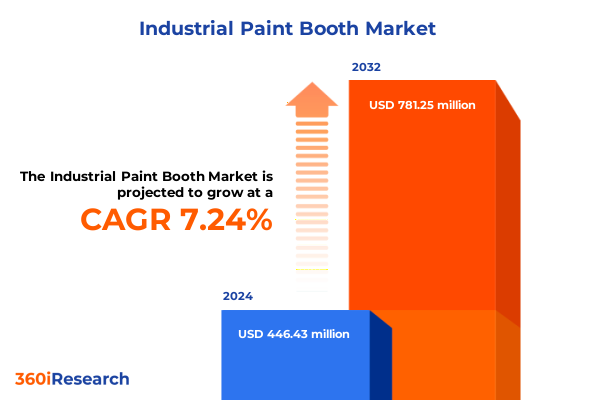

The Industrial Paint Booth Market size was estimated at USD 478.22 million in 2025 and expected to reach USD 516.18 million in 2026, at a CAGR of 7.26% to reach USD 781.25 million by 2032.

Setting the Stage for Industrial Paint Booth Evolution Amid Digitalization, Sustainability Mandates, and Dynamic Trade Pressures

The industrial paint booth has become an indispensable linchpin across multiple manufacturing sectors, serving as the critical interface where raw substrates transform into finished products that meet rigorous performance and aesthetic standards. With regulatory bodies intensifying enforcement of volatile organic compound (VOC) limits, companies must invest in sophisticated emission control technologies to remain compliant. The Environmental Protection Agency finalized amendments to National VOC Emission Standards for Aerosol Coatings in January 2025, mandating reformulations and updated test methods that directly shape paint booth design and operation protocols. At the same time, National Emission Standards for Hazardous Air Pollutants (NESHAP) for paint stripping and surface coating operations now require facility owners to implement advanced capture and filtration systems to reduce both VOC and hazardous air pollutant emissions by thousands of tons annually.

Simultaneously, U.S. manufacturers are exhibiting caution in capital expenditures, driven by policy uncertainty and rising input costs. June 2025 orders for core capital goods fell unexpectedly by 0.7%, reflecting a pullback in equipment investments amid ongoing trade tensions. The ISM manufacturing PMI slipped to 49.0 in March, marking the first contraction since late 2023, largely attributed to heightened anxiety over tariffs, rising material costs, and supply chain bottlenecks. For paint booth stakeholders, these macro signals underscore the importance of strategic capital allocation to ensure that new installations and upgrades deliver measurable returns on quality, throughput, and compliance.

Against this backdrop, the convergence of sustainability mandates and operational efficiency imperatives has accelerated adoption of water-wash filtration, low-VOC formulations, and powder-based systems. As industrial operations increasingly embrace ecological performance metrics, paint booths are evolving into high-tech, energy-efficient environments that integrate lighting, air flow, and heat control technologies. The industry’s shift toward waterborne coatings and fusion bonded epoxies also drives demand for specialized booth configurations capable of handling diverse chemistries without compromising throughput or finish consistency.

This executive summary sets the stage for a deep dive into the forces redefining the industrial paint booth landscape. Through examination of transformative shifts, tariff impacts, segmentation dynamics, regional variations, and leading innovators, decision-makers will gain actionable insights to navigate an environment marked by stringent regulations, sustainability commitments, and shifting trade policies.

Embracing Digital Innovation and Sustainable Practices as Paint Booths Transform into Intelligent, Eco-Friendly Production Hubs

The industrial paint booth sector is undergoing rapid digitalization as manufacturers embed IoT sensors, digital twins, and real-time analytics into core operations. Advanced control systems now monitor temperature, humidity, air velocity, and particulate levels with unprecedented precision, driving consistent coating quality and reducing the risk of rework. Simulation platforms enable virtual commissioning of paint booths, allowing engineers to model airflow patterns and energy consumption before physical installation. By leveraging these tools, industry leaders are streamlining commissioning cycles and minimizing unplanned downtime in alignment with broader Industry 4.0 objectives.

Concurrently, robotics and AI-driven automation are reshaping the booth environment. Robotic paint booths equipped with articulated arms deliver repeatable spray patterns, ultra-fine atomization, and comprehensive coverage that manual processes cannot match. These systems reduce operator exposure to hazardous compounds, enhance production speeds, and cater to high-mix, low-volume requirements common in aerospace and specialty manufacturing. Their adoption reflects an industry-wide shift toward error-proofing and scalable automation in precision finishing applications.

