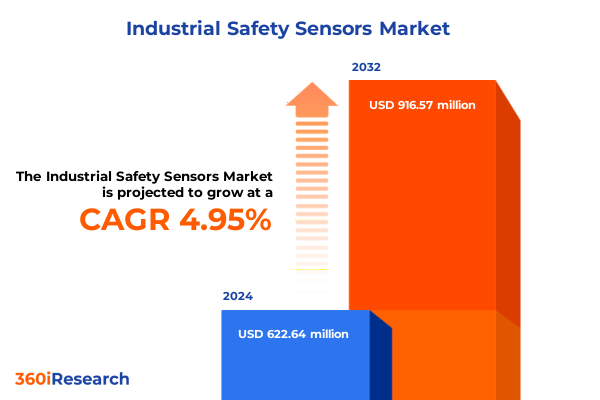

The Industrial Safety Sensors Market size was estimated at USD 647.95 million in 2025 and expected to reach USD 680.56 million in 2026, at a CAGR of 5.07% to reach USD 916.57 million by 2032.

Unveiling the Dynamic Convergence of Automation, Smart Safety Sensors, and Compliance Demands That Are Transforming Industrial Risk Management Today

Industries worldwide are increasingly reliant on sophisticated safety sensors to protect both personnel and critical assets while simultaneously enhancing overall operational performance. This digital transformation is driven by manufacturers embracing connected safety ecosystems that integrate sensors into broader automation platforms, ensuring seamless data flow and proactive risk mitigation for machinery and workspaces. Consequently, safety sensors have evolved from standalone protective instruments into integral nodes of an interconnected industrial network, delivering vital real-time insights that underpin smarter decision-making and heightened production efficiency.

manufacturers are leveraging Industrial Internet of Things (IIoT) frameworks to accelerate real-time monitoring and predictive maintenance capabilities, reducing unplanned downtime and optimizing asset utilization across complex facilities. Furthermore, the convergence of advanced sensor technologies with cloud and edge computing infrastructures enables on-site analytics and instantaneous anomaly detection, empowering operations teams to address potential safety hazards before they escalate into costly incidents. This shift toward data-driven safety strategies underscores a broader move from reactive safeguarding to predictive risk management, setting new benchmarks for industrial resilience and operational excellence.

As digital safety architectures grow more sophisticated, cybersecurity considerations and regulatory compliance have emerged as critical design imperatives. Sensor providers are responding by embedding robust encryption, authentication protocols, and secure firmware update mechanisms to safeguard against unauthorized access and ensure adherence to international safety standards. By prioritizing secure interoperability and certification readiness, stakeholders can confidently deploy next-generation sensor solutions that not only mitigate physical hazards but also uphold the integrity of interconnected industrial ecosystems.

Emerging Technological Paradigms Such as Edge Computing, AI-Driven Analytics, and Digital Twins Are Revolutionizing Industrial Sensor Applications

The industrial safety sensor landscape is experiencing transformative shifts as edge computing and artificial intelligence converge to redefine functionality. Edge-enabled sensors now process data near the source, dramatically reducing latency and enabling real-time decision making on critical safety thresholds. Simultaneously, AI-driven analytics embedded within sensor networks leverage machine learning models to identify anomalous patterns in equipment behavior, facilitating predictive maintenance practices that preempt equipment failures and enhance workforce protection.

Moreover, the rise of digital twin technology has introduced a virtual replication of physical assets and processes, allowing simulation of potential safety scenarios in a risk-free environment. By integrating sensor-derived real-time data streams into these digital replicas, organizations can conduct advanced what-if analyses, optimize protective measures, and accelerate design iterations without disrupting live operations. Consequently, digital twins have become a cornerstone of strategic planning and continuous improvement in high-hazard industries.

In addition, collaborative robotics and human-robot interaction are elevating the role of proximity sensors, safety light curtains, and laser scanners that must now offer millimeter-level accuracy and adaptive responsiveness. As production lines become more automated and co-located with human operators, these safety devices are evolving to deliver dynamic zone monitoring and intelligent shut-off capabilities. This shift underscores a broader trend toward context-aware safety architectures that not only protect personnel but also enhance overall system agility and throughput.

