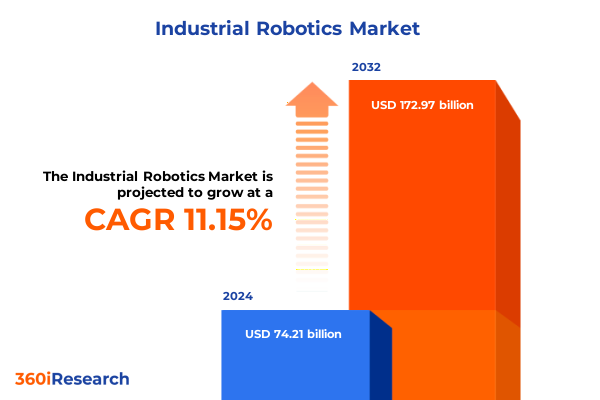

The Industrial Robotics Market size was estimated at USD 81.53 billion in 2025 and expected to reach USD 89.57 billion in 2026, at a CAGR of 11.34% to reach USD 172.97 billion by 2032.

Discover how advances in industrial robotics are revolutionizing manufacturing workflows, driving efficiency gains, and shaping the future of global industry

Discover why industrial robotics stands at the forefront of manufacturing innovation as organizations across the globe strive to enhance productivity and maintain competitive edge. Fueled by mounting labor shortages and the pursuit of operational excellence, manufacturers are increasingly turning to sophisticated automation solutions that blend hardware durability with intelligent control systems. The integration of robotics into production lines is no longer confined to high-volume automotive assembly but spans diverse sectors including electronics, medical devices, and consumer goods, reflecting a paradigm shift in how production workflows are architected and executed.

This transformation is underpinned by a notable surge in industrial robot installations, with the International Federation of Robotics reporting over 4.28 million units operational in factories worldwide in 2023, marking a 10% year-on-year increase. Annual installations exceeded half a million units for the third consecutive year, underscoring the technology’s critical role in modern manufacturing strategies. As organizations manage supply chain volatility and urbanization pressures, robotics offers resilience through precision, repeatability, and the capacity to adapt rapidly to evolving production demands.

Moreover, the convergence of robotics with emerging technologies such as artificial intelligence and advanced sensors is accelerating the shift from isolated automation to smart, interconnected production ecosystems. By collecting and analyzing real-time operational data, these systems enable predictive maintenance, dynamic throughput optimization, and enhanced quality control, ultimately driving down costs and unlocking new capabilities in agile manufacturing. With this solid foundation, industrial robotics is poised to deliver transformative value across the next wave of digital industrialization.

Highlighting seismic shifts redefining industrial robotics through digitalization, AI integration, collaborative automation, and networked manufacturing paradigms

The industrial robotics landscape is undergoing a seismic transformation as emerging technologies and shifting market demands converge. Digitalization is at the core of this metamorphosis, enabling robots to seamlessly integrate with enterprise resource planning systems and the Industrial Internet of Things. As a result, real-time visibility into production processes is no longer a distant aspiration but a tangible reality, fostering dynamic scheduling and rapid reconfiguration in response to fluctuating orders and material availability.

Equally pivotal is the incorporation of artificial intelligence and machine learning algorithms that empower robots with adaptive behaviors. No longer restricted to rigid, pre-programmed tasks, modern robotic systems can now interpret visual input, recognize anomalies, and make autonomous decisions to optimize cycle times and safeguard quality. Collaborative robots, or cobots, embody this shift by safely sharing workspaces with human operators, augmenting human dexterity in tasks such as precision assembly and inspection, and enhancing overall labor productivity.

Furthermore, the rise of networked manufacturing paradigms-where robots, machines, and control systems communicate over shared digital infrastructures-heralds the advent of smart factories. In these environments, autonomous mobile robots coordinate material flow, while intelligent end-of-arm tooling adjusts to diverse product variants without manual intervention, unlocking unprecedented flexibility in mass customization. Together, these transformative shifts are redefining not only what industrial robotics can achieve, but also how manufacturers conceptualize the future of production.

