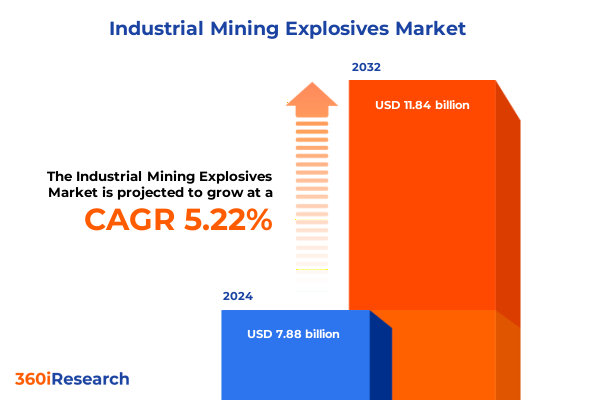

The Industrial Mining Explosives Market size was estimated at USD 8.28 billion in 2025 and expected to reach USD 8.70 billion in 2026, at a CAGR of 5.23% to reach USD 11.84 billion by 2032.

Revolutionizing Mining Operations Through Precision Explosive Technologies and Sustainable Practices Shaping Industrial Explosives Landscape in 2025

The industrial mining explosives sector stands at the nexus of energy, infrastructure, and resource extraction, serving as a foundational enabler of modern economic development. These advanced pyrotechnic materials facilitate the precise fragmentation of rock, unlocking reserves that fuel critical industries from battery metals to construction aggregates. Thanks to ongoing innovation and rigorous safety protocols, the sector continues to evolve, delivering solutions that not only enhance operational efficiency but also meet stringent environmental and regulatory standards. As global demand for critical minerals intensifies, driven by the energy transition and digital transformation, high-performance explosives remain indispensable to the timely and cost-effective development of mining projects across every continent.

Against this dynamic backdrop, the marketplace features an array of specialized formulations ranging from bulk emulsion systems to packaged electronic detonators, each tailored to specific geological conditions and operational requirements. Industry leaders are deploying mechanized charging systems, AI-driven blast design software, and comprehensive monitoring platforms to optimize fragmentation outcomes while minimizing environmental footprints and enhancing worker safety. The convergence of data analytics, digital solutions, and sustainable formulations underscores the sector’s commitment to precision, productivity, and responsible resource management. By contextualizing these transformative trends, this executive summary lays the groundwork for a thorough examination of the forces reshaping the industrial mining explosives landscape in 2025 and beyond. citeturn4search3turn4search0

Advancements in Safety, Digitalization, and Sustainability Are Redefining How Mining Explosives Drive Productivity and Environmental Stewardship in Industry

Technological innovation is catalyzing a profound shift in how explosives are designed, delivered, and optimized. Across global operations, digital platforms are integrating real-time blast data, geological models, and remote monitoring to refine initiation sequences and maximize energy efficiency. Industry pioneers have introduced wireless electronic detonators capable of resisting shock, electromagnetic pulses, and extreme environmental conditions, ensuring consistent timing accuracy even in the most demanding settings. At the same time, mechanized development charging systems empower operators to perform bulk loading tasks remotely, significantly reducing exposure to hazardous environments and enhancing overall site safety. These advancements mark a new era in which precision detonation is guided by predictive analytics and automated controls, yielding improved fragmentation, reduced rework, and lower total cost of ownership. citeturn1search0turn2search1

Parallel to the digital revolution, the sector is embracing sustainability as a strategic imperative. Leading manufacturers are deploying tertiary abatement technologies in their production facilities to curtail nitrous oxide emissions and adopting lower-carbon feedstocks for emulsion explosives. Electrification of mobile processing units is redefining bulk delivery, with electric MPUs capable of fast recharging via renewable-powered stations now undergoing field trials. These zero-emission vehicles not only diminish environmental impacts but also provide quieter, healthier working conditions for on-site personnel. Complemented by the development of biodegradable formulations and hydrogen peroxide-based emulsions that significantly reduce carbon content in blasting operations, such initiatives demonstrate the industry’s broader commitment to environmental stewardship and net-zero ambitions. citeturn1news14turn2search0

