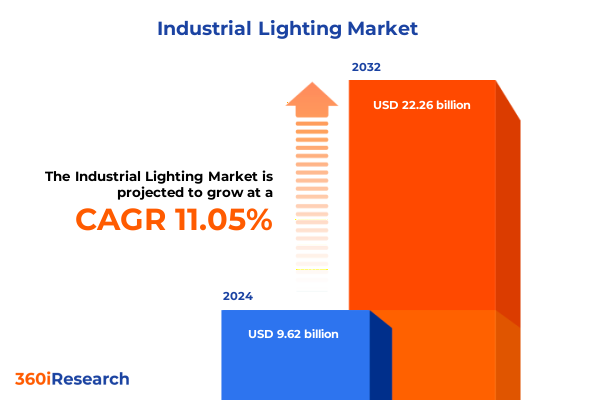

The Industrial Lighting Market size was estimated at USD 11.06 billion in 2025 and expected to reach USD 12.24 billion in 2026, at a CAGR of 11.12% to reach USD 23.15 billion by 2032.

Industrial lighting at the heart of modern operations, linking safety, efficiency, and digital transformation across global production networks

Industrial lighting has become a critical enabler of modern industrial performance, far beyond its traditional role of merely providing illumination. In factories, warehouses, cold storage facilities, power plants, mines, and refineries, lighting quality now influences worker safety, operational precision, energy consumption, and even employee well‑being. As production networks stretch across regions, the consistency and intelligence of lighting systems increasingly affect how reliably and efficiently assets can be operated and maintained.

The global shift from legacy fluorescent, halogen, and high‑intensity discharge solutions to advanced light‑emitting diode technologies is well underway, but the transformation is far from complete. Many facilities continue to run mixed inventories of older and newer systems, creating complexity in maintenance, controls, and energy management. At the same time, digitalization and the industrial internet of things are pushing lighting from a static infrastructure element to a connected platform that can sense, communicate, and respond in real time.

This executive summary examines how industrial lighting is evolving under the combined influence of technological innovation, regulatory tightening, sustainability imperatives, and an unsettled trade environment. It highlights the transformative shifts reshaping the landscape, assesses the cumulative impact of recent United States tariff actions in 2025, and distills insight from a detailed segmentation of products, technologies, applications, distribution models, and end users. In addition, it explores regional patterns and company strategies, and concludes with practical recommendations that industrial leaders can apply to align their lighting strategies with broader operational and financial goals.

Transformative shifts push industrial lighting from simple illumination hardware to intelligent, application specific and service oriented infrastructure

Industrial lighting is moving from commodity hardware toward intelligent infrastructure as several transformative shifts converge. The first and most visible change is the near‑universal migration toward LED‑based luminaires across flood lighting, high and low bay fixtures, panels, street and tube lighting. LEDs now dominate new specifications for industrial environments because they deliver higher efficacy, longer life, and better controllability than fluorescent, halogen, or traditional discharge sources. In manufacturing halls, warehouses, cold stores, and outdoor yards, this translates directly into lower maintenance disruption, reduced downtime for relamping, and more stable light levels.

Yet the transition is not purely about swapping light sources. Increasingly, industrial customers are specifying connected systems that incorporate drivers, sensors, and control logic capable of dimming, scheduling, and responding to occupancy or daylight. Wired controls using analog interfaces such as 0–10V or digital protocols like DALI and KNX are being complemented and, in many retrofit scenarios, challenged by wireless solutions based on Zigbee, Bluetooth Mesh, Wi‑Fi, or proprietary radio platforms. These connected systems make it possible to link lighting into supervisory control, building management, and warehouse management systems, transforming luminaires into distributed nodes that contribute data and control capabilities across the plant.

At the same time, the design philosophy of industrial lighting is shifting from one‑size‑fits‑all layouts to application‑specific solutions. In cold storage, lighting must combine high efficacy with performance at low temperatures and frequent door openings. In heavy manufacturing, rugged high bay and low bay fixtures must withstand vibration, dust, and sometimes chemical exposure while maintaining precise color rendering and glare control. Outdoor applications such as parking lots, sports venues, and industrial streets increasingly combine high‑output flood or street lighting with adaptive controls to balance visibility, safety, and energy savings. This trend toward tailored solutions is fundamentally changing product portfolios and pushing manufacturers to broaden their range of optics, form factors, and control options.

