complexity into the supply chain, they have also incentivized domestic production enhancements and strategic alliances that bolster resilience. Segmentation analysis underscores the diversity of product, processing, and end-use vectors, reinforcing hemp’s role across industries from textiles to pharmaceuticals.

Regional insights highlight the importance of tailoring market entry and growth strategies to local regulatory climates and consumer preferences. Furthermore, the competitive milieu is characterized by dynamic collaborations between agribusinesses, technology firms, and research institutions. By synthesizing these findings, this summary delineates strategic imperatives: proactive regulatory engagement, investment in processing infrastructure, robust R&D partnerships, and diversified distribution channels. Collectively, these approaches will enable stakeholders to harness the full potential of industrial hemp, advancing both commercial success and broader sustainability goals.

Connect With Ketan Rohom to Unlock Comprehensive Industrial Hemp Market Intelligence and Propel Strategic Decision-Making for Maximum Competitive Advantage

To explore this comprehensive market research report and gain tailored insights that align with your strategic objectives, reach out to Ketan Rohom, Associate Director of Sales & Marketing. Engaging directly with Ketan will provide you with a personalized walk-through of the study’s depth, ensuring that your organization secures actionable data and expert guidance for navigating the dynamic industrial hemp landscape. With an emphasis on custom deliverables and ongoing advisory support, this engagement will empower your teams to make data-driven decisions, optimize resource allocation, and foster sustainable growth within the hemp sector. Contact Ketan to initiate your subscription and unlock exclusive access to detailed analyses, competitive benchmarking, and future-oriented recommendations.

- How big is the Industrial Hemp Market?

- What is the Industrial Hemp Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?