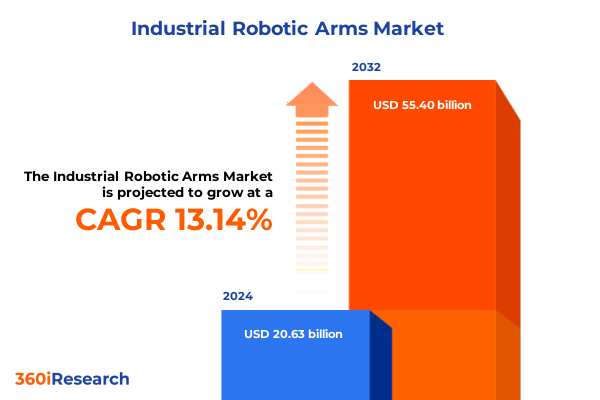

The Industrial Robotic Arms Market size was estimated at USD 23.10 billion in 2025 and expected to reach USD 25.86 billion in 2026, at a CAGR of 13.31% to reach USD 55.40 billion by 2032.

Embarking on a Comprehensive Exploration of Industrial Robotic Arms Revolutionizing Modern Manufacturing Environments Through Advanced Precision, Intelligence, and Operational Agility

The industrial robotic arms sector stands at a pivotal juncture as manufacturers worldwide intensify their pursuit of smarter, more agile production environments. Fueled by the ever-accelerating demands of digital transformation, autonomy, and data-driven decision making, these mechanical workhorses are evolving from fixed-function devices into intelligent collaborators within complex ecosystems. In an era where downtime equates to significant cost, the integration of advanced robotics has shifted from a competitive differentiator to an operational imperative.

Against this backdrop, the convergence of artificial intelligence, machine vision, and edge computing has redefined what robotic arms can achieve. Modern systems not only execute programmed motions with micron-level precision but also adapt in real time to variations in workpiece geometry, tool wear, and production cadence. As a result, manufacturers are unlocking new pathways to product customization, quality consistency, and throughput optimization. The growing prevalence of digital twins and predictive analytics further amplifies this capability, enabling end-to-end simulations that de-risk process changes and accelerate new product introduction.

Looking beyond pure performance metrics, the adoption of industrial robotic arms is reshaping workforce dynamics and value chains. While concerns around job displacement linger, evidence shows that human-robot collaboration is fostering new roles centered on programming, maintenance, and data interpretation. Moreover, regional initiatives aimed at strengthening supply chain resilience have spotlighted local fabrication of robotic components, giving rise to a more distributed manufacturing landscape. Collectively, these forces portend a transformative decade for industrial robotics, one characterized by unprecedented levels of agility, intelligence, and integration.

Navigating the Pivotal Technological, Operational, and Strategic Transformations Reshaping the Industrial Robotic Arms Landscape at an Unprecedented Pace

The industrial robotic arms landscape is undergoing a remarkable metamorphosis driven by advances in core technologies and evolving operational priorities. On the technology front, next-generation sensors and vision systems are enabling unprecedented levels of spatial awareness and quality inspection, turning previously manual tasks into automated, high-precision processes. At the same time, software platforms featuring open architectures and application programming interfaces are simplifying integration with enterprise resource planning and manufacturing execution systems, thereby enhancing orchestration across the shop floor.

Operationally, manufacturers are moving away from monolithic production lines toward reconfigurable cells capable of multi-model assembly and rapid changeovers. Collaborative robots have emerged as a key enabler of this shift, working alongside human operators without the need for traditional safety barriers and adapting to variations in real time. Meanwhile, modular end-of-arm tooling and quick-change gripper systems facilitate rapid adaptation to product mix shifts and smaller batch sizes, reflecting an era where flexibility is as critical as speed.

Strategically, the focus on lifecycle value rather than mere equipment acquisition cost is spurring business model innovation. Robotics-as-a-service offerings are gaining traction, allowing firms to convert capital expenditures into operational expenditures and scale deployments in line with evolving demand. Partnerships between robotics manufacturers, system integrators, and software specialists are also proliferating, forming ecosystems that deliver turnkey automation solutions. These collaborative networks are redefining competitive boundaries and setting new benchmarks for total cost of ownership, responsiveness, and aftermarket support.

