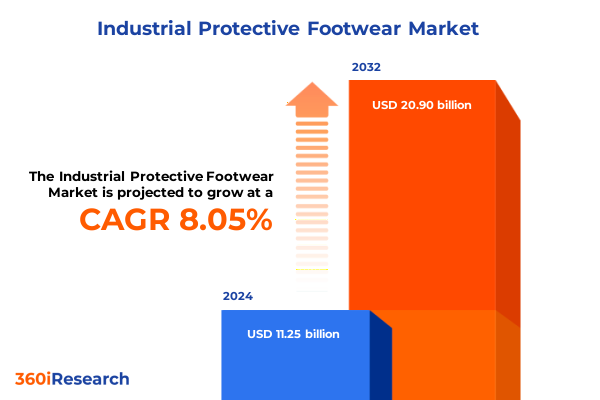

The Industrial Protective Footwear Market size was estimated at USD 12.10 billion in 2025 and expected to reach USD 13.01 billion in 2026, at a CAGR of 8.12% to reach USD 20.90 billion by 2032.

Pioneering the Industrial Protective Footwear Revolution: Understanding the Forces Shaping Safety and Compliance in Global Work Environments

Across modern industrial settings, protective footwear has evolved from a basic compliance requirement into a strategic component of workforce safety and operational resilience. The convergence of stricter global safety regulations with heightened awareness of workplace injuries has placed a premium on high-performance footwear solutions that protect workers without compromising comfort or productivity. Consequently, organizations are reevaluating traditional offerings in favor of footwear that integrates advanced materials, ergonomic design, and smart monitoring capabilities.

Moreover, the rapid expansion of sectors such as manufacturing, construction, and energy has driven diversified demand profiles, prompting suppliers to innovate across multiple fronts. Technological breakthroughs in composite toe protection, puncture-resistant soles, and electrical hazard mitigation have redefined product benchmarks. These developments, combined with sustainability imperatives and digital manufacturing methods, create a compelling backdrop for understanding the current state and future trajectory of the industrial protective footwear market.

Navigating Unprecedented Transformations in Industrial Safety Footwear: Technological Innovations, Sustainability Imperatives, and Worker Behavior Shifts Driving Change

The industrial protective footwear landscape is undergoing a profound transformation driven by technological innovation, sustainability priorities, and evolving worker expectations. Additive manufacturing techniques now allow for rapid prototyping of custom-fit boots, enabling manufacturers to address ergonomic concerns more precisely while reducing production lead times. In parallel, the adoption of smart materials-such as phase-change polymers and self-healing composites-marks a departure from conventional leather and rubber, offering enhanced thermal regulation and extended product lifecycles.

In addition, environmental considerations are reshaping product development priorities. Manufacturers are increasingly exploring recycled and bio-based materials to align with corporate sustainability targets and meet consumer demand for responsible sourcing. This shift has led to an industry-wide emphasis on circular economy principles, whereby end-of-life footwear is designed for disassembly and material recovery. As a result, supply chains are adapting to support closed-loop processes, reducing waste and lowering ecological footprints.

Meanwhile, the workforce is asserting new expectations around comfort, personalization, and digital connectivity. Wearable sensors embedded in boots can now monitor fatigue and impact loads, feeding data into centralized safety management systems to preempt injuries. These convergence points between digital transformation and product innovation underscore the critical importance of agility and cross-functional collaboration among designers, engineers, and safety professionals in shaping the next generation of protective footwear.

Evaluating the Multifaceted Effects of 2025 United States Tariff Adjustments on Industrial Protective Footwear Supply Chains and Cost Structures

The introduction of new United States tariffs in 2025 has had a ripple effect across the industrial protective footwear supply chain, prompting manufacturers and distributors to reassess sourcing strategies and pricing models. Incremental duty increases on key raw inputs-such as specialty polymers, steel for toe reinforcement, and treated leathers-have elevated production costs, leading some enterprises to explore alternative suppliers outside traditional tariff jurisdictions. Consequently, nearshoring and diversification initiatives have gained momentum as companies seek to mitigate exposure to import levies.

Furthermore, pass-through costs have exerted pressure on end users, compelling procurement teams in sectors like construction and oil & gas to renegotiate long-term contracts or optimize inventory management to smooth expenditure fluctuations. Simultaneously, supplier partnerships are evolving to incorporate more flexible terms and shared risk models, ensuring supply continuity even as regulatory conditions shift. Over the medium term, firms that proactively adjust supply networks and refine pricing frameworks will be better positioned to absorb future policy changes without compromising profitability.

In the competitive landscape, these tariff adjustments have also accelerated conversations around automation in manufacturing and local production capacity expansion. By investing in advanced machinery and workforce upskilling, organizations aim to offset external cost pressures with productivity gains, while reinforcing domestic resilience. This strategic pivot underscores the industry’s adaptability and highlights the importance of dynamic tariff impact assessments as part of ongoing risk management.

