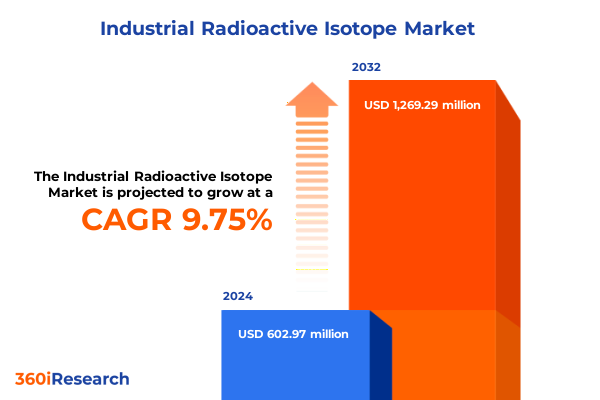

The Industrial Radioactive Isotope Market size was estimated at USD 660.07 million in 2025 and expected to reach USD 723.44 million in 2026, at a CAGR of 9.79% to reach USD 1,269.29 million by 2032.

Transformative Power of Industrial Radioactive Isotopes Enhances Precision Measurement, Non-Destructive Testing, Tracing, and Sterilization Across Multiple Sectors

Industrial radioactive isotopes have emerged as indispensable tools across a spectrum of industrial processes, transforming operations through unparalleled precision and reliability. In measurement applications, low-energy gamma and beta emitters provide continuous, non-contact monitoring of material levels in silos, tanks, and conveyors, enabling real-time process control and minimizing production variability. Similarly, high-energy gamma sources support thickness gauging on metal and plastic lines, ensuring product consistency and reducing waste. Furthermore, these isotopes underpin the evolution of non-destructive testing, offering radiographic inspections that reveal internal defects without disassembly or downtime, a critical advantage in safety-critical sectors.

Beyond measurement and testing, industrial isotopes play a vital role in tracing and sterilization operations. Radioactive tracers facilitate flow rate analysis and leak detection in oil and gas pipelines, providing early warnings of anomalies and safeguarding against environmental hazards. Concurrently, gamma sterilization processes leverage robust isotopes to neutralize pathogens in food and medical instruments, guaranteeing hygiene standards without compromising packaging or material integrity. As manufacturing and infrastructure sectors pursue higher efficiency and compliance, the inherent stability and penetrating power of radioactive isotopes continue to drive innovation and operational excellence.

Digital Radiography and Decentralized Production Spark a New Era of AI-Enabled Inspection and Resilient Supply Chains for Industrial Isotopes

Recent technological advancements and shifting regulatory landscapes have collectively reshaped the industrial isotope market, prompting an era of transformative growth. The integration of digital sensors with isotope sources now enables predictive maintenance through AI-driven analytics, where radiographic images are processed in real time to identify micro-defects before they escalate into critical failures. Transitioning from traditional film techniques, this digital radiography revolution has accelerated inspection cycles and improved defect detection rates, particularly in high-value aerospace components.

Simultaneously, logistical challenges and geopolitical tensions have sparked a reevaluation of supply chain architectures. With major isotopes such as Cobalt-60 and Iridium-192 historically produced in a handful of reactors overseas, emerging policies have incentivized regional capacity expansion and the exploration of cyclotron-based synthesis for short-lived radionuclides. This pivot addresses risks from reactor outages and transportation delays while fostering collaborations between energy providers, research institutes, and equipment manufacturers. As a result, the market is witnessing a diversification of source types and production methods, underpinned by investments in modular, on-site isotope generation technologies.

Broad-Sweep Tariffs on Lab Goods and Uranium Materials Heighten Costs, Disrupt Supply Chains, and Prompt Calls for Policy Deferrals in 2025

Since late 2024, a series of U.S. tariff measures has indiscriminately increased import duties on critical materials and laboratory goods, inadvertently affecting industrial isotope supply chains. A universal 10% levy on most imported products took effect in April 2025, followed by country-specific surcharges that have driven duties on Chinese lab equipment and raw materials to as high as 145% within days of implementation. Furthermore, under Section 301 tariff reviews, the duty on actinides and uranium compounds rose from 7.5% to 25% for goods entering after September 27, 2024, encompassing isotopes integral to industrial and medical applications.

