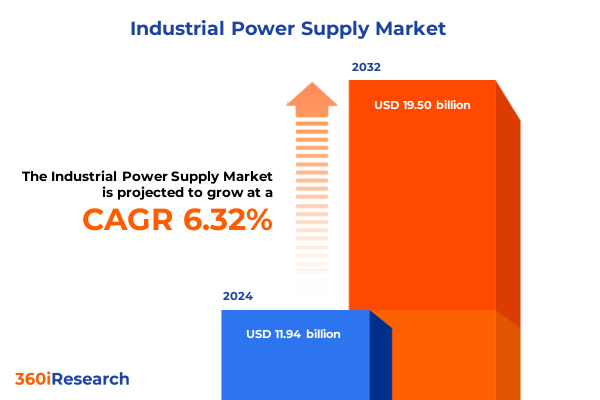

The Industrial Power Supply Market size was estimated at USD 12.61 billion in 2025 and expected to reach USD 13.32 billion in 2026, at a CAGR of 6.42% to reach USD 19.50 billion by 2032.

Powering the Future: Uncovering the Evolution and Core Drivers Shaping the Industrial Power Supply Landscape for Strategic Decision-Making

The industrial power supply sector stands at a pivotal junction, where technological advancements intersect with evolving operational demands to redefine how energy conversion and management solutions are conceived. As traditional manufacturing plants modernize with the integration of automation and robotics, the reliance on sophisticated power supply systems has never been more critical. Simultaneously, the transition toward renewable energy sources and the expansion of distributed power networks are reshaping the prerequisites for reliability, efficiency, and form factor in industrial applications.

This landscape is driven by the convergence of digitization, heightened focus on energy conservation, and the imperative to maintain uninterrupted operations in an era of increasingly complex supply chains. Industry stakeholders are compelled to evaluate not only core performance metrics such as voltage stability and power density but also emergent attributes like smart monitoring, predictive maintenance compatibility, and modular scalability. Understanding these multidimensional drivers is essential for decision-makers seeking to position their firms at the forefront of innovation and resilience.

Navigating Transformative Shifts: Mapping Technological Innovations and Sustainability Imperatives Driving Changes in Industrial Power Supply Systems

Recent years have witnessed profound shifts in the industrial power supply domain, propelled by breakthroughs in wide-bandgap semiconductor materials that enable higher efficiency and reduced thermal footprints compared to legacy silicon-based systems. These technological innovations have unlocked new design paradigms, allowing for more compact converter topologies and enhanced dynamic response characteristics, which are indispensable for high-speed automation and precision control environments.

Concurrent regulatory developments, including stricter efficiency mandates and more rigorous electromagnetic compatibility standards, are compelling manufacturers to optimize every aspect of their product design and manufacturing processes. The drive toward sustainability has further accelerated the adoption of eco-friendly materials and end-of-life recycling frameworks, as organizations strive to meet both corporate social responsibility targets and regulatory requirements. Consequently, the industrial power supply market is undergoing a transformative redefinition, where agility, compliance, and environmental stewardship converge to shape the next wave of product innovation.

Assessing the Cumulative Effects of United States Tariffs on Industrial Power Supply Components and Supply Chains Through 2025

Over the course of 2025, a series of tariff measures enacted by the United States government have exerted mounting pressure on the cost structures and supply chain configurations of industrial power supply manufacturers. Initially introduced under Section 301 of the Tariff Act, the U.S. Trade Representative implemented a doubling of duties on key electronic components-including thyristors, transistors, and integrated circuits classified under HTS headings 8541 and 8542-from 25% to 50% effective January 1, 2025, directly impacting the sourcing of semiconductors and discrete devices critical to converter and inverter architectures. Manufacturers reliant on Chinese-origin components have been compelled to reevaluate their procurement strategies or absorb incremental manufacturing costs, with downstream effects on pricing and lead times.

Complementing these measures, the administration’s proclamation dated June 3, 2025, elevated the Section 232 tariffs on imported steel and aluminum from 25% to 50%, directly influencing the raw material expenses of transformer cores, enclosures, heat sinks, and chassis assemblies utilized across power supply product lines. This abrupt escalation challenged production planning, heightened inventory carrying costs, and triggered renegotiation of supplier agreements. As a result, industry players have been exploring localized sourcing options and strategic stockpiling to mitigate volatility.

Taken together, the cumulative impact of these tariff actions has prompted a strategic realignment of supply chain footprints, fostering diversification away from single-country dependencies and accelerating investment in nearshoring initiatives. While these shifts have introduced short-term cost pressures, they have also catalyzed a broader reassessment of risk management frameworks, encouraging greater resilience in the face of trade policy uncertainty.

Illuminating Key Market Segmentation Insights Revealing How Product Types, Applications, Output Power Ranges, End Users, Sales Channels, Efficiency Levels, and Cooling Methods Drive Demand Dynamics

The industrial power supply market’s complexity emerges most clearly when dissecting the myriad dimensions through which products, applications, and user needs intersect. Converters, for instance, span the spectrum from AC-AC solutions-such as cycloconverters and matrix converters-to a diverse array of AC-DC options available in both enclosed and open frame formats. Beyond these, DC-DC converters offer isolated, non-isolated, or multi-output configurations, while inverters present choices between embedded modules and standalone units. Complementing these are uninterruptible power supplies that deliver fail-safe backup through line interactive, offline, or online topologies.

