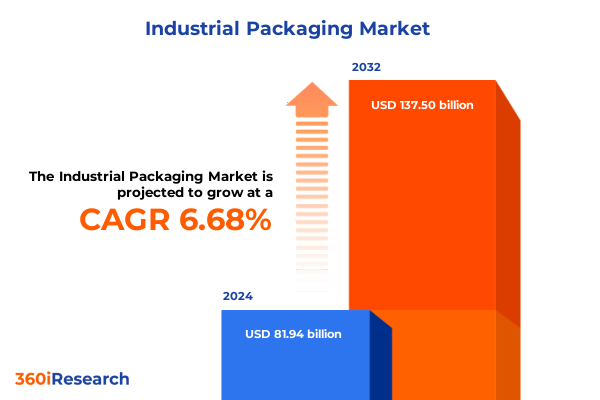

The Industrial Packaging Market size was estimated at USD 87.13 billion in 2025 and expected to reach USD 92.65 billion in 2026, at a CAGR of 6.73% to reach USD 137.50 billion by 2032.

Industrial Packaging Industry Landscape Explored through Emerging Drivers, Operational Challenges, and Sustainability Imperatives Shaping Market Trajectories

The industrial packaging industry plays a pivotal role in ensuring the safe and efficient transport of goods across diverse sectors. Accelerated by the exponential growth of e-commerce and global supply chain complexity, today’s industrial packaging landscape demands solutions that balance protection, cost efficiency, and environmental responsibility. As companies strive to meet tight delivery timelines and evolving consumer expectations, packaging innovations have become a critical differentiator in logistics performance and brand reputation. According to recent analysis, automation and smart packaging technologies can boost productivity by up to 30% while reducing operational costs by as much as 25% as Industry 4.0 principles reshape production lines and distribution processes.

Confronting this dynamic environment, manufacturers and brand owners are under mounting pressure to adopt sustainable practices in response to stringent environmental regulations and shifting consumer preferences toward circular economy models. Industry thought leaders emphasize that protopian approaches-continuous, incremental improvements-are vital for addressing packaging waste and advancing sustainable materials such as paper-based alternatives and bioplastics. Collaboration across stakeholders and platforms accelerates progress toward closed-loop systems and reinforces brand trust amid rising public scrutiny of single-use plastics.

Simultaneously, digital transformation is driving unprecedented innovation in packaging solutions. Internet of Things (IoT) sensors, RFID tags, and AI-powered analytics are enabling real-time visibility into product conditions, enhancing traceability, and reducing shrinkage in transit. Early adopters of these smart packaging systems report gains in quality control and customer engagement, as interactive labels and connected packaging deliver detailed product information at the point of use.

In this executive summary, we present a holistic overview of the industrial packaging market’s key drivers, transformative shifts, regulatory impacts, segmentation insights, regional dynamics, leading player strategies, and actionable recommendations. By synthesizing the latest industry developments and expert perspectives, this analysis equips decision-makers with the knowledge needed to navigate complexities, capture emerging opportunities, and sustain competitive advantage in 2025 and beyond.

Revolutionizing Industrial Packaging through Automation, Smart Technologies, and Sustainability Innovations Driving Operational Efficiency and Value Creation

The convergence of automation and robotics is dramatically reshaping industrial packaging operations, marking a pivotal shift from manual processes to highly automated production lines. Automated guided vehicles (AGVs), AI-driven robotic arms, and machine learning algorithms now coordinate to optimize packaging configurations and streamline material handling. Companies integrating these solutions have reported significant improvements in throughput and error reduction, underscoring the transformative potential of Industry 4.0 in meeting escalating demand pressures. Moreover, industry leaders emphasize the critical role of human expertise in leveraging automation, with initiatives focusing on upskilling workers to collaborate effectively alongside machines, thereby maximizing productivity without sacrificing workforce engagement.