Medical and research stakeholders have cautioned against these sweeping tariffs, with professional societies highlighting the fragile nature of isotope supply chains. The Society of Nuclear Medicine and Molecular Imaging warned that tariffs would escalate costs and disrupt life-saving procedures reliant on Mo-99 and other short-lived tracers. Similarly, cardiac imaging leaders urged a deferral of duties on radiopharmaceuticals and associated equipment until domestic production can scale, noting that over 80% of diagnostic scans depend on imported isotopes. In the nuclear energy sector, Canada’s exemption of uranium from tariffs offers temporary relief, yet studies estimate that potential levies on Canadian energy exports could inflate fuel costs for U.S. reactors by $150–200 million annually and complicate fuel procurement cycles for the 18–24 month assembly process. These compounded trade barriers underscore the urgency for strategic supply diversification and policy engagement.

Holistic View of Application, Isotope, End-User, Production, Source, and Product Form Segmentation Reveals Tailored Solutions and Emerging Synthesis Routes

Industrial isotope applications span diverse measurement and testing methodologies, each demanding tailored source characteristics. Level sensors deploy gamma and beta emitters to gauge granular materials and liquids without contact, while thickness meters harness penetrating gamma rays to verify metal and plastic tolerances on high-speed production lines. In non-destructive testing, isotopes calibrate casting and weld inspection systems that detect subsurface flaws invisible to visual or ultrasonic methods. Oil and gas operations employ radiotracers for flow rate analysis and pipeline leak detection, furnishing critical data for asset integrity management. Meanwhile, gamma sources sterilize packaged foods and medical instruments, leveraging the deep penetration of Cobalt-60 to neutralize pathogens without heat.

Isotope selection further reflects distinct emission profiles: Americium-241’s low-energy gamma output suits X-ray fluorescence and static elimination, Cesium-137’s high-energy gammas bolster density gauges and food irradiation, Cobalt-60 serves dual roles in sterilization and radiography, and Iridium-192 excels in high-resolution weld and pipeline inspections. End users from construction projects inspecting bridges and pipelines to aerospace and automotive manufacturers enforcing structural tolerances rely on these isotopes to uphold safety and quality standards. Oil and gas companies apply downstream tracers to optimize processing and upstream leak detection to mitigate environmental risks. Research institutes explore novel tracer chemistries and sensor designs, driving the next wave of industrial innovations.

The production landscape bifurcates between reactor-based activation, delivering large isotope batches under rigorous licensing, and cyclotron-based synthesis, enabling decentralized, on-demand generation of short-half-life radionuclides with lower long-lived waste profiles. Products arrive as sealed sources for fixed installations or unsealed solutions injectable into process streams, while liquid suspensions facilitate uniform tracer distribution and solid seeds support long-term calibrations. This segmentation reveals a market shaped by application specificity, production method, source encapsulation, and product form dynamics.

This comprehensive research report categorizes the Industrial Radioactive Isotope market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Production Method

- Source Type

- Radioisotope Type

- Product Form

- Application

- End User

Regional Dynamics Highlight North American Dominance, European Capacity, and Rapid Asia-Pacific Expansion of Industrial Radioisotope Production and Utilization

In the Americas, the United States remains the primary consumer, buoyed by its extensive healthcare infrastructure, advanced manufacturing sector, and large nuclear fleet. Canada continues as a key isotope supplier, notably for Cobalt-60 and Ir-192, with several licensed reactor facilities and service providers located near major U.S. markets. Brazil and Mexico are expanding radiographic and sterilization capacities to support growing industrial and healthcare demands, while regulatory harmonization within NAFTA and USMCA frameworks facilitates cross-border distribution.

