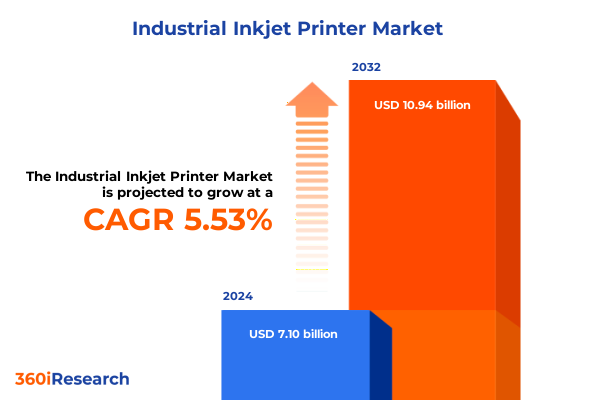

The Industrial Inkjet Printer Market size was estimated at USD 7.47 billion in 2025 and expected to reach USD 7.87 billion in 2026, at a CAGR of 5.58% to reach USD 10.94 billion by 2032.

Exploring the Evolution and Strategic Importance of Industrial Inkjet Printing Solutions Driving Efficiency and Innovation Across Diverse Manufacturing Sectors

Industrial inkjet printing has transcended its origins in desktop graphics to become a cornerstone of modern manufacturing, enabling unprecedented levels of flexibility and efficiency. As digital production demands have soared across automotive, packaging, textile, and electronics sectors, inkjet technology has evolved to meet requirements for rapid changeovers, short-run customization, and integrated digital workflows. This shift from analog to digital marks a pivotal moment where manufacturers prioritize agility and quality simultaneously, driving investments in advanced printhead architectures and integrated process controls.

The rapid adoption of ultraviolet (UV) inkjet solutions underscores the market’s embrace of sustainable, high-performance formulations. By 2024, the global UV inkjet segment surpassed $1.4 billion in annual revenue, propelled by growth in labels, flexible packaging, and ceramic decorating applications. Simultaneously, eco-conscious customers have driven ink makers to reformulate resins with bio-based monomers and reduce volatile organic compound emissions, pushing water-based UV systems toward nearly a third of the European industrial printing market. These dynamics highlight the synergistic rise of digital capability and environmental stewardship in redefining industrial inkjet’s role across manufacturing landscapes.

Identifying the Transformative Technological and Market Shifts Reshaping the Industrial Inkjet Printing Landscape Globally

Technological advancements are reshaping the industrial inkjet landscape, with sustainability emerging as a primary catalyst for innovation. End users in packaging and textiles increasingly demand inks formulated from renewable feedstocks. In response, manufacturers have transitioned from petroleum-based chemistries to plant-derived acrylates and lignin-based photoinitiators, which today constitute over one-fifth of new UV product introductions. This eco-centric evolution has spurred secondary developments in deinking-compatible resins and LED-based curing systems, lowering energy consumption by more than a third in high-volume signage applications.

Parallel to material innovation, digital integration and automation are redefining print production. Advanced printhead designs coupled with artificial intelligence–driven registration systems now enable multilayer white-plus-CMYK workflows on varied substrates, from PVC-free wallpapers to roll-to-roll textile banners. The rise of on-demand, personalized printing is particularly pronounced in ceramics and direct-to-object segments, where flexible velocity configurations and inline quality inspection cameras ensure consistent output at speeds exceeding 120 m/min on high-speed lines. Collectively, these shifts underscore a market transitioning toward intelligent, sustainable, and highly configurable inkjet solutions.

Assessing the Cumulative Effects of United States Tariff Policies on Industrial Inkjet Printing Equipment and Supply Chains Through 2025

Since the initial imposition of Section 301 tariffs on Chinese manufacturing goods in 2018, industrial inkjet equipment has experienced a complex cost environment. Numerous tariff exclusions covering hundreds of product categories were extended through mid-2025 to ease sourcing constraints, yet equipment components outside those exclusions continue to incur additional duties. As exclusion waivers lapse, manufacturers face renewed cost pressures, triggering strategic realignments in supply chains and sourcing locales.