Assessing the Deep and Far-Reaching Consequences of Latest United States Tariff Measures on Global Industrial Robotic Arms Supply Chains and Cost Structures

Recent tariff measures enacted by the United States in 2025 have introduced significant complexities for global industrial robotic arms supply chains. With increased duties applying to key components and incoming robot subassemblies, original equipment manufacturers are grappling with higher landed costs and extended lead times. As a result, procurement strategies have swiftly shifted toward alternative sources, including regional suppliers in the Americas and allied Asia-Pacific nations, to mitigate price pressures and safeguard production continuity.

In response to these headwinds, many system integrators and end users have accelerated plans to localize critical manufacturing steps. This drive toward onshore fabrication of essential parts such as actuators, gearboxes, and high-precision sensors not only reduces exposure to import tariffs but also reinforces supply chain transparency and agility. Concurrently, government incentives and grant programs have emerged to support domestic robotics innovation, encouraging strategic investments in research and development facilities.

These tariff-induced dynamics are also influencing contractual frameworks. Clients are increasingly negotiating tariff-adjustment clauses and exploring fixed-price maintenance agreements to stabilize total cost of ownership. Furthermore, the imperative to sustain innovation has led many stakeholders to invest in digital tools that monitor supply chain risk, track alternative sourcing options in real time, and simulate tariff scenarios. Collectively, these measures are reshaping procurement and production strategies, underscoring the need for adaptive planning in an era of evolving trade landscapes.

Distilling Crucial Market Segmentation Insights Across Robot Typologies, Core Applications, and Diverse End-User Industries Driving Tailored Automation Solutions

An in-depth examination of market segmentation reveals that robotic arm typologies are driving differentiated value propositions across industrial applications. By robot type, the landscape encompasses five principal classifications including articulated designs offering versatile multi-axis motion, cartesian frameworks delivering structured linear precision, collaborative models engineered to operate safely alongside human counterparts, delta configurations optimized for high-speed pick and place tasks, and SCARA varieties suited for horizontal assembly mechanics. Each classification addresses distinct operational needs, from heavy-payload welding to ultra-fast small-parts handling.

When considering application segmentation, assembly operations continue to anchor many early deployments, yet machine tending has emerged as a critical second wave of adoption, streamlining repetitive load-unload tasks. Material handling spans an array of functions, from automated packaging and palletizing to sophisticated pick and place and sorting activities that reduce cycle times. Painting processes are benefiting from robotic consistency and overspray reduction, while welding applications leverage specialized arm configurations for arc, laser, and spot welding to achieve uniform bead quality and minimal rework.

End-user industry insights further illuminate where robotic arms are making the greatest inroads. Traditional automotive manufacturing remains a core adopter, integrating robotics for high-volume production and complex assembly cycles. Electronics production demands precision and clean-room compatibility, prompting innovative end-of-arm tooling solutions. In food and beverage, hygienic designs and wash-down capabilities are paramount, whereas logistics and warehousing leverage robotic arms for order fulfillment. Broader manufacturing sectors continue to explore customized deployments, extending robotics benefits to niche and batch-driven processes that historically relied on manual labor.

This comprehensive research report categorizes the Industrial Robotic Arms market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Robot Type

- Application

- End User Industry

Revealing Distinct Regional Dynamics and Adoption Patterns Shaping Industrial Robotic Arms Integration Across Americas, EMEA, and Asia-Pacific Markets

Global adoption patterns for industrial robotic arms exhibit clear regional distinctions that inform strategic deployment decisions. In the Americas, robust industrial infrastructure and strong capital investment programs have fostered early uptake of high-payload articulated systems, particularly in automotive and metal fabrication sectors. Supportive regulatory frameworks and workforce development initiatives are also catalyzing growth in collaborative deployments for small to mid-sized enterprises seeking improved productivity while maintaining labor flexibility.