Parallel to automation, the rise of smart packaging has unlocked new possibilities for traceability, security, and consumer engagement. Embedding sensors, RFID labels, and NFC chips into primary and secondary containers enables real-time monitoring of temperature, humidity, and location throughout the supply chain. This heightened visibility not only mitigates risks of spoilage and counterfeit products but also supports rapid, data-driven decision-making in the event of recalls or disruptions. Advanced traceability systems are now viewed as indispensable for compliance in regulated sectors such as pharmaceuticals and food & beverage, where product integrity is paramount.

On the material front, sustainability imperatives are driving innovation in both traditional and emerging substrates. Corrugated board manufacturers are enhancing recycled content and optimizing fiber strength, while bioplastics and plant-based resins are gaining traction as viable alternatives to conventional polymers. The industry is witnessing a surge in collaborative research efforts aimed at developing compostable packaging films and barrier coatings. These eco-innovations are extending beyond primary packaging to include protective cushioning and fill materials, reflecting a systemic shift toward cradle-to-cradle design principles that prioritize resource efficiency and end-of-life recyclability.

Assessing the Comprehensive Implications of 2025 United States Tariff Measures on Industrial Packaging Supply Chains, Costs, and Strategic Responses

The tariff landscape in 2025 has introduced profound cost implications and strategic challenges for industrial packaging stakeholders. In April 2025, the U.S. government imposed stacked duties on imported steel and aluminum under Section 232, raising tariffs on these raw materials to an effective rate of 45% for goods originating from China and 25% for other countries. Concurrently, Section 301 measures maintained a 145% duty on select Chinese imports, encompassing specialized packaging components and machinery. These combined measures have escalated landed costs for metal drums, cans, and closures, necessitating recalibration of supply chain strategies and pricing models.

Metal packaging producers have reported cost increases of up to 24% for aluminum cans following the tariff hikes, with downstream food & beverage manufacturers facing an estimated 9–15% surge in canned goods expenses. Such price volatilities are prompting a cautious shift toward alternative materials, including aseptic cartons, glass bottles, and flexible pouches, each presenting unique logistical and operational considerations. The search for cost parity has intensified supplier negotiations, with a renewed emphasis on long-term partnerships to secure material availability and mitigate pricing shocks.

Beyond material costs, tariffs have disrupted established sourcing networks and inventory frameworks. Retailers and packagers reliant on Chinese-made components have encountered lead-time extensions and stock‐out risks, driving exploration of nearshoring and regional supply options. Reports from major players illustrate that to preserve profit margins, manufacturers have streamlined product offerings-reducing packaging thickness and trimming non-essential design elements-while absorbing some cost pressures internally to safeguard market share during the holiday season. In sectors such as food service, where packaging performance is mission-critical, these adjustments have tested brand resilience and customer satisfaction metrics.

Amid these tensions, a landmark U.S.-China trade agreement signed on May 12, 2025, introduced a 90-day tariff reduction window, lowering reciprocal duties from 145% to 30% on targeted goods and from 125% to 10% on U.S. exports to China. Although offering temporary relief, this de-escalation underscores the volatile nature of trade policy and highlights the importance of agile procurement strategies that can adapt to swiftly changing duty structures and regulatory developments.

Uncovering Critical Segmentation Dimensions in Materials, Packaging Types, End-Use Industries, Applications, Technologies, and Distribution Channels

Critical segmentation in industrial packaging begins with material classifications, where glass offerings encompass borosilicate and soda-lime variants, each selected for their thermal, chemical, and cost performance. Metal packaging solutions are further differentiated into aluminum and steel options, reflective of weight, durability, and recyclability considerations. Paper & board substrates extend across carton board, corrugated board, and kraft paper, catering to applications demanding structural integrity or eco-friendly credentials. Meanwhile, the plastics domain features HDPE, PET, PP, and PVC, chosen for their barrier properties, clarity, and moldability. In parallel, packaging types divide into flexible formats, which optimize space and material usage, and rigid formats, which prioritize structural protection and stacked stability. These material and type distinctions form the backbone of product selection criteria and supply chain design.

