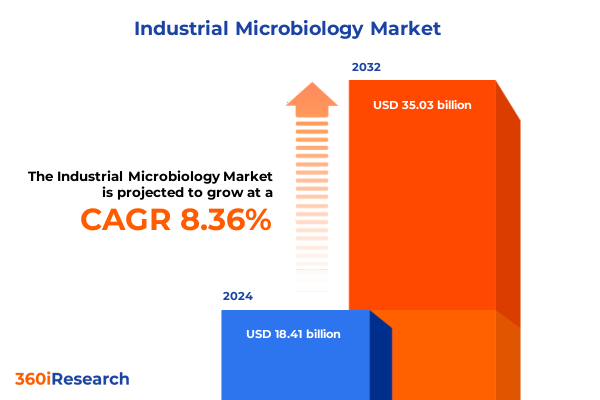

The Industrial Microbiology Market size was estimated at USD 19.76 billion in 2025 and expected to reach USD 21.21 billion in 2026, at a CAGR of 8.52% to reach USD 35.03 billion by 2032.

An authoritative opening on how converging technological advances, process innovation, and policy dynamics are redefining strategic priorities in industrial microbiology

Industrial microbiology now sits at the confluence of accelerating scientific capability and urgent commercial demand, creating a period of strategic consequence for leaders across biotechnology, chemicals, food, and environmental services. Advances in strain engineering, high‑throughput analytics and the application of AI to biological design have compressed discovery cycles and increased the range of commercially viable biological products. At the same time, downstream process innovations and renewed investment in biomanufacturing infrastructure are lowering barriers to scale, enabling biological routes for enzymes, biofuels, bioplastics and high‑value pharmaceutical ingredients to compete more effectively with established petrochemical or synthetic routes. These trends are reshaping strategic decision‑making: product portfolios, supply‑chain footprints and capital allocation are now evaluated through a biological lens that mixes technology risk, regulatory pathways and country‑level trade policy.

Consequently, organizations must balance rapid technology adoption with operational resilience. Firms that integrate modern computational tools into strain design and process development are shortening time‑to‑proof and reducing experimental burden, while those investing in modular, flexible biomanufacturing capacity are positioning themselves to respond to both market opportunities and geopolitical disruption. This combination of scientific momentum and structural sensitivity defines the contemporary industrial microbiology landscape and sets the agenda for the deeper insights that follow.

How synthetic biology industrialization, precision fermentation scale‑up, and geopolitical supply‑chain realignments are jointly shifting value creation across industrial microbiology

Over the last two years, three transformative shifts have remapped competitive advantage in industrial microbiology: the rapid industrialization of synthetic biology platforms, the scaling imperative for precision fermentation, and the geopolitical recalibration of supply chains. Synthetic biology firms have moved from experimental proof‑of‑concepts to platform commercialization, using automated foundries and data‑driven strain engineering to reduce development cycles. Parallel investments in precision fermentation capacity-public and private-are enabling companies to translate molecule design into reproducible, food‑grade and industrial outputs, driving new entrants and traditional food and chemical companies to form strategic partnerships or build in‑house capacity. At the same time, governments and large multinational customers are imposing new trade and procurement pressures that reward domestic or allied manufacturing capacity, prompting global players to realign production pipelines and reconsider dependency on long, single‑source supply chains.

These shifts interact and reinforce one another. As on‑shore capacity grows, it creates demand for localized upstream and downstream services-bioreactors, cell culture expertise and downstream processing know‑how-making end‑to‑end capability a premium differentiator. Digitalization and machine learning augment this dynamic by improving process predictability and reducing scale‑up risk, which in turn accelerates investment decisions. Taken together, the landscape now favors organizations that can combine advanced biological design, flexible process engineering and geopolitical agility to secure customers and access to regulated markets. Evidence of this recalibration is visible in announced manufacturing investments, strategic collaborations and the restructuring decisions made by platform companies seeking sustainable pathways to profitability.