To address some of these challenges, the Office of the U.S. Trade Representative launched a targeted exclusion process for machinery used in domestic manufacturing under HTS chapters 84 and 85. Importers may request relief for specific industrial presses and ancillary equipment through a formal petition system, with decisions expected on a rolling basis and granted exclusions valid into the second half of 2025. Although this mechanism affords select relief, the administrative lead times and uncertainty constrain immediate capex planning.

Concurrent to these measures, the reinstatement and escalation of Section 232 tariffs on steel and aluminum have dramatically reshaped input costs. In June 2025, the tariff rate on imported steel and aluminum surged to 50 percent, with downstream products such as stamped parts and alloy components now subject to full duties. These measures, intended to bolster domestic production, have instead generated bottlenecks, as mills operate below optimal capacity while demand from equipment manufacturers accelerates.

The cumulative impact of these tariff regimes extends beyond raw material costs to finished machinery pricing. Equipment reliant on specialty alloys, precision motor systems, and imported electronic controls now bears an average price increase approaching 18 percent, according to industry assessments. These elevated costs have prompted some print service providers to delay new press acquisitions, while others explore alternative sourcing strategies and pursue tariff exclusion requests to mitigate near-term financial burdens.

Uncovering Key Segmentation Insights Revealing How Ink Type Printing Speed Droplet Size Resolution and Application Shape the Market Dynamics

Industrial inkjet printing demand is shaped by a multifaceted segmentation framework that intersects material science, throughput requirements, print precision, and end-use applications. Ink chemistry variations from dye-based formulations to UV-curable systems govern compatibility with substrates and drying protocols; within the UV category, LED-driven inks cater to rapid on-press curing needs while mercury-based variants deliver deep adhesion on challenging surfaces. Production environments demand distinct performance profiles, spanning high-speed operations for mass packaging rolls to low-speed precision tasks in ceramic and medical device marking.

Droplet size classifications introduce another layer of differentiation, with ultrafine jets below ten picoliters enabling ultra-high resolution replicating photographic details while larger droplets exceeding fifty picoliters accelerate deposit volumes for pigmented and functional inks on textured ceramics. Resolution tiers, from sub-600 to above 1200 DPI, align with final product expectations, whether artist-grade proofing or industrial labeling. Meanwhile, application segments such as shrink-sleeve labels, roll-to-roll textile printing, and sanitaryware decoration impose distinct substrate handling and post-cure requirements, driving OEMs and end users to optimize press architecture to balance speed, precision, and material compatibility in a rapidly diversifying landscape.

This comprehensive research report categorizes the Industrial Inkjet Printer market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Printing Technology

- Ink Type

- Resolution

- Material

- Print Architecture

- Application

- End-Use Industry

Analyzing Regional Dynamics and Growth Drivers Across Americas Europe Middle East Africa and AsiaPacific Inkjet Printer Markets

Regional market dynamics for industrial inkjet printing diverge significantly across the Americas, EMEA, and Asia-Pacific, each driven by unique end-user priorities and regulatory frameworks. In the Americas, North American converters and print service providers leverage robust infrastructure investments and additive manufacturing synergies to adopt high-speed inkjet lines for flexible packaging and corrugated substrates. Favorable energy policies and incentives under recent manufacturing acts have accelerated factory digitalization projects, driving demand for scalable multi-lane press configurations optimized for short-run agility.

Within Europe, the Middle East, and Africa, environmental regulations such as the EU’s VOC Directive and emerging carbon pricing schemes have incentivized the shift toward solvent-free water-based UV inkjet systems. Textile and decorative printing segments in Europe favor LED-curable inks to comply with stringent sustainability mandates while maintaining high color fidelity. Across the Gulf Cooperation Council and North African regions, infrastructure expansion and government-backed industrial parks are fueling new opportunities for ceramic tile and graphic arts printing, leveraging hybrid digital-analog workflows.