Examining the multifaceted repercussions of recent United States tariffs on industrial robotics imports and supply chains throughout 2025

Throughout 2025, United States tariff policies have exerted a profound influence on the industrial robotics sector, presenting both challenges and strategic inflection points for manufacturers and equipment suppliers. Measures enacted under Section 301 of the Trade Act have been particularly consequential; effective January 1, 2025, the Office of the United States Trade Representative increased tariffs on certain Chinese-origin products essential to robotics production, including solar wafer materials and tungsten components integral to actuator manufacturing. These escalations have reverberated across global supply chains, compelling stakeholders to reassess sourcing strategies and evaluate alternative component sources to mitigate escalating input costs.

In parallel, the Office of the U.S. Trade Representative has offered limited relief through the extension of exclusions for select equipment, allowing certain robotics and automation imports to maintain tariff exemptions through August 31, 2025. While these extensions provide temporary reprieve for some capital-intensive machinery, the exclusions are not universally applicable, and their impending expiration underscores the uncertainty that continues to loom over long-term capital planning. Simultaneously, the USTR’s new, rolling exclusion request process for machinery used in domestic manufacturing has empowered companies to apply for specific tariff relief, though submissions must have been filed by March 31, 2025, to secure potential exemption windows through late summer. Implementers must navigate this administrative landscape carefully to maximize available relief.

Beyond the direct cost implications, heightened tariff levels have accelerated the push toward localized manufacturing of critical components. Manufacturers are increasingly exploring domestic partnerships and investing in regional supplier development to insulate their automation roadmaps from geopolitical volatility. Although such moves may entail upfront investments in tooling, certification, and workforce training, they promise greater supply chain resilience and can catalyze the development of specialized robotics ecosystems within the United States. As manufacturers adapt, the tariff landscape of 2025 is likely to serve as a catalyst for reinvigorated domestic production and supply chain diversification strategies across the industrial robotics domain.

Uncovering critical segmentation insights that delineate the industrial robotics market by robot types, applications, industry verticals, and payload capacities

A nuanced understanding of market segmentation is critical for stakeholders seeking to target the right solutions to specific production challenges. Within the robot type dimension, articulated robots dominate applications requiring complex, multi-axis movements, with four-axis variants focusing on simpler picking and palletizing tasks, while six-axis models, categorized by payload capacity-from up to five kilograms for intricate part assembly to payloads exceeding fifty kilograms for heavy material handling-enable a broad spectrum of functions. Cartesian systems, distinguished into gantry configurations for large-scale operations and linear designs for focused tasks, provide cost-effective solutions where work envelopes demand precise, straight-line motion.

In the realm of collaborative automation, power and force limited designs ensure safe human-robot interaction without external safety fencing, whereas speed and separation monitored variants leverage integrated sensing to modulate operations dynamically. Delta robots, valued for their rapid pick-and-place capabilities, have evolved to handle high-speed sorting in sectors such as food processing, while SCARA robots, differentiated by three-axis models for planar movements and four-axis versions for additional rotary flexibility, remain staples in electronics assembly.

Application segmentation further refines the market landscape: assembly processes demand robust torque control for precise fitting of components, inspection roles rely on high-resolution vision integration, and laser-guided material handling-from machine tending through palletizing to pick-and-place workflows-benefit from robots that balance speed with repeatable accuracy. Packaging, painting, and coating applications emphasize corrosion resistance and path precision, sorting tasks call for vision-based object recognition, and welding operations leverage high-payload articulated arms to ensure consistent seam quality.

Industry vertical perspectives reveal distinct adoption patterns, with automotive production maintaining its role as the primary driver of robot deployment, followed by significant uptake in electronics manufacturing, food and beverage processing characterized by hygienic design requirements, and the pharmaceuticals sector where cleanroom-compatible robots are essential. Meanwhile, metals and machinery, plastics, and chemical industries increasingly integrate robotics to manage repetitive tasks and handle hazardous materials. Overlaying these classifications is the payload capacity segmentation, which cross-cuts various robot types and applications, offering targeted solutions from micro-payload tasks under five kilograms to heavy-duty operations above fifty kilograms. Together, these segmentation insights paint a multifaceted picture of the industrial robotics ecosystem, enabling decision-makers to align technology choices with operational demands.