Analysis of Comprehensive Tariff Measures Impacting Explosives Supply Chains, Manufacturing Costs, and Strategic Procurement Responses in the United States

The cumulative effect of U.S. tariff measures implemented in 2025 has introduced new complexities for domestic explosives manufacturers and their extended supply chains. Under Section 301 of the Trade Act, tariffs of up to 25 percent have been imposed on select tungsten products-key constituents of drilling bits and downhole components-while solar wafer and polysilicon duties have surged to 50 percent in a bid to counter unfair trade practices. These actions, aimed at bolstering domestic industrial resilience, have nonetheless increased input costs for proprietary components used in detonator assemblies and ignition devices. Simultaneously, reciprocal tariffs targeting imports from Canada, Mexico, and China have broadened the coverage, prompting industry bodies to petition for exemptions to safeguard essential explosives inputs and protect over 60,000 American jobs. citeturn0search4turn0search1

Further compounding cost pressures, the Section 232 tariffs on steel and aluminum imports have risen to 25 percent, affecting the production of bulk tanks, loading systems, and containment vessels integral to explosives logistics and storage. This escalation requires manufacturers to reevaluate procurement strategies for structural components, delay lines, and pressure vessels, while downstream industries face potential pass-through costs that could disrupt project timelines across mining, energy, and infrastructure sectors. Stakeholders are navigating a landscape where raw material price volatility and regulatory uncertainty necessitate agile sourcing and greater emphasis on domestic fabrication capabilities to maintain continuity of supply. citeturn0search6

In-Depth Evaluation of Market Dynamics Revealed Through Product, Delivery Method, and Application Segmentation Highlighting Growth Drivers and Challenges

A granular examination of product-type segmentation underscores how diverse formulations drive discrete value pools. Blasting agents such as ammonium nitrate fuel oil continue to anchor high-volume surface mining operations, while high explosives-engineered for precision and high brisance-address specialized tasks in underground and hard-rock environments. Low explosives, including black powder substitutes, fulfill niche applications such as seismic exploration and pyrotechnic signaling, benefiting from simpler initiation requirements. Specialty explosives-characterized by custom chemistries that optimize blast wave propagation and minimize environmental residues-are gaining traction in markets demanding exacting performance and regulatory compliance. Each product category plays a distinct role in addressing geological challenges, operational safety considerations, and sustainability objectives. citeturn1search0turn2search0

When viewed through the lens of delivery method, bulk explosives dominate large-scale mining, leveraging on-site mixing and mechanized loading for cost efficiency and scalability. Conversely, packaged explosives-typically pre-blended and contained in cartridges or sticks-offer modular flexibility and ease of transport, making them indispensable for remote or small-scale operations. Bulk systems, with their reliance on in-country manufacturing and robust distribution networks, underscore the strategic value of localized production to mitigate cross-border tariff risks. Packaged deliveries, though less prevalent volumetrically, are critical enablers of swift response in civil engineering, quarrying, and infrastructure maintenance contexts. citeturn2search0turn3search2

Application-based segmentation reveals metal mining as a primary driver of explosives demand, with battery metals exploration fueling robust growth for copper, lithium, and nickel extraction projects aimed at supporting the green energy transition. Copper’s strategic importance for electrification infrastructure has intensified focus on precision blasting techniques that maximize resource recovery and reduce dilution. Meanwhile, gold and precious mineral operations exploit advanced initiation systems to optimize fragmentation in challenging ore bodies. Non-metal mining applications, spanning coal, granite, marble, and limestone extraction, continue to benefit from high-energy formulations tailored for consistent performance in large open-pit settings, though coal’s long-term outlook faces headwinds from global decarbonization trends. citeturn4search0turn5search0

This comprehensive research report categorizes the Industrial Mining Explosives market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Delivery Method