Another structural shift is the reframing of lighting as a strategic lever in decarbonization and environmental, social, and governance agendas. Energy codes and voluntary programs worldwide emphasize efficient, controllable lighting in industrial and commercial buildings, and national initiatives on solid‑state lighting continue to promote advanced research and adoption. Government programs focused on solid‑state lighting, particularly in North America, have highlighted the remaining potential for efficiency and connected controls in high‑use applications such as industrial and outdoor lighting, underscoring that significant additional energy savings remain untapped if advanced systems are widely deployed.

Finally, new business models are emerging as suppliers move beyond product sales toward services. Light‑as‑a‑service arrangements, where customers pay recurring fees rather than upfront capital, are gaining traction in some segments, especially where customers seek to outsource design, installation, and ongoing optimization. For suppliers, this shift demands deeper understanding of specific vertical needs across automotive, food and beverage, logistics, mining, oil and gas, pharmaceuticals, power generation, and warehousing, and it elevates the importance of robust monitoring, analytics, and lifecycle support embedded within lighting solutions.

Cumulative United States tariff impacts in 2025 reshape industrial lighting sourcing, pricing strategies, and long term investment planning

The industrial lighting sector is deeply entangled with global trade flows, and the tariff landscape in 2025 has become a defining factor in sourcing, pricing, and investment decisions. The United States maintains layered import duties on many Chinese lighting products, combining baseline customs duties with additional trade‑related charges and reciprocal levies. For LED fixtures, luminaires, and components imported from China, effective tariff burdens are commonly reported around thirty percent, reflecting standard Harmonized Tariff Schedule rates combined with Section 301 and related measures. These rates significantly reshape landed costs for flood lights, high bay and low bay luminaires, panels, street and tube lighting used across industrial facilities.

Policy volatility has compounded the impact. A series of executive orders and negotiations in 2025 produced a cycle of escalating, then partially reduced, tariffs, including periods where reciprocal duties between the United States and China were projected to rise well above previous trade war levels before temporary truces held them closer to thirty percent on many goods. For lighting manufacturers that rely heavily on Chinese contract production, this unpredictability has made it challenging to set stable price lists, manage inventories, or commit to long‑term sourcing contracts.

In response, major North American lighting brands have implemented price increases on selected fixtures and electronic products while simultaneously accelerating diversification of their supply chains. Several companies have shifted portions of production from China to countries such as Vietnam and Cambodia, aiming to mitigate tariff exposure while maintaining access to low‑cost, high‑volume manufacturing capacity. This reconfiguration is particularly visible in industrial categories such as high bay fixtures, retrofit kits, and panel lighting, which historically were heavily dependent on Chinese factories.

The cumulative effect for industrial end users is a more complex cost and risk profile. On one hand, the higher tariff burden raises acquisition costs for imported luminaires and components, driving some buyers to delay non‑critical upgrades or stretch the operating life of existing fluorescent or discharge systems. On the other hand, the operational savings from LED retrofits and intelligent controls remain compelling, especially in facilities with long operating hours and high energy intensity. As a result, many capital planners are scrutinizing total cost of ownership more rigorously, pushing suppliers to justify premium pricing through documented maintenance reductions, energy savings, and enhanced operational resilience.

Looking ahead, trade policy risk now sits alongside energy prices, regulatory changes, and carbon objectives as a core planning parameter for industrial lighting strategies. Proposals such as pollution‑based fees on imported industrial goods, which would reward low‑emission manufacturing regions and penalize carbon‑intensive supply chains, introduce another potential layer of future cost differentiation. Industrial buyers and manufacturers alike are therefore prioritizing modularity, multi‑sourcing, and regionalized production, so that product portfolios for flood, high bay, panel, street, and tube luminaires can be adapted quickly if tariff regimes shift again.

Importantly, tariff dynamics intersect with connectivity and controls. While LEDs and luminaires often remain exposed to higher duties, certain semiconductor components used in advanced control systems may fall under more favorable classifications, slightly easing the economics of connected projects. This nuance encourages some manufacturers to emphasize value‑added connected solutions over basic commodity fixtures, further accelerating the broader transformation of the industrial lighting landscape.

