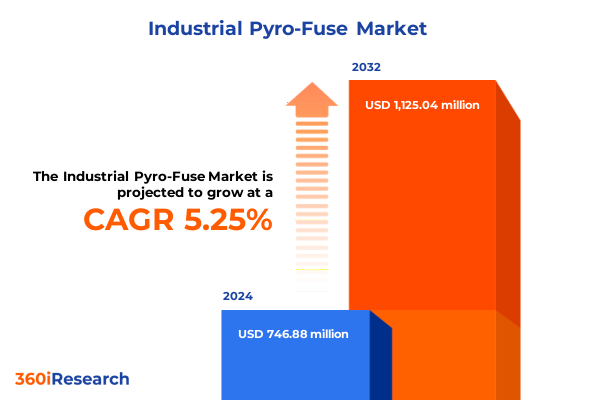

The Industrial Pyro-Fuse Market size was estimated at USD 784.22 million in 2025 and expected to reach USD 823.90 million in 2026, at a CAGR of 5.29% to reach USD 1,125.04 million by 2032.

Discover the critical dynamics and strategic imperatives shaping the Industrial Pyro-Fuse market and unlocking new opportunities across diverse sectors

Industrial Pyro-Fuse technology stands at the forefront of safeguarding electrical systems across mission-critical applications. As electrical networks evolve to support greater power demands, heightened safety requirements, and integration with renewable energy sources, the role of Pyro-Fuse solutions becomes increasingly indispensable. These components not only protect equipment from overcurrent, surge, and thermal events but also ensure operational continuity by mitigating risks that could lead to catastrophic failures. In an era defined by stringent safety regulations and a relentless push toward energy efficiency, Pyro-Fuse products deliver a compelling combination of responsiveness, reliability, and adaptability.

Against this backdrop, stakeholders across manufacturing, energy, transportation, and infrastructure sectors are placing unprecedented emphasis on precision-engineered fusing solutions. The mounting complexity of power distribution networks, coupled with the advent of smart grid technologies and digital monitoring platforms, underscores the necessity for fuses that can operate seamlessly within integrated systems. Consequently, manufacturers are intensifying efforts to refine materials, innovate designs, and enhance performance characteristics to meet the evolving demands of global industries. This introduction sets the stage for an in-depth analysis of the transformative forces reshaping the Pyro-Fuse market, offering executives a concise yet comprehensive foundation to inform strategic decision-making.

Explore the groundbreaking innovations and regulatory evolutions redefining performance standards and competitive advantages in Pyro-Fuse technology

The Industrial Pyro-Fuse landscape has experienced a wave of transformative shifts driven by breakthroughs in materials science, regulatory mandates, and digital integration. In recent years, the development of advanced composite materials and nanostructured alloys has significantly enhanced fuse responsiveness and thermal stability. These materials innovations have enabled manufacturers to design fuses capable of withstanding higher fault currents and rapid temperature fluctuations, thus addressing the stringent performance criteria required in high-voltage transmission, renewable energy installations, and automotive power systems.

Simultaneously, regulatory evolutions are exerting a profound influence on market dynamics. Governments and standards bodies in key markets have introduced more rigorous safety protocols, compelling industry participants to adopt fuses with improved interruption ratings and precision calibration. In the United States, revised electrical codes now mandate higher fault-current tolerances and more comprehensive testing regimes, prompting a shift toward certification-driven procurement. This regulatory emphasis has elevated the importance of traceability and quality assurance, reinforcing the competitive advantage of manufacturers that can demonstrate compliance through third-party validations and transparent supply chains.

In parallel with material and regulatory trends, the integration of digital monitoring and smart grid interfaces is redefining expectations for fuse performance. Real-time data acquisition platforms enable predictive maintenance models, where early detection of thermal anomalies or current spikes can avert equipment downtime. As a result, fuse suppliers are partnering with sensor and software providers to deliver intelligent fusing solutions that seamlessly integrate into Internet of Things (IoT) ecosystems. These collaborative ecosystems are fostering a new generation of Pyro-Fuse offerings that combine physical safety mechanisms with advanced analytics, thereby expanding the market potential across energy, manufacturing, and transportation industries.