Assessing the Broad Financial, Supply Chain, and Investment Repercussions of 2025 U.S. Trade Tariffs on Industrial Safety Sensor Manufacturers

The introduction of additional U.S. tariffs on imported electrical and electronic components in 2025 has had a pronounced financial impact on safety sensor manufacturers. Rising duties on critical parts-such as semiconductors, transducers, and specialized cabling-have driven component cost increases of up to 25%, a burden that many suppliers and integrators have been forced to absorb to maintain competitive pricing structures. Consequently, profit margins across the sensor value chain have come under pressure as companies reevaluate sourcing strategies and negotiate price adjustments with distributors.

Furthermore, leading industrial technology firms have publicly acknowledged the operational strains induced by these trade policies. For example, Texas Instruments reported inventory build-outs and altered ordering patterns as customers sought to mitigate potential supply chain disruptions, contributing to a nearly 12% drop in its share price in response to tariff-related uncertainty. Similarly, General Motors cautioned investors about a $4–5 billion tariff headwind affecting its automotive sensors and electronic subsystems business, signalling pronounced cost inflation in components that rely on cross-border supply networks.

Beyond corporate earnings, investment decisions have also been reshaped by tariff volatility. A recent survey by the Ifo Institute revealed that nearly 30% of German companies postponed planned U.S. investments due to unpredictable trade measures, while 15% canceled projects altogether, indicating that tariffs are influencing not only immediate cost structures but also long-term expansion strategies for sensor manufacturers and end-users alike. In response, many stakeholders are diversifying manufacturing footprints and accelerating automation investments to reduce exposure to future policy shifts.

Unlocking Critical Segmentation Dimensions to Illuminate Unique Opportunities Across Sensor Types, Safety Levels, Applications, and Industry Verticals

The market for industrial safety sensors is stratified by sensor type, where laser scanners excel in mapping volatile work zones and proximity sensors provide rapid presence detection. Photoelectric sensors encompass diffuse, retro-reflective, and through-beam variants, each tailored for specific detection ranges and environmental conditions, while safety light curtains are differentiated by Type 2 and Type 4 classifications, reflecting ascending performance levels for risk reduction.

Functionally, the industry aligns with Safety Integrity Levels from SIL 1 through SIL 4, guiding design and implementation rigor according to application criticality. This tiered structure ensures that high-risk processes receive advanced sensor architectures and redundant safety paths, whereas less critical operations may leverage more cost-effective configurations under lower SIL requirements.

In application segmentation, automotive environments encompass body and paint shops demanding robust proximity and area scanners, whereas energy and power installations span nuclear plants and renewable energy sites with stringent regulatory imperatives. Manufacturing lines split between assembly and packaging processes, each necessitating custom sensor arrays to balance throughput with safeguarding. Similarly, oil and gas operations differentiate offshore drilling platforms from refinery units, driving unique sensor resilience and certification needs.

Output connectivity varies from wired M12 interfaces-with 4-pin and 5-pin configurations prevalent in traditional installations-to wireless solutions operating on Bluetooth or Wi-Fi protocols that facilitate flexible placement and mobile diagnostics. End-user industries such as aerospace require ultra-high reliability, while food and beverage processing divides between beverage and dairy applications, each with hygienic sensor designs. The healthcare sector segments into medical devices and pharmaceutical production, demanding sterile compliance, and mining operations bifurcate into surface and underground mining, where environmental robustness is paramount.

Mounting approaches contrast flush mounting-available in board and panel installations-with non-flush options suited to harsher external environments. Sensor technologies span infrared, magnetic field, and ultrasonic principles, offering tailored detection mechanisms for diverse material properties. Integration levels range from fully embedded modules that connect seamlessly to automation controllers to standalone units providing on-board processing. Finally, maintenance paradigms shift between predictive maintenance driven by real-time analytics and preventive maintenance scheduled through routine inspections, marking a crucial evolution in ensuring uninterrupted safety and reliability.

This comprehensive research report categorizes the Industrial Safety Sensors market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Sensor Type

- Technology

- Connectivity

- End-User

Navigating Regional Dynamics and Regulatory Variations Across the Americas, EMEA, and Asia-Pacific to Inform Strategic Sensor Deployment

In the Americas, market momentum is being propelled by robust adoption of Industry 4.0 initiatives and government incentives supporting smart manufacturing modernization. The United States has maintained its position as a key market for advanced safety sensors, although recent tariff policies have prompted some firms to restructure supply chains and re-evaluate foreign sourcing strategies. Despite these challenges, investments in domestic automation offerings and local content requirements continue to drive sensor integration into critical infrastructure and automotive sectors.

