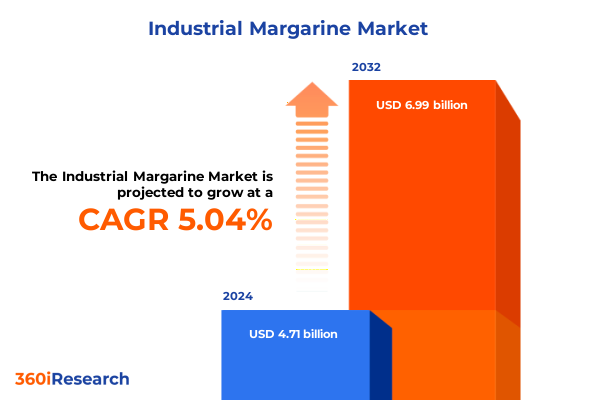

The Industrial Margarine Market size was estimated at USD 4.89 billion in 2025 and expected to reach USD 5.06 billion in 2026, at a CAGR of 5.25% to reach USD 6.99 billion by 2032.

Setting the Stage for Industrial Margarine’s Evolution and Strategic Importance in Modern Food Manufacturing Environments to Drive Efficiency and Quality

Industrial margarine plays a pivotal role in large-scale food production by delivering consistent textural properties and functional performance across a wide range of applications. As an essential fat blend in bakery, confectionery, and foodservice operations, it provides manufacturers with reliable emulsification, moisture retention, and extended shelf life. Over the past decade, the industry has shifted from hydrogenation-based processes toward innovative fat modifications, enabling producers to meet stringent health regulations and consumer demand for cleaner label ingredients.

Beyond its technical advantages, industrial margarine offers cost efficiency that drives operational stability. Its stability under high-volume production and capacity to integrate specialty oils and additives make it a versatile component in formulation design. As manufacturers seek to align product offerings with evolving dietary trends, industrial margarine emerges as a strategic ingredient, balancing performance requirements with regulatory compliance and consumer expectations. This introduction sets the foundation for exploring the transformative shifts, tariff impacts, and strategic insights shaping the industrial margarine landscape today.

Uncovering the Transformative Shifts Shaping Industrial Margarine Through Health Trends Sustainability Priorities and Technological Innovation in Production

In recent years, consumer and regulatory pressures have triggered a fundamental evolution in the industrial margarine landscape. A growing emphasis on trans-fat elimination has driven manufacturers to adopt interesterification and enzymatic customization of triglyceride structures, effectively replacing partially hydrogenated oils. Concurrently, the demand for clean label formulations has gained traction, prompting ingredient suppliers to innovate plant-based blends and transparent supply chain practices.

Moreover, sustainability priorities have reshaped sourcing strategies. Transparent palm oil certifications and partnerships with sustainable agriculture programs have become non-negotiable, aligning corporate responsibility goals with market demands. At the same time, digital transformation is redefining quality control and logistics. Advanced process monitoring and predictive maintenance systems are automating production lines, reducing waste, and enhancing traceability from raw materials to finished goods.

Technological advancements in emulsifier systems and microstructure control have expanded the functionality of margarine in high-performance applications, such as laminated dough and enrobing processes. The convergence of these shifts-health-driven formulation, responsible sourcing, and Industry 4.0 capabilities-signals a new phase of innovation in industrial margarine. Forward-looking manufacturers are integrating these trends to optimize cost structures, accelerate product development cycles, and maintain competitive differentiation in a rapidly evolving marketplace.

Analyzing the Cumulative Impact of 2025 United States Tariffs on Industrial Margarine Supply Chains Production Costs and Strategic Sourcing Decisions

The implementation of elevated United States tariffs on select imported fats and oils in early 2025 has had a cascading effect on industrial margarine operations. Tariffs aimed at supporting domestic oilseed producers have increased the landed cost of key derivatives, notably palm oil fractions and specialty specialty fats used for interesterified blends. In response, manufacturers have reconfigured sourcing strategies, prioritizing regional suppliers with favorable trade terms.

Consequently, production costs for custom margarine formulations have risen, compelling contract manufacturers and large-scale bakeries to negotiate long-term supply agreements. Some organizations have secured tariff-exempt quotas or engaged in co-processing partnerships to mitigate surcharges. These adjustments underscore the importance of dynamic procurement frameworks and adaptive contract structures in preserving margin integrity.

Looking ahead, the enduring impacts of the 2025 tariff policy highlight the critical need for diversified sourcing and robust supplier relationships. Manufacturers that proactively evaluate alternative feedstocks, invest in on-shoring capabilities, or leverage cross-border consolidation will be best positioned to navigate potential future trade disruptions. The cumulative tariff adjustments reinforce the strategic imperative of supply chain resilience and flexible production planning in the industrial margarine sector.

