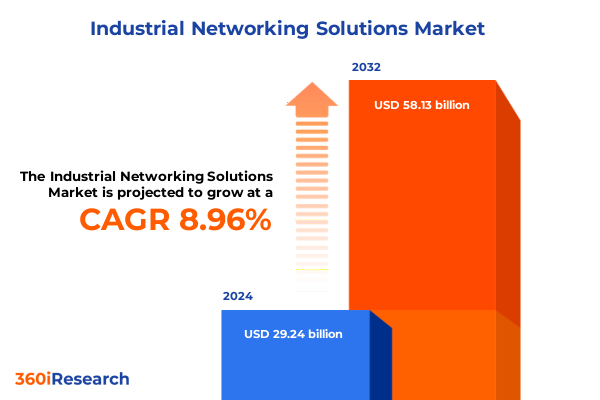

The Industrial Networking Solutions Market size was estimated at USD 33.76 billion in 2025 and expected to reach USD 38.54 billion in 2026, at a CAGR of 14.36% to reach USD 86.43 billion by 2032.

Navigating the Convergence of Digital Transformation, Connected Industrial Networks, and Cybersecurity to Foster Resilient and Intelligent Manufacturing Operations

The industrial landscape is undergoing a profound transformation driven by digital initiatives that converge operational technology with enterprise IT. Manufacturers and process industries are increasingly deploying interconnected sensors, programmable logic controllers, and edge computing platforms to unlock real-time visibility into production systems. This shift is not merely an efficiency play; it fosters new models of predictive maintenance, condition-based monitoring, and autonomous process adjustments that elevate asset uptime and throughput. Against this backdrop, network reliability and cybersecurity emerge as non-negotiable imperatives, as data integrity and system availability underpin both operational continuity and competitive differentiation.

Moreover, the proliferation of the Industrial Internet of Things has accelerated dramatically, with a significant majority of organizations having launched or advanced IIoT strategies to capture data-driven performance gains. Industry surveys indicate that over 70% of companies have deployed or are actively developing IIoT initiatives to optimize asset utilization, enhance energy efficiency, and reduce unplanned downtime. In parallel, the convergence of artificial intelligence and edge analytics is embedding intelligence directly within factories, enabling real-time anomaly detection and automated decision-making at the machine level. This AIoT convergence is projected to account for the lion’s share of new IIoT deployments by 2025, reflecting a shift toward “intelligence inside” architectures that balance connectivity and on-premise processing for maximal responsiveness.

Unveiling the Technological Disruptions and Operational Paradigm Shifts Reshaping Industrial Networking Ecosystems for Enhanced Connectivity and Efficiency

Industrial Ethernet technologies have solidified their position as the backbone of modern factory and process automation networks, capturing a growing share of new node installations. Recent analyses reveal that Ethernet-based connections now account for more than three-quarters of all industrial network deployments, with protocols such as PROFINET and EtherNet/IP leading the charge. Their open architectures and high throughput enable sub-millisecond communication and seamless integration with supervisory control and data acquisition systems. At the same time, legacy fieldbus protocols are ceding ground, representing an increasingly niche role in long-life-cycle applications where cost sensitivity and deterministic performance remain paramount.

Complementing wired networks, wireless communication technologies continue to expand their footprint in industrial settings, particularly in hard-to-reach or mobile applications. While traditional Wi-Fi and Bluetooth solutions facilitate flexible access point connections, emerging private wireless initiatives and low-power standards such as Zigbee are enabling dependable, secure data exchange for asset management and mobile robotics. Although industrial 5G adoption is still in its early stages, pilot deployments in select regions underscore its potential to deliver ultra-low latency and dedicated spectrum for mission-critical use cases. Collectively, these shifts underscore a hybrid networking paradigm that balances the predictability of wired infrastructures with the adaptability of wireless links.

Assessing the Ripple Effects of 2025 United States Trade Tariffs on Industrial Networking Supply Chain Dynamics and Cost Structures

The introduction of elevated trade tariffs in 2025 has introduced new cost pressures across industrial networking supply chains, directly affecting the pricing of critical automation components imported into the United States. Recent corporate disclosures indicate that while tariff-related expenses remain a modest portion of overall sales impact, they are poised to influence purchasing decisions and contract negotiations throughout the next fiscal quarters. Organizations that had initially anticipated tariff burdens near 3% have reported actual impacts closer to 1.5%, owing to proactive pricing adjustments and diversified sourcing strategies. Concurrently, the broader economic effects of higher duties have reverberated through raw material costs, shipping fees, and customs handling, underscoring the importance of agile procurement processes and vigilant cost management.

