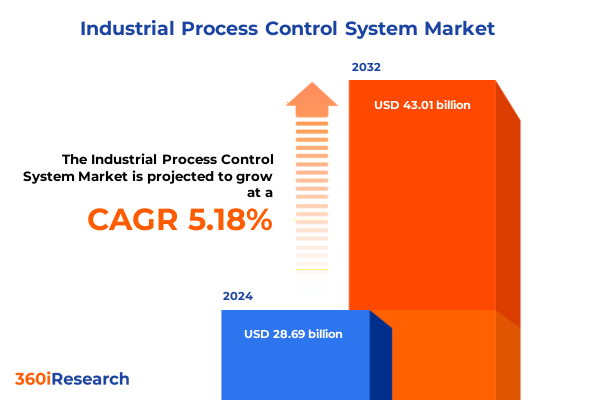

The Industrial Process Control System Market size was estimated at USD 30.00 billion in 2025 and expected to reach USD 31.74 billion in 2026, at a CAGR of 5.27% to reach USD 43.01 billion by 2032.

Industrial Process Control Systems Are Revolutionizing Manufacturing and Infrastructure Through Digital Transformation and Intelligent Automation

The landscape of industrial process control has entered a new era characterized by the convergence of digital technologies and traditional automation frameworks. As manufacturers and infrastructure operators strive for higher throughput enhanced quality and reduced operational risk they are increasingly turning to advanced process control systems that integrate real-time monitoring analytics and automated regulation of complex processes. This introduction lays the foundation for understanding how state-of-the-art control architectures combine hardware components field instruments and programmable logic controllers with sophisticated software platforms to deliver precise management of temperature pressure flow and chemical composition across diverse production environments.

In parallel the expansion of service offerings has transformed the way end users adopt and maintain these critical systems. Beyond consulting services that guide system selection and design organizations now benefit from installation and commissioning protocols that ensure seamless integration with existing operations along with ongoing maintenance and support frameworks that uphold system reliability and minimize downtime. The interplay between hardware devices distributed control system units instrumentation and programmable logic controllers and software layers encompassing DCS programming SCADA and analytics environments underscores the multifaceted nature of modern process control.

Against this backdrop this executive summary offers a cohesive narrative of the key drivers market forces and technological advancements shaping the future of industrial process control. By examining transformative shifts regulatory influences segmentation insights and regional dynamics this document equips decision makers with a clear understanding of the critical levers for success in an increasingly digitalized industrial ecosystem.

Emergence of Industry 4.0 IoT Connectivity Edge Computing and AI Is Redefining the Industrial Process Control Landscape With Unprecedented Efficiency

The past several years have seen a seismic shift in the way process control architectures are designed deployed and managed. At the forefront of this transformation is the proliferation of Industry 4.0 paradigms which leverage Internet of Things connectivity edge computing and artificial intelligence to create self-optimizing production environments. These emerging technologies are enabling continuous monitoring of system health advanced anomaly detection and predictive maintenance routines that preemptively address potential failures before they escalate into costly disruptions.

Moreover cloud integration has fostered a new era of collaborative analytics where cross-plant data aggregation and benchmarking unlock powerful insights into efficiency gaps and best practices. Coupled with the rapid advancement of cybersecurity protocols industrial operators are navigating a delicate balance between increased connectivity and robust defense against cyber threats. As organizations extend their control networks to the enterprise layer and remote operations they are implementing zero-trust frameworks and encryption standards that safeguard critical assets without hampering the flow of operational data.

Consequently these converging forces are redefining expectations for performance reliability and transparency. Control strategies that once relied on static setpoints and manual adjustments are giving way to dynamic model-based control loops and autonomous decision engines. As a result process control is evolving from a reactive discipline into a proactive intelligence-driven domain capable of continuously self-tuning to meet production targets while adhering to stringent quality safety and environmental mandates.

Cumulative Impact of 2025 United States Tariffs on Equipment Imports and Supply Chains Is Driving Shifts in Sourcing and Domestic Production Strategies

In 2025 United States trade policies introduced a new wave of tariffs targeting a wide array of imported industrial equipment and electronic components. The cumulative impact of these measures has rippled through global supply chains altering cost structures for distributed control system units field instruments and programmable logic controllers sourced from overseas manufacturers. As import duties increase landed costs for critical hardware segments rise correspondingly prompting many end users to reassess their sourcing strategies.

Simultaneously this tariff landscape has spurred a renewed emphasis on domestic production capabilities and supplier diversification. Many control system providers have accelerated initiatives to localize manufacturing operations or establish secondary assembly lines within North America. This strategic pivot not only mitigates exposure to import duties but also enhances supply chain resilience by reducing lead times and dependencies on single-source vendors. It is also catalyzing partnerships between equipment vendors and domestic electronics fabricators to co-develop compliant solutions that adhere to regulatory thresholds while maintaining performance requirements.