Segmentation insights reveal distinct industrial lighting opportunities across products, technologies, installations, applications and end use industries

Analyzing industrial lighting through a segmentation lens reveals how heterogeneous and nuanced this market truly is, with each category exhibiting distinct drivers, constraints, and innovation paths. From a product perspective, flood lighting, high bay, low bay, panel, street, and tube lighting each respond to different operational realities. High and low bay luminaires dominate in manufacturing halls, warehouses, and distribution centers where mounting heights are significant and uniform illumination is critical. Panels increasingly serve industrial offices, control rooms, and clean manufacturing spaces that demand low glare and good visual comfort. Tube lighting remains an important retrofit path in legacy installations where existing linear fluorescent infrastructure is still in place, while flood and street luminaires are central to outdoor yards, parking lots, sports venues, and internal plant roads where robust construction, optical control, and weather resistance are paramount.

Technological segmentation underscores the displacement of older light sources by solid‑state solutions. Fluorescent and halogen technologies persist mainly in legacy and niche applications or where budgets remain constrained, while high‑intensity discharge retains a foothold in some extreme high‑mast or high‑temperature environments. Induction lighting maintains relevance where exceptionally long service life is valued and controls requirements are modest. However, LED has become the default choice for new construction and most significant retrofit projects, owing to its combination of efficacy, controllability, optical flexibility, and falling cost per lumen. This technology shift enables more granular dimming, dynamic color tuning in some specialized manufacturing or inspection applications, and closer integration with sensors and digital control platforms.

Installation type introduces another important layer of differentiation. New construction projects give designers the freedom to specify integrated luminaires, advanced wired controls, and optimized layouts from the outset, often combining high and low bay, panel, and outdoor lighting into a unified controls backbone. In contrast, retrofit activity spans simple lamp replacement, fixture replacement, and complete system upgrades. Lamp replacement remains the lowest‑cost and least disruptive path, favored where downtime is highly constrained and electrical infrastructure is dated. Fixture replacement offers a step change in performance and reliability while often reusing existing wiring. Complete system upgrades, though capital intensive, enable holistic redesign of lighting distributions, incorporation of wired or wireless controls, and seamless alignment with broader building or plant modernization programs.

Connectivity technology itself is heavily segmented between wired and wireless architectures. Wired approaches that include 0–10V analog dimming, digital addressable protocols such as DALI, and building automation platforms like KNX or power line communication offer highly reliable control, often preferred in mission‑critical or electromagnetically noisy industrial environments. Wireless systems built on Zigbee, Bluetooth and Bluetooth Mesh, Wi‑Fi, or proprietary radio solutions excel in retrofit scenarios, large open warehouses, or facilities where running new control cabling would be cost prohibitive or disruptive. Many modern industrial sites deploy hybrid architectures, using wired control for core production areas and wireless nodes to extend intelligence to storage zones, peripheral buildings, or outdoor assets.

Application segmentation draws a clear distinction between indoor and outdoor needs. Indoors, cold storage facilities require luminaires that perform efficiently at low temperatures and withstand frequent switching triggered by occupancy sensors. Manufacturing facilities span a wide range of tasks from precision assembly to heavy fabrication, driving demand for customized optics, glare control, and color rendering. Warehouses and logistics centers prioritize uniformity, vertical illumination for racking, and integration with material‑handling automation. Outdoors, parking lots demand both visibility and perceived safety, sports venues require precise beam control and often higher color quality, while industrial streets and yards focus on durability and adaptive controls to respond to varying occupancy and security requirements.

The distribution channel landscape is equally diverse. Direct sales models are frequently used for large capital projects where specification, customization, and performance guarantees are critical. Distributors continue to play a pivotal role in replenishment, regional coverage, and project aggregation, especially for tube lighting, retrofit kits, and standard high bay or panel products. Online sales channels have grown in importance for standardized industrial fixtures and components, offering procurement teams rapid price transparency and availability checks. Original equipment manufacturers, finally, act as both product designers and private‑label suppliers, shaping offerings that may be branded by others but rely on their design, certification, and manufacturing expertise.