Europe, the Middle East, and Africa (EMEA) present a highly heterogeneous environment shaped by stringent regulatory landscapes across the EU, United Kingdom, and GCC states. In Western Europe, compliance with machinery directives and harmonized standards has elevated demand for certified sensor solutions, while Eastern European manufacturers are seeking cost-effective partnerships to meet rising safety benchmarks. Meanwhile, Middle Eastern petrochemical projects leverage high-temperature-tolerant and explosion-proof sensors, and African mining operations prioritize rugged devices capable of enduring severe environmental stressors.

Asia-Pacific remains the largest production hub for industrial sensors, supported by extensive electronics manufacturing ecosystems in East and Southeast Asia. However, regional trade realignments and geopolitical tensions have introduced supply chain uncertainties, prompting end-users in Australia, Japan, and South Korea to diversify component sourcing beyond dominant suppliers. At the same time, rapid industrialization in India and ASEAN nations is sparking fresh demand for safety solutions tailored to scaling manufacturing, energy, and infrastructure development projects.

This comprehensive research report examines key regions that drive the evolution of the Industrial Safety Sensors market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Strategic Collaborators Shaping the Industrial Safety Sensor Ecosystem Through Technology and Partnerships

Leading industrial technology providers continue to advance safety sensor capabilities through strategic partnerships and targeted acquisitions. One prominent example is Texas Instruments, which, despite recent tariff-related headwinds, has been bolstering its analog and interface product lines to deliver higher integration density and improved signal fidelity for safety applications. By leveraging diverse manufacturing footprints and cross-border R&D centers, these firms are driving incremental performance gains and cost optimizations that reinforce their market positioning.

Additionally, automation solution integrators and original equipment manufacturers are collaborating closely with sensor vendors to deliver turnkey safety systems featuring centralized diagnostics and unified control architectures. These alliances are enabling faster time to market for customized sensor suites suited to specific end-user processes, while also facilitating comprehensive service offerings that encompass installation, training, and lifecycle support. Such synergies underscore a broader industry trend toward consolidated technology stacks and end-to-end responsibility models.

Smaller, specialized sensor innovators are differentiating through niche applications-such as high-precision laser scanners for collaborative robotics or hermetically sealed ultrasonic sensors for extreme-temperature environments. These agile players often establish close technical partnerships with system integrators, co-developing sensor adaptations that address unique process requirements. Their focused expertise complements the broad portfolios of global conglomerates, creating a more dynamic and competitive ecosystem that accelerates overall innovation rates.

This comprehensive research report delivers an in-depth overview of the principal market players in the Industrial Safety Sensors market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd.

- Amphenol Corporation

- Bosch Sensortec GmbH

- Chamberlain Group

- China Security & Fire IoT Sensing Co., Ltd.

- Datalogic S.p.A.

- Dwyer Instruments, LLC

- Emerson Electric Co.

- GZ Cyndar Co., Ltd.

- Honeywell International Inc.

- Keyence Corporation

- Mitsubishi Electric Corporation

- Nanjing Wotian Tech. Co., Ltd.

- Olea Systems, Incorporated

- Omron Corporation

- Optex Fa Co., Ltd.

- Panasonic Corporation

- Pepperl+Fuchs SE

- Pilz GmbH & Co. KG

- Pizzato Elettrica S.r.l.

- Rockwell Automation Inc.

- S.R.I Electronics

- Schmersal, Inc.

- Schneider Electric SE

- Sensata Technologies, Inc.

- SensoPart Industriesensorik GmbH

- SICK AG

- Siemens AG

- SoftNoze USA Inc.

- TM Automation Instruments Co., Ltd.

- TSM Sensors s.r.l.

- Turck, Inc.

Prioritized Strategic Roadmap for Industry Leaders to Harness Sensor Innovations, Optimize Supply Chains, and Achieve Compliance Excellence

To stay ahead in a rapidly evolving market, industry leaders should prioritize integration of edge analytics within sensor networks, enabling localized decision-making and reducing data latency. By investing in AI-powered anomaly detection algorithms, organizations can transition from reactive fault resolution toward predictive maintenance frameworks, thereby enhancing safety while minimizing unexpected downtime.

