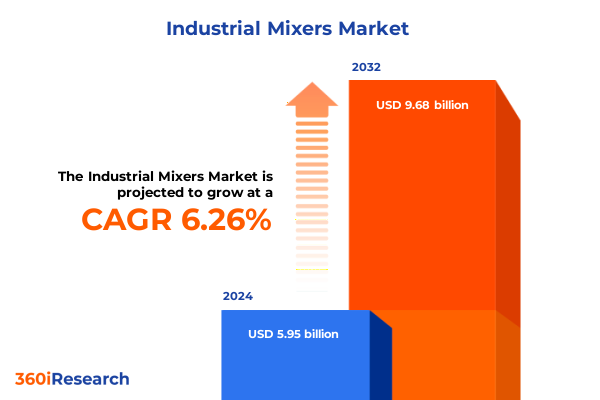

The Industrial Mixers Market size was estimated at USD 6.33 billion in 2025 and expected to reach USD 6.74 billion in 2026, at a CAGR of 6.55% to reach USD 9.88 billion by 2032.

Setting the Stage for Industrial Mixers: Defining the Critical Role of Mixing Technologies Across Chemical, Food, Pharmaceutical, and Wastewater Applications

Industrial mixers have evolved into indispensable assets across diverse industries, underpinning critical processes from emulsification in pharmaceuticals to high-viscosity blending in paints. These robust machines ensure uniform consistency, precise particle size reduction, and efficient heat transfer, addressing the rigorous demands of chemical, food and beverage, cosmetics, and wastewater treatment applications. Modern facilities rely on a spectrum of mixer designs-ranging from dynamic high-shear impellers to static packed-bed configurations-to achieve process optimization, quality compliance, and throughput acceleration. With digital monitoring capabilities now featured in nearly four out of five new installations, these systems deliver real-time insights into torque, temperature, and viscosity fluctuations, empowering operators to maintain stringent quality thresholds and minimize unplanned downtime.

As global manufacturing intensifies, the integration of mixing technologies into automated production lines has become paramount. Today’s industrial mixers are no longer isolated workhorses; they are central nodes within interconnected process ecosystems, enabling predictive maintenance and energy management. Their deployment spans volumetric scales from lab benches to industrial reactors exceeding 10,000 liters, illustrating their adaptability. Furthermore, the emphasis on hygienic design-particularly in food and beverage and pharmaceutical sectors-has driven over 70% of new mixers to meet NSF and 3-A sanitary standards, ensuring regulatory compliance and safeguarding consumer health.

Looking ahead, sustainability imperatives are reshaping mixer selection criteria. Manufacturers are favoring stainless-steel alloys with lower embodied carbon, variable-frequency drives for energy-efficient operation, and modular platforms to reduce material waste during scale-up. As end users pursue circular economy goals, industrial mixers will continue to evolve, driving productivity gains while aligning with broader environmental and safety mandates.

Navigating Transformative Shifts: How Automation, Digital Integration, and Sustainability Imperatives Are Redefining Mixer Design and Deployment

The industrial mixer landscape is undergoing tectonic shifts propelled by automation, digital integration, and sustainability mandates. Adoption of smart controls and Industry 4.0 connectivity has grown by nearly one-fifth in the past two years, allowing mixers to self-optimize speed and torque profiles according to real-time sensor data. This connectivity not only elevates process repeatability but also unlocks predictive maintenance, reducing unplanned stoppages by up to 30%, and enabling remote troubleshooting to compress service turnaround times.

Simultaneously, digital monitoring platforms now accompany 79% of new mixer deployments, reflecting the sector’s embrace of data-driven decision making. Manufacturers leverage these platforms to analyze vibration and thermal trends, ensuring regulatory compliance and enhancing operator safety. The rise of custom-configured solutions illustrates another transformative vector: the push for modularity and rapid reconfiguration to address fluctuating production needs. Customization orders for mixers have surged 21% since 2022, underscoring the market’s pivot toward tailored performance attributes and flexible batch-to-continuous processing modes.

Sustainability considerations have equally influenced design trajectories. Equipment makers are integrating energy-efficient motors, optimized impeller geometries, and advanced sealing materials to minimize friction losses, lower energy consumption, and extend service life. The drive for circularity has led to the use of recycled stainless-steel content and designs engineered for ease of disassembly and refurbishment. Together, these trends signal a new era for industrial mixing: one defined by intelligent operation, environmental stewardship, and agile manufacturing capabilities.