Sustainability has emerged as a second transformative axis. The EPA’s extension of compliance deadlines for VOC standards underscores the challenge of reformulating aerosol coatings without compromising performance. Yet many manufacturers are embracing water-wash filtration, hybrid energy modules, and variable-frequency drive fans to cut energy use and VOC emissions. These innovations not only facilitate regulatory adherence but also support corporate ESG goals, as companies seek to document carbon reductions and operational efficiencies.

Finally, modular booth designs are gaining traction as firms prioritize flexibility and rapid deployment. Prefabricated panels and plug-and-play HVAC components enable paint booths to be assembled in days rather than weeks, addressing expansion needs or line relocations with minimal disruption. This modularity extends to filtration and lighting packages, offering a balance of cost-effectiveness, customization, and compliance that appeals to manufacturers across automotive refinish, general industrial, and woodworking sectors.

Assessing How 2025 U.S. Tariff Escalations Are Reshaping Supply Chains, Pricing Dynamics, and Investment Strategies in the Industrial Paint Booth Sector

By mid-2025, U.S. import tariffs have soared to their highest levels since World War II, exerting deep pressure on domestic industries that rely on imported components and raw materials. Average U.S. import duties climbed from just above 2% at the start of the year to nearly 15% by July, a surge driven by broad levies on Canada, Mexico, China, and other key trading partners. Manufacturers such as General Motors warned of a $4–5 billion headwind to 2025 earnings, illustrating the scale of cost escalation reverberating through supply chains. In paint booth operations, higher prices for steel, aluminum, motors, and control electronics have translated into elevated equipment costs, longer lead times, and complex sourcing strategies.

Industry associations underscore the sector-specific ramifications. The American Coatings Association called out new tariffs on Canada, Mexico, and China for disrupting the flow of raw materials, forcing booth operators to absorb higher input costs or renegotiate long-term contracts. According to a PCI Magazine analysis, tariffs have already driven up production costs by more than 25% for some coating formulators, compelling manufacturers to optimize formulations, invest in automation, or shift production footprints to mitigate margin erosion. A recent survey by the Ifo Institute found that nearly 30% of German industrial firms have postponed planned U.S. investments-and 15% have canceled them-largely because of tariff uncertainty, signaling a broader hesitation to commit capital in the current trade landscape.

Together, these measures constitute a cumulative burden that reshapes investment strategies, vendor partnerships, and operational roadmaps. To remain resilient, paint booth stakeholders must factor tariff volatility into procurement models, diversify supplier networks, and explore nearshoring or onshoring opportunities within USMCA partners and beyond.

Unveiling Key Segmentation Insights That Reveal Market Dynamics Across Technology, Booth, Filtration, Operation, End Uses, Configuration and Paint System Dimensions

The industrial paint booth market is defined by multiple axes of segmentation that reveal its intrinsic complexity. When analyzed by technology, the sector includes air spray, airless spray, electrostatic, and high volume low pressure systems, each offering distinct trade-offs in atomization quality, transfer efficiency, and throughput. Booth type segmentation further differentiates solutions into crossdraft, downdraft, and semi-downdraft configurations, with airflow direction and contaminant capture effectiveness guiding equipment selection.

Filtration represents a critical layer of segmentation, spanning cartridge filters, dry filters, electrostatic precipitators, and water-wash systems. Dry filter options branch into bag and pad filters, while water-wash approaches leverage liquid media to capture particulates and solvents. Operation mode creates another dimension, encompassing automatic, manual, and semi-automatic booths. Within automatic systems, conveyorized and robotic spray variants facilitate continuous, high-speed production. Manual booths rely on airless guns or handheld spray apparatus, whereas semi-automatic lines blend manual assistance or robotic-assisted techniques to balance control and efficiency.

End use industry segmentation breaks down market applications into aerospace, automotive, general industrial, marine, and wood sectors. The aerospace sector subdivides into commercial and defense applications; automotive into OEM and refinish operations; general industrial into appliances and heavy machinery; marine into commercial shipbuilding and yacht coating; and wood into cabinet and furniture finishing. Configuration segmentation distinguishes portable units-floor-mounted or handheld-from stationary booths, which install as ceiling-mounted or wall-mounted systems. Finally, paint system segmentation addresses powder coating, solvent-based, and water-based applications. Powder coating splits into electrostatic powder and fluidized bed options; solvent-based into acrylic and alkyd variants; and water-based into acrylic and polyurethane formulations.