End‑user industries form the final segmentation layer and bring sharp differences in lighting priorities. Automotive plants focus on visual accuracy for inspection and color‑critical tasks while also seeking flexible, reconfigurable lighting to support changing production lines. Food and beverage facilities emphasize hygiene, ingress protection, and the avoidance of glass breakage, favoring sealed fixtures and shatter‑resistant designs. Logistics operators prioritize energy‑efficient high bay and aisle lighting integrated with occupancy and daylight sensing to match lighting output with variable throughput patterns. Mining and oil and gas facilities operate under hazardous or harsh conditions, requiring specialized luminaires with appropriate certifications and robust mechanical construction. Pharmaceutical production and cleanrooms need tightly controlled glare, high color rendering, and compatibility with stringent cleaning protocols. Power generation sites value reliability and maintenance access in challenging environments, while warehousing and general manufacturing balance energy performance with worker comfort and safety.

Taken together, these segmentation dimensions highlight why no single product or technology can address all industrial lighting needs. Successful strategies require aligning specific combinations of product type, technology, installation approach, connectivity, application, distribution model, and end‑user vertical to deliver solutions that are technically appropriate, economically justified, and resilient in the face of policy and supply chain change.

This comprehensive research report categorizes the Industrial Lighting market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Technology

- Installation Type

- Connectivity Technology

- Application

- End User

- Distribution Channel

Regional perspectives show divergent industrial lighting priorities across the Americas, EMEA and Asia Pacific industrial and infrastructure hubs

Regional dynamics strongly influence how industrial lighting technologies are adopted and prioritized. In the Americas, the United States remains a central driver of advanced industrial lighting due to stringent energy codes, occupational safety regulations, and strong focus on decarbonization in both private and public sectors. The tariff environment has particular relevance here, as duties on imported LED luminaires and components from China and other trading partners affect procurement strategies for manufacturers, logistics providers, and utilities. Canada tends to follow similar technology trends, with a strong emphasis on energy efficiency and cold‑climate performance, while in Latin America the emphasis often falls on cost‑effective, robust LED solutions that can cope with voltage instability, challenging infrastructure, and demanding outdoor environments.

Across Europe, the Middle East, and Africa, regulatory and economic diversity shape distinct lighting patterns. In Europe, regulatory frameworks that phase out inefficient lamp types and mandate efficient building systems have accelerated the shift to LED and connected lighting in industrial settings. High energy prices in several European markets further strengthen the case for advanced controls and optimized high and low bay solutions. Industrial users increasingly integrate lighting into broader digital building platforms, treating connected luminaires as part of their data and automation infrastructure.

In the Middle East, industrial lighting demand is closely tied to large‑scale infrastructure, oil and gas projects, and rapidly expanding logistics hubs. High ambient temperatures, dust, and occasionally corrosive atmospheres drive demand for rugged, sealed luminaires with high output and long lifetimes. Energy efficiency is gaining attention as governments seek to reduce domestic energy consumption and free more resources for export, leading to wider adoption of high‑efficacy LED systems in refineries, petrochemical plants, and ports. In Africa, industrial lighting activity is more uneven, but urbanization, mining, and power generation projects create pockets of strong demand for reliable, low‑maintenance LED solutions that can handle grid variability and harsh site conditions.

Asia‑Pacific remains both the manufacturing engine and one of the most dynamic demand centers for industrial lighting. China has long served as a major production base for LED components, modules, and luminaires, influencing global pricing and supply availability even as trade tensions and tariffs reshape export economics. Domestically, China continues to invest heavily in manufacturing, logistics, and power infrastructure, driving ongoing demand for high bay, flood, street, and specialized industrial LED lighting. India, meanwhile, is accelerating its industrialization and urban infrastructure build‑out, supported by government initiatives that encourage LED adoption and energy‑efficient industrial facilities.

Other Asia‑Pacific economies, including Vietnam, Malaysia, Thailand, and Indonesia, are emerging as alternative production and export hubs for industrial luminaires and components, partly in response to tariff pressures on Chinese goods. These countries also represent growing end markets in their own right as they develop manufacturing bases and logistics networks. Across the broader region, industrial customers increasingly consider not only fixture cost and performance but also the resilience of cross‑border supply chains, access to local technical support, and compatibility with regional standards and certification regimes.

