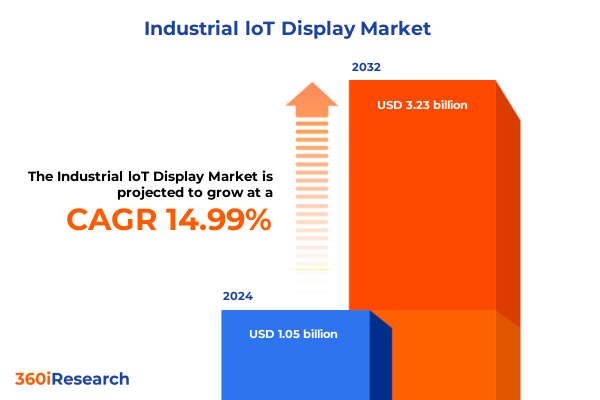

The Industrial loT Display Market size was estimated at USD 1.21 billion in 2025 and expected to reach USD 1.36 billion in 2026, at a CAGR of 15.01% to reach USD 3.23 billion by 2032.

Exploring Industrial IoT Display Ecosystems: Unveiling the Intersection of Hardware, Software, and Emerging Connectivity for Enhanced Operational Efficiency

Industrial Internet of Things (IoT) display technologies are revolutionizing how organizations visualize, interact with, and manage critical data at the operational edge. As smart factories, energy grids, and healthcare facilities migrate toward data-driven decision-making, the need for rugged, connected, and user-centric display solutions has never been more critical. These interfaces serve as crucial nodes that bridge sensors, control systems, analytics engines, and human operators, enabling real-time visibility and rapid response to dynamic conditions.

This executive summary delves into the pivotal trends, forces, and insights shaping the Industrial IoT display ecosystem. Beginning with a high-level overview of the technological and market landscape, it progresses through landmark shifts in hardware and connectivity, examines the ramifications of new United States tariffs enacted in 2025, and articulates nuanced segmentation and regional perspectives. Additionally, it highlights leading companies’ strategic initiatives, provides targeted recommendations for industry leaders, and outlines the research methodology that underpins the findings. Collectively, these sections offer an authoritative, cohesive narrative designed to inform senior executives, product strategists, and investment committees as they navigate opportunities and risks within this transformative domain.

Navigating Revolutionary Technological Shifts and Integration Paradigms Transforming Industrial IoT Display Solutions Across Diverse Operational Environments

The Industrial IoT display landscape is undergoing a fundamental metamorphosis driven by the convergence of edge computing, advanced networking, and intelligent user interfaces. Historically, manufacturers and utilities relied on isolated human-machine interface panels that offered limited data visualization. However, the advent of decentralized edge architectures, powered by embedded AI accelerators, has enabled displays to perform preliminary analytics locally, significantly reducing latency and bandwidth demands.

Furthermore, the proliferation of 5G and private LTE networks is accelerating the deployment of high-resolution touchscreens and immersive smart glasses in both controlled and remote environments. Consequently, operators can access contextualized insights without leaving the shop floor or service site. Similarly, vision systems integrated with machine learning models are automating quality control processes, while wearable displays provide hands-free guidance for maintenance technicians.

Moreover, the integration of digital twin frameworks is redefining the role of Industrial IoT displays by enabling synchronized visual replicas of physical assets. These digital twins facilitate scenario simulations and predictive diagnostics directly on the display interface, enhancing decision-making speed and accuracy. As a result, organizations can achieve higher uptime, improved safety, and reduced operational risk, marking a decisive shift from passive data presentation to proactive, intelligence-driven collaboration between machines and humans.

Assessing the Aggregate Consequences of 2025 United States Tariffs on Industrial IoT Display Supply Chains Cost Structures and Competitive Dynamics

In 2025, the introduction of elevated United States tariffs on imported electronics and manufacturing components has exerted significant pressure on the Industrial IoT display supply chain. The new measures have driven up material costs, particularly for critical substrates and semiconductor components, compelling providers to reassess their sourcing strategies. Consequently, procurement teams are increasingly exploring domestic and nearshore manufacturing partners to mitigate exposure to additional duties.