Unlocking Critical Market Segmentation Dynamics for Industrial Protective Footwear Across Product Types, End User Industries, Materials, Safety Features, and Distribution Channels

Understanding how industrial protective footwear meets diverse customer needs requires a nuanced look at product, end user, material, safety, and distribution dimensions. Product offerings span from specialized electrical hazard boots designed to prevent arc-flash injuries to insulated boots that maintain thermal comfort in extreme cold, rain boots engineered for wet environments, and standard safety boots categorized by cut, including high-cut and mid-cut variants that balance ankle support with mobility. Completing the lineup are safety shoes, differentiated into low-cut designs for lightweight tasks and slip-on models for convenience and rapid deployment.

End user industries play a pivotal role in shaping product priorities. Chemical plants demand resistance to corrosive agents and flame-retardant properties, whereas construction sites emphasize puncture-resistant soles and reinforced toe protection. In food & beverage facilities, hygiene and slip resistance take precedence, while manufacturing floors value durability under repetitive impact. Mining and oil & gas operations require robust designs that withstand abrasive terrains and potential electrical hazards. These varied applications drive specialized requirements, guiding manufacturers toward modular product architectures.

Material selection further influences performance and cost balance. Composite materials offer a lightweight alternative to steel toe inserts and reduce cold transfer, leather remains prized for durability and fit, and rubber compounds deliver excellent water resistance and chemical inertness. Safety features such as electrical hazard protection, flame resistance, and puncture resistance are integral, with toe protection options extending to composite and steel configurations based on risk profiles. Finally, distribution channels-from traditional offline routes encompassing dealer networks and specialty stores to online platforms hosted on manufacturer sites and third-party retailers-affect how products reach end users, with digital channels enabling direct engagement and expedited order fulfillment. Recognizing these segmentation layers is essential for tailoring strategies that resonate across core customer groups.

This comprehensive research report categorizes the Industrial Protective Footwear market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Material

- Safety Feature

- End User Industry

- Distribution Channel

Illuminating Regional Market Opportunities and Challenges in Industrial Protective Footwear Across the Americas, Europe, Middle East & Africa, and Asia-Pacific Regions

Regional market dynamics in industrial protective footwear reflect divergent economic drivers, regulatory frameworks, and infrastructure development levels. In the Americas, stringent occupational safety standards and a focus on domestic manufacturing investment underpin demand for high-performance protective footwear. U.S. regulatory bodies mandate regular compliance audits, fueling interest in certified products that deliver measurable risk reduction and meet stringent test criteria. This environment encourages continuous innovation and quality assurance across the supply chain.

Europe, Middle East & Africa present a tapestry of regulations and market conditions. The European Union’s CE marking requirements drive standardized safety benchmarks, while individual member states introduce localized directives that reflect regional labor practices and environmental policies. In the Middle East, rapid industrialization and energy sector growth create burgeoning demand for specialized footwear, often sourced from EMEA hubs or imported from established Asian manufacturers. African markets, though fragmented, are witnessing gradual upticks in safety awareness as multinational projects set new procurement standards for worker protection.

Asia-Pacific remains a dynamic growth engine characterized by emerging economies, large workforces, and ambitious infrastructure programs. Nations in Southeast Asia and South Asia are ramping up industrial zone development, generating significant footwear demand. Meanwhile, cost sensitivity and local manufacturing capabilities shape purchasing decisions, with regional suppliers leveraging lower production costs to serve both domestic and export markets. Collectively, these regional insights underscore the imperative for tailored market approaches that align product innovation, compliance strategies, and channel optimization with distinct geographic realities.

This comprehensive research report examines key regions that drive the evolution of the Industrial Protective Footwear market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Industry Titans in the Global Industrial Protective Footwear Market Shaping Tomorrow’s Safety Solutions

The competitive landscape in industrial protective footwear is defined by a handful of global leaders and agile regional specialists that compete on innovation, brand reputation, and distribution reach. Established multinational corporations have leveraged extensive R&D investments to pioneer advanced composites, smart integration, and sustainable materials, setting elevated performance benchmarks. These large players often maintain expansive global footprints, comprehensive after-sales support, and certified manufacturing facilities that ensure consistent quality across regions.

Conversely, nimble regional manufacturers have carved niches by focusing on local market nuances, such as lightweight designs suited for tropical climates or specialized soles tailored to particular industrial hazards. Through strategic partnerships with raw material suppliers and focused branding efforts, these companies can rapidly adapt product lines to meet emerging safety regulations or sector-specific requirements. The interplay between global product standards and local customization has intensified competitive pressures, prompting all players to refine their value propositions through enhanced service models and collaborative innovation networks.

This comprehensive research report delivers an in-depth overview of the principal market players in the Industrial Protective Footwear market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- Ansell Limited

- Bata Corporation

- Caterpillar Inc.

- COFRA S.r.l.

- DEWALT

- Dunlop Protective Footwear

- Elten GmbH

- Hewitt Shoe Company LLC

- Honeywell International Inc.

- Jallatte S.A.S.

- Liberty Safety

- Oliver Footwear Pty Ltd.