Faced with rising import levies, many industrial OEMs and system integrators are accelerating nearshoring and regional sourcing initiatives to mitigate exposure and shorten lead times. This realignment has driven increased engagement with suppliers in Mexico, Eastern Europe, and Southeast Asia, while also invigorating discussions on domestic manufacturing investments. Despite the unpredictability of future tariff schedules, these realignments contribute to enhanced supply chain resilience and reduce reliance on single-region dependencies, thereby safeguarding project timelines and supporting long-term operational continuity.

Illuminating Critical Market Segmentation Dimensions Fueling Specialized Tailored Strategies and Solution Deployment in Industrial Networking Applications

To pinpoint growth opportunities and optimize solution portfolios, it is essential to understand the multiple market segmentation dimensions in play. When evaluating product types, it becomes evident that Ethernet switches, gateways, industrial routers, media converters, network interface cards, and wireless access points each possess distinct deployment characteristics. Within the Ethernet switch category, both managed and unmanaged options present tailored functionality, addressing requirements from advanced traffic prioritization to simplified network extension. Recognizing these product nuances guides procurement strategies and supports targeted vendor selection.

Equally pivotal is segmenting by end-user industry, where energy and utilities, healthcare, manufacturing, oil and gas, and transportation each drive unique connectivity demands. For instance, utilities prioritize deterministic communication and cybersecurity, whereas healthcare facilities emphasize network redundancy and compliance with patient data privacy requirements. By appreciating these vertical-specific needs, solution architects can craft specialized offerings that align with regulatory standards and operational objectives.

Another critical lens is network technology, spanning fieldbus, industrial Ethernet, and wireless modalities. Within fieldbus installations, protocols such as CANbus, Modbus RTU, and Profibus uphold legacy systems, while industrial Ethernet variants like EtherNet/IP, Modbus TCP, and Profinet enable high-speed data exchange. On the wireless front, Bluetooth, Wi-Fi, and Zigbee address mobility and retrofit scenarios, expanding connectivity to non-traditional devices. Layering bandwidth considerations-from sub-gigabit to multi-hundred gigabit capacities-allows for the deployment of solutions calibrated to data throughput priorities, whether for real-time control or bulk data aggregation. Lastly, mounting types such as DIN rail, rack mount, and wall mount influence installation flexibility and space utilization, ensuring that network equipment integrates organically into diverse plant architectures.

This comprehensive research report categorizes the Industrial Networking Solutions market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Offering

- Network Technology

- Bandwidth

- Mounting Type

- Subscription Model

- Application

- Industry Vertical

- Organization Size

- Deployment Mode

Delineating Distinct Regional Dynamics Shaping Adoption Trajectories and Innovation Pathways Across the Americas, EMEA, and Asia-Pacific Networking Markets

Regional characteristics play a decisive role in shaping industrial networking adoption patterns across the globe. In the Americas, robust digital infrastructure investment and strong automation vendor ecosystems underpin high network penetration rates. Leading enterprises in the region have capitalized on private networking and edge computing to modernize brownfield sites, driving demand for both wired and wireless modules. This mix of greenfield expansion and legacy system upgrades fosters a market environment where reliability and long-term support partnerships are valued attributes by end users and systems integrators alike.

Across Europe, the Middle East, and Africa, a diverse regulatory landscape and established Industry 4.0 initiatives influence deployment priorities. Countries such as Germany, the United Kingdom, and the Nordics emphasize industrial cybersecurity standards and energy-efficient network designs, often integrating digital twin technologies within their manufacturing roadmaps. In contrast, smaller markets in Eastern Europe and the Middle East are embracing cost-effective entry-level networking platforms to accelerate production digitalization. Meanwhile, Asia-Pacific stands out as the fastest-growing region, propelled by aggressive smart factory programs in China and India, government-backed infrastructure projects, and a burgeoning start-up ecosystem focused on industrial wireless innovation. This region’s combination of scale and dynamism creates fertile ground for novel connectivity solutions, from 5G campus networks to advanced I/O devices tailored for high-volume manufacturing.