Uncover the deep-rooted consequences of United States 2025 tariff implementations on supply chains cost structures and strategic sourcing for Pyro-Fuse products

The cumulative impact of United States tariffs implemented in 2025 has reverberated across the Pyro-Fuse supply chain, fundamentally altering cost structures and sourcing strategies. Historically reliant on a balanced mix of domestic production and targeted imports, the industry confronted steep duty increases on select fuse materials and manufacturing equipment. These elevated tariffs have eroded traditional cost advantages of offshore suppliers, driving manufacturers to reassess the viability of complex international procurement networks.

In response, many leading component producers have accelerated investments in reshoring initiatives, expanding in-country assembly and manufacturing capabilities. While these moves have bolstered supply chain resilience and mitigated tariff exposure, they have also triggered a recalibration of capital expenditure allocations and pricing models. Cost pressures associated with domestic labor rates and infrastructure development have been partially offset by improved logistics efficiency and reduced lead times. Moreover, strategic partnerships with local materials suppliers have emerged as a key tactic to secure reliable feedstock streams, thereby insulating production lines from future tariff volatility.

Beyond reshoring efforts, the tariff landscape has spurred innovation in alternative fuse designs that minimize reliance on high-duty components. Research and development teams have prioritized the substitution of certain metal alloys with less tariff-sensitive formulations, while maintaining or enhancing performance benchmarks. Concurrently, procurement units are engaging in more dynamic hedging practices, using advanced analytics to anticipate tariff adjustments and optimize inventory holdings. Collectively, these measures underscore the industry’s adaptability and its commitment to sustaining competitive pricing without compromising safety and reliability.

Gain comprehensive understanding of segmentation parameters shaping end-user applications product portfolios and distribution strategies in the Pyro-Fuse market

Segmentation analysis unveils how diverse end-user industries shape distinct demand profiles for Pyro-Fuse products. In automotive applications, the distinction between original equipment manufacturers and aftermarket suppliers drives diversification of fuse ratings, with Oem partnerships emphasizing integration into emerging electric vehicle platforms, while aftermarket channels focus on retrofit safety enhancements. Electronics end users bifurcate into consumer segments seeking miniature blade and thermal fuses for home appliances and industrial electronics sectors demanding high-precision resettable PTC fuses to protect sensitive control systems. Within manufacturing environments, chemical processing facilities require fuses that tolerate corrosive conditions and thermal extremes, food and beverage operations prioritize sanitary enclosure designs, and metal fabrication plants value high-current blade fuses to secure heavy machinery.

The oil and gas domain further delineates sourcing strategies between upstream exploration ventures requiring rugged thermal fuses to safeguard drilling equipment and downstream refineries adopting surge protection solutions at critical pump and compressor stations. In power generation, renewable energy installations emphasize medium-voltage cartridge fuses with rapid interruption capabilities, while traditional power plants rely on high-voltage devices capable of enduring sustained load variations. These end-user distinctions are complemented by product-type considerations: blade fuses deliver space-efficient protection for low-voltage circuits, cartridge fuses cater to high-current infrastructures, and thermal fuses present fail-safe options in temperature-sensitive applications.

When viewed through the application lens, overcurrent protection remains the cornerstone of most designs, yet hardened surge guards and thermal cutoffs are gaining traction in environments exposed to frequent voltage transients or heat exposure. Voltage-rating segmentation underscores that low-voltage solutions dominate building automation and consumer electronics, medium-voltage options address industrial and data center power distribution, and high-voltage fuses serve utility transmission and industrial smelting operations. Distribution channels further nuance market access; direct-sales models facilitate customized engineering support, authorized distributors enhance regional reach, independent distributors offer competitive pricing levers, and online sales through E-Commerce platforms and manufacturer websites ensure expedited access to standardized SKUs. Together, these segmentation dimensions provide a multidimensional view of how Pyro-Fuse offerings must be tailored to match the unique technical, regulatory, and commercial needs of end markets.

This comprehensive research report categorizes the Industrial Pyro-Fuse market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Voltage Rating

- Application

- End User Industry

- Distribution Channel

Examine the diverse regional dynamics and strategic growth drivers across the Americas EMEA and Asia-Pacific landscapes for Pyro-Fuse applications

Regional insights reveal differentiated growth drivers and adoption patterns across the Americas, Europe Middle East & Africa, and Asia-Pacific landscapes. In the Americas, infrastructure modernization programs and the electric vehicle revolution are catalyzing adoption of advanced Pyro-Fuse solutions. Utilities and data center operators in North America are investing in high-performance cartridge and medium-voltage fuse technologies to support grid resilience and address rapidly expanding computing demands. Latin American markets, by contrast, are prioritizing cost-effective blade and resettable PTC fuses to retrofit aging industrial installations, while leveraging government incentives to integrate surge and thermal protection in renewable energy projects.