Revealing Critical Insights Across Packaging Application and Product Type Segments to Empower Strategic Decision Making in the Industrial Margarine Market

A deep dive into packaging, application, and product type reveals nuanced performance drivers that inform go-to-market approaches for industrial margarine solutions. Brick formats remain pivotal for industrial bakeries requiring precise dough lamination and portion control, whereas bulk deliveries optimize cost efficiency for high-volume continuous processes. Tub packaging caters to foodservice operators who prioritize ease of handling and rapid service turnaround.

Application-based insights show that the bakery segment leverages margarine blends to achieve optimal crumb structure in bread, lint-free finishes on cakes, and delicate flakiness in pastries. In confectionery, specialized margarine formulations enhance the mouthfeel and snap of chocolate enrobing systems and contribute to uniform texture in candy centers. Within foodservice, rapid-melting margarine profiles are tailored for full service restaurants, hotel kitchens, and quick service environments, ensuring consistent spreadability and flavor release under diverse cooking conditions.

Product types further differentiate performance attributes. Hard margarine delivers high-creaming capacity and dough stability, liquid margarine supports continuous blending and aeration processes, and soft margarine balances spreadability with emulsion stability. By aligning packaging formats, application requirements, and margarine types, manufacturers can precisely engineer formulations that meet specific operational criteria and consumer quality standards.

This comprehensive research report categorizes the Industrial Margarine market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Packaging

- Application

Illuminating Regional Dynamics and Growth Drivers Across the Americas Europe Middle East Africa and Asia Pacific in the Industrial Margarine Landscape

Regional dynamics in the industrial margarine market underscore distinct drivers and innovation pathways. In the Americas, the convergence of clean label demands and sustainability requirements has spurred the adoption of traceable, non-GMO oil sources and reduced reliance on partially hydrogenated fats. Major producers in North America are partnering with certified growers to streamline palm oil supply chains while incorporating locally sourced soybean and canola oils for optimized performance.

Meanwhile, Europe, the Middle East, and Africa (EMEA) emphasize stringent regulatory compliance and premium quality. Europe’s regulatory framework has enforced trans-fat limitations and environmental mandates, prompting innovation in interesterified blends and bio-based additives. In Middle Eastern markets, customization for high-temperature stability in pastry and confectionery applications drives demand for advanced emulsifier technologies, while African markets prioritize cost-effective blends adapted to regional processing capabilities.

Asia-Pacific presents rapid growth opportunities, fueled by expanding commercial bakery chains and increasing foodservice penetration. In Southeast Asia, cost-sensitive segments adopt high-yield margarine blends for mass production of breads and snack products. Meanwhile, in developed Asia-Pacific markets, premiumization trends are leading to margarine formulations enriched with omega-3 fatty acids and natural antioxidants. These regional insights highlight the importance of localized product development and supply network optimization to meet diverse market expectations.

This comprehensive research report examines key regions that drive the evolution of the Industrial Margarine market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining How Leading Industrial Margarine Manufacturers Leverage Sustainability and Collaborative Research to Drive Competitive Advantage and Market Evolution

Leading players in the industrial margarine sector are deploying differentiated strategies to secure market leadership and drive innovation. Bunge has capitalized on its integrated oilseed processing infrastructure to offer vertically integrated margarine solutions, enabling granular control over raw material quality and cost efficiencies. This integration fuels their ability to customize fatty acid profiles and meet specific functional requirements for high-volume industrial applications.

Cargill’s approach emphasizes research and development in specialty fats, leveraging proprietary enzymatic interesterification processes to produce clean label, trans-fat-free margarine blends. Strategic partnerships with academic institutions and technology startups have accelerated the development of performance-enhanced products, such as margarine variants optimized for gluten-free formulations and advanced aeration in confectionery applications.

Upfield has distinguished itself through a dedicated focus on plant-based margarine innovations and sustainability certifications. By aligning its product portfolio with circular economy principles and investing in renewable energy across manufacturing sites, Upfield reinforces its commitment to environmental stewardship while addressing consumer demand for ethical ingredient sourcing.

Wilmar International’s global footprint in palm oil production underpins its strategic advantage in securing traceable feedstocks. Through the Roundtable on Sustainable Palm Oil (RSPO) and digital traceability platforms, the company strengthens risk management across complex supply chains. Meanwhile, Conagra’s acquisitions have broadened its margarine and specialty fats portfolio, integrating niche brands to serve the evolving preferences of bakery and foodservice customers. These competitive strategies illustrate how leading organizations combine operational scale, R&D investments, and sustainable practices to influence market direction.

This comprehensive research report delivers an in-depth overview of the principal market players in the Industrial Margarine market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AAK AB

- Adeka Corporation

- Archer-Daniels-Midland Company

- Aveno NV

- BRF S.A.

- Bunge Limited

- Cargill, Incorporated

- Conagra Brands, Inc.

