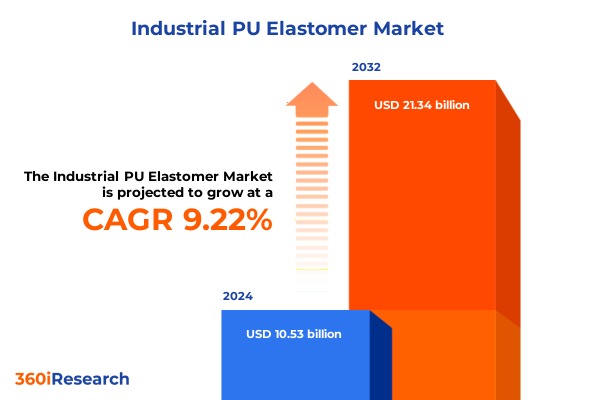

The Industrial PU Elastomer Market size was estimated at USD 11.34 billion in 2025 and expected to reach USD 12.21 billion in 2026, at a CAGR of 9.45% to reach USD 21.34 billion by 2032.

Exploring the Strategic Drivers and Innovation Pathways Shaping the Industrial Polyurethane Elastomer Industry in a Rapidly Evolving Economic Environment

The industrial polyurethane elastomer sector stands at a pivotal juncture, where advanced material performance must reconcile with evolving environmental and regulatory demands. Known for its exceptional combination of durability, abrasion resistance, and load-bearing capacity, this class of materials forms a critical backbone for applications spanning heavy machinery mounts to precision footwear components. Across manufacturing hubs, engineers and procurement specialists alike are recalibrating material selections to achieve optimal balance between operational longevity and life-cycle sustainability. As corporations look to differentiate through product performance, polyurethane elastomers continue to garner attention for their ability to deliver consistent mechanical properties under high-stress conditions.

Amid shifting global trade dynamics and heightened scrutiny of chemical sustainability, stakeholders are prioritizing transparency in raw material sourcing and production methods. Polyurethane elastomer producers are responding by exploring bio-based polyols, optimizing reaction injection molding processes, and leveraging digital simulation to accelerate R&D cycles. In parallel, cross-industry alliances are emerging to standardize sustainability benchmarks, ensuring that end products live up to brand and regulatory commitments. Through these collaborative endeavors, material suppliers are not only enhancing technical capabilities but also reinforcing end-user confidence in performance and compliance.

This executive summary lays out the core drivers reshaping the polyurethane elastomer market. We begin by mapping transformative technological and sustainability shifts, then examine the specific impact of recent U.S. tariff measures. Following this, we distill critical segmentation and regional observations, highlight competitive positioning among leading companies, and propose actionable recommendations. A concise overview of the research methodology grounds these insights before concluding with a strategic synthesis and an invitation to explore the full report.

Examining the Transformative Technological Advances and Sustainability Imperatives Reshaping the Polyurethane Elastomer Landscape Across Multiple End Markets

The trajectory of the polyurethane elastomer landscape is being fundamentally altered by a convergence of technological breakthroughs and sustainability mandates. Digital process controls and advanced simulation tools now enable manufacturers to fine-tune polymer formulations with unprecedented precision, reducing time-to-market while enhancing product reliability. This heightened level of process intelligence underpins the transition from generic grades to application-specific elastomers tailored for sectors such as automotive suspension components and high-load industrial wheels.

Concurrently, regulatory pressures around greenhouse gas emissions and chemical safety are compelling both raw material suppliers and processors to invest in next-generation feedstocks. Bio-based polyols derived from non-food biomass and recycled PET intermediates are gaining traction, reflecting a broader industry commitment to circular economy principles. As companies incorporate these sustainable inputs, they are revisiting legacy processing methods, including reaction injection molding, to ensure compatibility with new chemistries without compromising mechanical performance.

Looking ahead, the intersection of material science innovations and an unwavering focus on environmental stewardship is set to create a more resilient, transparent supply chain. Producers who successfully integrate digital manufacturing platforms with green chemistry breakthroughs will not only meet evolving customer expectations but also position themselves as strategic partners in an era where sustainability equates to market leadership.