Analyzing the Cumulative Impact of 2025 United States Tariff Measures on Industrial Mixers and Their Supply Chains Across Steel, Aluminum, and Finished Equipment

In 2025, United States tariff initiatives have exerted profound influence on the industrial mixer value chain. A sweeping 10% reciprocal tariff on virtually all imports, effective April 5, has become the baseline duty, compounding pre-existing levies for steel and aluminum components on which many mixers depend. Adding complexity, an executive proclamation raised ad valorem tariffs on steel and aluminum to 50% as of June 4 for non-UK imports, tightening margins for imported vessels, impellers, and support structures.

These escalations are especially acute for mixers fabricated overseas, where the blended steel and aluminum content subjects imported assemblies to layered duties. Concurrently, imports originating from China now incur a 54% effective duty, stemming from the combination of Section 301 measures and universal tariffs. As a result, buyers are experiencing a marked uptick in landed costs and extended lead times due to customs inspections and updated classification requirements. The cumulative impact has triggered renegotiations of supply agreements, with some buyers seeking local manufacturing partnerships or onshoring key subassemblies to mitigate tariff exposure.

The ripple effects are evident in investment patterns: nearly 30% of German industrial enterprises have postponed or canceled U.S. investments, citing tariff uncertainty as the primary deterrent. This hesitancy extends to end users of industrial mixers, where capital project deferrals and phased upgrade schedules have emerged as risk management strategies amid stubborn trade tensions. To buffer volatility, many stakeholders are recalibrating procurement strategies, diversifying supplier bases, and exploring bonded warehousing solutions to reduce duty liabilities while maintaining uninterrupted production.

Key Segmentation Perspectives Revealing Unique Dynamics in End Use, Mixer Type, Capacity, Operation Modes, Applications, Speed Profiles, and Power Output Ranges

A nuanced view of industrial mixer segmentation reveals distinctive growth drivers and adoption patterns by end use, mixer type, capacity, operation mode, application, speed, and power output. Products tailored for chemical manufacturing, pharmaceuticals, and cosmetics command precise hygienic standards and material compositions to withstand corrosive or sterile processes. Conversely, food and beverage processors often prioritize clean-in-place functionality and smooth interior finishes to expedite sanitation cycles. Water and wastewater treatment plants leverage static mixers such as packed-bed, plate, and tube configurations for continuous dispersion of treatment chemicals in high-flow environments.

Dynamic mixers bifurcate into high-shear and low-shear variants, each optimized for different rheological requirements. High-shear agitators are indispensable for rapid emulsification and nanoparticle dispersion, while low-shear impellers excel at blending viscous materials with minimal heat buildup. Capacity distinctions between batch and continuous systems influence investment decisions: batch mixers offer flexibility for multi-product facilities, whereas continuous mixers afford higher throughput for standardized production lines.

Further differentiation arises through operation modes-automatic, semi-automatic, and manual-reflecting the degree of operator involvement and control system sophistication. Applications span dispersion, emulsification, homogenization, and basic mixing, each demanding tailored impeller designs and vessel geometries. Speed profiles divide between high-speed applications for fine particle size reduction and low-speed regimes for gentle bulk blending. Finally, power output ranges from sub-100 kW units, suitable for laboratory and pilot scales, up to mega-watt-class installations exceeding 500 kW for large-scale chemical reactors. Collectively, these segmentation lenses guide stakeholders in aligning mixer capabilities with specific process requirements and performance objectives.

This comprehensive research report categorizes the Industrial Mixers market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Capacity

- Operation Mode

- Speed

- Power Output

- End Use

- Application

Regional Dynamics Shaping Industrial Mixer Demand Across the Americas, Europe Middle East & Africa, and Asia Pacific Zones Fueled by Diverse Industrial Growth Drivers

Regional landscapes in the industrial mixer domain are shaped by varied manufacturing footprints, regulatory regimes, and sectoral priorities across the Americas, Europe Middle East & Africa, and Asia Pacific. In the Americas, North American facilities benefit from mature manufacturing ecosystems, with over 72,000 units installed in the United States alone, where 43% support food and beverage processes and 31% serve chemical and mineral operations. Advanced adoption of IoT-enabled mixers, compliance-driven design enhancements, and strong after-sales networks underpin sustained demand in the region.