Subsequently, product roadmaps have had to accommodate these cost fluctuations by prioritizing modular architectures that allow for component substitutions without extensive redesign. Meanwhile, distributors and system integrators are renegotiating contracts to include tariff‐related escalation clauses, ensuring price stability for end users. In parallel, some display vendors have initiated collaborative partnerships with strategic suppliers, sharing the burden of increased input costs while preserving margins through joint optimization initiatives.

Furthermore, these tariff dynamics have catalyzed a renewed focus on supply chain resilience and multi-tier risk management. Leading organizations are employing advanced analytics to model duty impact scenarios, thereby informing inventory strategies such as just-in-time and safety stock adjustments. Ultimately, while the 2025 tariffs have introduced short-term cost headwinds, they have also accelerated the industry’s transition toward more agile, transparent, and diversified supply chain ecosystems.

Analyzing Market Dynamics Across End User Industries Applications Display Types Connectivity and Screen Size Preferences Shaping Industrial IoT Displays

The Industrial IoT display market exhibits pronounced diversity when viewed through the lens of end-user industries. Automotive stakeholders leverage interfaces for both passenger vehicle infotainment and commercial vehicle fleet management, tailoring display durability and connectivity to meet stringent safety standards. In the energy and utilities sector, power generation facilities and renewable installations rely on robust panels and wearables that withstand temperature extremes and regulatory compliance, while water utilities prioritize corrosion-resistant enclosures and low-power consumption features. In healthcare environments, diagnostics labs demand high-resolution screens calibrated for medical imaging, hospitals integrate wall-mounted touch systems for patient monitoring, and pharmaceutical firms require sanitized, explosion-proof displays for controlled substance production. Meanwhile, manufacturing operations span automotive and electronics assembly lines through to food and beverage plants, where displays must endure washdown cycles, and oil and gas applications-from upstream exploration rigs to downstream distribution centers-call for intrinsically safe, mid-temperature-rated devices.

When segmenting by application, asset tracking displays equip logistics managers with end-to-end visibility of critical components, while energy management dashboards consolidate sensor feeds into unified operational views. Predictive maintenance solutions employ thermal imaging and vibration monitoring screens to alert technicians of anomalies, reducing unplanned downtime. Process automation interfaces support both continuous manufacturing pipelines and discrete assembly operations, enabling granular control and rapid recipe changes. Quality control visualization tools provide inspectors with on-screen defect detection overlays, ensuring product consistency.

Display type also plays a pivotal role: HMI panels remain the backbone of control rooms, rugged tablets offer mobile access across hazardous zones, smart glasses deliver augmented reality overlays for complex tasks, vision systems execute high-speed inspection routines, and wearable displays provide context-aware alerts. Connectivity choices-from Bluetooth for local sensor pairing, cellular for remote site connectivity, and Ethernet for fixed installations, to LoRaWAN for low-power wide-area networks and Wi-Fi for enterprise integration-influence deployment scenarios. Finally, screen size preferences range from greater than ten inches for situational awareness screens, through seven to ten inches for balance between portability and usability, down to less than seven inches for compact, one-handed operation.

This comprehensive research report categorizes the Industrial loT Display market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Display Type

- Connectivity Technology

- Screen Size

- Application

- End User Industry

Examining Regional Market Nuances Across Americas Europe Middle East Africa and Asia Pacific to Illuminate Distinct Industrial IoT Display Adoption Patterns

Across the Americas, Industrial IoT display adoption is propelled by large-scale manufacturing hubs in the United States, Mexico’s growing automotive assembly zones, and Canada’s energy exploration projects. In these regions, emphasis on workforce safety and productivity accelerates the integration of multi-touch panels and rugged tablets within smart factory and upstream field operations. In addition, regulatory frameworks encouraging infrastructure modernization have spurred municipal water utilities and grid operators to deploy next-generation visualization platforms that support real-time demand response.

In the Europe, Middle East & Africa region, regulatory mandates around data sovereignty and cybersecurity are shaping purchasing decisions. European industrial conglomerates are incorporating intrinsically safe displays in process plants to comply with ATEX standards, while Middle Eastern oil and gas operators demand custom coatings to withstand harsh desert conditions. Meanwhile, African mining and utilities projects are gradually embracing solar-powered display solutions, leveraging low-power connectivity options to overcome grid instability.