Consequently the tariff-driven environment reinforces the need for organizations to align procurement roadmaps with evolving trade regulations. Firms that proactively optimize their supplier base and integrate tariff modeling into capital planning are better positioned to offset incremental costs. Moreover this scenario underscores the value of system architectures designed for modular upgrades enabling phased deployments that adapt to shifting economic conditions without requiring wholesale system overhauls.

Holistic Understanding of Industrial Process Control Market Through Offering Component End User Application and Communication Segmentation

A nuanced understanding of the industrial process control market emerges when examining multiple segmentation lenses. From an offering perspective the ecosystem spans hardware components such as distributed control system units field instruments and programmable logic controllers alongside professional services encompassing consulting system installation commissioning and maintenance support as well as software platforms that include distributed control system applications programmable logic controller programming suites and supervisory control and data acquisition environments.

Delving into component categories reveals controllers that house the core decision engines for both distributed and programmable logic control functions, industrial networking protocols ranging from wired Ethernet and fieldbus variants to emerging wireless standards, measuring instruments that cover analytical instruments flow measurement devices and level detection technologies, and a spectrum of sensors and transmitters engineered to monitor flow rate, liquid levels, pressure variables and temperature gradients.

When assessing end users the breadth of applications spans chemical processing, food and beverage production, upstream and downstream oil and gas operations, pharmaceutical manufacturing, power generation facilities, and water and wastewater treatment plants each with its own regulatory mandates and operational priorities. Application end use further differentiates market requirements through functions such as dynamic flow control, accurate level regulation, particulate matter monitoring in gas streams, precision pressure modulation and tight temperature control. Finally communication infrastructure is stratified by fieldbus protocols including Foundation Fieldbus, Modbus RTU and Profibus, industrial Ethernet standards like Ethernet/IP, Modbus TCP and Profinet, as well as wireless schemes such as ISA100, Wi-Fi and WirelessHART.

This comprehensive research report categorizes the Industrial Process Control System market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Offering

- Communication

- End User

- Application

Distinct Regional Dynamics in the Americas Europe Middle East & Africa and Asia Pacific Are Shaping Adoption of Industrial Process Control Infrastructure

Regional dynamics play a pivotal role in shaping the trajectory of process control adoption and modernization efforts. In the Americas market participants benefit from established manufacturing hubs and a mature industrial base where regulatory compliance and digital transformation initiatives are driving upgrades to legacy control systems. Headline trends include the migration toward integrated information management platforms that unify operations across dispersed facilities and the emergence of service-based models that deliver lifecycle support and remote monitoring capabilities.

Conversely the Europe Middle East and Africa region is experiencing heightened focus on sustainability and energy efficiency. Control solution providers are tailoring offerings to meet stringent emissions targets and carbon footprint reduction goals, especially within chemical and power generation sectors. Meanwhile ongoing investments in localized assembly facilities and public-private collaborations are expanding the availability of advanced control technologies across emerging markets in North Africa and the Gulf Cooperation Council states.

In Asia Pacific rapid industrialization coupled with the rise of smart manufacturing initiatives has ignited demand for scalable, cost-effective control architectures. Government-led programs in China and Southeast Asian economies are incentivizing automation upgrades through grants and tax relief schemes, while Japan and South Korea continue to pioneer robotic integration and human machine interface advancements. Collectively these disparate regional landscapes underscore the importance of customizing technology roadmaps to local legislative frameworks, supply chain realities and workforce skill sets.

This comprehensive research report examines key regions that drive the evolution of the Industrial Process Control System market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Leading Technology Providers Including Siemens ABB Emerson Honeywell And Others Are Driving Innovation in Process Automation Solutions And Integrated Software Services

Major technology providers are actively shaping the future of process control through a blend of organic innovation and strategic partnerships. Leading European and North American firms have been investing heavily in next-generation control architectures that integrate real-time analytics modules, cybersecurity suites and cloud connectivity to support hybrid deployment models. These companies are also leveraging their global footprints to co-create solutions with regional partners and ensure compliance with local standards.

Meanwhile Japanese and Korean vendors are distinguishing themselves with high-performance hardware platforms and advanced human machine interface designs that facilitate intuitive operator engagement and reduce configuration complexity. Their proven track record in sectors such as automotive assembly and semiconductor fabrication is now being extended into energy and chemical processing applications.

In parallel independent software players and specialized automation integrators are carving out niches by offering modular application libraries, open architecture frameworks and expert domain services. By combining deep vertical expertise with agile development methodologies, these entities accelerate custom solution delivery and support iterative system enhancements. Collectively the interplay between established conglomerates and agile specialists is fostering a competitive landscape rich in collaboration opportunities and technological differentiation.

This comprehensive research report delivers an in-depth overview of the principal market players in the Industrial Process Control System market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd

- Advantech Co Ltd

- Azbil Corporation

- Beckhoff Automation GmbH & Co KG

- Delta Electronics Inc

- Emerson Electric .