Asia-Pacific stands out as the fastest-growing market with a surging appetite for on-demand, personalized printing solutions across consumer electronics, automotive interiors, and direct-to-garment applications. Investments in smart factory platforms, particularly in China and Southeast Asia, integrate vision-based quality inspection modules with inkjet deposition, enabling mid-run changeovers at speeds exceeding 120 m/min. The region’s dynamic supply chain ecosystem, bolstered by local ink and substrate manufacturing, positions Asia-Pacific to lead adoption curves for emerging inkjet innovations globally.

This comprehensive research report examines key regions that drive the evolution of the Industrial Inkjet Printer market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Stakeholders and Their Strategic Initiatives Driving Competitive Advantage in the Industrial Inkjet Printer Market

Key industry players continue to push the boundaries of industrial inkjet performance and sustainability through strategic product launches and partnerships. HP, for example, introduced Thermacore, a next-generation thermal inkjet engine that triples throw distance and doubles swath width while incorporating recycled plastics and enhancing ink efficiency to minimize waste. This breakthrough positions HP to compete directly in high-speed packaging and marking segments traditionally dominated by continuous inkjet and laser systems.

Further expanding its digital production portfolio, HP unveiled the PageWide Web Press T4250 HDR and T500M HD, offering up to twice the productivity of prior models with recirculating ink architecture and offset-level vibrancy across direct mail and book publishing applications. By combining high duty cycles with inline quality inspection and automation modules, these presses enable print service providers to scale new digital workflows with minimal manual intervention.

Domino Printing Sciences has fortified its label and narrow web leadership through a strategic partnership with Lake Image Systems, integrating real-time vision inspection into its K600i dot-matrix UV inkjet platforms and N730i digital label presses. This collaboration ensures zero-defect throughput for demanding shrink-sleeve and in-mold labels, addressing stringent quality requirements in pharmaceutical and food packaging sectors.

Epson’s enterprise-grade SureColor P20000 and precision SC-P600 large-format printers demonstrate the brand’s dual focus on production speed and photographic fidelity. The P20000 combines precision drop control with advanced pigment inks to deliver durable outdoor signage at widths up to 64 inches, while the SC-P600 caters to specialist photo studios with nine-color pigment arrays designed for gallery-grade prints under controlled archival conditions.

This comprehensive research report delivers an in-depth overview of the principal market players in the Industrial Inkjet Printer market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Arrow Systems, Inc.

- Canon Inc.

- Citronix Inc.

- Diagraph Marking & Coding by Illinois Tool Works Inc.

- Domino Printing Sciences PLC by Brother Industries, Ltd.

- Engage Technologies Corporation

- Engineered Printing Solutions

- Hitachi, Ltd.

- HP Inc.

- HSA Systems A/S

- InkJet Inc. by Cyklop International

- Keyence Corporation

- Kishu Giken Kogyo Co., Ltd.

- Konica Minolta, Inc.

- Kyocera Corporation

- Linx Printing Technologies by Danaher Corporation

- Markem-Imaje by Dover Corporation

- Mimaki Engineering Co., Ltd.

- MSSC LLC

- Numeric Inkjet Technologies Pvt. Ltd.

- Pannier Corporation

- Paul Leibinger GmbH & Co.KG

- Quadient s.r.o.

- REA Elektronik GmbH

- Ricoh Company, Ltd.

- Roland DGA Corporation

- Seiko Epson Corporation

- Sun Packaging Technologies, Inc.

- Toshiba Corporation

- Ventec International Group

- Videojet Technologies Inc.

- Xerox Corporation

Actionable Strategies for Industry Leaders to Leverage Innovation Partnerships and Operational Excellence in Industrial Inkjet Printing

To navigate an increasingly intricate industrial inkjet landscape, leaders should prioritize end-to-end supply chain resilience by actively leveraging USTR exclusion mechanisms and diversifying component sourcing across low-tariff jurisdictions. Establishing dedicated cross-functional teams to monitor HTS classifications and file exclusion requests can unlock relief on critical equipment capital expenditures and raw material imports.

Investing in sustainable ink formulations and energy-efficient curing systems will yield both regulatory compliance and cost savings. Companies should partner with chemistry innovators to co-develop bio-based resin platforms and LED-driven UV curing units, aligning product roadmaps with corporate sustainability goals and emerging environmental standards across global markets.