Within the Asia-Pacific landscape, a fusion of government-led digitization initiatives and the rise of tier-1 electronics suppliers has driven rapid uptake of smart glass and vision system deployments. Japan’s precision manufacturing sector focuses on ultra-high-resolution interfaces for robotics integration, whereas India’s emerging pharmaceuticals industry is investing in sanitized, explosion-proof panel solutions. China’s vast renewable energy build-out and Southeast Asia’s expanding logistics networks rely heavily on network-agnostic, portable tablets, demonstrating the region’s adaptability to varied environmental and infrastructure conditions.

This comprehensive research report examines key regions that drive the evolution of the Industrial loT Display market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Competitive Strategies and Innovation Roadmaps of Leading Technology and Automation Firms Shaping the Industrial IoT Display Ecosystem

Leading enterprises within the Industrial IoT display ecosystem are advancing differentiated strategies to capture growing demand. Siemens continues to integrate its Mindsphere platform with high-performance panels, offering turnkey solutions for digital twin visualization and predictive analytics. Rockwell Automation leverages strategic alliances with telecommunications providers to bundle private LTE-enabled rugged tablets optimized for remote monitoring, while ABB focuses on modular HMI panel architectures that streamline customization for specific vertical applications.

Schneider Electric has enhanced its EcoStruxure framework by embedding vision systems capable of inline defect detection, enabling clients to retrofit legacy production lines with minimal downtime. Honeywell’s wearable display portfolio has expanded to include augmented reality models calibrated for field service in hazardous environments. Meanwhile, Advantech and Kontron are investing heavily in scalable embedded display boards designed for hybrid edge-cloud deployments, catering to original equipment manufacturers seeking cost-effective integration.

Further, global technology conglomerates such as Panasonic and Lenovo have entered the rugged tablet segment, combining enterprise-grade security with industrial-strength durability. These new entrants are challenging incumbents by offering competitive pricing and rapid innovation cycles. Collectively, these industry leaders are shaping the competitive landscape through strategic collaborations, targeted M&A activity, and continuous product refinement aimed at addressing the full spectrum of Industrial IoT display requirements.

This comprehensive research report delivers an in-depth overview of the principal market players in the Industrial loT Display market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Advantech Co. Ltd.

- Allen-Bradley Inc.

- Avalue Technology Inc.

- Beckhoff Automation GmbH & Co. KG

- CDW Corporation

- Cisco Systems Inc.

- DFI Inc.

- Elo Touch Solutions Inc.

- GE HealthCare Technologies Inc.

- Honeywell International Inc.

- LG Display Co. Ltd.

- NCR Corporation

- Panasonic Holdings Corporation

- Planar Systems Inc.

- Samsung Electronics Co. Ltd.

- Sharp Corporation

- Siemens AG

Actionable Strategic Imperatives and Roadmap Recommendations to Drive Sustainable Growth and Technological Leadership in the Industrial IoT Display Sector

To capitalize on emerging opportunities, industry leaders should adopt a modular design ethos that accelerates time-to-market and simplifies tariff-driven component swaps. By standardizing on common display interfaces and chassis form factors, organizations can swiftly pivot between suppliers, reducing dependency on any single geographic region. In addition, investing in edge analytics capabilities within display firmware will empower operators to process data locally, curbing bandwidth costs and improving resilience amid connectivity disruptions.

Moreover, executives are advised to forge strategic partnerships with telecom carriers to pilot 5G-enabled display trials in mission-critical settings. Such collaborations can uncover optimal spectrum usage models and service level agreements tailored to industrial workloads. Simultaneously, companies should intensify efforts to certify displays against cybersecurity frameworks and functional safety standards, ensuring regulatory compliance and strengthening client trust.

Finally, tailoring user interfaces and ergonomics to specific end-user segments-whether upstream oil rigs, continuous process plants, or medical diagnostics labs-will differentiate solutions and drive premium adoption. By aligning screen size, resolution, and input modalities with operational workflows, firms can enhance usability and reduce training overhead. These recommendations, executed in concert, will position industry leaders to outpace competition and deliver sustainable value across diverse deployment scenarios.