- Application

Regional Perspectives Illustrating Diverse Market Trajectories Across Americas, Europe Middle East Africa, and Asia Pacific Explosives Sectors

The Americas region exhibits a mature market characterized by extensive domestic manufacturing ecosystems and rigorous regulatory frameworks for explosives production and use. In the United States, commercial explosives underpin critical industries such as mining, energy, and infrastructure development, supporting an economic footprint of over $19 billion annually and more than 60,000 direct jobs. Meanwhile, recent administrative actions aimed at revitalizing domestic manufacturing have spurred investments in local ammonium nitrate fuel oil and electronic detonator facilities to reduce import reliance and enhance supply chain security. North American operators increasingly deploy digital blast design platforms and remote charging systems, reflecting broader industry trends toward automation and data-driven decision-making. Furthermore, shifting energy policies and public scrutiny of coal mining have prompted a recalibration of explosives demand, with a gradual pivot toward non-fuel extraction segments. citeturn0search1turn5search4

In Europe, Middle East & Africa, regulatory and sustainability imperatives shape market evolution. Europe’s stringent environmental standards drive adoption of low-NOx, biodegradable explosive formulations and advanced waste-capture technologies at production sites. African markets, notably South Africa and Ghana, leverage exploding demand for battery and precious metals through strategic partnerships with global suppliers, while concurrently contending with challenges related to informal and illegal mining activities. Coordinated enforcement actions targeting illicit use of harmful chemicals and explosives underscore the need for robust governance frameworks and community engagement to mitigate environmental and social risks. The Middle East’s infrastructure boom, fueled by hydrocarbon revenue diversification, sustains demand for quarrying and tunneling explosives, although heavy reliance on imported bulk emulsion systems highlights the region’s vulnerability to global trade fluctuations. citeturn6news12turn6news11

Asia-Pacific leads global consumption, driven by expansive mining operations in China, India, and Australia that account for more than 45 percent of worldwide explosives usage. Rapid urbanization and infrastructure rollout in these economies underpin sustained demand for high-performance formulations, with coal and iron ore extraction contributing significant volumes. Automation and digital blasting solutions penetrate the region at a rapid pace, supported by government initiatives funding research into safer, eco-friendly explosives and mechanized charging systems. The Asia-Pacific market’s scale and diversity necessitate tailored distribution strategies, with localized production hubs emerging to address tariff-related uncertainties and logistical complexities inherent to cross-border shipments. citeturn7search0turn7search2

This comprehensive research report examines key regions that drive the evolution of the Industrial Mining Explosives market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examination of Leading Industry Players Showcasing Strategic Innovations, Sustainability Initiatives, and Operational Excellence in Explosives Manufacturing

Orica, the world’s largest explosives manufacturer, continues to cement its leadership through aggressive digital and sustainability agendas. By integrating advanced mechanized charging systems and AI-driven blast optimization tools such as BlastVision™ and WebGen™, the company has enhanced operational safety and productivity across North American and Australian operations. Orica’s decarbonization strategy features tertiary abatement installations that deliver up to 50 percent reductions in Scope 1 and Scope 2 emissions at key production sites. Strategic acquisitions-including Terra Insights and Cyanco-have expanded its specialty chemicals and digital solutions portfolios, underpinning a diversified earnings base and fueling a 15 percent increase in digital solutions EBIT year over year. As Orica celebrates 150 years of innovation, its pivot toward circular, low-carbon products positions the company to meet evolving regulatory demands and customer expectations for environmental stewardship. citeturn1news12turn1search1

Dyno Nobel is refining its value proposition through a focused transition to an explosives-only business model, underpinned by the separation of fertilizer assets and targeted divestitures totaling over $700 million. This strategic realignment enhances cash flow visibility and reduces exposure to cyclical agricultural markets, enabling the company to channel investments into next-generation drilling and blasting technologies. Dyno Nobel’s introduction of the DYNOBULK Electric Mobile Processing Unit exemplifies its commitment to sustainable innovation, delivering zero-emission bulk delivery solutions with fast-charging capabilities powered by renewable energy. Concurrently, the launch of the DigiShot Plus XR series underscores the brand’s emphasis on shock-resistant, high-accuracy electronic detonators designed for extreme environments, driving safety and performance gains across global mining operations. citeturn2search0turn2search1