Across Europe, the Middle East, and Africa, Western Europe leads reactor-based isotope production, with France and the United Kingdom hosting major Co-60 manufacturing plants and research reactors dedicated to Mo-99 and Ir-192. The European Union’s stringent safety and environmental regulations drive ongoing investments in digital radiography and sealed source management. Meanwhile, the Middle East is initiating nuclear power and desalination projects that require specialized isotopic gauges, and South Africa’s historic role as a Mo-99 supplier underscores the continent’s strategic importance, even as regional producers seek to diversify export destinations.

The Asia-Pacific region is rapidly pursuing self-sufficiency, with China scaling cyclotron installations for short-lived medical isotopes and India modernizing its reactor fleet to bolster Co-60 output. Australia, rich in uranium reserves, is evaluating conversion and enrichment partnerships to enter the isotope export market. Japan, recovering from reactor shutdowns, leverages research institutions to advance isotope generator technologies. These regional dynamics illustrate a shift toward decentralized production and reinforced supply chains across global markets.

This comprehensive research report examines key regions that drive the evolution of the Industrial Radioactive Isotope market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Strategic Profiles of Nordion under BWXT, Eckert & Ziegler, NorthStar, and Cameco Reveal a Diverse Ecosystem of Capacity, Licensing, and Technological Innovation

Nordion, now under BWXT stewardship, has leveraged its historic expertise in Cobalt-60 supply to deliver sealed sources and gamma processing systems from its Canadian facilities, while pioneering patent-protected reactor technologies to maintain reliability in sterilization and radiography services. Eckert & Ziegler has distinguished itself through diversified isotope portfolios, offering Cs-137, Co-60, Am-241, and neutron sources across global production sites in Germany and the Czech Republic, and recently achieving full GMP-grade Actinium-225 output via cyclotron integration. NorthStar Medical Radioisotopes has advanced domestic Mo-99 production with a dedicated pilot facility in Wisconsin, deploying hot cell engineering tailored to industrial tracer and radiopharmaceutical applications.

BWXT’s acquisition of Nordion’s isotope business has expanded its license portfolio and workforce, enabling accelerated market entry for Mo-99 and emerging actinide products within its Nuclear Power Group segment. Cameco, while primarily recognized for uranium enrichment, underpins reactor feedstock procurement essential to reactor-based activation of isotopes such as Ir-192 and Co-60, and its strategic exemption from Canadian uranium tariffs underscores its influence on U.S. nuclear supply chains. Together, these organizations shape a competitive landscape driven by regulatory compliance, technological leadership, and integrated supply models.

This comprehensive research report delivers an in-depth overview of the principal market players in the Industrial Radioactive Isotope market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Alpha-Omega Services, Inc.

- CHINA NUCLEAR ENERGY TECHNOLOGY CORPORATION LIMITED

- Eckert & Ziegler BEBIG GmbH

- ELECTRONIC & ENGINEERING CO. (I) P. LTD.

- Framatome

- Frontier Technologies Corporation

- International Isotopes, Inc.

- Ion Beam Applications SA

- IRE ELiT

- ISOFLEX USA

- Laurentis Energy Partners Inc.

- Mirion Technologies, Inc.

- NRD, LLC USA

- NTP Radioisotopes SOC Ltd

- QSA Global, Inc.

- Rosatom State Atomic Energy Corporation

- SHINE Technologies, LLC

- SRB Technologies, Inc.

- Trace Sciences International

Strategic Alliances, Policy Advocacy, and On-Site Production Investments Bolster Supply Chain Resilience and Accelerate Technology Adoption

To mitigate supply chain disruptions, industry leaders should pursue strategic partnerships with regional reactor operators and cyclotron providers, ensuring diversified sourcing of critical isotopes. Proactive engagement with policy makers and trade authorities can advocate for targeted tariff exemptions or deferrals for essential industrial isotopes and associated equipment. Investment in modular, on-site production units-such as small cyclotrons-will enhance resilience against transportation delays and geopolitical tensions. Companies should also integrate advanced digital radiography platforms with AI-based defect recognition to maximize return on investment and adhere to evolving safety standards.