Furthermore, enterprises must develop resilient supply chain strategies that encompass regional manufacturing capabilities and multi-source component agreements. Proactively diversifying sourcing beyond single-market dependencies will mitigate risks associated with tariff fluctuations and geopolitical shifts. Collaborative procurement alliances and joint manufacturing ventures can further stabilize input costs and secure preferential access to critical sensor technologies.

In addition, aligning with emerging functional safety standards-such as IEC 62061 and ISO 13849-will ensure compliance readiness and unlock new business opportunities in regulated sectors. Establishing cross-functional safety governance teams that incorporate engineering, legal, and operational expertise can accelerate certification processes and reduce time to market for advanced sensor solutions. Moreover, forging strategic partnerships with system integrators and robotics suppliers will facilitate end-to-end safety architectures that are both scalable and adaptable to future technology advancements.

Rigorous Research Framework Combining Primary Engagements, Secondary Data Triangulation, and Expert Validation to Ensure Insightful Market Analysis

This analysis was developed through a rigorous, multi-tiered research methodology combining primary interviews with industry executives, technical experts, and end-user stakeholders, alongside extensive secondary research of publicly available regulatory standards, peer-reviewed publications, and corporate disclosures. Expert roundtables and targeted surveys provided qualitative insights into emerging technology adoption rates and implementation challenges.

Secondary sources included academic journals on sensor technology, safety regulations published by international standards bodies, and financial reports from leading automation vendors. Data triangulation techniques ensured consistency across market segmentation models, while in-depth case studies highlighted successful deployment scenarios in diverse industrial environments.

Finally, all findings underwent a comprehensive validation process with a dedicated advisory panel comprised of safety engineers, supply chain specialists, and industry analysts. This iterative validation framework enhanced the accuracy and reliability of our strategic recommendations and market insights, ensuring decision-makers receive actionable intelligence grounded in real-world expertise.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Industrial Safety Sensors market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Industrial Safety Sensors Market, by Sensor Type

- Industrial Safety Sensors Market, by Technology

- Industrial Safety Sensors Market, by Connectivity

- Industrial Safety Sensors Market, by End-User

- Industrial Safety Sensors Market, by Region

- Industrial Safety Sensors Market, by Group

- Industrial Safety Sensors Market, by Country

- United States Industrial Safety Sensors Market

- China Industrial Safety Sensors Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1908 ]

Summarizing the Transformational Trajectory of Safety Sensor Technologies, Market Influences, and Strategic Imperatives for Industry Decision-Makers

In conclusion, the industrial safety sensor sector is at a pivotal juncture, characterized by rapid technological convergence, shifting trade dynamics, and evolving regulatory requirements. The advent of edge computing, AI-driven analytics, and digital twin integration is elevating safety sensors from passive safeguarding devices to intelligent components of holistic risk management ecosystems.

Meanwhile, geopolitical developments and tariff policies continue to reshape supply chain considerations, prompting manufacturers to diversify sourcing strategies and localize production capabilities. At the same time, segmentation insights reveal nuanced requirements across sensor types, functional safety levels, applications, and end-user industries, underscoring the importance of tailored solutions that balance performance, compliance, and cost efficiency.

Looking ahead, organizations that successfully blend technological innovation with strategic supply chain resilience and rigorous compliance governance will be best positioned to lead in the next era of industrial safety. By capitalizing on these insights and adopting a proactive approach to sensor deployment, decision-makers can drive safer, more efficient operations while unlocking new avenues for value creation.

Engage Directly with Ketan Rohom to Secure Your Comprehensive Industrial Safety Sensor Market Intelligence and Drive Informed Strategic Decisions

To obtain the full, in-depth industrial safety sensors market research report and gain unparalleled strategic insights, please reach out to Ketan Rohom, Associate Director, Sales & Marketing. Ketan can guide you through a tailored consultation to determine how this comprehensive analysis aligns with your organizational objectives and help you secure the competitive intelligence needed to drive growth and innovation in your safety sensor initiatives.

- How big is the Industrial Safety Sensors Market?

- What is the Industrial Safety Sensors Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?