Analyzing the Far-Reaching Effects of Newly Implemented U.S. Tariffs on Polyurethane Elastomer Feedstocks and Supply Chains in 2025

The introduction of new tariff measures by the United States in early 2025 has exerted significant pressure on the cost structure of polyurethane elastomer feedstocks and components. Tariffs targeting isocyanate intermediates and imported pre-blended polyols have compelled many processing plants to reevaluate sourcing strategies. In response, some producers have accelerated plans to localize key raw material manufacturing, seeking to mitigate customs duties and logistical delays. This reorientation, however, requires substantial capital investment and coordination with local chemical producers to ensure supply continuity and quality consistency.

Downstream manufacturers of vibration-isolating bushings, gaskets, and precision roller wheels have felt the ripple effects of increased material expenses, prompting design engineers to pursue material efficiency gains and alternative polymer blends. In certain applications, hybrids combining lower-cost co-polymers with elastomeric segments are being trialed to offset incremental duty-driven costs. Such innovations have underscored the critical role of formulation agility and strategic raw material partnerships in preserving both performance specifications and margin targets.

Despite these challenges, the tariff environment has also spurred constructive collaboration between domestic chemical firms and end-user OEMs. Joint ventures and long-term off-take agreements are emerging as mechanisms to stabilize pricing and secure dedicated production volumes. As the industry adapts, the cumulative impact of the 2025 U.S. tariffs will likely be measured not only in cost differentials but also in the pace of regional supply chain reinvention and the evolution of new formulation pathways.

Uncovering Critical Segmentation Insights Across End-Use Industries, Applications, Polymer Types, Physical Forms, and Advanced Processing Methods

Insights derived from a granular exploration of segmentation dimensions reveal distinct performance and adoption patterns across the industrial polyurethane elastomer ecosystem. When examining end-use industries such as automotive and transportation, footwear, industrial machinery, and oil and gas, it becomes evident that demand drivers differ substantially: automotive applications prioritize fatigue resistance and noise-dampening properties, whereas oil and gas installations emphasize chemical inertness and high-temperature stability. Footwear soles, in contrast, demand a careful balance of elasticity, abrasion resistance, and lightweight construction.

From the standpoint of application categories that include bushings and mounts, footwear soles, gaskets and seals, and wheels and rollers, formulation strategies must align closely with functional requirements. Bushings and mounts for heavy-duty equipment call for high tear strength and compression set resistance, while wheels and rollers used in material handling systems require optimized rebound resilience and load-bearing capacity. In gasket and seal applications, compatibility with diverse fluids and tight dimensional tolerances takes precedence.

Exploring polymer type distinctions among polycarbonate polyol, polyester polyol, and polyether polyol systems highlights varied trade-offs in hydrolytic stability, low-temperature flexibility, and compatibility with specialty diisocyanates. Meanwhile, the physical form-whether presented as a dispersion, liquid, or solid-affects handling, mixing ease, and processing efficiency. Lastly, the selection of processing techniques such as extrusion, injection molding, or reaction injection molding directly informs production throughput, part complexity, and capital equipment requirements. Together, these segmentation insights serve as a roadmap for material scientists and product designers aiming to tailor polyurethane elastomer solutions with precision.

This comprehensive research report categorizes the Industrial PU Elastomer market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Form

- Processing Method

- End Use Industry

- Application

Illuminating Regional Dynamics and Growth Drivers in the Americas, Europe Middle East and Africa, and Asia-Pacific Polyurethane Elastomer Markets

Regional dynamics continue to shape the polyurethane elastomer industry in distinct ways across global markets. In the Americas, a robust manufacturing base and growing infrastructure spending drive demand for high-performance mounts, gaskets, and rollers. North America’s regulatory focus on chemical transparency and recycling has also incentivized producers to integrate post-consumer recycled content into polyol streams, reinforcing circularity initiatives.