Moreover, aligning R&D spending with next-generation tracer chemistry and non-film imaging modalities will unlock new application areas, from high-precision composite inspections to integrated leak detection networks. Cross-industry consortiums can streamline licensing processes and share best practices for radioactive source handling, training, and disposal. Lastly, continuous monitoring of trade policy developments and tariff schedules, coupled with flexible procurement strategies, will enable organizations to adapt swiftly to regulatory shifts and capitalize on emerging market opportunities.

Comprehensive Mixed-Method Research Design Combining Executive Interviews, Survey Data, Trade Analysis, and Regulatory Review for Rigorous Insights

This report synthesizes qualitative and quantitative research methodologies to deliver robust insights. Primary research involved structured interviews with industry executives, subject matter experts, and regulatory officials, complemented by survey-based feedback from end users across construction, manufacturing, oil and gas, and research sectors. Secondary research integrated public domain data from trade associations, scholarly journals, government publications, and licensed databases to validate market drivers, tariff impacts, and regional trends.

Data triangulation techniques were employed to ensure consistency, cross-verifying findings from multiple sources. Segmentation analyses were informed by product application, isotope type, end-use industry, production method, source encapsulation, and product form. Regional insights leveraged import-export statistics and strategic policy reviews. Finally, company profiles were constructed using press releases, financial filings, and proprietary interviews to map competitive dynamics and investment priorities. This multidisciplinary approach underpins the report’s strategic recommendations and future outlook.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Industrial Radioactive Isotope market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Industrial Radioactive Isotope Market, by Production Method

- Industrial Radioactive Isotope Market, by Source Type

- Industrial Radioactive Isotope Market, by Radioisotope Type

- Industrial Radioactive Isotope Market, by Product Form

- Industrial Radioactive Isotope Market, by Application

- Industrial Radioactive Isotope Market, by End User

- Industrial Radioactive Isotope Market, by Region

- Industrial Radioactive Isotope Market, by Group

- Industrial Radioactive Isotope Market, by Country

- United States Industrial Radioactive Isotope Market

- China Industrial Radioactive Isotope Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1908 ]

Executive Synthesis Highlights Technological Evolution, Trade Challenges, Segmentation Nuances, and Strategic Imperatives for Industrial Isotope Stakeholders

Industrial radioactive isotopes continue to underpin critical measurement, testing, and sterilization processes across diverse industries, driving operational precision and safety. Transformative shifts-ranging from AI-enhanced digital radiography to decentralized cyclotron production-highlight the sector’s adaptive response to technological and geopolitical pressures. U.S. tariff measures have underscored the fragility of global supply chains, prompting calls for strategic diversification and policy engagement. Detailed segmentation reveals nuanced demand patterns across applications, isotopes, end users, and production methods, while regional analyses illustrate evolving capacity dynamics from North America to Asia-Pacific.

Leading organizations have responded with strategic acquisitions, expanded production licenses, and technological investments, positioning themselves at the forefront of the industrial isotope landscape. Actionable recommendations emphasize supply chain resilience, regulatory collaboration, and investments in advanced imaging and on-site generation technologies. By leveraging these insights, decision-makers can navigate complex trade environments, optimize procurement strategies, and drive innovation in radioactive isotope applications. This Executive Summary lays the foundation for a deeper exploration of market opportunities and strategic imperatives in the full report.

Empower Your Strategic Decisions with an Exclusive Invitation to Secure the Comprehensive Market Analysis and Drive Growth in Industrial Isotope Applications

For tailored insights, in-depth data, and strategic guidance on navigating this complex and evolving industrial radioactive isotope landscape, contact Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch. Discover how our comprehensive market research can empower your decision-making, mitigate risks, and unlock growth opportunities across applications, regions, and isotopic technologies. Reach out today to secure your copy of the full report and position your organization at the forefront of industrial innovation.

- How big is the Industrial Radioactive Isotope Market?

- What is the Industrial Radioactive Isotope Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?