This comprehensive research report categorizes the Industrial Robotics market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Robot Type

- Application

- Industry Vertical

Revealing regional dynamics shaping industrial robotics adoption across the Americas, Europe, Middle East & Africa, and the thriving Asia-Pacific manufacturing hubs

Regional dynamics continue to shape the trajectory of industrial robotics adoption, with distinct drivers and maturation levels across key global markets. In the Americas, strong government incentives and the reshoring of automotive and semiconductor manufacturing have catalyzed investment in advanced robotics, particularly in the United States, where robotics shipments to manufacturers increased by approximately 12% in 2023 and where partnerships between robotics providers and AI developers are fostering next-generation automation platforms. Canada and Brazil are also embracing robotics, driven by the need to modernize legacy manufacturing and address labor constraints in mining and agriculture.

In Europe, Middle East & Africa, regulatory frameworks emphasizing safety standards and interoperability are pushing robotics suppliers to innovate collaborative solutions that comply with stringent directives. Germany, despite being surpassed by China in robot density, remains a hub for high-precision robotic systems tailored to its robust automotive, machinery, and chemical sectors. Italy’s packaging and plastics industries are similarly investing in specialized robots, while regional initiatives for digital transformation in South Africa and the Gulf Cooperation Council are gradually elevating robotics adoption across diverse applications, from mining to pharmaceuticals.

The Asia-Pacific region continues to dominate deployment volumes, accounting for 70% of new industrial robot installations in 2023, driven by China’s unparalleled investments in automation, Japan’s pursuit of labor productivity amid demographic shifts, and South Korea’s leadership in robot density underpinned by its electronics and automotive sectors. Emerging markets like India are recording double-digit growth rates in installations, with government programs underpinned by ‘‘Make in India’’ priorities fueling demand, while Southeast Asian nations leverage robotics to ascend value chains in electronics assembly and automotive component manufacturing.

This comprehensive research report examines key regions that drive the evolution of the Industrial Robotics market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing leading industrial robotics pioneers and emerging innovators leveraging cutting-edge technologies and strategic partnerships

At the forefront of industrial robotics, incumbent pioneers continue to solidify their positions through sustained innovation and expansive service portfolios. ABB, for instance, is exploring a potential spin-off of its robotics division to sharpen strategic focus on autonomous manufacturing solutions. Fanuc and Yaskawa, long established in supplying high-precision articulated robots, are augmenting their offerings with integrated vision systems and AI-driven controls, catering to evolving demands in electronics and metal fabrication.

Meanwhile, KUKA is investing heavily in software platforms that unify robot programming and analytics, enabling seamless integration across multi-vendor workcells, and Universal Robots is expanding its collaborative line with power-and-force limited cobots designed for safe interaction in space-constrained environments. Emerging companies are also disrupting the landscape: Realtime Robotics captured industry attention by winning the IERA Award for its autonomous motion planning tool that orchestrates multi-robot cell choreography without collision, marking a significant leap in operational efficiency.

In parallel, U.S.-based startups such as Apptronik and Agility Robotics are driving domestic innovation, seeking to reduce reliance on complex international supply chains through localized R&D and manufacturing partnerships. Similarly, robot providers are forging strategic alliances with semiconductor and AI leaders-Nvidia’s foundational models for robotic arm inference exemplify this convergence-propelling a new breed of intelligent automation capable of adaptive learning on the factory floor. Together, these key companies insights illustrate a competitive ecosystem where technological prowess and collaborative networks define market leadership.

This comprehensive research report delivers an in-depth overview of the principal market players in the Industrial Robotics market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd.

- Ametek. Inc.

- Autodesk Inc.

- CODESYS GmbH

- Delta Electronics, Inc.

- Emerson Electric Co.

- FANUC CORPORATION

- Fuji Electric Co., Ltd.

- General Electric Company

- Hitachi, Ltd.

- Honeywell International Inc.

- KUKA AG

- Murata Manufacturing Co., Ltd

- Omron Corporation

- Panasonic Corporation

- Robert Bosch GmbH

- Rockwell Automation, Inc

- Schneider Electric SE

- Seiko Epson Corporation

- SEW-Eurodrive GmbH & Co KG

- Siemens AG

- Texas Instruments Incorporated

- Toshiba Corporation

- UiPath, Inc.