Analysis of how the 2025 U.S. tariff adjustments have created immediate operational frictions, driven reshoring investments, and altered capital and supplier decision frameworks across biotechnology

The cumulative effect of U.S. tariff actions in 2025 has been to intensify near‑term operational pressure while also reshaping longer term strategic responses across the life sciences and industrial biotechnology ecosystem. Firms dependent on imported active pharmaceutical ingredients, specialized lab equipment, or process components have reported both increased input costs and longer qualification cycles for alternative suppliers. Industry associations and surveys of biotechnology firms highlight the speed with which tariff exposure can force costly supplier diversification, regulatory rework and, in some cases, the reprioritization of R&D activities. In practice, these trade measures have incentivized large multinational drug and biotechnology companies to accelerate domestic capacity investments, announce multi‑billion‑dollar manufacturing programs, and explore tariff‑risk mitigation strategies such as expanding regional sourcing and negotiating tariff carve‑outs with allied partners.

For industrial microbiology specifically, the tariffs have altered the calculus for capital projects and vendor selection. Companies facing higher import duties for fermentation equipment or critical raw materials are increasingly evaluating modular and locally‑sourced process equipment, qualifying domestic CDMOs, and pursuing supply‑chain co‑location with critical end markets to preserve margin and regulatory timelines. The policy environment has also increased demand for advisory expertise in customs classification, origin rules and bilateral trade negotiations, as business teams seek to avoid unexpected duty exposure that can delay product launches or inflate manufacturing costs. Importantly, industry voices have warned that abrupt tariff measures can slow innovation by diverting constrained R&D budgets toward operational reconfiguration rather than discovery and clinical progress.

Actionable segmentation insights revealing how product types, applications, end users, technology choices, and organism groups define distinct commercial and operational playbooks in industrial microbiology

Segment‑level behaviors in industrial microbiology are differentiated by product, application, end‑user, technology and organism-patterns that create distinct opportunity maps for development, manufacturing and commercial teams. By product type, high‑value categories such as amino acids, antibiotics and vitamins typically demand stringent regulatory controls and traceable supply chains, while biofuels and bioplastics are shaped by feedstock economics, lifecycle metrics and downstream purification costs. Enzymes are noteworthy because their commercial logic spans multiple pockets: enzyme formulations tailored for animal feed require robustness and cost‑effectiveness, detergents require stability across temperature and chemistry, and food processing applications emphasize food‑grade certification and sensory performance. These product dynamics imply different margin structures, customer engagement models and technical validation pathways.

Across applications, agriculture and food and beverage customers prioritize process consistency, regulatory compliance and cost of goods, whereas environmental and biofuels applications emphasize robustness against variable feedstocks and the ability to integrate into existing industrial systems. Pharmaceuticals-especially drug discovery and drug formulation-are the most demanding application group in terms of quality systems, documentation and regulatory timelines, which typically require vertically integrated or tightly certified supplier relationships. End users vary accordingly: agriculture firms and food manufacturers tend to favor multi‑year supply agreements and technical service bundles, environmental agencies focus on demonstrable performance in field deployments, pharmaceutical companies demand GMP‑grade materials and validated processes, and research institutes emphasize experimental flexibility and access to custom strains or enzyme blends.

Technology choices further segment pathways to scale. Bioreactors and cell culture infrastructure are essential for consistent biologics and high‑purity ingredient production, while downstream processing determines final product quality and cost. Fermentation practices diverge into solid‑state and submerged approaches, each with particular strengths: solid‑state fermentation offers advantages in substrate flexibility and energy intensity for some enzyme and bioplastic routes, while submerged fermentation remains the default for many high‑volume, tightly‑controlled bioproducts. Organism type also defines development trajectories: algae and yeast excel in certain feedstock conversions and lipid production, fungi and filamentous organisms are powerful for enzyme and specialty‑metabolite production, and bacteria-both Gram‑negative and Gram‑positive-remain foundational for rapid growth and genetic tractability. Together these segmentation layers create multiple, overlapping value chains that require bespoke commercialization strategies, not one‑size‑fits‑all roadmaps.

This comprehensive research report categorizes the Industrial Microbiology market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Technology

- Organism Type

- Application

- End User

Comparative regional intelligence showing why Americas, Europe Middle East & Africa, and Asia‑Pacific each demand distinct operational strategies, partner models, and investment responses

Regional dynamics are now a core strategic variable for industrial microbiology, with distinct drivers and risk profiles across the Americas, Europe, Middle East & Africa, and Asia‑Pacific. In the Americas, recent announcements of large capital commitments and manufacturing expansions by global drugmakers reflect a policy and market environment that strongly rewards on‑shore capability and rapid access to the U.S. market. These moves have accelerated demand for US‑based CDMO capacity, advanced bioreactors and downstream processing skills, and they have created commercial opportunities for firms that can move quickly to qualify GMP‑compliant domestic suppliers.