Multiphase Research Methodology Integrating Primary Interviews Secondary Data Analysis and Validation Processes to Ensure Robust Industrial IoT Display Insights

This research employs a multiphase methodology to ensure comprehensive, validated insights. Initially, secondary research consolidated information from annual reports, regulatory filings, and open-source databases to map the competitive landscape and identify prevailing technology trends. Concurrently, technical whitepapers and industry standards documentation were reviewed to assess the evolution of connectivity protocols and display hardware specifications.

Subsequently, primary interviews were conducted with over two dozen senior executives, product managers, and system integrators across key regions. These conversations provided qualitative context around adoption barriers, proof-of-concept outcomes, and roadmap priorities. In parallel, a series of expert roundtables facilitated peer validation of preliminary findings, enabling triangulation of market drivers and potential disruptions.

Finally, data was synthesized using both top-down and bottom-up approaches. The top-down analysis evaluated global trade flows and macroeconomic indicators to ascertain broader market forces, while the bottom-up perspective aggregated vendor-level disclosures and end-user procurement strategies. Rigorous cross-validation ensured that the conclusions and recommendations presented herein are robust, objective, and directly applicable to corporate decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Industrial loT Display market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Industrial loT Display Market, by Display Type

- Industrial loT Display Market, by Connectivity Technology

- Industrial loT Display Market, by Screen Size

- Industrial loT Display Market, by Application

- Industrial loT Display Market, by End User Industry

- Industrial loT Display Market, by Region

- Industrial loT Display Market, by Group

- Industrial loT Display Market, by Country

- United States Industrial loT Display Market

- China Industrial loT Display Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2067 ]

Synthesizing Key Findings Insights and Strategic Pathways to Reveal the Future Trajectory and Imperatives in the Evolving Industrial IoT Display Landscape

In synthesizing the key findings, it becomes evident that Industrial IoT displays are transitioning from passive information panels to intelligent, adaptive interfaces that underpin operational excellence. Tariff-related cost pressures have catalyzed a shift toward modular, supplier-agnostic designs, while transformative technologies such as edge AI, private 5G, and digital twins are expanding the functional scope of these displays. Furthermore, segmentation analysis highlights the importance of tailoring solutions to the unique requirements of automotive, energy, healthcare, manufacturing, and oil and gas sectors.

Regional dynamics underscore the need for nuanced go-to-market strategies that address regulatory mandates in Europe, infrastructure variability in Africa, and the rapid digitization of Asia-Pacific. Leading providers are responding by forging cross-industry partnerships, integrating advanced analytics into firmware, and pursuing strategic M&A to enhance their portfolios. As a result, the competitive landscape is more dynamic, with emerging entrants challenging incumbents on price, agility, and innovation velocity.

Ultimately, organizations that embrace flexible architectures, invest in localized connectivity trials, and prioritize user-centric interface design will secure sustainable advantages. By aligning product roadmaps with evolving end-user workflows and regulatory frameworks, industry stakeholders can navigate the complexities of the Industrial IoT display market and position themselves for long-term success.

Take Your Strategic Decisions to the Next Level by Engaging with Ketan Rohom Associate Director Sales & Marketing to Secure Industrial IoT Display Insights

To explore how these comprehensive insights can transform your strategic roadmap and operational capabilities in the Industrial IoT display market, reach out directly to Ketan Rohom, Associate Director Sales & Marketing at 360iResearch. Engaging with Ketan will provide you with personalized guidance on how to leverage the full report to address cost challenges, accelerate technology adoption, and identify high-value opportunities in your target segments. His expertise in market applications, tariffs, and competitive analysis will help align your decision-making with the latest industry developments.

By securing this research, you will gain actionable data that supports investment prioritization, supplier negotiations, and solution customization tailored to end-user requirements and regional specificities. Connect with Ketan Rohom today to schedule a one-on-one consultation and receive a detailed briefing that empowers your organization to stay ahead of evolving market dynamics and regulatory shifts.

- How big is the Industrial loT Display Market?

- What is the Industrial loT Display Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?