This comprehensive research report examines key regions that drive the evolution of the Industrial Networking Solutions market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators Driving Competitive Advantage Through Integrated Solutions and Collaborative Ecosystem Strategies in Industrial Networking

Cisco Systems continues to lead the industrial networking market, reporting stronger-than-expected orders for its Ethernet switches and routers amid surging demand for AI-driven infrastructure. Recent guidance revisions cite over a billion dollars in AI-related networking orders year-to-date, reflecting the increasing role of data centers and edge AI deployments in driving hardware refresh cycles. The company’s decision to expand its stock repurchase program further underscores its confidence in sustained demand for secure, high-capacity networks that support next-generation industrial applications.

Siemens AG has strategically bolstered its digital portfolio through the landmark acquisition of Altair Engineering, adding sophisticated simulation and analysis capabilities to its existing automation hardware offerings. This move enhances Siemens’s Xcelerator platform, enabling a seamless digital twin experience that spans design, production, and operational phases. By integrating these advanced software tools, Siemens is forging a connected ecosystem that empowers customers to simulate and optimize network topologies before physical deployment, shortening development cycles and reducing implementation risk.

TE Connectivity has demonstrated resilience in navigating tariff headwinds, achieving a noteworthy year-on-year growth in its industrial solutions segment. Despite minor tariff-related sales impacts, the company’s ability to adjust pricing strategies and secure localized supply agreements has limited cost exposures to under 2%. This proactive approach, along with investments in automated manufacturing lines, has reinforced TE Connectivity’s position as a reliable supplier of ruggedized connectors and network interface cards for critical industrial environments.

This comprehensive research report delivers an in-depth overview of the principal market players in the Industrial Networking Solutions market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Cisco Systems, Inc.

- Siemens AG

- Rockwell Automation, Inc.

- Schneider Electric SE

- ABB Ltd.

- Oki Electric Industry Co., Ltd.

- Belden Inc.

- Honeywell International Inc.

- GE Vernova

- Emerson Electric Co.

- Huawei Technologies Co., Ltd.

- Eaton Corporation plc

- Dell Inc.

- Nokia Corporation

- Intel Corporation

- Hewlett Packard Enterprise Development LP

- Mitsubishi Electric Corporation

- Advantech Co., Ltd.

- TP-Link Systems Inc.

- ALE International

- Antaira Technologies LLC

- Extreme Networks, Inc.

- Semtech Corporation

- Moxa Inc.

- D-Link Corporation

- HMS Industrial Networks

- Arista Networks, Inc.

- Celona Inc.

- CSG Networks Pvt. Ltd.

- Litmus Automation Inc.

- Patton LLC

- Yokogawa Electric Corporation

Strategic Imperatives and Tactical Recommendations to Bolster Operational Resilience Accelerate Innovation and Optimize Industrial Networking Infrastructure

Leaders in the industrial networking domain should prioritize a multi-layered security strategy that aligns with evolving regulatory requirements and threat landscapes. Embedding encryption at the device level, implementing network segmentation, and adopting continuous monitoring solutions will not only protect critical assets but also reinforce stakeholder confidence in digital initiatives. By coupling these measures with regular vulnerability assessments and security training for engineering teams, organizations can stay ahead of emerging cyber risks.

To fortify supply chain resilience, firms should diversify procurement sources across geographic regions and explore nearshoring opportunities that reduce lead times and tariff exposures. Establishing strategic partnerships with regional distributors and local manufacturing hubs can provide alternative avenues for sourcing key components, while also supporting agile response to market fluctuations. Additionally, embracing modular network architectures that allow for incremental scaling will enable faster adaptation to evolving production requirements.

Investing in workforce capability is equally critical; equipping technical teams with expertise in emerging protocols, edge computing platforms, and AI-enabled network management tools ensures that the organization can unlock the full potential of advanced connectivity solutions. By fostering cross-functional collaboration between IT and operations teams, companies can break down silos and accelerate the deployment of converged OT/IT systems that drive measurable productivity gains.