In Europe, Middle East & Africa, the region’s strengths in advanced fermentation science, industrial chemistry and regulatory sophistication support a growing focus on sustainable biomanufacturing, bioplastics and specialty enzymes. Large European players are investing in demo‑scale fermentation and purification facilities, while public policy levers emphasize circularity and reduced carbon intensity-conditions that favor technologies able to demonstrate lifecycle advantages. Across the Middle East and Africa, government‑led industrialization programs are increasingly supportive of bio‑based manufacturing as part of diversification strategies. In the Asia‑Pacific, rapid capacity expansion, significant CDMO investment, and active government incentives have transformed the region into both a source of scale and a centre for innovation. National programs in South Korea, Singapore, India and China are driving new biologics and fermentation projects, creating a dense regional ecosystem for process development, contract manufacturing and talent supply that global players now incorporate into their network strategies. These regional distinctions require companies to align product certification, partner selection and logistics planning to local regulatory and market realities.

This comprehensive research report examines key regions that drive the evolution of the Industrial Microbiology market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

How leading biosolutions integrators, platform synthetic biology firms, and specialized CDMOs are adjusting strategy to secure capacity, protect margins, and accelerate commercialization

Company‑level behavior during this period has been shaped by three imperatives: securing reliable capacity, demonstrating technological differentiation, and managing capital discipline. Some legacy enzyme and cultures firms consolidated assets to create broader biosolutions platforms, combining application knowledge with enzyme and strain portfolios to serve multiple industries. Platform synthetic biology companies have restructured to sharpen their services and product lanes, seeking profitable pathways through government contracts, targeted collaborations and selective divestitures. Large chemical and agrochemical incumbents are investing selectively in fermentation plants and bioproduct lines to diversify away from petrochemical feedstocks while leveraging existing sales channels into agriculture and industrial markets.

Across the supplier landscape, this translates into two dominant archetypes: integrated biosolutions firms that bundle R&D, application support and scale‑up capabilities, and specialized service providers-CDMOs, equipment OEMs and analytical platforms-that offer modular capacity and technical expertise. Integration allows faster commercialization for regulated products but requires higher capital intensity and cross‑functional coordination; specialization reduces fixed cost for customers but increases the need for rigorous vendor qualification and intellectual property governance. These company behaviors underscore a market now interoperable between deep‑vertical players and nimble, service‑oriented providers, creating both consolidation pressures and partnership opportunities.

This comprehensive research report delivers an in-depth overview of the principal market players in the Industrial Microbiology market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- Agilent Technologies, Inc.

- Ajinomoto Co., Inc.

- Archer Daniels Midland Company

- Avantor, Inc.

- BASF SE

- Becton, Dickinson and Company

- Bio-Rad Laboratories, Inc.

- bioMérieux SA

- Chr. Hansen Holding A/S

- Danaher Corporation

- DuPont de Nemours, Inc.

- Eppendorf SE

- Eurofins Scientific SE

- Evonik Industries AG

- Hardy Diagnostics

- HiMedia Laboratories Private Limited

- Hy Laboratories Ltd.

- Kerry Group plc

- Koninklijke DSM N.V.

- Lonza Group AG

- Merck KGaA

- Neogen Corporation

- Novozymes A/S

- QIAGEN N.V.

- Sartorius AG

- Thermo Fisher Scientific Inc.

High‑impact, executable recommendations for executive teams to combine modular capacity, data‑driven bioprocessing, and proactive trade strategies to protect and accelerate growth

Industry leaders should act now across three focused fronts to translate risk into advantage: invest in adaptable, modular manufacturing capacity while prioritizing regulatory alignment; embed data‑centric process development to reduce scale‑up uncertainty; and proactively manage tariff and trade risks through diversified sourcing and policy engagement. First, modular and flexible biomanufacturing footprints allow companies to pivot volumes between product lines and to qualify the same physical space for multiple regulatory classes, lowering the effective cost of capacity and speeding time to market. Where capital is constrained, partnerships with established CDMOs or co‑location agreements can achieve similar resilience without full ownership of physical assets.