Across Europe, the Middle East, and Africa, stringent safety and environmental standards have driven innovation in precision robotics and clean-room compatible platforms for industries such as pharmaceuticals and electronics. Emphasis on sustainability has spurred demand for energy-efficient motion control systems and lightweight materials. This region’s emphasis on cross-industry collaboration is further advancing research consortia that integrate robotics with additive manufacturing, IoT connectivity, and advanced analytics to create truly smart production environments.

In the Asia-Pacific realm, aggressive government support for advanced manufacturing and high-volume electronics production has propelled widespread deployment of delta and SCARA robots. Emerging markets in Southeast Asia and India are rapidly expanding their automation footprints to compete on cost and quality. Meanwhile, legacy manufacturing hubs are investing in system upgrades that blend traditional articulated arms with next-generation collaborative units, reflecting a hybrid approach to meeting both mass-production and customization demands.

This comprehensive research report examines key regions that drive the evolution of the Industrial Robotic Arms market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining Strategic Differentiators, Innovation Trajectories, and Competitive Positioning of Leading Industrial Robotic Arm Manufacturers and Emerging Challengers

Leading manufacturers in the industrial robotic arms arena are differentiating themselves through strategic investments in software ecosystems, service networks, and hardware enhancements. Companies with expansive global footprints are leveraging their scale to deliver comprehensive automation suites that unite motion control, vision guidance, and artificial intelligence under unified operating environments. This integration accelerates deployment timelines and reduces complexity for end users by offering pre-validated process libraries and remote support capabilities.

Concurrent with this integrated approach, mid-tier providers are carving out niche positions by developing specialized end-of-arm tooling and domain-specific applications. Their agility allows them to respond rapidly to evolving customer requirements in sectors such as life sciences, packaging, and emerging consumer electronics. Strategic alliances between hardware vendors and local system integrators are further amplifying reach, enabling tailored service models that combine global best practices with deep regional expertise. Together, these dynamics are cultivating a more nuanced competitive landscape that balances scale-driven solutions with bespoke, sector-focused innovation.

This comprehensive research report delivers an in-depth overview of the principal market players in the Industrial Robotic Arms market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd.

- Barrett Technology, LLC

- Comau S.p.A.

- DENSO Corporation

- EFORT Intelligent Equipment Co., Ltd.

- Estun Automation Co., Ltd.

- FANUC Corporation

- Guangdong Topstar Technology Co., Ltd.

- Hyundai Robotics Co., Ltd.

- Inovance Technology Co., Ltd.

- JEL Corporation

- Kawasaki Heavy Industries, Ltd.

- KUKA AG

- Mitsubishi Electric Corporation

- Nachi-Fujikoshi Corp.

- Panasonic Corporation

- Robostar Co., Ltd.

- Seiko Epson Corporation

- Siasun Robot & Automation Co., Ltd.

- STEP Electric Corporation

- Techman Robot Inc.

- Universal Robots A/S

- Yamaha Motor Co., Ltd.

- Yaskawa Electric Corporation

Charting Pragmatic Strategies and Operational Imperatives for Industry Leaders to Capitalize on Automation Trends, Mitigate Disruptions, and Foster Sustainable Growth

To thrive amidst accelerating automation trends, industry leaders should prioritize the establishment of modular, scalable architectures that accommodate both current production requirements and future technology upgrades. By adopting open software platforms that support rapid integration of new analytics, vision, and machine learning capabilities, organizations can mitigate the risk of obsolescence and foster continuous improvement across the production lifecycle.

Strategic diversification of supplier networks is equally critical. Firms should evaluate near-term alternatives in adjacent geographies and cultivate relationships with trusted component makers to reduce exposure to trade policy shifts. Concurrent investment in comprehensive digital supply chain visibility tools will enhance real-time risk management and enable scenario planning for tariff fluctuations or geopolitical disruptions.