In Europe, the emphasis on energy efficiency and sustainability continues to drive retrofits and new installations. Germany, France, and the UK collectively account for more than two-thirds of regional unit sales, with 57% of new mixers rated eco-friendly and 61% configured for compliance with stringent EU directives on waste and emissions. Middle East and Africa markets, though smaller in volume-representing approximately 11% of global installed units-are increasingly investing in corrosion-resistant and high-temperature mixers tailored for oil and gas processing and water treatment applications.

Asia Pacific stands out as the fastest-growing region, commanding 37% of global demand with over 155,000 installed mixers. This surge is driven by China and India, which together represent nearly three-quarters of regional installations. Automation integration has risen by 29% since 2022, while the chemical and environmental sectors seek bespoke mixing solutions to support battery manufacturing, specialty chemicals, and wastewater reuse initiatives.

This comprehensive research report examines key regions that drive the evolution of the Industrial Mixers market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Insight into Prominent Industrial Mixer Manufacturers Demonstrating Innovation in High-Shear Technology, Digital Services, and Strategic Partnerships

Leading equipment providers are asserting their positions through innovation in high-shear technology, digital services, and global support networks. SPX Flow distinguishes itself with a broad product portfolio serving chemicals, food processing, and pharmaceutical clients, leveraging remote monitoring platforms to offer uptime guarantees and service contracts that extend mixer lifecycles. EKATO continues to advance impeller and agitator designs through its focus on computational fluid dynamics, delivering tailored solutions for complex mixing challenges and filing nearly one-third of new industry patents since 2023.

Sulzer maintains a strong foothold in water treatment and energy applications, utilizing its corrosion-resistant alloy expertise to meet the rigorous demands of desalination plants and refineries. Alfa Laval, GEA Group, and Xylem enhance their competitive edge through strategic acquisitions and cross-sector partnerships, broadening their service offerings from basic mixers to fully integrated process skids. Meanwhile, niche specialists like Silverson Machines and TEIKOKU ELECTRIC focus on high-precision emulsification and pharmaceutical-grade mixing, carving out leadership in sterile and high-viscosity segments.

Emerging manufacturers from Asia and South America are leveraging cost competitiveness and agile customization to enter established markets. Zhejiang Great Wall Mixers and local OEMs in India are forging alliances with end users to deliver turnkey installations, challenging incumbents with shorter lead times and region-specific engineering expertise. Collectively, these competitive strategies underscore the intensity of innovation and the critical role of after-sales service and digital enablement in driving market leadership.

This comprehensive research report delivers an in-depth overview of the principal market players in the Industrial Mixers market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Admix Innovations Private Limited

- AGOSTINI LIMITED

- AOCNO BAKING MACHINERY CO.,LTD

- ARDE Barinco, Inc.

- Asphalt Drum Mixers Inc

- Foshan Golden Milky Way Intelligent Equipment Co., Ltd.

- Frain Industries, Inc.

- IMER International S.p.A,

- Macons Equipments Pvt. Ltd.

- Marion Process Solutions

- Merlo Spa.

- NILKANTH ENGINEERING LIMITED

- PerMix Tec Co., Ltd.

- SANY Heavy Industry India Pvt. Ltd.

- Simem S.p.A.

- Sulzer Brothers Ltd.

- Teka Maschinenbau GmbH

- Yenchen Machinery Co., Ltd.

- Zhengzhou Great Wall Machinery Manufacture Co., Ltd.

Strategic Recommendations for Industry Leaders to Reinforce Supply Chain Resilience, Digital Enablement, and Sustainable Innovation in Industrial Mixers

To thrive amid escalating tariff pressures, rapid technological evolution, and tightening regulatory landscapes, industry leaders should prioritize supply chain resilience by diversifying sourcing across low-tariff and bonded-warehouse regions. Establishing joint ventures with local fabricators can reduce exposure to import levies while accelerating delivery schedules. Next, intensifying investment in digital twins and predictive analytics will optimize mixer performance, enabling real-time adaptations to fluctuating process conditions and minimizing unplanned maintenance events.

Operational leaders must also align product development roadmaps with sustainability imperatives by integrating eco-design principles such as recyclable materials, energy-efficient drives, and modular assemblies conducive to refurbishment. Enhancing after-sales service portfolios-through remote diagnostics, spare-parts kitting, and performance-based maintenance contracts-will reinforce customer loyalty and unlock recurring revenue streams. Additionally, cultivating talent through targeted training programs that blend fluid dynamics, automation, and data science expertise will equip teams to harness emerging technologies effectively.