Taken together, these segmentation frameworks guide market analysis by clarifying the interplay between technical capabilities, operational requirements, and end-use specifications.

This comprehensive research report categorizes the Industrial Paint Booth market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Booth Type

- Filter Type

- Operation Mode

- Paint System

- End Use Industry

Regional Performance Patterns Exposing How Americas, EMEA and Asia-Pacific Markets Navigate Regulatory, Economic and Supply Chain Divergences

In the Americas, demand for industrial paint booths remains anchored in the automotive, aerospace, and general industrial sectors. Infrastructure stimulus measures and renewed emphasis on domestic manufacturing have bolstered spending on high-efficiency downdraft and electrostatic booths. However, lingering tariff uncertainties have complicated cross-border supply chains, prompting many North American operators to explore USMCA-sourced components and adjust capital budgets accordingly. This regional focus on localized procurement and nearshoring reflects a broader shift toward resilience in the face of global trade volatility.

Europe, the Middle East, and Africa (EMEA) are navigating a complex mosaic of economic headwinds, fragmented regulatory regimes, and energy constraints. Automotive OEM plants in Germany and the United Kingdom, along with aerospace finishing hubs in France and Poland, are investing selectively in modular and automated booth technologies to manage energy costs and comply with stricter VOC limits. EMEA’s growth trajectory remains cautious, as evidenced by nearly 30% of German companies postponing U.S. investments in response to tariff ripples, even as EU regulatory frameworks evolve to support low-emission operations.

Asia-Pacific leads in adoption rates for next-generation paint booth solutions, driven by robust expansion in China’s manufacturing belt, India’s aerospace ambitions, and Southeast Asia’s growing automotive assembly capacity. Regional manufacturers are rapidly integrating IoT monitoring and robotics into traditional spray booths, optimizing cycle times and minimizing material waste. Yet, redirected global trade flows-spurred by U.S. tariff policies-have generated logistical chokepoints, underscoring the need for diversified supply channels and deeper collaboration with local equipment providers.

This comprehensive research report examines key regions that drive the evolution of the Industrial Paint Booth market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Market-Leading Paint Booth Innovators Delivering Breakthrough Solutions in Automation, Sustainability and Operational Efficiency

Market-leading equipment suppliers are driving continuous innovation in industrial paint booths. Nordson Corporation has recently introduced the Encore HD and VT manual powder spray systems, featuring high-density, low-velocity pumps that deliver precise coating control and rapid color changes. In parallel, Nordson’s new manufacturing facility in South Carolina underscores its commitment to nearshoring critical powder and liquid spray equipment production.

Graco Inc. strengthened its market position through the strategic acquisition of Corob, integrating volumetric paint dosing and mixing technologies into its portfolio. The company’s launch of ergonomic Stellair ACE air-spray guns prioritizes operator comfort without sacrificing performance, reflecting a human-centric approach to equipment design. Under Graco’s umbrella, Gema continues to lead in electrostatic powder-coating innovations, leveraging a global demo network to scale advanced solutions across industrial and commercial segments.

Wagner Group and Dürr AG remain influential in advancing eco-friendly and automated booth configurations. Wagner’s introduction of Bluetooth-enabled spray control and energy-efficient LED lighting showcases its focus on sustainability and user interface enhancements. Dürr AG’s modular downdraft and semi-downdraft systems incorporate adaptable panel designs and integrated filtration, enabling rapid deployment with minimal on-site construction. Meanwhile, Eisenmann SE and Carlisle Companies Inc. continue to expand their offerings in automated conveyorized booths, emphasizing seamless integration with digital maintenance platforms and predictive analytics.

This comprehensive research report delivers an in-depth overview of the principal market players in the Industrial Paint Booth market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Ace Paints, Inc.

- Akzo Nobel N.V.

- Asian Paints Limited

- Axalta Coating Systems Ltd.

- BASF SE

- Benjamin Moore & Co.

- Berger Paints Ltd.

- Chugoku Marine Paints, Ltd.

- DAW SE

- Hempel A/S

- Jotun A/S

- Kansai Paint Co., Ltd.

- KCC Corporation

- Kelly-Moore Paints Co., Inc.

- Masco Corporation

- Nippon Paint Holdings Co., Ltd.

- PPG Industries, Inc.

- RPM International Inc.

- SK Kaken Co., Ltd.