Austin Powder, backed by a strategic investment from American Industrial Partners, is leveraging nearly two centuries of heritage to accelerate its growth trajectory. The company’s sustainability report highlights achievements such as lead-free primary detonators, advanced monitoring collaborations, and digital blast reporting tools that enhance predictive accuracy and overpressure control. Through its Paradigm® software suite and E*STAR electronic detonator platforms, Austin Powder drives consistent fragmentation and operational predictability in small-scale quarrying and large-bore mining contexts alike. The recent award of a multi-year contract at the Barrick Veladero Mine in Argentina underscores its capacity to deliver reliable supply, technical expertise, and localized service support in high-altitude environments, further solidifying its competitive foothold in Latin America. citeturn3search0turn3search5

Omnia Holdings’ explosives segment, led by BME Mining & Industries, has capitalized on surging battery metal exploration budgets across Africa. A special dividend declared amidst flat fertiliser earnings reflects the segment’s robust performance, driven by elevated lithium, cobalt, and copper exploration activity. Partnerships with technology firms have yielded first-to-market bio-emulsion formulations that reduce carbon content by over 90 percent, aligning with global sustainability mandates. With manufacturing presence spread across 17 African countries and expansion into Asia-Pacific through strategic alliances, Omnia’s explosives division exemplifies the regionally nuanced approach required to address diverse regulatory, logistical, and environmental landscapes. citeturn6news12

This comprehensive research report delivers an in-depth overview of the principal market players in the Industrial Mining Explosives market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AECI Limited

- AMA Group

- Austin Powder Company

- BME by Omnia Holdings Limited

- Enaex S.A.

- Explosia, a.s.

- Explotech

- Hanwha Corporation

- IDEAL Industrial Explosives Ltd.

- Incitec Pivot Limited

- Indian Oil Corporation Limited

- Johnson Hi-Tech PTY LTD

- Keltech Energies Limited

- Kemek Ltd.

- MaxamCorp Holding, S.L

- Nelson Brothers Inc.

- NITROERG S.A by KGHM Polska Miedź S.A.

- NOF CORPORATION

- Orica Limited

- PREMIER EXPLOSIVES LIMITED

- PT. Dahana

- Sasol Limited

- SBL Energy Limited

- Solar Industries India Ltd.

- Vetrivel Explosives Pvt Ltd.

Actionable Strategies to Guide Industry Leaders in Digital Transformation, Sustainable Supply Chains, and Regional Market Adaptation for Explosives Sector Success

To thrive amid escalating complexity, industry leaders must accelerate digital transformation efforts by adopting automated initiation systems and remote loading platforms. By leveraging predictive analytics and AI-enhanced blast design software, organizations can refine timing sequences, reduce misfires, and optimize fragment size distribution. Integrating drone-based monitoring and real-time sensor data into continuous improvement frameworks will further enhance safety and performance, transforming traditional blasting into a sophisticated, data-driven discipline. Early adopters of these digital solutions will secure tangible productivity gains and differentiate their service offerings in a competitive landscape. citeturn1search0turn2search1

Sustainability is no longer optional; companies must invest in eco-friendly formulations and decarbonization technologies to meet tightening regulatory requirements and stakeholder expectations. Initiatives such as low-carbon ammonium nitrate production, tertiary abatement for emission reduction, and non-nitrate bio-emulsion explosives can significantly lower environmental footprints. Collaborating with research institutions and technology partners to accelerate R&D of green blasting solutions will be critical for maintaining license to operate, securing premium project contracts, and future-proofing product portfolios against emerging ESG standards. citeturn1news14turn6search6