- Currimjee Jeewanjee and Company Limited

- EFKO Group

- FGV Holdings Berhad

- Fuji Oil Holdings Inc.

- Gagar Foods Pvt.Ltd.

- Golden Agri-Resources Ltd.

- IFFCO Group

- IPSA spa

Delivering Actionable Recommendations to Enable Industry Leaders to Harness Sustainability and Supply Chain Resilience in the Industrial Margarine Landscape

To thrive amidst regulatory changes and shifting consumer priorities, companies should embed sustainability at the core of their operations by securing certified oil sources and investing in post-consumer waste reduction initiatives. Strengthening relationships with strategic suppliers and diversifying feedstock portfolios will mitigate tariff risks and ensure uninterrupted production.

Innovation pipelines must prioritize clean label formulations, harnessing enzymatic and interesterification technologies to replace partially hydrogenated fats without compromising functionality. Advancing digital traceability systems will enhance quality assurance and support transparency initiatives, fostering brand trust in increasingly conscious markets.

Moreover, manufacturing leaders should adopt agile procurement frameworks that leverage real-time market intelligence to navigate dynamic pricing and trade policies. Cross-functional collaboration between R&D, supply chain, and sales teams will accelerate go-to-market speed and align product roadmaps with emerging application trends across bakery, confectionery, and foodservice segments.

Outlining a Rigorous Research Methodology Integrating Primary Stakeholder Engagement and Secondary Data Validation for Actionable Industrial Margarine Insights

Our analysis combined extensive primary stakeholder interviews with leading margarine producers, ingredient suppliers, and end-user facilities to capture firsthand insights on operational challenges and innovation priorities. Detailed discussions with process engineers and quality directors provided clarity on functional performance requirements across diverse applications.

Simultaneously, secondary data validation encompassed a thorough review of trade publications, regulatory filings, and sustainability audit reports. This triangulation of quantitative and qualitative inputs ensured a balanced perspective on raw material dynamics, tariff impacts, and technological trends. Rigorous data cleansing and cross-referencing against proprietary databases reinforced the validity of our findings.

Quality assurance protocols included consistency checks, peer reviews by industry experts, and scenario-based sensitivity analyses. These methodological safeguards guarantee that the insights presented herein are both credible and directly applicable to strategic decision-making in the industrial margarine domain.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Industrial Margarine market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Industrial Margarine Market, by Type

- Industrial Margarine Market, by Packaging

- Industrial Margarine Market, by Application

- Industrial Margarine Market, by Region

- Industrial Margarine Market, by Group

- Industrial Margarine Market, by Country

- United States Industrial Margarine Market

- China Industrial Margarine Market

- Competitive Landscape

- List of Figures [Total: 15]

- List of Tables [Total: 1113 ]

Summarizing Key Findings on Industrial Margarine Market Dynamics and Emphasizing the Path Forward for Innovation Sustainability and Strategic Growth Strategies

The industrial margarine market is undergoing significant transformation driven by regulatory mandates, consumer health preferences, and sustainability imperatives. The shift toward trans-fat-free, plant-based formulations has been complemented by advanced fat modification techniques and digital supply chain enhancements. Regional dynamics underscore the need for tailored approaches, from cost-sensitive blends in Asia-Pacific to premium, high-stability formulations in EMEA and clean label innovations in the Americas.

Leading organizations are leveraging integrated supply chains, R&D collaborations, and sustainability certifications to differentiate their offerings and build resilience against trade fluctuations. The 2025 US tariff adjustments highlight the importance of agile procurement and diversified sourcing strategies that safeguard margins and ensure supply continuity.

Looking forward, success in the industrial margarine sector will hinge on the ability to align product performance with evolving application needs, regulatory landscapes, and consumer expectations. Companies that innovate responsibly, optimize their supply networks, and embrace data-driven insights will secure competitive advantage and drive long-term growth.

Take the Next Step Toward Gaining In-Depth Industrial Margarine Market Insights by Connecting with Ketan Rohom to Secure Your Comprehensive Research Access

To gain access to this comprehensive analysis of current trends and future outlook for industrial margarine, engage directly with Ketan Rohom, Associate Director of Sales & Marketing. Ketan brings a deep understanding of the functional applications and strategic value of industrial margarine formulations, helping you navigate critical decisions and tailor solutions to your operational needs.

By connecting with Ketan, you will receive personalized guidance on how this research can inform your product development, procurement strategies, and sustainability commitments. Whether you represent a large-scale bakery, a confectionery manufacturer, or a foodservice operation, these insights will empower you to stay ahead of market shifts and regulatory changes.

Secure your copy of the report today and position your organization for long-term success in an increasingly competitive and innovation-driven environment. Don’t miss the opportunity to leverage these actionable findings-reach out to Ketan Rohom now and transform your industrial margarine strategy.

- How big is the Industrial Margarine Market?

- What is the Industrial Margarine Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?