- Rahman Group

- Rock Fall Company Ltd.

- U-Power S.p.A.

- UVEX SAFETY GROUP GmbH & Co. KG

- Versar PPS

- Würth Group

Formulating Strategic, Actionable Recommendations for Industry Leaders to Navigate Competitive Pressures and Evolving Regulatory Landscapes Effectively

To thrive amid tightening regulations and dynamic supply chain landscapes, industry leaders should prioritize investments in advanced materials research and digital manufacturing technologies. By forging alliances with polymer scientists and additive manufacturing specialists, companies can accelerate the development of next-generation composites that offer superior strength-to-weight ratios while maintaining cost efficiency. Additionally, integrating real-time data capture within footwear platforms can transform products into proactive safety tools that anticipate worker needs and reduce incident rates.

Supply chain resilience is equally critical. Firms should diversify sourcing strategies by combining nearshoring options with established international partnerships, ensuring continuity when regulatory shifts or geopolitical tensions arise. Embedding flexible contractual terms with key suppliers-such as volume-adjustment clauses or shared cost escalation mechanisms-can safeguard operations against external shocks. Simultaneously, organizations must adopt digital procurement solutions that enhance visibility across multi-tier supplier networks, enabling rapid response to tariff changes or material shortages.

Furthermore, sustainability and circularity should be elevated from marketing narratives to core business imperatives. Companies can design for disassembly, collaborate with third-party recyclers, and implement take-back programs to reclaim end-of-life footwear materials. Combining these environmental efforts with transparent reporting and certification builds trust with end users and aligns with growing corporate social responsibility mandates. Taken together, this multi-pronged strategy will equip industry leaders to anticipate market shifts, satisfy evolving customer expectations, and maintain a competitive advantage.

Detailing a Robust, Transparent Research Methodology Combining Qualitative and Quantitative Techniques for Industrial Safety Footwear Market Analysis

This market analysis draws upon a comprehensive methodology that synthesizes both qualitative and quantitative research techniques. Primary data were collected through in-depth interviews with safety managers, procurement executives, and product development leaders across key industries, ensuring direct insights into evolving needs and pain points. Complementing these conversations, numerous field observations at manufacturing and distribution centers provided contextual understanding of production workflows and logistical constraints.

Secondary research involved meticulous review of industry reports, regulatory databases, and patent filings to map innovation trajectories and compliance requirements. Data triangulation was employed to validate findings, cross-referencing interview feedback with published standards and publicly available corporate disclosures. Additionally, workshops with materials scientists and ergonomic experts enriched the analysis of emerging technologies. This rigorous, layered approach ensures that conclusions reflect real-world practices and anticipate future trends with a high degree of confidence.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Industrial Protective Footwear market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Industrial Protective Footwear Market, by Product Type

- Industrial Protective Footwear Market, by Material

- Industrial Protective Footwear Market, by Safety Feature

- Industrial Protective Footwear Market, by End User Industry

- Industrial Protective Footwear Market, by Distribution Channel

- Industrial Protective Footwear Market, by Region

- Industrial Protective Footwear Market, by Group

- Industrial Protective Footwear Market, by Country

- United States Industrial Protective Footwear Market

- China Industrial Protective Footwear Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1749 ]

Summarizing Key Insights and Concluding Perspectives on the Evolution and Future Trajectory of the Industrial Protective Footwear Sector

The evolution of industrial protective footwear is marked by accelerated innovation, shifting trade policy dynamics, and a relentless focus on worker safety. As manufacturers adopt advanced materials, digital integration, and sustainable practices, the industry is transitioning from conventional closed-toe solutions to intelligent platforms that blend protection with performance. The cumulative impact of these developments will redefine safety standards and create new opportunities for differentiation.

Looking ahead, companies that successfully navigate tariff complexities, leverage deep segmentation insights, and tailor offerings to regional requirements will emerge as market leaders. Continuous investment in R&D, coupled with agile supply chain strategies, will be essential to meet the demands of diverse end users. Ultimately, the protective footwear sector stands at a transformative juncture where strategic foresight and collaborative innovation will shape its trajectory for years to come.

Engage with Ketan Rohom for Exclusive Access to Comprehensive Industrial Protective Footwear Market Research Reports Tailored to Your Strategic Needs

For decision-makers seeking to deepen their understanding of the industrial protective footwear landscape and secure a competitive edge, partnering with Ketan Rohom, Associate Director of Sales & Marketing, opens the door to a wealth of proprietary insights. By engaging directly, stakeholders will gain access to a tailored market research report that reflects the latest regulatory developments, supply chain dynamics, segmentation intricacies, and regional nuances specific to their strategic priorities.

This personalized collaboration ensures that each report is crafted to address unique corporate objectives, whether refining product portfolios, optimizing distribution strategies, or anticipating tariff impacts. To begin the process of acquiring a comprehensive analysis and explore customizable options, reach out to initiate a conversation with Ketan Rohom today

- How big is the Industrial Protective Footwear Market?

- What is the Industrial Protective Footwear Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?