Overall, the Americas, Europe, the Middle East and Africa, and Asia‑Pacific each exhibit unique mixes of drivers such as regulatory pressure, energy price levels, labor costs, and trade policy. Understanding these nuances is essential for manufacturers, distributors, and project owners seeking to align product portfolios, sourcing strategies, and go‑to‑market approaches with the realities of each regional industrial ecosystem.

This comprehensive research report examines key regions that drive the evolution of the Industrial Lighting market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Industrial lighting competitors evolve from product centric portfolios to differentiated ecosystems of robust luminaires, controls and digital services

The competitive landscape in industrial lighting is characterized by a mix of global incumbents, regional specialists, and emerging technology‑driven entrants. Established international players with strong brands in luminaires and controls anchor the market with broad portfolios spanning flood, high bay, low bay, panel, street, and tube products for both indoor and outdoor industrial applications. These companies increasingly emphasize connected systems, offering integrated drivers, sensors, gateways, and software platforms that allow customers to commission, monitor, and optimize lighting across complex sites.

At the same time, a cohort of specialized manufacturers has built reputations in demanding niches such as hazardous location lighting, mining and tunneling, offshore oil and gas, and high‑bay solutions for heavy industry. Their strengths often lie in mechanical robustness, thermal management, and deep understanding of certification requirements. These firms are expanding their offerings to include more advanced LED engines and controls while maintaining the durability and reliability that define their brands.

Several large North American and European manufacturers have responded to tariff pressures and global supply chain disruptions by rebalancing production footprints, relocating part of their manufacturing from China to other Asia‑Pacific countries and, in some cases, nearshoring selected product lines. This trend is particularly evident in high‑volume industrial categories such as high bay fixtures, flat panels, and retrofit kits used in warehouses and manufacturing facilities. Companies are also investing in design for manufacturing and modular product platforms that can accommodate different regional components or assembly locations without extensive re‑engineering.

Digital capabilities increasingly differentiate leading companies from price‑driven competitors. Vendors that combine hardware with commissioning tools, analytics dashboards, and integration with building and industrial automation systems can help customers translate lighting data into operational insights. These capabilities are especially valuable in logistics, automotive, and advanced manufacturing facilities, where analytics can inform space utilization, shift patterns, and maintenance planning. Some providers are extending into service models that include performance guarantees, periodic optimization, and lifecycle support contracts.

Meanwhile, online‑centric and value‑oriented brands target cost‑sensitive segments with simplified, standardized industrial luminaires available through e‑commerce and distribution channels. While often lacking in sophisticated controls or customization, these offerings can be attractive for basic warehouse, storage, or outdoor security applications where capital budgets are tight and technical requirements are straightforward. The challenge for such brands is to manage quality and warranty risk while operating within thin margins and a volatile tariff environment.

Overall, competition is shifting from a narrow focus on fixture efficacy and price toward a broader contest around total value: energy and maintenance performance, ease of installation and integration, responsiveness to regional tariffs and regulations, and the ability to serve diverse end users from automotive and pharmaceuticals to power generation, mining, and warehousing with tailored, reliable lighting solutions.

This comprehensive research report delivers an in-depth overview of the principal market players in the Industrial Lighting market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Delta Electronics, Inc.

- Signify N.V.

- Everlight Electronics Co., Ltd.

- LITE-ON Technology Corporation

- JAN CHENG LIGHTING CO., LTD

- Schneider Electric SE

- Panasonic Holdings Corporation

- ams-OSRAM AG

- RAB Lighting Inc.

- Legrand S.A.

- Eaton Corporation plc

- Honeywell International Inc.

- Samsung Electronics Co., Ltd

- Pookoo Industrial Co.,Ltd.

- Glamox AS

- Emerson Electric Co.

- Zumtobel Group AG

- ABB Ltd.

- K-Source Technology Ltd.

- Wentai Technology Corp.

- NAN YA PHOTONICS INC.

- Dongguan Winstar Power Technology Limited

- Laster Tech Co., Ltd.