End-use segmentation further refines market focus by aligning packaging specifications with industry imperatives. Agricultural applications rely heavily on bags and bulk containers engineered for moisture resistance and load management. Chemical producers deploy drums and intermediate bulk containers (IBCs) that meet stringent safety and compatibility standards. Consumer goods companies segment between home care and personal care lines, balancing presentation with functional protection. The food & beverage category subdivides into bakery, beverages, and dairy, each requiring customized barrier and handling characteristics. Pharmaceutical packaging extends to blister packs, bottles, and vials, all subject to rigorous regulatory controls and traceability mandates. Applications across these industries are categorized into primary, secondary, and tertiary stages, defining the contact level, grouping method, and transport configuration for optimized logistics flow and brand delivery.

Technological segmentation illuminates preferences in manufacturing methods, beginning with blow molding techniques such as extrusion blow and stretch blow for hollow containers. Extrusion processes address film and structural forms through blow film extrusion, film extrusion, and pipe extrusion. Injection molding pathways include micro, overmolding, and standard variants to yield complex geometries and multi-material assemblies. Thermoforming processes split into pressure thermoforming and vacuum thermoforming to produce rigid trays and custom shapes. Finally, distribution channels bifurcate into offline retail networks, leveraging direct sales and distributor relationships, and online retail platforms, which demand packaging optimized for direct-to-consumer shipment resilience. Together, these technological and channel dimensions define cost structures, production footprints, and go-to-market strategies within the industrial packaging domain.

By understanding and combining these segmentation axes, companies can tailor offerings to precise customer requirements, optimize production investments, and align innovation efforts with market needs. This comprehensive segmentation framework underpins targeted research, product development roadmaps, and strategic planning exercises across the industrial packaging ecosystem.

This comprehensive research report categorizes the Industrial Packaging market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Material

- Packaging Type

- Technology

- Application

- End-Use Industry

- Distribution Channel

Analyzing Regional Dynamics across the Americas, Europe Middle East & Africa, and Asia Pacific to Reveal Strategic Opportunities and Market Nuances

In the Americas region, North America leads with a mature infrastructure anchored by advanced manufacturing hubs in the United States and Canada. Demand in this region is propelled by sectors such as chemicals, pharmaceuticals, food & beverage, and automotive, where rigorous quality standards, automation adoption, and sustainability initiatives converge to shape market requirements. Regulatory frameworks around waste reduction and recycling drive both public and private investments in recyclable and reusable packaging solutions, reinforcing North America’s position as a bellwether for global packaging innovations. E-commerce penetration further amplifies this dynamic, as direct-to-consumer models necessitate robust, damage-resistant packaging systems.

Europe, Middle East & Africa features diverse market maturity levels, from Western Europe’s stringent circular economy regulations to emerging markets in the Middle East and Africa focused on basic infrastructure expansion. European countries emphasize eco-friendly materials and extended producer responsibility mandates, compelling manufacturers to innovate in recyclable board and compostable films. Meanwhile, logistical improvements and industrial investments in the Middle East and Africa are unlocking new growth corridors, with growing chemical, oil & gas, and construction activities driving demand for bulk containers, drums, and crate solutions. Cross-regional trade corridors are also emerging as packaging flows align with shifting global manufacturing footprints and nearshoring strategies �citeturn3search1.

Asia-Pacific stands out as the largest and fastest-growing region, driven by rapid industrialization, expanding manufacturing capacity, and surging domestic consumption in China, India, and Southeast Asia. The region’s status as a global manufacturing hub underpins robust demand for industrial packaging across electronics, chemicals, food processing, and automotive sectors. Investments in high-speed production lines and automated packaging systems are proliferating, supported by favorable government policies and expanding export markets. The broad spectrum of economic maturity within Asia-Pacific fosters a dynamic competitive environment, where cost-effective solutions compete alongside premium, high-performance offerings amid rising expectations for sustainability and digital integration.