Application-driven segmentation further nuances the landscape: industrial automation systems integrate power modules in CNC machinery, process control frameworks, and robotic platforms; renewable energy setups demand robust interfaces for solar inverters and wind turbine systems; telecom infrastructure relies on high-reliability supplies for both data centers and network equipment. Meanwhile, field and laboratory instruments in test and measurement roles, as well as marine and railway engines in transportation networks, each impose specific performance, footprint, and environmental requirements.

Output power ranges delineate markets into categories up to 500 W, spanning subdivisions from sub-200 W to 200–500 W, through mid-tier 501–1000 W offerings, and extending into the above-1000 W realm, which itself bifurcates into 1001–3000 W and beyond 3000 W solutions. End-user dynamics reveal that energy and utility operators leverage modular systems for both distribution and power generation infrastructures, manufacturing sectors-from automotive to electronics and food & beverage-demand tailored reliability and efficiency, while oil & gas ventures in exploration and refining and transportation and logistics players in aviation and shipping each drive distinct specifications.

Distribution pathways also shape competitive positioning: direct sales channels foster close customer engagement, distribution partnerships with retailers and wholesalers enable broad market coverage, and online portals-through B2B marketplaces and manufacturer websites-offer streamlined access. Efficiency levels segment offerings into standard, high, and ultra-high tiers, underpinning design tradeoffs, and cooling methods determine system reliability, from passive convection cooling to forced air architectures with single or dual fans, or advanced liquid cooling solutions utilizing oil or water.

Taken together, these segmentation insights illuminate the multifaceted decision matrix that manufacturers, distributors, and end users must navigate to align technology capabilities with application demands and operational priorities.

This comprehensive research report categorizes the Industrial Power Supply market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Output Power Range

- Efficiency Level

- Cooling Method

- Application

- Sales Channel

Regional Market Dynamics Explored Through the Americas Europe Middle East & Africa and Asia-Pacific Trends Shaping Industrial Power Supplies Worldwide

Regional market dynamics illustrate the varied pace and nature of industrial power supply adoption across major territories. In the Americas, revitalized manufacturing investments and expanding automation deployments have underscored the importance of reliable, locally supported power systems. Supply chain resilience initiatives, especially in North America, are driving nearshore sourcing strategies and bolstering domestic production capacities for critical components.

Across Europe, the Middle East, and Africa, stringent energy efficiency regulations and ambitious carbon reduction targets are accelerating the transition toward greener power supply solutions. Governments and utilities are incentivizing the integration of advanced converters and inverters within renewable energy projects, while industrial enterprises prioritize modular and scalable systems that align with evolving sustainability mandates.

Asia-Pacific remains the fastest growing region, fueled by rapid industrialization, infrastructure expansion, and the proliferation of telecommunication networks. Emerging economies in South and Southeast Asia are posting robust demand for low- and mid-power supply products, whereas established manufacturing hubs in East Asia are advancing high-power and high-efficiency offerings, driving competitive innovation and technology diffusion throughout the region.

This comprehensive research report examines key regions that drive the evolution of the Industrial Power Supply market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Competitive Landscape Analysis Highlighting Strategic Positioning Innovations Partnerships and Technological Leadership of Leading Industrial Power Supply Providers

The competitive landscape is characterized by a blend of multinational conglomerates and specialized innovators competing across technology, service, and geographic dimensions. Established players have leveraged deep manufacturing expertise to introduce modular, field-programmable architectures that facilitate rapid customization, while newer entrants are differentiating through digital monitoring platforms and cloud-enabled predictive maintenance services.

Strategic partnerships and mergers have emerged as key tactics, enabling firms to augment their product portfolios and access new end markets. Collaborative ventures between semiconductor manufacturers and power systems integrators have accelerated the commercialization of wide-bandgap solutions, while alliances with software providers have infused next-generation analytics into power management ecosystems.

Furthermore, companies that prioritize vertically integrated supply chains and localized manufacturing footprints have gained agility in responding to tariff fluctuations and logistical challenges. Investments in smart factory frameworks and additive manufacturing techniques have reinforced competitive positioning, as the ability to deliver tailored, high-performance power solutions with reduced lead times becomes a critical differentiator.

This comprehensive research report delivers an in-depth overview of the principal market players in the Industrial Power Supply market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd.

- Acopian Technical Company

- Advanced Energy Industries, Inc

- Artesyn Embedded Power Inc.

- Bel Fuse Inc.

- Cosel Co., Ltd.

- CUI Inc.

- Delta Electronics, Inc.

- Eaton Corporation plc

- Friwo Gertebau GmbH

- GlobTek Inc.

- Lambda

- MEAN WELL Enterprises Co., Ltd.