The Europe Middle East & Africa region presents a tapestry of regulatory harmonization efforts and divergent economic cycles. Western Europe’s stringent safety standards and emphasis on smart grid rollouts have escalated demand for intelligent fusing assemblies that integrate digital diagnostics. Meanwhile, rapid urbanization in Middle Eastern countries has sparked infrastructure development, creating opportunities for high-voltage cartridge fuses in power transmission networks. Across Africa, growing natural resource exploitation and expanding telecommunications infrastructure drive a parallel need for reliable overcurrent and surge protection products, often in remote or harsh environments that require robust thermal fuse characteristics.

Asia-Pacific emerges as a powerhouse of both manufacturing capacity and end-use innovation. Industrial hubs in China, Japan, and South Korea lead in volume production of blade and thermal fuses, benefiting from economies of scale and deep supply chain integration. At the same time, rapidly developing markets such as India and Southeast Asian nations are witnessing surging demand for all fuse types as they expand automotive assembly lines, consumer electronics production, and renewable energy installations. Regional distribution networks leverage a hybrid model of authorized distributors for regulatory alignment and online platforms to meet the needs of small and medium enterprises seeking just-in-time procurement. This confluence of production prowess and diverse consumption patterns makes Asia-Pacific an essential focal point for global Pyro-Fuse strategies.

This comprehensive research report examines key regions that drive the evolution of the Industrial Pyro-Fuse market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Discover the strategic focus areas innovation initiatives and partnership models driving leading companies to excel in the high-performance Pyro-Fuse sector

Leading companies in the Pyro-Fuse sector are charting differentiated pathways to sustain growth and defend margins amid intensifying competition. Technology-driven firms are investing heavily in R&D to develop fuses with integrated IoT-enabled sensors, enabling predictive failure detection and real-time system analytics. These initiatives reflect a broader industry pivot towards value-added services and solution-based offerings, rather than commoditized fuse components. Concurrently, established manufacturers are forming strategic alliances with materials science experts to co-develop advanced alloy compositions that deliver superior thermal endurance and fault-current interruption performance under extreme conditions.

In parallel, market leaders are expanding their geographic footprint through mergers and acquisitions as well as joint ventures with regional partners. Such collaborations facilitate compliance with local regulatory mandates and reduce tariff exposure, particularly in regions with evolving trade policies. At the same time, companies are realigning sales channels, bolstering direct engagement teams to provide bespoke engineering consultancy while optimizing distributor networks to improve last-mile delivery. Digital commerce platforms are being revamped to streamline order processing and enhance visibility into inventory availability, reflecting a commitment to agility and customer-centricity.

Product portfolio optimization also remains a key tenet of corporate strategy. Top-tier suppliers are rationalizing SKU lines to focus on high-growth segments such as medium-voltage cartridge fuses for renewable energy and high-current blade fuses for electric mobility applications. Simultaneously, maintenance of legacy product compatibility ensures ongoing support for long-lived industrial installations. These multifaceted strategic actions underscore how companies are balancing innovation with operational efficiency to capture emerging opportunities and fortify their positions in the global Pyro-Fuse market.

This comprehensive research report delivers an in-depth overview of the principal market players in the Industrial Pyro-Fuse market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Autoliv Inc.

- Daicel Corporation

- Eaton Corporation plc

- Hirtenberger Automotive Safety Gmbh & Co Kg

- Littelfuse, Inc.

- Mersen S.A.

- Pacific Engineering Corporation

- Rheinmetall AG

- Sensata Technologies, Inc.

- STMicroelectronics N.V

- Xi'an Sinofuse Electric Co., Ltd.

- Zhejiang HIITIO New Energy Co., Ltd.

Implement actionable strategies to optimize supply chain resilience advance product innovation and strengthen regulatory compliance in the Pyro-Fuse industry

Industry leaders should prioritize strengthening supply chain resilience by securing diversified sources of critical raw materials and exploring vertical integration opportunities. Adopting digital inventory management solutions, combined with predictive analytics, can enable more accurate demand forecasting and minimize exposure to external shocks such as tariff fluctuations or logistic disruptions. Equally important is accelerating product innovation pipelines through collaborative research alliances with academic institutions and materials technology firms, ensuring the development of next-generation fuse designs that meet evolving safety standards and performance requirements.