Finally, forging collaborations among OEMs, end users, and research institutions can accelerate innovation in advanced mixing processes-such as acoustic, ultrasonic, and magnetically driven systems-addressing next-generation challenges in biotech, battery materials, and sustainable chemical synthesis. By adopting these strategies, industry participants can convert market complexities into competitive advantages and secure long-term growth.

Methodological Framework Employing Rigorous Secondary and Primary Research Techniques to Ensure Comprehensive Analysis of Industrial Mixer Trends

This analysis was underpinned by a rigorous research methodology integrating both secondary and primary data collection. Secondary research encompassed the review of industry publications, regulatory announcements, and financial disclosures to establish a foundational understanding of market dynamics, competitive landscapes, and tariff structures. Sources included government proclamations, multilateral organization reports, and leading trade journals, ensuring a comprehensive view of the 2025 policy environment and technological trajectories.

Primary research consisted of in-depth interviews with senior executives, process engineers, and purchasing managers across key end-use sectors such as chemicals, food and beverage, pharmaceuticals, and water treatment. Quantitative surveys captured insights on capital expenditure trends, digital adoption rates, and supplier evaluation criteria. Observational studies conducted at production facilities provided context on equipment utilization, maintenance practices, and operator workflows.

Triangulation of these data streams enabled validation of high-impact themes-from tariff impacts to segmentation growth vectors-while predictive scenario modeling assessed the interplay of trade policy changes and technology adoption. The result is a balanced, fact-based assessment designed to inform strategic decisions without reliance on singular data sources, delivering a robust and actionable resource for stakeholders.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Industrial Mixers market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Industrial Mixers Market, by Type

- Industrial Mixers Market, by Capacity

- Industrial Mixers Market, by Operation Mode

- Industrial Mixers Market, by Speed

- Industrial Mixers Market, by Power Output

- Industrial Mixers Market, by End Use

- Industrial Mixers Market, by Application

- Industrial Mixers Market, by Region

- Industrial Mixers Market, by Group

- Industrial Mixers Market, by Country

- United States Industrial Mixers Market

- China Industrial Mixers Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 1590 ]

Synthesis of Key Findings Underscoring the Strategic Role of Smart Automation, Supply Chain Agility, and Eco-Design in Industrial Mixer Deployments

Industrial mixers have transcended their traditional role as mere process utilities, emerging as strategic enablers of operational excellence, regulatory compliance, and sustainable manufacturing. The confluence of smart automation, digital twin capabilities, and eco-design innovations is reshaping expectations for mixer performance and lifecycle management. Simultaneously, the evolving trade policy landscape-marked by universal tariffs and steel and aluminum duty hikes-underscores the importance of supply chain agility and localized production strategies.

Segmentation analyses highlight that no single mixer configuration fits all needs: from high-shear emulsifiers in pharmaceuticals to static packed-bed units in wastewater treatment, each application demands a tailored approach. Regional insights reveal divergent growth patterns, with Asia Pacific’s rapid volume expansion complementing the Americas’ technology-driven upgrades and Europe’s focus on energy efficiency and compliance. Competitive dynamics further demonstrate that leadership is defined by innovation in digital services, after-sales engagement, and collaborative ecosystem development.

Looking forward, organizations that align their capital allocation, R&D investments, and talent development with these multi-dimensional trends will be best positioned to capture new opportunities and navigate policy uncertainties. By integrating actionable intelligence from this report, stakeholders can optimize mixer deployments, enhance resilience, and drive sustainable growth in an increasingly complex and interconnected global landscape.

Unlock Strategic Growth and Innovation by Engaging with Ketan Rohom for Customized Insights on Industrial Mixers and Market Dynamics

Ready to gain a competitive edge and secure actionable insights tailored to your strategic priorities across industrial mixing technologies and market dynamics? Connect with Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch, to discuss how our detailed report can inform your decision-making. Whether you need deeper analysis on tariff impacts, segmentation drivers, or regional growth patterns, Ketan can guide you through the report’s customization options and special promotional packages. Don’t miss the opportunity to leverage this comprehensive resource to drive innovation, optimize operations, and enhance your market positioning. Contact Ketan Rohom today and transform your strategic planning with data-backed clarity and expert support.

- How big is the Industrial Mixers Market?

- What is the Industrial Mixers Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?