This comprehensive research report examines key regions that drive the evolution of the Industrial Packaging market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industrial Packaging Players’ Strategic Initiatives in Mergers, Sustainable Innovations, and Digital Transformations Catalyzing Market Leadership

International Paper exemplifies a strategic transformation from traditional paper production toward bespoke corrugated packaging solutions, evidenced by its acquisition of DS Smith and investment in automated box plants in Pennsylvania and Iowa. Under the leadership of CEO Andy Silvernail, the company is refocusing on higher-margin custom packaging, enhancing regional service models, and deploying high-speed automation to meet bespoke demand, while managing the headwinds of economic uncertainty and trade tensions.

Ranpak has positioned itself at the forefront of sustainable automation, offering biodegradable paper packaging and robotics-driven systems that optimize void filling and protective cushioning. CEO Omar Asali emphasizes a human-centered automation philosophy, advocating for workforce upskilling to augment AI-powered packaging lines. Partnerships with major retailers such as Amazon and Ikea have facilitated rapid deployment of these solutions, contributing to a reported 10% revenue growth in 2024 and reinforcing Ranpak’s role in driving eco-innovation in high-volume distribution centers.

Mondi, a global leader in sustainable packaging and paper solutions, continues to leverage protopian collaboration models to address packaging waste through incremental material innovations. Its focus on recyclable barrier coatings and modular packaging platforms underscores industry efforts to meet circular economy goals. Collaboration with initiatives such as the Ellen MacArthur Foundation reflects Mondi’s commitment to supply chain transparency and continuous product improvement, driving both environmental impact reduction and brand value for its customers �citeturn0news15.

This comprehensive research report delivers an in-depth overview of the principal market players in the Industrial Packaging market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Amcor PLC

- Apple Converting Inc.

- Assemblies Unlimited, Inc.

- C-P Flexible Packaging, Inc.

- Constantia Flexibles International GmbH

- Cosmo Films

- Coveris Management GmbH

- ePac Holdings, LLC

- Filton Packaging

- FlexPak Services LLC

- FPS Flexible Packaging Solutions

- Huhtamäki Oyj

- Jarrett Industries

- Logos Pack

- Mondi PLC

- Multi-Plastics, Inc.

- Novolex Holdings, LLC

- Oliver-Tolas Healthcare Packaging B.V.

- PPC Flexible Packaging LLC

- ProAmpac Holdings Inc.

- Rengo Co., Ltd.

- Reynolds Consumer Products LLC by Alcoa Corporation

- Sealed Air Corporation

- Sonoco Products Company

- Transcontinental Inc.

- UKRPLASTIC

- Victory Packaging by WestRock Company

- Wipak Walsrode GmbH & Co. KG

- Yash Pakka Limited

Strategic Imperatives and Practical Recommendations for Industry Leaders to Navigate Tariff Challenges and Accelerate Innovation in Industrial Packaging

Industry leaders should accelerate the integration of automated and robotic systems across packaging operations to improve throughput, accuracy, and cost efficiency. Investing in advanced robotics and AI-driven machinery enables real-time decision-making for optimal packaging configurations, reducing waste and maximizing asset utilization. To realize these benefits, companies must develop structured change management programs to upskill existing workforces and foster cross-functional collaboration between engineering, IT, and operations teams.

To navigate ongoing tariff volatility, organizations must diversify their supplier networks and explore nearshoring or regional sourcing strategies. Establishing strategic partnerships with local material providers can buffer against sudden duty increases and logistics bottlenecks. At the same time, scenario planning and dynamic pricing models should be employed to assess the impact of potential policy changes on landed costs, enabling proactive adjustments to procurement and pricing strategies that protect margins without sacrificing competitiveness �citeturn1search2.