Collaboration between OEMs and end users on modular automation and additive workflows can accelerate integration of digital printing into broader manufacturing lines. Adopting open digital architectures and advanced vision inspection allows seamless mid-run changeover and inline quality assurance, reducing waste and maximizing throughput on multifunction printing platforms.

Finally, continuous workforce development focusing on digital maintenance protocols and data analytics will empower operators to optimize press performance, minimize downtime, and capture actionable insights from production metrics. Cultivating a culture of innovation readiness ensures companies remain agile in adapting to evolving ink chemistries, tariff policies, and application requirements.

Detailing Rigorous Research Methodologies Combining Primary and Secondary Data for Comprehensive Industrial Inkjet Market Analysis

This research integrates a comprehensive methodology combining secondary data analysis and primary qualitative insights. Initially, extensive desk research reviewed published technical notes, regulatory filings, and peer-reviewed articles to map technological developments and sustainability trends. Supplementing this, a series of in-depth interviews were conducted with C-level executives, production managers, and R&D directors across OEMs, ink formulators, and end-user organizations to validate emerging drivers and challenges.

Quantitative data points were triangulated against publicly available trade statistics, tariff schedules from USTR and Customs records, and annual equipment shipment reports. A rigorous data validation process ensured consistency across multiple sources, with discrepancies resolved through follow-up inquiries and targeted expert consultations. The segmentation framework was then applied to categorize market dynamics by ink type, speed, droplet size, resolution, and application, providing a structured lens for analysis. Lastly, regional and company profiles were enriched through event case studies and recent product announcements, offering a timely perspective on competitive positioning and strategic initiatives.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Industrial Inkjet Printer market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Industrial Inkjet Printer Market, by Printing Technology

- Industrial Inkjet Printer Market, by Ink Type

- Industrial Inkjet Printer Market, by Resolution

- Industrial Inkjet Printer Market, by Material

- Industrial Inkjet Printer Market, by Print Architecture

- Industrial Inkjet Printer Market, by Application

- Industrial Inkjet Printer Market, by End-Use Industry

- Industrial Inkjet Printer Market, by Region

- Industrial Inkjet Printer Market, by Group

- Industrial Inkjet Printer Market, by Country

- United States Industrial Inkjet Printer Market

- China Industrial Inkjet Printer Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 3180 ]

Concluding Perspectives on the Future Trajectory of Industrial Inkjet Printing Technologies and Market Resilience Amid Ongoing Disruptions

The industrial inkjet printing market stands at the convergence of digital transformation and sustainable manufacturing imperatives. Technological breakthroughs in printhead design, material formulations, and automated workflows are unlocking new application frontiers while addressing environmental and cost pressures. Tariff landscapes, though complex, present opportunities for strategic supply chain optimization through targeted exclusion processes and tariff engineering.

Regional distinctions underscore the importance of nuanced market approaches, with the Americas leading high-volume roll-to-roll deployments, EMEA emphasizing eco-compliance and material innovation, and Asia-Pacific spearheading digital integration and personalized production. Leading OEMs and ink developers continue to expand capabilities through breakthrough technologies such as HP’s Thermacore and Domino’s vision-guided label platforms, driving competitive differentiation and enabling service providers to meet evolving customer demands.

As the market evolves, collaboration between stakeholders on open architectures, sustainable chemistries, and workforce readiness will be paramount. Harnessing these insights, decision-makers can confidently chart paths that balance innovation, operational resilience, and sustainability mandates, ensuring industrial inkjet printing remains a strategic pillar in tomorrow’s manufacturing blueprint.

Empower Your Business with Direct Access to Expert Market Insights by Engaging Ketan Rohom for the Industrial Inkjet Printer Report

Elevate your strategic decision-making and gain unparalleled market intelligence by securing the comprehensive Industrial Inkjet Printer Market Research Report. Connect directly with Ketan Rohom, Associate Director of Sales & Marketing, to customize your inquiry and receive expert guidance on accessing the full study, empowering your organization with actionable insights tailored to your objectives.

- How big is the Industrial Inkjet Printer Market?

- What is the Industrial Inkjet Printer Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?