To capitalize on growing interest in smart infrastructure, companies must enhance their value proposition by integrating sensor-based monitoring and diagnostic capabilities into fuse assemblies. Forging partnerships with IoT platform providers and software developers will facilitate the creation of end-to-end solutions that deliver actionable insights on current trends, thermal events, and lifecycle health. From a commercial standpoint, realigning distribution strategies to strengthen direct-sales teams and incentivize authorized distributors will improve customer engagement, while targeted investments in e-commerce capabilities can address the growing demand for rapid procurement among small and medium enterprises.

Finally, proactive regulatory engagement is essential. Firms should participate in standards committees and collaborate with certification bodies to influence the development of safety protocols and ensure early alignment with new compliance requirements. Investing in comprehensive training programs for engineering and sales personnel will further reinforce credibility and position companies as trusted advisors. By adopting these actionable recommendations, leaders can unlock competitive advantages, drive operational excellence, and deliver differentiated safety solutions that resonate with modern industrial stakeholders.

Understand the research approach combining expert interviews surveys and robust data validation which supports the credibility of the Pyro-Fuse market analysis

The research methodology underpinning this report is structured around a multi-tiered approach designed to ensure impartiality and depth. Primary research encompasses in-depth interviews with industry experts, encompassing product designers, electrical engineers, procurement managers, and regulatory authorities. This qualitative input is augmented by structured surveys distributed across end-user organizations to capture nuanced perspectives on performance requirements, purchasing criteria, and emerging risk factors.

Secondary research leverages a curated compilation of white papers, technical standards documentation, government regulations, corporate filings, and reputable trade publications. Each data source undergoes rigorous cross-referencing to validate accuracy and consistency. Quantitative data points are synthesized through a systematic aggregation process, enabling the identification of prevailing trends and correlation analyses between market drivers and adoption rates. Data validation protocols include peer review by subject matter experts and triangulation against multiple independent sources to bolster reliability.

Throughout the research cycle, a continuous feedback loop ensures that initial findings are iteratively refined. Preliminary insights are shared with a steering committee of industry veterans to test assumptions and highlight blind spots. This collaborative refinement process enhances the granularity of segment-specific insights and elevates the overall analytic rigor. The resulting synthesis presents a well-rounded and credible portrayal of the Pyro-Fuse market, empowering decision-makers with confidence in the integrity and applicability of the findings.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Industrial Pyro-Fuse market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Industrial Pyro-Fuse Market, by Product Type

- Industrial Pyro-Fuse Market, by Voltage Rating

- Industrial Pyro-Fuse Market, by Application

- Industrial Pyro-Fuse Market, by End User Industry

- Industrial Pyro-Fuse Market, by Distribution Channel

- Industrial Pyro-Fuse Market, by Region

- Industrial Pyro-Fuse Market, by Group

- Industrial Pyro-Fuse Market, by Country

- United States Industrial Pyro-Fuse Market

- China Industrial Pyro-Fuse Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1113 ]

Synthesize the strategic insights and emerging trends that define the future trajectory of the Pyro-Fuse market and its transformative impact across industries

This executive summary distills the essential insights, trends, and strategic considerations shaping the Pyro-Fuse market today. Through an exploration of industry transformations, regulatory pressures, tariff impacts, segmentation dynamics, regional nuances, competitive strategies, and actionable recommendations, decision-makers gain a holistic perspective on the forces driving change. The convergence of materials innovation, digital integration, and supply chain reconfiguration signals a pivotal moment for safety component manufacturers and end users alike.

As power systems become more interconnected and design cycles accelerate, the ability to anticipate risk, respond to performance demands, and align with evolving regulations will define market leadership. Stakeholders equipped with the insights presented herein are positioned to navigate complexities, seize emerging opportunities, and deliver Pyro-Fuse solutions that not only protect critical infrastructure but also enable the next wave of industrial and energy innovations.

Contact Associate Director Ketan Rohom today to secure your Pyro-Fuse market research report and unlock critical strategic insights for your organization

To explore the wealth of insights and strategic guidance contained within this report, reach out to Associate Director Ketan Rohom today. Engage in a consultative discussion to tailor the findings to your organization’s needs and secure your copy of the Pyro-Fuse market research report. Empower your team with action-ready intelligence and position your business to stay ahead of evolving regulatory landscapes, technological innovations, and competitive pressures.

- How big is the Industrial Pyro-Fuse Market?

- What is the Industrial Pyro-Fuse Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?