- Murata Manufacturing Co., Ltd.

- Phoenix Contact GmbH & Co. KG

- PULS GmbH

- RECOM Power GmbH

- Schneider Electric SE

- Siemens AG

- SL Power Electronics Corp.

- TDK Corporation

- Traco Power AG

- Vicor Corporation

- XP Power Limited

Actionable Industry Recommendations for Leaders to Optimize Supply Chains Enhance Operational Resilience and Capitalize on Emerging Industrial Power Supply Opportunities

Industry leaders must adopt a multipronged approach to thrive amid evolving market dynamics. First, diversifying supply chains to incorporate both regional and global sources will mitigate the impact of policy-driven cost escalations and logistical disruptions. Establishing alternative manufacturing sites or strategic inventory buffers can provide a crucial hedge against tariff-induced volatility.

Second, prioritizing investment in digital capabilities-including embedded monitoring, data analytics, and remote diagnostics-will enhance product differentiation and foster closer customer relationships. By harnessing real-time performance insights, companies can transition from reactive service models to prescriptive maintenance frameworks, thus maximizing uptime and reducing lifecycle costs.

Third, embracing sustainability as a core design principle by integrating eco-friendly materials, enhancing conversion efficiency, and supporting end-of-life recycling initiatives will align offerings with regulatory requirements and corporate social responsibility objectives. Organizations that lead in green credentials are better positioned to secure strategic contracts with utility providers and forward-looking industrial partners.

Finally, forging collaborative ecosystems with semiconductor suppliers, software developers, and system integrators will accelerate innovation cycles and enable the rapid deployment of next-generation solutions. Such alliances can unlock synergies in technology development and market access, ensuring that leaders stay ahead of emerging application demands.

Comprehensive Research Methodology Detailing Data Collection Analytical Frameworks Validation Techniques and Quality Controls Underpinning Reliable Industrial Power Supply Market Insights

Our research methodology combined rigorous primary and secondary data collection to ensure comprehensive coverage and analytical integrity. Primary insights were gathered through structured interviews with senior executives, R&D heads, and procurement specialists across power supply manufacturers, distributors, and key end-user segments. These qualitative inputs provided firsthand perspectives on technology trajectories, procurement practices, and emerging application requirements.

Secondary research encompassed an exhaustive review of regulatory filings, technical whitepapers, patent databases, and industry association publications. This phase ensured that both quantitative variables-such as component pricing trends and material cost indices-and qualitative insights-such as strategic partnerships and M&A activities-were triangulated to form a holistic understanding.

Analytical frameworks, including Porter’s Five Forces and value chain mapping, were applied to assess market attractiveness and identify structural drivers. Validation processes involved cross-referencing estimates with publicly disclosed corporate performance metrics and third-party trade data, resulting in a robust, defensible set of insights. Quality controls were embedded at each stage to verify consistency, minimize bias, and uphold the highest standards of research reliability.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Industrial Power Supply market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Industrial Power Supply Market, by Product Type

- Industrial Power Supply Market, by Output Power Range

- Industrial Power Supply Market, by Efficiency Level

- Industrial Power Supply Market, by Cooling Method

- Industrial Power Supply Market, by Application

- Industrial Power Supply Market, by Sales Channel

- Industrial Power Supply Market, by Region

- Industrial Power Supply Market, by Group

- Industrial Power Supply Market, by Country

- United States Industrial Power Supply Market

- China Industrial Power Supply Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 3657 ]

Conclusive Perspectives on Industrial Power Supply Market Evolution Emphasizing Strategic Imperatives Operational Excellence and Future Outlook for Informed Decision-Making

In summary, the industrial power supply market is undergoing a period of rapid transformation driven by technological breakthroughs, regulatory shifts, and evolving end-user demands. Companies that proactively adapt their supply chain strategies, invest in digital and green innovations, and cultivate strategic partnerships will emerge as market frontrunners. The interplay between policy dynamics-such as tariffs-and sustainability imperatives underscores the need for resilient, agile operating models. Looking ahead, stakeholders who embrace data-driven decision-making and foster collaborative innovation ecosystems will be best equipped to harness the full potential of the next-generation power supply landscape.

Drive Informed Growth by Securing the Complete Industrial Power Supply Market Research Report Today with Ketan Rohom for Tailored Strategic Insights

To gain a deeper, more nuanced understanding of the industrial power supply market and secure a competitive edge, we invite you to obtain the complete research report directly from Ketan Rohom, Associate Director of Sales & Marketing. His extensive experience in delivering customizable insights ensures that you can access tailored analysis addressing your unique strategic priorities. Engage with Ketan to discuss bespoke data queries, priority segmentation focus, and in-depth regional breakdowns that will empower your decision-making. Don’t miss the opportunity to leverage this comprehensive intelligence to drive informed investments, optimize your product roadmap, and stay ahead of market disruptions. Reach out to Ketan Rohom today to initiate your purchase and transform your market approach with precision-engineered insights.

- How big is the Industrial Power Supply Market?

- What is the Industrial Power Supply Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?