- LiteTronix Optotek Corp.

- Nichia Corporation

- Tachai Industrial Co., Ltd.

Actionable strategies help industrial leaders convert lighting from a reactive cost center into a proactive driver of resilience and performance

In this environment of technological transition and policy uncertainty, industrial lighting decision‑makers must adopt proactive, strategy‑driven approaches rather than incremental, reactive upgrades. A first actionable step is to treat lighting as a critical part of operational infrastructure that directly influences safety, quality, and cost. This perspective encourages cross‑functional collaboration among engineering, energy management, procurement, operations, and sustainability teams, ensuring that specifications for high and low bay, flood, panel, street, and tube luminaires reflect not only procurement prices but also lifetime maintenance requirements, downtime implications, and regulatory compliance.

Leaders should also prioritize structured retrofit roadmaps that distinguish between lamp replacement, fixture replacement, and complete system upgrades across their facility portfolios. By mapping existing assets and categorizing them according to age, condition, and operational criticality, organizations can design multi‑year investment plans that capture quick energy and maintenance wins while reserving capital for comprehensive upgrades in facilities where connected lighting and integration with automation systems will generate the largest returns. Within these plans, it is prudent to evaluate where wired controls such as 0–10V or DALI remain advantageous, and where wireless solutions based on Zigbee, Bluetooth Mesh, Wi‑Fi, or proprietary radio technologies can accelerate deployment or simplify retrofits.

Another priority is to embed tariff and trade risk into sourcing and design decisions. This entails diversifying suppliers and manufacturing locations, qualifying products from multiple regions, and favoring modular luminaire architectures that can accommodate component substitutions or alternative assembly sites without extensive recertification. Industrial buyers should engage vendors in transparent discussions about how tariffs on LED fixtures and components are being managed, and seek commercial arrangements that share risk while maintaining incentives for innovation.

End‑user specific strategies are equally important. Automotive and pharmaceutical facilities may focus on high color rendering, stringent quality control, and compatibility with cleanroom or specialized inspection processes. Food and beverage plants must prioritize ingress protection and hygienic design. Mining, oil and gas, and power generation sites require certified hazardous‑location or heavy‑duty luminaires with proven resilience. Logistics and warehousing environments benefit most from occupancy responsive high bay lighting tightly integrated with warehouse management systems. By segmenting their own portfolios in this way, industrial organizations can define clear technical standards for each category, streamline procurement, and avoid piecemeal purchasing that fragments inventory and complicates maintenance.

Finally, industry leaders should leverage data generated by connected lighting systems to support continuous improvement. Even basic occupancy and energy data from luminaires can reveal underutilized spaces, misaligned shift patterns, or maintenance inefficiencies. When combined with other operational data streams, lighting information can support broader initiatives in predictive maintenance, safety analytics, and space planning. Building internal capability to interpret and act on such insights will distinguish organizations that simply install new lighting from those that use it as a platform for operational excellence.

Robust multi source research methodology underpins nuanced insight into technologies, segments, regions and competitive industrial lighting dynamics

The insights summarized in this executive overview rest on a rigorously structured research methodology designed to capture both the breadth and depth of the industrial lighting landscape. At the foundation is extensive secondary research drawing on government energy and technology programs, industry and trade associations, standards organizations, public company filings, technical journals, patent activity, and conference proceedings related to solid‑state lighting, controls, and industrial applications. This secondary base establishes a factual framework for technology evolution, regulatory trends, and documented shifts in manufacturing and supply chains.

Building on this foundation, targeted primary research engages stakeholders across the value chain, including luminaire and component manufacturers, lighting designers and engineering consultancies, electrical contractors and integrators, distributors, online channel operators, and end users from sectors such as automotive, food and beverage, logistics, mining, oil and gas, pharmaceuticals, power generation, and warehousing. Interviews and structured discussions focus on practical issues such as installation practices in high bay and low bay environments, challenges in retrofitting panels and tubes, adoption of wired versus wireless controls, and the real‑world impact of tariffs and trade measures on sourcing, pricing, and project timing.