- The Sherwin-Williams Company

Strategic Imperatives for Industry Leaders to Drive Innovation, Mitigate Tariff Risks and Capitalize on Emerging Paint Booth Technologies

To capitalize on digital transformation, industry leaders should invest in integrated sensor networks and digital twin platforms that enable real-time process monitoring and predictive maintenance. By simulating airflow dynamics and energy consumption in a virtual environment, companies can optimize booth performance before incurring on-site costs, reducing commissioning timelines and unplanned downtime.

Given tariff volatility, organizations must diversify supply chains by qualifying alternative suppliers in adjacent markets and nearshoring critical components where feasible. Proactive scenario planning-incorporating tariff rate fluctuations and policy shifts-will help maintain stable procurement costs and ensure uninterrupted equipment rollouts. Developing long-term contracts with USMCA partners can also offset the impact of punitive duties on raw materials and finished goods.

Sustainability imperatives require a concerted approach to emission control and energy efficiency. Upgrading to water-wash filtration systems, variable-frequency drive fans, and LED-based curing modules not only ensures compliance with EPA VOC standards but also aligns with corporate ESG targets. Leadership teams should engage with regulatory agencies early to influence upcoming rulemakings and secure grant funding or incentives for green equipment upgrades.

Transparent Research Methodology Outlining Rigorous Data Collection, Expert Validation and Analytical Techniques Underpinning the Market Intelligence

This report employs a comprehensive multi-stage research methodology blending both secondary and primary data sources. Secondary research involved exhaustive analysis of regulatory filings, industry publications, patent databases, and macroeconomic statistics to map the competitive environment and identify emerging trends. Publicly available resources-such as EPA rulemakings, Federal Register entries, and financial disclosures-provided contextual underpinnings for tariff impacts and compliance requirements.

In the primary research phase, in-depth interviews were conducted with a cross-section of market participants, including OEM equipment manufacturers, coatings formulators, facility managers, and regulatory experts. These interviews captured nuanced perspectives on technological adoption, operational challenges, and sourcing strategies. Data triangulation techniques reconciled insights from interviews with quantitative indicators-such as capital equipment orders and manufacturing PMI readings-to ensure analytical rigor.

Finally, the study applied a bottom-up approach to segment analysis, validating market categorizations through expert panel reviews. This iterative process ensured that the final segmentation framework accurately reflects the diversity of technology platforms, operational modes, and end-use requirements across the global industrial paint booth market.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Industrial Paint Booth market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Industrial Paint Booth Market, by Booth Type

- Industrial Paint Booth Market, by Filter Type

- Industrial Paint Booth Market, by Operation Mode

- Industrial Paint Booth Market, by Paint System

- Industrial Paint Booth Market, by End Use Industry

- Industrial Paint Booth Market, by Region

- Industrial Paint Booth Market, by Group

- Industrial Paint Booth Market, by Country

- United States Industrial Paint Booth Market

- China Industrial Paint Booth Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2862 ]

Concluding Perspective Emphasizing Adaptive Strategies, Collaborative Innovation and Sustainable Growth Imperatives for Paint Booth Stakeholders

The industrial paint booth landscape is at an inflection point defined by digital convergence, sustainability mandates, and evolving trade policies. As tariffs reshape supply chains and input costs rise, organizations must adapt through diversified sourcing, modular deployments, and strategic automation. Meanwhile, the drive for low-VOC and energy-efficient solutions is creating new opportunities for equipment providers and end-users alike.

By aligning capital investments with advanced analytics, human-machine collaboration, and rigorous regulatory foresight, industry leaders can unlock enhanced productivity, reduce compliance risks, and embed environmental stewardship within their operations. Ultimately, those who integrate innovation across their paint booth workflows will secure a sustained competitive advantage in a market characterized by stringent quality standards and dynamic external pressures.

Secure Your Customized Industrial Paint Booth Market Intelligence and Unlock Competitive Advantages with Ketan Rohom’s Expert Sales and Marketing Support

To gain immediate access to comprehensive market insights on industrial paint booths, reach out to Ketan Rohom, Associate Director of Sales & Marketing. Engage directly to discuss tailored report packages, customize data breakdowns, and unlock strategic advantages for your organization’s paint booth procurement, deployment, and optimization initiatives. Ketan’s expertise will ensure you secure actionable intelligence that aligns with your operational objectives and competitive challenges.

- How big is the Industrial Paint Booth Market?

- What is the Industrial Paint Booth Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?