Within Europe, Middle East and Africa, sustainability compliance is often the predominant consideration, as stringent environmental regulations compel organizations to certify their material inputs and extend producer responsibility. Manufacturers across this combined region have been early adopters of bio-based monomers and closed-loop processing systems, aided by government incentives for low-carbon technologies. Conversely, certain energy-intensive sectors in the Middle East continue to leverage local petrochemical advantages to supply regional construction and transportation projects.

The Asia-Pacific region remains the largest capacity hub for polyurethane elastomers, fueled by rapid industrialization, expanding automotive assembly lines, and surging investment in logistics and e-commerce infrastructure. Southeast Asia and India are witnessing an uptick in domestic polyol production, helping to alleviate logistical bottlenecks. Collectively, these regional narratives underscore the importance of tailoring market engagement strategies to address local regulatory requirements, feedstock availability, and end-user priorities.

This comprehensive research report examines key regions that drive the evolution of the Industrial PU Elastomer market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Competitive Strategies, Innovation Portfolios, and Collaborative Initiatives of Leading Players in the Polyurethane Elastomer Industry

Leading companies in the polyurethane elastomer domain are differentiating through a combination of innovation, capacity expansion, and strategic partnerships. Major chemical conglomerates have established dedicated R&D centers to trial bio-based polyols and next-generation diisocyanate alternatives, often collaborating with academic institutions to accelerate material qualification cycles. Smaller specialty firms, on the other hand, have focused on niche application segments such as precision footwear soles or heavy-duty industrial rollers, carving out defensible positions by offering highly customized formulation services and rapid prototyping capabilities.

A pronounced trend among top-tier players involves the integration of digital platforms to support predictive maintenance and lifecycle management for elastomeric components. By embedding sensors or leveraging advanced material informatics, these providers can offer value-added services that span from component health monitoring to end-of-life recycling logistics. Furthermore, several companies have pursued joint ventures with regional distributors to ensure consistent technical support and reduce lead times for critical applications.

Competitive intensity is heightened by the arrival of new entrants from adjacent polymer sectors, challenging established firms to refine their value propositions. In response, incumbents are doubling down on sustainability credentials, publishing product carbon footprints, and aligning with third-party environmental certifications. As a result, customers now evaluate suppliers not only on technical merit but also on their ability to demonstrate transparent, verifiable progress toward circular economy goals.

This comprehensive research report delivers an in-depth overview of the principal market players in the Industrial PU Elastomer market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- BASF SE

- Covestro AG

- Eastman Chemical Company

- Huntsman Corporation

- INOAC CORPORATION

- LANXESS AG

- Lubrizol Corporation

- Mitsui Chemicals, Inc.

- The Dow Chemical Company

- Tosoh Corporation

- Wanhua Chemical Group Co., Ltd.

- Woodbridge Group

Delivering Actionable Strategies for Industry Leaders to Advance Operational Excellence and Sustainable Innovation in Polyurethane Elastomer Manufacturing

Industry leaders seeking to capitalize on the evolving polyurethane elastomer landscape should prioritize a set of targeted strategic actions. First, accelerating investment in bio-based and recycled polyol development will mitigate exposure to supply chain volatility while resonating with sustainability-focused end-users. Integrating these novel feedstocks demands cross-functional coordination between R&D, procurement, and manufacturing operations to ensure process compatibility without sacrificing performance.

Second, companies must strengthen digital capabilities across the value chain. Implementing advanced analytics and real-time monitoring systems can enhance quality control, reduce scrap rates, and support predictive maintenance offerings. By marrying material science expertise with data-driven insights, providers can unlock new service models that deepen customer engagement and foster long-term partnerships.

Third, diversifying geographic supply networks and forging strategic alliances with regional chemical producers will build resilience against future tariff shifts or logistic disruptions. Establishing joint-venture manufacturing hubs in key growth markets can shorten lead times and improve responsiveness to local standards. Finally, embedding lifecycle thinking into product design-such as designing for disassembly and participating in take-back schemes-will strengthen brand reputation and align with emerging regulatory directives. Collectively, these recommendations equip industry stakeholders to navigate complexity and secure sustained competitive advantage.