Mitigating tariff-induced supply chain risks requires a strategic emphasis on local manufacturing and diversified sourcing networks. Establishing regional production hubs for bulk emulsion and cartridge explosives can reduce exposure to import duties and logistical disruptions. Furthermore, forging long-term partnerships with key raw material suppliers and leveraging in-country fabrication capacities will enhance supply certainty and cost predictability. Proactively engaging with trade policymakers to seek tariff exemptions for critical explosives inputs, as advocated by industry associations, can preserve competitiveness and safeguard project timelines. citeturn0search0turn2search5

Transparent Overview of Methodological Approach Combining Primary Research, Secondary Data, Expert Consultations, and Rigorous Data Triangulation for Report Insights

This report’s insights are derived from a rigorous methodological framework that combines primary and secondary research protocols to ensure comprehensiveness and accuracy. Primary research involved in-depth interviews with senior executives, technical specialists, and procurement managers across leading explosives manufacturers, mining operators, and regulatory bodies. These firsthand discussions provided nuanced perspectives on strategic initiatives, product development roadmaps, and supply chain dynamics.

Secondary research encompassed a thorough review of authoritative sources, including publicly available financial disclosures, regulatory filings, industry association publications, government trade notices, and sector analyses from recognized institutions. Data triangulation techniques were employed to reconcile divergent data points and validate key findings, while statistical tools facilitated trend analysis across segmentation criteria and regional boundaries. The integration of qualitative insights with quantitative metrics ensures that the report delivers actionable intelligence calibrated to meet the strategic needs of decision-makers in the mining explosives domain.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Industrial Mining Explosives market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Industrial Mining Explosives Market, by Product Type

- Industrial Mining Explosives Market, by Delivery Method

- Industrial Mining Explosives Market, by Application

- Industrial Mining Explosives Market, by Region

- Industrial Mining Explosives Market, by Group

- Industrial Mining Explosives Market, by Country

- United States Industrial Mining Explosives Market

- China Industrial Mining Explosives Market

- Competitive Landscape

- List of Figures [Total: 15]

- List of Tables [Total: 954 ]

Concluding Reflections on Industry Shifts, Tariff Impacts, Segmentation Insights, and Regional Developments Shaping the Future of Mining Explosives Market

As the industrial mining explosives market transitions into a new phase marked by digital sophistication and environmental accountability, stakeholders must navigate an intricate tapestry of economic, regulatory, and technical forces. Catalysts such as high-precision detonators, electric bulk delivery systems, and green emulsion chemistries are converging to redefine operational benchmarks for safety, efficiency, and sustainability. Meanwhile, U.S. tariff developments underscore the imperative for resilient supply chains and localized manufacturing strategies to mitigate geopolitical and trade policy uncertainties.

By dissecting segmentation patterns and regional nuances, this summary illuminates the diverse pathways through which market participants can capture value and maintain competitive advantage. The collective insights derived herein offer a strategic compass for decision-makers, enabling a proactive posture toward emerging challenges and opportunities. Ultimately, the confluence of innovation, policy, and market demand will shape a future in which mining explosives not only facilitate access to critical resources but also embody the highest standards of environmental stewardship and operational excellence. citeturn4search0turn0search1

Invitation to Collaborate with Sales Leadership for Exclusive Access to Customized Mining Explosives Market Intelligence and Strategic Insights

For those ready to gain a competitive edge and unlock comprehensive insights into the industrial mining explosives landscape, reach out directly to Ketan Rohom, Associate Director of Sales & Marketing, to secure your personalized copy of this in-depth market research report. With expert guidance on how to translate data-driven analysis into strategic advantage, this report delivers the clarity and foresight decision-makers need to navigate complex market dynamics, anticipate emerging opportunities, and drive sustainable growth across the explosives value chain. Partner with Ketan Rohom to elevate your strategic planning and ensure your organization remains at the forefront of innovation, safety, and operational excellence in the evolving mining explosives sector.

- How big is the Industrial Mining Explosives Market?

- What is the Industrial Mining Explosives Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?