- Yokogawa Electric Corporation

Outlining actionable recommendations for industry leaders to harness robotics innovation, optimize deployment, and foster agile manufacturing ecosystems

To capitalize on the accelerating momentum in industrial robotics, manufacturers should first undertake comprehensive process audits to identify high-impact automation opportunities. Undertaking modular pilot deployments with collaborative robots allows for rapid assessment of operational benefits while minimizing capital expenditure and workforce disruption. Partnering with system integrators who possess cross-industry expertise ensures tailored solutions that align with unique production requirements and integrate seamlessly with existing infrastructure.

Next, organizations are advised to establish robust data strategies, leveraging industrial internet platforms to collect performance metrics and apply predictive analytics. These insights facilitate continuous improvement cycles and inform maintenance scheduling, reducing unplanned downtime and extending equipment lifecycles. Simultaneously, investing in upskilling programs for the workforce is critical: equipping operators with programming and troubleshooting capabilities fosters human-robot collaboration and cultivates a culture of innovation within the factory environment.

Finally, procurement leaders should actively engage in policy dialogues and monitor tariff relief mechanisms, including ongoing Section 301 exclusion opportunities, to mitigate cost pressures. Diversifying supplier networks and exploring nearshoring options enhance supply chain resilience against geopolitical fluctuations. By following these actionable recommendations, industry leaders can accelerate their automation journeys, unlock operational agility, and secure a sustainable competitive advantage.

Detailing rigorous research methodology blending primary interviews, secondary data analysis, and expert validation to ensure comprehensive robotics insights

Our analysis is grounded in a rigorous research methodology that synthesizes insights from primary and secondary sources to deliver comprehensive market perspectives. We conducted in-depth interviews with C-level executives, system integrators, and technology evangelists from leading robotics providers and end-user organizations. These conversations illuminated real-world challenges and success stories across diverse manufacturing environments.

Complementing qualitative data, we performed extensive secondary research, reviewing industry reports, trade publications, and regulatory filings to track the evolution of tariff measures and emerging technology trends. Expert validation sessions with subject matter authorities in automation, supply chain management, and international trade provided critical data triangulation and ensured the credibility of our findings. This multi-pronged approach underpins a robust analysis framework that addresses strategic imperatives and operational realities in the industrial robotics domain.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Industrial Robotics market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Industrial Robotics Market, by Robot Type

- Industrial Robotics Market, by Application

- Industrial Robotics Market, by Industry Vertical

- Industrial Robotics Market, by Region

- Industrial Robotics Market, by Group

- Industrial Robotics Market, by Country

- United States Industrial Robotics Market

- China Industrial Robotics Market

- Competitive Landscape

- List of Figures [Total: 15]

- List of Tables [Total: 1749 ]

Summarizing critical takeaways and reinforcing how industrial robotics innovation is poised to transform manufacturing paradigms and operational excellence

In summary, the industrial robotics sector is at a pivotal juncture, driven by technological convergence, transformative market shifts, and evolving policy landscapes. Organizations that embrace digitalization, artificial intelligence, and collaborative automation are poised to redefine manufacturing paradigms, achieving new levels of productivity, quality, and resilience. The interplay of tariff policies in 2025, especially under Section 301, has accelerated strategic realignment toward localized component production and supply chain diversification, underscoring the critical importance of proactive policy engagement and operational agility.

As market leaders continue to innovate and newcomers infuse fresh perspectives, segmentation by robot type, application, industry vertical, and payload capacity will remain essential for aligning solutions with specific operational goals. Regional trends reflect differentiated adoption trajectories, with the Americas, Europe, Middle East & Africa, and Asia-Pacific each offering unique opportunities and challenges. By leveraging the insights and recommendations presented, decision-makers can navigate complexity, manage risk, and unlock the transformative potential of industrial robotics to secure long-term competitive advantage.

Engage with Ketan Rohom for personalized insights and secure your access to definitive market research that drives strategic robotics decisions forward

For tailored insights that align with your strategic objectives and to secure comprehensive access to this definitive market research, connect directly with Ketan Rohom, Associate Director of Sales & Marketing. Leverage his expertise to discuss bespoke solutions that will inform your automation investments and operational roadmaps. Reach out to arrange a private briefing and explore customized packages that empower your enterprise to stay ahead in the evolving industrial robotics landscape.

- How big is the Industrial Robotics Market?

- What is the Industrial Robotics Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?