Detailing the Comprehensive Research Framework, Data Collection Techniques, and Analytical Approaches Underpinning the Polyurethane Elastomer Market Analysis

The analysis underpinning this executive summary is founded on a rigorous research framework that blends primary and secondary methodologies. In the initial phase, extensive desk research examined technical journals, trade publications, and public regulatory filings to surface prevailing material trends, tariff developments, and sustainability initiatives. This foundation was complemented by interviews with key stakeholders, including R&D leads, procurement executives, and OEM design engineers, to validate emerging themes and uncover application-specific requirements.

Data triangulation was achieved by cross-referencing trade flow statistics, patent filings, and corporate sustainability disclosures. Supply chain mapping exercises identified shifts in feedstock sourcing, while detailed process audits with select processors illuminated the practical implications of integrating advanced polyol chemistries. For quantitative robustness, cost-component analyses contrasted pre- and post-tariff scenarios, highlighting the levers most sensitive to duty-driven changes.

Throughout the research lifecycle, iterative validation sessions ensured alignment with ground-level industry experiences and prevented bias. Segment definitions and regional parameters were refined in collaboration with domain experts, ensuring that end-use, application, type, form, and processing method categorizations accurately reflect current market realities. This comprehensive approach yields a multifaceted perspective that balances depth of insight with broad industry relevance.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Industrial PU Elastomer market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Industrial PU Elastomer Market, by Type

- Industrial PU Elastomer Market, by Form

- Industrial PU Elastomer Market, by Processing Method

- Industrial PU Elastomer Market, by End Use Industry

- Industrial PU Elastomer Market, by Application

- Industrial PU Elastomer Market, by Region

- Industrial PU Elastomer Market, by Group

- Industrial PU Elastomer Market, by Country

- United States Industrial PU Elastomer Market

- China Industrial PU Elastomer Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 954 ]

Synthesizing Key Insights and Strategic Takeaways to Guide Decision-Makers in Navigating the Evolving Polyurethane Elastomer Industry Landscape

In consolidating the key findings, several overarching themes emerge. The industry is in the midst of a dual transition: one driven by digitalization and precision formulation capabilities, and the other by sustainability expectations that permeate every segment from raw material selection to end-of-life recovery. Tariff interventions in 2025 have accelerated localization efforts and innovative supply chain models, underscoring the importance of agility and strategic partnerships.

Furthermore, segmentation analysis highlights that optimal material solutions are increasingly bespoke, with distinct requirements for end-use industries such as automotive or oil and gas, for application categories ranging from gaskets to wheels, and across polymer types, physical forms, and processing techniques. Regional landscapes offer divergent opportunities: mature markets demand environmental assurances and performance validation, while high-growth regions prize cost efficiency and capacity availability.

As leading companies navigate this multifaceted environment, a balanced emphasis on sustainability, digital innovation, and operational flexibility will be vital. The cumulative insights presented here serve as a strategic playbook, guiding decision-makers toward investment priorities and partnership models that align with the next phase of industry evolution.

Engage with Ketan Rohom to Unlock Exclusive Polyurethane Elastomer Market Intelligence and Secure Strategic Insights Tailored to Your Business Needs

For in-depth strategic guidance and to obtain the complete market intelligence report covering all facets of the industrial polyurethane elastomer landscape, connect with Ketan Rohom, Associate Director of Sales & Marketing. Ketan will tailor the research insights to your specific business objectives and provide the necessary documentation to empower your decision-making. Seize this opportunity to leverage a wealth of analysis, from technological innovations and regulatory developments to supply chain dynamics and competitive assessments. Reach out to engage directly with expert support and secure the competitive advantage your organization needs to navigate the complexities of the polyurethane elastomer sector effectively.

- How big is the Industrial PU Elastomer Market?

- What is the Industrial PU Elastomer Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?