Finally, forging collaborative partnerships between operations teams and R&D functions will expedite the translation of emerging technologies into practical applications. Upskilling initiatives should equip workforces with the competencies required for programming, troubleshooting, and optimizing advanced robotic systems. By embedding an innovation-centric culture and aligning incentives around automation performance metrics, organizations can sustain momentum in productivity gains while navigating an increasingly complex competitive landscape.

Outlining Rigorous Research Methodology Integrating Multi-Source Data Validation, Expert Consultations, and Analytical Frameworks Underpinning This Comprehensive Study

This comprehensive study employed a rigorous multi-phase research methodology designed to ensure data integrity and analytical depth. Commencing with an extensive secondary research phase, relevant literature, technical white papers, regulatory filings, and corporate disclosures were systematically reviewed to build a robust foundational understanding of industrial robotic arms technologies and market trajectories. Concurrently, patent databases and standards bodies were analyzed to gauge innovation hotspots and emerging best practices.

The primary research component involved structured interviews and workshops with a cross section of stakeholders, including robotics OEM executives, system integrators, end-user operations managers, and independent analysts. Insights gleaned from these engagements were triangulated against field survey data and real-world case studies to validate key trends and identify performance benchmarks. Quantitative data points were further corroborated through direct data exchanges with industry consortia and technical advisory groups.

An analytical framework integrating thematic clustering, scenario analysis, and competitive benchmarking underpinned the subsequent insight generation. Results were subjected to iterative validation sessions with subject-matter experts to refine findings and ensure relevance. The final deliverable presents a holistic view of strategic imperatives, technological enablers, and risk factors central to industrial robotic arm adoption.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Industrial Robotic Arms market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Industrial Robotic Arms Market, by Robot Type

- Industrial Robotic Arms Market, by Application

- Industrial Robotic Arms Market, by End User Industry

- Industrial Robotic Arms Market, by Region

- Industrial Robotic Arms Market, by Group

- Industrial Robotic Arms Market, by Country

- United States Industrial Robotic Arms Market

- China Industrial Robotic Arms Market

- Competitive Landscape

- List of Figures [Total: 15]

- List of Tables [Total: 954 ]

Synthesizing Core Insights and Outlook for Industrial Robotic Arms Adoption to Empower Decision-Making in an Era of Accelerated Automation Evolution

Throughout this executive summary, the industrial robotic arms domain has been revealed as a confluence of rapid technological innovation, evolving trade dynamics, and shifting operational paradigms. The interplay of advanced sensor fusion, artificial intelligence, and collaborative design principles is redefining how manufacturers approach automation, from small-batch customization to high-volume production. These developments underscore the critical importance of agility and continuous innovation in sustaining competitive advantage.

Simultaneously, external forces such as tariff policies and regional investment incentives are reshaping procurement strategies and localization decisions. Organizations that proactively manage supply chain risk, embrace modular automation architectures, and invest in workforce transformation will be best positioned to navigate this complex landscape. By synthesizing segmentation, regional, and competitive insights, decision-makers can chart a course that capitalizes on emerging opportunities while hedging against uncertainties.

The journey toward fully autonomous, intelligent production systems is ongoing, and the companies that lead this transformation will do so by aligning strategic vision with disciplined execution. In this era of accelerated automation evolution, informed decision-making grounded in comprehensive, up-to-date insights will be the differentiator between industry leaders and followers.

Engage Directly with Ketan Rohom for In-Depth Market Intelligence and Exclusive Access to the Complete Industrial Robotic Arms Research Insights Package

For comprehensive and actionable insights into the industrial robotic arms sector, engage directly with Ketan Rohom, Associate Director of Sales & Marketing, to gain privileged access to the full research report. Harness this opportunity to equip your organization with bespoke intelligence, strategic foresight, and tailored recommendations that will drive informed investment decisions, optimize supply chain strategies, and accelerate technology deployments.

Connect with Ketan Rohom to secure the definitive guide on industrial robotic arms innovation and market dynamics, ensuring your leadership team stays ahead of emerging trends, competitive shifts, and regulatory developments. Transform insight into impact by partnering with an industry expert committed to your long-term success.

- How big is the Industrial Robotic Arms Market?

- What is the Industrial Robotic Arms Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?