Second, accelerating adoption of machine learning and advanced analytics in strain selection, upstream control and downstream optimization materially reduces experimental cycles and scale‑up failures. Firms that combine historical process data with modern ML approaches can improve predictability in bioreactor performance and reduce expensive scale‑up iterations. Third, companies must treat tariff exposure as a strategic variable: assessing customs classifications, exploring ally‑aligned sourcing to take advantage of preferential treatments, and engaging industry associations to shape pragmatic transition policies will lower the operational cost of trade uncertainty. By sequencing these actions-flexible capacity, digital process control, and proactive trade management-leaders can both defend current portfolios and create a runway for new biologically‑derived products.

Clear explanation of the mixed‑method research approach combining primary interviews, secondary evidence, and expert validation to produce actionable industrial microbiology intelligence

This analysis synthesizes primary stakeholder interviews, structured secondary research and expert validation to ensure findings are grounded in both practitioner experience and published evidence. Primary inputs included dialogues with R&D heads, process engineers, procurement specialists and regulatory affairs leads to test hypotheses around scale‑up risk, tariff exposure and partnership models. Secondary research drew on peer‑reviewed literature, company announcements and industry association surveys to triangulate technology trends and policy impacts. Expert validation sessions with operating executives and technical advisers were used to resolve contested interpretations and to stress‑test recommended actions against realistic operational constraints.

Segmentation mapping aligned product, application, end‑user, technology and organism dimensions to create multi‑axis decision frameworks. Technology assessments evaluated the maturity of bioreactors, cell‑culture platforms and downstream options, and risk scoring captured regulatory complexity and supply‑chain fragility. Where appropriate, scenario analysis was used to illustrate how tariff outcomes and regional investment decisions could alter supply networks and capital priorities. Throughout, emphasis was placed on reproducible reasoning and transparent source attribution so that commercial teams can trace conclusions back to underlying evidence and adapt them to unique corporate circumstances.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Industrial Microbiology market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Industrial Microbiology Market, by Product Type

- Industrial Microbiology Market, by Technology

- Industrial Microbiology Market, by Organism Type

- Industrial Microbiology Market, by Application

- Industrial Microbiology Market, by End User

- Industrial Microbiology Market, by Region

- Industrial Microbiology Market, by Group

- Industrial Microbiology Market, by Country

- United States Industrial Microbiology Market

- China Industrial Microbiology Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1590 ]

A conclusive assessment of the strategic choices facing firms as science, manufacturing, and trade policy converge to determine who will lead the industrial microbiology transition

Industrial microbiology is at an inflection point where scientific capability, process engineering and trade policy converge to create differentiated winners and losers. Organizations that can integrate advanced biological design with robust, modular manufacturing and disciplined trade risk management will unlock the most value. Those that fail to adapt risk facing longer qualification times, higher production costs and constrained commercial access in tariff‑sensitive markets. The good news is that many of the tools needed to succeed exist today: modular biomanufacturing approaches, proven fermentation strategies, and machine learning methods for process optimization all materially reduce the historical friction between lab success and commercial production.

As the sector evolves, cross‑functional coordination-between R&D, process development, procurement and government affairs-will determine whether companies convert technological promise into repeatable, profitable product lines. For decision‑makers, the priority is clear: accelerate investments in operational flexibility and data‑driven process control while engaging proactively in trade and policy conversations that affect inputs and market access. These combined steps will convert present uncertainty into a strategic advantage and create durable pathways for biologically‑derived products across industrial, food and pharmaceutical applications.

Immediate opportunity to secure a tailored executive briefing and complete industrial microbiology market research report with a senior sales contact leading the engagement

To obtain the full market research report and a tailored briefing on the industrial microbiology landscape, contact Ketan Rohom, Associate Director, Sales & Marketing. Ketan will arrange a private walkthrough that highlights the report’s methodology, deep-dive segment analyses, regional implications, and the bespoke scenario work relevant to your strategic questions. He can also coordinate a short executive briefing that focuses on tariff-sensitive supply‑chain actions, technology adoption priorities, and partnership opportunities aligned with your business objectives.

Engaging with Ketan will connect you to a concise delivery path for the complete dataset, appendices, and reproducible evidence files used to generate the insights in this summary. Reach out to schedule a demonstration of the report’s interactive exhibits and to discuss licensing options and enterprise packages tailored to development, manufacturing, or M&A due diligence needs.

- How big is the Industrial Microbiology Market?

- What is the Industrial Microbiology Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?