- Endress+Hauser Group Services AG

- Fanuc Corporation

- Festo SE & Co KG

- Fuji Electric Co Ltd

- General Electric Co (GE Digital)

- Hitachi Ltd

- Honeywell International Inc

- Johnson Controls International plc

- Mitsubishi Electric Corporation

- Omron Corporation

- Phoenix Contact GmbH & Co KG

- Robert Bosch GmbH

- Rockwell Automation Inc

- Schneider Electric SE

- Siemens AG

- Valmet Oyj

- WAGO Kontakttechnik GmbH & Co KG

- Yaskawa Electric Corporation

- Yokogawa Electric Corporation

Actionable Strategic Recommendations for Industry Leaders to Enhance Efficiency Reliability and Security in Industrial Process Control Systems

Industry leaders seeking to maintain a competitive edge should prioritize the adoption of digital twin and AI-driven analytics frameworks to enable predictive maintenance, dynamic process optimization and virtual commissioning. By creating digital replicas of physical assets, organizations can simulate various operating scenarios identify inefficiencies and validate control strategies before implementing changes in live production environments; this approach reduces risk and shortens project timelines.

Moreover it is imperative to reinforce cybersecurity postures by embedding security-by-design principles throughout system lifecycles. This entails rigorous network segmentation, continuous vulnerability assessments and incident response planning, complemented by comprehensive employee training to cultivate a security-aware culture. At the same time deploying modular scalable architectures allows for phased expansion and technology refreshes, ensuring capital investments align with evolving operational requirements.

To fully leverage digital transformation, businesses should invest in workforce upskilling programs that blend domain knowledge with data science proficiencies. Collaboration with academic institutions and professional bodies can accelerate skills development while strategic alliances with cloud service providers and system integrators facilitate the integration of advanced services. Lastly, embedding sustainability metrics into process design not only addresses regulatory imperatives but also unlocks long-term cost efficiencies and supports corporate environmental goals.

Robust Research Methodology Leveraging Primary Expert Interviews And Comprehensive Secondary Data To Deliver Validated Market Insights

The research methodology underpinning this report synthesizes insights from both primary and secondary sources to ensure a holistic and validated perspective. Primary research included in-depth interviews with senior engineering executives, plant managers and control system architects across multiple industries and regions. These conversations provided firsthand insights into pain points, technology adoption drivers and strategic investment priorities.

Secondary research efforts involved canvassing technical white papers, peer-reviewed journal articles regulatory filings and proprietary case studies from industry associations. Publicly available standards documentation and product literature were also reviewed to map technological benchmarks and interoperability requirements. To bolster the credibility and accuracy of the findings, data triangulation techniques were employed whereby information gathered from disparate sources was cross-verified against interview feedback and industry events.

Quality assurance protocols included peer reviews by subject matter experts and iterative validation cycles with key stakeholders to refine interpretations and ensure alignment with current industry practices. Geographic representation was carefully balanced to capture mature markets in the Americas and Western Europe as well as emerging economies in Asia Pacific and the Middle East, thereby providing a comprehensive view of global process control developments.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Industrial Process Control System market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Industrial Process Control System Market, by Offering

- Industrial Process Control System Market, by Communication

- Industrial Process Control System Market, by End User

- Industrial Process Control System Market, by Application

- Industrial Process Control System Market, by Region

- Industrial Process Control System Market, by Group

- Industrial Process Control System Market, by Country

- United States Industrial Process Control System Market

- China Industrial Process Control System Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1272 ]

Conclusion Emphasizing Strategic Importance of Adopting Advanced Industrial Process Control Systems for Sustainable Competitive Advantage

In conclusion the industrial process control landscape is undergoing profound change driven by digital transformation, shifting trade policies and evolving regional dynamics. Organizations that embrace integrated automation strategies underpinned by advanced analytics, robust cybersecurity frameworks and modular architectures will unlock new levels of operational efficiency and resiliency. Tariff-induced supply chain realignments underscore the importance of flexible sourcing models and domestic production partnerships to mitigate cost pressures.

Furthermore segmentation analyses reveal that market requirements vary considerably across hardware, services and software domains as well as component categories, end user verticals and communication protocols. These insights emphasize the need for tailored solution roadmaps and vendor collaborations that address industry-specific challenges. By aligning technology investments with sustainability objectives and workforce development initiatives, stakeholders can drive both immediate performance gains and long-term competitive advantage.

Ultimately the synthesis of market trends, company trajectories and actionable recommendations in this report equips decision makers with the strategic clarity needed to navigate an increasingly complex and interconnected industrial ecosystem.

Ready to Gain Invaluable Insights and Drive Transformation Talk to Ketan Rohom to Secure Your Comprehensive Industrial Process Control Market Research Report

Are you prepared to elevate your strategic decision-making and capitalize on the rapid evolution of industrial process control systems? Engage directly with Ketan Rohom Associate Director Sales & Marketing at 360iResearch to secure your comprehensive market research report today and empower your organization with unparalleled insights into transformative trends opportunities and actionable strategies that will position you at the forefront of industry innovation

- How big is the Industrial Process Control System Market?

- What is the Industrial Process Control System Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?