Articulating a Robust Mixed-Method Research Framework Integrating Primary Stakeholder Insights with Secondary Data Synthesis for Unbiased Analysis

This report’s insights derive from a rigorous mixed-methodology framework that integrates primary interviews with senior executives, network architects, and system integrators alongside extensive secondary research. Primary engagements included in-depth discussions with C-level and senior management professionals representing leading manufacturers, utilities, and transportation operators to capture firsthand perspectives on technology adoption drivers and deployment challenges.

Secondary data collection encompassed analysis of industry publications, regulatory filings, patent databases, and proprietary vendor documentation. By cross-referencing these sources, the research team validated market trends and identified inflection points across product segments, network technologies, and regional landscapes. Statistical triangulation techniques were employed to synthesize qualitative insights with quantitative indicators, ensuring the findings reflect a balanced and accurate portrayal of the competitive environment.

Throughout the research process, ongoing peer review and expert validation sessions were conducted to confirm the integrity of the analysis. This iterative approach, supported by methodological transparency and data traceability, reinforces the reliability of the conclusions and recommendations presented herein.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Industrial Networking Solutions market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Industrial Networking Solutions Market, by Offering

- Industrial Networking Solutions Market, by Network Technology

- Industrial Networking Solutions Market, by Bandwidth

- Industrial Networking Solutions Market, by Mounting Type

- Industrial Networking Solutions Market, by Subscription Model

- Industrial Networking Solutions Market, by Application

- Industrial Networking Solutions Market, by Industry Vertical

- Industrial Networking Solutions Market, by Organization Size

- Industrial Networking Solutions Market, by Deployment Mode

- Industrial Networking Solutions Market, by Region

- Industrial Networking Solutions Market, by Group

- Industrial Networking Solutions Market, by Country

- United States Industrial Networking Solutions Market

- China Industrial Networking Solutions Market

- Competitive Landscape

- List of Figures [Total: 21]

- List of Tables [Total: 2385 ]

Synthesizing Core Strategic Takeaways to Empower Decision-Makers and Future-Proof Investments in Industrial Networking Ecosystems

As industrial operations evolve toward greater autonomy and intelligence, the underpinning networks must adapt to deliver uncompromising performance and security. The convergence of industrial Ethernet, wireless technologies, and edge computing platforms underscores a shift toward hybrid architectures that balance speed, reliability, and flexibility. At the same time, the 2025 tariff environment highlights the ongoing need for agile supply chain strategies and diversified sourcing models.

Companies that embrace a holistic approach-aligning segmentation-based solution design, region-specific deployment tactics, and strategic partnerships-will be best positioned to navigate market complexities and capture growth opportunities. By investing in secure, scalable network infrastructures and fostering a culture of continuous innovation, organizations can unlock new revenue streams, enhance operational efficiencies, and mitigate risks associated with geopolitical and economic disruptions.

Ultimately, informed decision-making rooted in comprehensive market intelligence and actionable recommendations will serve as the catalyst for resilient digital transformation across industrial ecosystems. The insights compiled in this summary provide a strategic roadmap for leaders seeking to future-proof their investments and accelerate their journey toward fully connected manufacturing and process environments.

Seize Exclusive Market Intelligence and Actionable Insights with Associate Director Ketan Rohom to Access Tailored Industrial Networking Research Consultation

To gain a competitive edge in the rapidly evolving industrial networking landscape, engage directly with Associate Director Ketan Rohom for a personalized consultation that aligns with your organization’s unique operational priorities and strategic objectives. His expertise in synthesizing complex market intelligence allows for tailoring the insights and recommendations to your specific product segments, end-user applications, and regional ambitions. By collaborating with Ketan, you will benefit from an in-depth dialogue on the critical shifts shaping connectivity protocols, tariff implications, and vendor innovation trajectories, ensuring that your investment decisions are informed by the most current, actionable data.

Whether your focus lies in optimizing Ethernet switch deployments, diversifying your wireless infrastructure footprint, or navigating tariff-driven cost pressures, Ketan’s consultative approach will help distill the extensive research into clear, prioritized strategies. Initiate your tailored access to comprehensive market research and expert guidance today to accelerate time-to-value, fortify supply chain resilience, and harness emerging technologies across industrial networking domains.

- How big is the Industrial Networking Solutions Market?

- What is the Industrial Networking Solutions Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?