Quantitative and qualitative insights are then organized around the key segmentation dimensions of product type, technology, installation type, connectivity approach, application, distribution channel, and end user vertical. This framework allows patterns and divergences to surface clearly, highlighting, for example, differences in retrofit strategies between mature industrial markets and fast‑growing manufacturing hubs, or variations in connectivity adoption between mission‑critical process industries and more flexible logistics warehouses.

Throughout the process, findings are cross‑validated to reduce bias and ensure robustness. Statements regarding tariff levels, regulatory changes, and major strategic moves by leading lighting companies are corroborated through multiple independent sources wherever possible. Analytical judgments about emerging opportunities or risks are grounded in this evidence base, and care is taken to avoid projecting precise market sizes or shares, focusing instead on directional trends and structural dynamics.

The outcome is an integrated, multi‑angle view of industrial lighting that connects on‑the‑ground experiences in factories, warehouses, and energy facilities with broader forces such as decarbonization policy, digital infrastructure development, and evolving trade relationships. This methodology enables decision‑makers to draw on a coherent narrative supported by diverse and credible information streams when shaping their own strategies.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Industrial Lighting market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Industrial Lighting Market, by Product Type

- Industrial Lighting Market, by Technology

- Industrial Lighting Market, by Installation Type

- Industrial Lighting Market, by Connectivity Technology

- Industrial Lighting Market, by Application

- Industrial Lighting Market, by End User

- Industrial Lighting Market, by Distribution Channel

- Industrial Lighting Market, by Region

- Industrial Lighting Market, by Group

- Industrial Lighting Market, by Country

- United States Industrial Lighting Market

- China Industrial Lighting Market

- Taiwan Industrial Lighting Market

- Competitive Landscape

- List of Figures [Total: 20]

- List of Tables [Total: 1771 ]

Conclusion highlights industrial lighting’s pivotal role as technology, regulation, sustainability and trade forces converge on global operations

Industrial lighting stands at a pivotal moment, shaped by converging trends in technology, regulation, sustainability, and global trade. The rapid advance and widening adoption of LED technologies, combined with increasingly capable wired and wireless controls, is redefining what is possible in high bay, low bay, flood, panel, street, and tube applications across industrial facilities. At the same time, policy frameworks that prioritize energy efficiency and lower carbon emissions are making high‑performance, controllable lighting a non‑negotiable element of modern industrial infrastructure.

However, these opportunities unfold against a backdrop of tariff‑driven cost pressures, shifting supply chains, and growing expectations for digital integration and data‑driven operations. Regional differences across the Americas, Europe, the Middle East and Africa, and Asia‑Pacific ensure that no single approach will succeed everywhere. Instead, winning strategies will be those that respect local realities while leveraging global innovation in luminaires, controls, and services.

By understanding and acting on the segmentation insights outlined here, industrial leaders can design lighting programs that are technically sound, economically resilient, and aligned with broader organizational priorities. Those who move decisively to modernize legacy systems, harness connected capabilities, and manage trade and regulatory risks will position their facilities not only to meet today’s demands, but also to adapt smoothly to the next wave of industrial transformation.

Partner with industry expertise through Ketan Rohom to turn complex industrial lighting shifts into actionable investment decisions

Industrial lighting decisions are no longer a matter of replacing lamps when they fail; they are strategic investments that shape safety, productivity, energy performance, and competitiveness. To act with confidence, stakeholders across the value chain need objective, segmentation‑deep intelligence on technologies, applications, tariffs, and regional dynamics rather than relying solely on vendor narratives or piecemeal internal data.

To gain that level of clarity, engage directly with Ketan Rohom, Associate Director, Sales & Marketing, to explore and purchase the comprehensive industrial lighting market research report. Through this engagement, decision‑makers can access detailed insights on product and technology shifts, installation and connectivity choices, tariff implications, and competitive positioning across all major regions and end‑use industries.

By working with Ketan Rohom, leaders can ensure that their capital planning, sourcing strategies, and innovation roadmaps are grounded in rigorous research rather than assumptions. This report is designed to support board‑level discussions, plant modernization programs, and long‑term procurement strategies, enabling organizations to move from reactive responses to tariffs and regulation toward proactive, value‑driven lighting strategies that deliver measurable operational benefits.

- How big is the Industrial Lighting Market?

- What is the Industrial Lighting Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?