Embracing smart packaging solutions with embedded sensors and digital tracking capabilities can unlock new value streams in traceability, quality assurance, and consumer engagement. Companies should pilot IoT-enabled packaging in high-value or high-risk segments-such as pharmaceuticals and perishable goods-to quantify performance improvements and build a business case for broader rollout. Collaborating with technology providers and industry consortia accelerates innovation diffusion and ensures interoperable systems across supply chains �citeturn0search1.

Finally, prioritizing sustainable material innovations and circular economy principles will be essential for long-term resilience and brand differentiation. By investing in recyclable substrates, bioplastics, and closed-loop recycling programs, organizations can mitigate regulatory risks, reduce environmental impact, and meet growing customer expectations for eco-friendly packaging solutions �citeturn0news15.

Elucidating Rigorous Research Methodology Incorporating Primary Interviews, Secondary Data Sources, and Expert Validation to Ensure Analytical Accuracy

This research synthesized insights through a rigorous, multi-stage methodology combining both secondary and primary data sources. The secondary research phase incorporated extensive desk reviews of reputable industry publications, trade association reports, government tariff schedules, and corporate disclosures. Notable frameworks and segmentation approaches were referenced from established market intelligence firms, ensuring alignment with industry standards and comprehensive coverage of material, technology, and application dimensions.

In parallel, primary research was conducted via in-depth interviews with key stakeholders across the industrial packaging ecosystem, including manufacturers, brand owners, distributors, and technology providers. These conversations provided qualitative perspectives on operational challenges, strategic priorities, and emerging trends. Triangulation of quantitative data with expert insights enabled validation of thematic findings and enhanced the robustness of the analysis, ensuring that the report’s recommendations are grounded in real-world industry practices and leadership experiences.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Industrial Packaging market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Industrial Packaging Market, by Material

- Industrial Packaging Market, by Packaging Type

- Industrial Packaging Market, by Technology

- Industrial Packaging Market, by Application

- Industrial Packaging Market, by End-Use Industry

- Industrial Packaging Market, by Distribution Channel

- Industrial Packaging Market, by Region

- Industrial Packaging Market, by Group

- Industrial Packaging Market, by Country

- United States Industrial Packaging Market

- China Industrial Packaging Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 3180 ]

Synthesis of Industrial Packaging Market Insights Emphasizing Strategic Adaptation, Innovation Priorities, and Resilience in a Dynamic Global Environment

The industrial packaging sector stands at a critical juncture, balancing the dual imperatives of operational efficiency and sustainable innovation amid shifting trade policies. As automation and smart technologies reshape production and logistics, companies must adapt quickly to maintain competitiveness and meet evolving customer demands. Concurrently, tariff volatility underscores the need for agile procurement and diversified supply chain strategies that mitigate cost risks and ensure material availability.

Segmentation frameworks offer a granular lens through which to align product offerings with industry needs, guiding investments in materials, technologies, and market channels. Regional nuances-from North America’s maturity to Asia-Pacific’s growth dynamism-further highlight the importance of context-specific strategies. Leading companies are already demonstrating how targeted M&A, eco-innovation, and digital transformation can drive market leadership.

By integrating these insights and adopting the actionable recommendations outlined herein, industry stakeholders can navigate complexity, capitalize on emerging opportunities, and transition toward more resilient, sustainable packaging ecosystems. Continued collaboration across the value chain and ongoing investment in innovation will be pivotal to achieving long-term growth and environmental stewardship in 2025 and beyond.

Secure Your Comprehensive Industrial Packaging Market Report Now by Connecting with Ketan Rohom for Customized Insights and Purchasing Details

To access the comprehensive market research report covering these critical insights and more, reach out to Ketan Rohom, Associate Director of Sales & Marketing. He is ready to provide you with tailored details on how this report can support your strategic decision-making, supply chain optimization, and innovation initiatives.

Engage with Ketan Rohom today to secure your copy of the industrial packaging market report and gain a competitive advantage through data-driven intelligence that addresses tariffs, sustainability, segmentation, and regional dynamics.

- How big is the Industrial Packaging Market?

- What is the Industrial Packaging Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?